From policy tweets to sudden token transfers, those with privileged knowledge often act ahead of time, leaving subtle hints that sharp-eyed investors can catch. Politicians, corporate executives, and crypto whales have all been known to shift assets before market-shaking announcements go public.

This leaves ordinary traders vulnerable when volatility strikes without warning. Yet, by learning to recognise unusual trading flows and whale activity, even newer investors can react quicker and potentially benefit from these signals.

This piece explains how insider trading differs from market manipulation, explores real-world examples from equities and crypto, and offers practical ways to identify the signs of an imminent ‘rug pull’ or a major market swing.

Insider Trading Vs Market Manipulation

First, some groundwork. The US Securities and Exchange Commission defines insider trading as the act of trading a security based on material, non-public information, thus violating a duty of trust.

Think of a government official privy to a forthcoming policy change who secretly buys stocks set to gain. Or a company CEO who quietly dumps shares before weak earnings are announced. Both fall under unlawful insider trading.

Market manipulation, by contrast, refers to artificially steering an asset’s price, demand, or supply. This could involve spreading false news, coordinating trades to trigger a deceptive rally, or tampering with quote data.

For instance, tweeting fake information to push a stock lower, only to scoop it up cheaply and profit once the truth surfaces, is market manipulation.

Both practices undermine trust and fairness in markets, which is why regulators and the public are increasingly questioning whether the powerful are ‘playing’ the system.

Important Note:

Retail traders should never engage in illegal insider trading. All methods discussed here rely solely on public data, like disclosures or on-chain analytics. Responding to such information, even if it points to someone else trading with insider knowledge, is entirely legal. It can, in fact, help to level the playing field.

Real-World Cases Of Suspicious Trades Ahead Of News

Trump’s Tariff Tweets And Well-Timed Bets

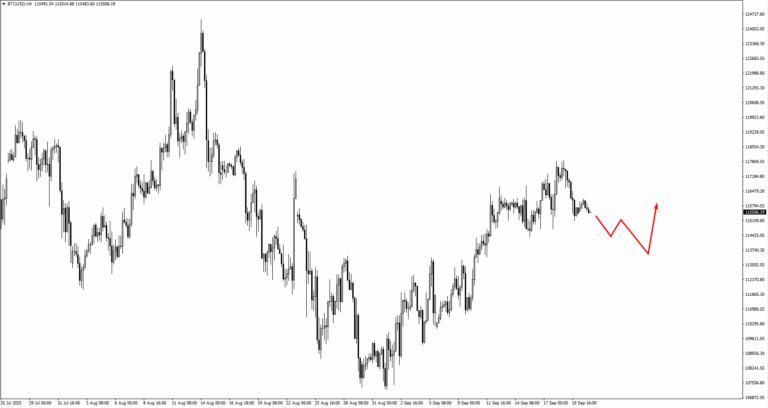

Back in April 2025, President Trump jolted markets by unveiling sweeping tariffs that initially sent stocks tumbling, only to reverse and suspend most of them, fueling a sharp rebound. The S&P 500 jumped more than 9% in a single session following his U-turn.

Just hours before that recovery, Trump had tweeted, ‘This is a great time to buy,’ raising eyebrows. At the same time, mystery traders had already placed enormous bets on a rally.

One anonymous trader snapped up 420,000 S&P E-mini futures right before Trump declared that talks with China were “back on track,” pocketing an estimated $1.8 billion.

Across several trades, these unidentified players reportedly made around $3.5 billion. As one veteran remarked, ‘There’s definitely funny business going on,’ pointing to how frequently someone seemed perfectly positioned for Trump’s announcements.

Congressional Trades Before Market Shifts

Lawmakers were not idle either. During the nine days surrounding Trump’s tariff flip, more than 30 members of Congress conducted over 1,200 stock transactions worth up to $28 million.

Many of these trades stood to gain from the rebound, executed even before Trump’s tone softened publicly.

While some insisted blind trusts or advisers were managing their portfolios, the timing raised suspicions. Representative Alexandria Ocasio-Cortez noted ‘interesting chatter on the floor’ and demanded full disclosure from any lawmaker trading within 48 hours of the events.

Today, tracking political trades has become a key red flag for switched-on retail investors.

Crypto Whale Dump: Ripple’s XRP

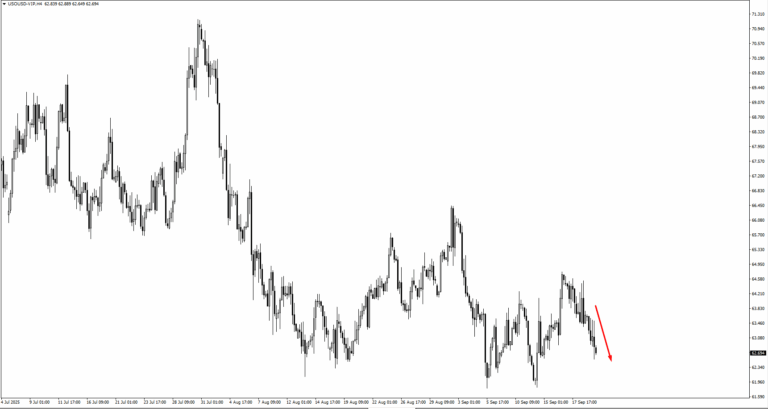

The crypto sphere has its share of insider manoeuvres, too. In July 2025, following a favourable court ruling that propelled XRP to $3.60, a multi-year peak, a wallet tied to Ripple’s co-founder Chris Larsen shifted 50 million XRP (worth $175 million) to exchanges and wallets.

Blockchain analysts found roughly $140 million of that stash was sold.

Within two weeks, XRP had collapsed 25% to $2.72.

Retail holders accused Larsen of ‘dumping’ at the top, sparking debate over whether Ripple’s leadership was acting in bad faith.

Regardless, blockchain data told the story: a major insider had moved vast sums ahead of a steep decline. For those monitoring whale wallets, the red flag was visible.

Tracking Insider Moves In US Equities

Follow The Smart Money On Capitol Hill

The 2012 STOCK Act requires members of Congress to disclose their trades, though they have 45 days to file them. Even with delays, these disclosures can reveal useful patterns.

Paul Pelosi, husband of former Speaker Nancy Pelosi, famously beat the market with returns of 65% in 2023 and 71% in 2024, largely from timely bets on Nvidia and Alphabet. His success inspired “Congress-tracking” ETFs such as NANC (Democrats) and KRUZ (Republicans).

Retail traders can access free resources like Capitol Trades or Quiver Quant to see what politicians are buying or selling. Watching clusters of trades in sectors linked to upcoming policy can be telling. For example, multiple lawmakers piling into defence stocks before a Pentagon contract announcement is hardly a coincidence.

Monitor Corporate Insider Filings

Corporate insiders, from CEOs to major shareholders, must submit Form 4 to the SEC whenever they trade company stock. These filings are public, providing insight into executive sentiment.

Sites like OpenInsider, Finviz, or the SEC’s EDGAR system make it easy to track such transactions. A cluster of insider buys often signals confidence. Heavy or sudden selling may indicate worries, or simply profit-taking. Context is crucial, but unusual activity often precedes bigger moves.

Watch Unusual Options Activity

Options markets can act as a canary in the coal mine. Surges in call or put volume sometimes flag that someone is betting on a large price swing.

For instance, Nasdaq call volumes spiked the day before Trump scrapped tariffs, hinting that some traders had advance knowledge. Platforms like Unusual Whales, Barchart, or broker tools can help you monitor these trends.

Remember, not every big options move is insider-driven. Some may be hedges. Treat it as one clue among many.

Crypto: Spotting The Whales Before They Strike

Track Whale Wallets With On-Chain Tools

Blockchain is transparent. Large transfers, especially from private wallets to exchanges, often foreshadow market action. Tools like Whale Alert broadcast these moves in real time.

If a founder or major holder shifts coins onto an exchange, it could signal upcoming selling pressure. Block explorers, such as Etherscan or advanced platforms like Nansen, make it easier to follow the trail of smart money.

Watch Token Unlocks And Distribution Schedules

Founders and early investors often hold locked tokens that eventually become tradable. Websites like TokenUnlocks track when these events occur.

If large unlocks line up right after a price surge, expect potential selling pressure.

Spot the Red Flags of Rug Pulls

A ‘rug pull’ happens when project developers drain liquidity and abandon a token. Warning signs include:

– Concentrated ownership, with just a few wallets holding the majority.

– Developers controlling the liquidity pool.

– Suspicious wallet transfers into mixers or exchanges.

– Sudden radio silence or vague communication from the project team.

Conclusion: Staying One Step Ahead As A Retail Trader

In today’s markets, a single tweet or whale transfer can send prices swinging. While retail traders don’t have insider access, monitoring public signals can sharpen their edge. Blockchain flows, congressional disclosures, and options activity all provide breadcrumbs.

Not every unusual trade ends in a headline. But many headlines leave traces. The goal is to catch those signs early, adjust your strategy, and avoid being blindsided.

Stay alert. Stay informed. And trade with purpose.