Have you ever heard of a unique financial index called the Volfefe Index?

If you kept up with financial markets during Donald Trump’s presidency, you’re likely aware of his frequent tweeting and the existence of this strange yet real index.

The Volfefe Index is an analytical model created by JPMorgan to measure the impact of Donald Trump’s tweets on US interest rates.

And that’s not all…

Bank of America analysts also concluded that since 2016, the stock market tended to dip on days when Trump tweeted more than 35 times, and rebound on days when he tweeted fewer than five times!

Social Media Posts by Influential Figures Can Shift Market Direction

Social media has transformed how we connect, entertain, learn, and share information. Platforms like X, Facebook, and Reddit have opened up a borderless world to anyone with an internet connection.

But alongside the growing influence of social media in modern society, its power to reshape the financial world in an instant has increased as well, as we saw with Donald Trump and Twitter.

A tweet from a CEO, an endorsement from a celebrity, or advice from an influencer can rattle markets and shake global financial sentiment!

Here, we highlight five incidents where social media activity changed the course of financial markets:

1. Shiba Inu Cryptocurrency Rallies Following Elon Musk’s Tweet

The world’s richest entrepreneur, Elon Musk, is a vocal supporter of Dogecoin. Musk frequently shares his views on Shiba Inu-themed cryptocurrencies through his posts on X.

Recently, Musk joked on X about wanting to serve in the “Department of Government Efficiency” or its acronym, D.O.G.E.

This post racked up 81.9 million views at the time of writing, boosting Dogecoin’s value by 6%.

Another Musk tweet about Dogecoin on 1 April was anything but an April Fool’s prank:

The tweet’s impact on Dogecoin was no joke. It sent the price soaring by 30% to $0.7011 in just minutes!

2. Mark Cuban’s Scepticism On Bitcoin

If you’re familiar with the NBA, you’ll know Mark Cuban as the former owner of the Dallas Mavericks, who won the championship in 2011.

But Cuban’s NBA involvement is just one of his many ventures that paved the way for his billionaire status, including Broadcast.com, HDNet, and MicroSolutions.

So, it’s no surprise that when Cuban tweets, his 8.9 million followers take notice, and often act!

In a now-deleted tweet from early June 2017, Cuban warned that Bitcoin was in a bubble, ready to burst at any moment.

The price of Bitcoin reacted almost immediately. It dropped from $2,967.48 to $2,750.66 following Cuban’s tweet.

This was just one of many instances of Cuban voicing his scepticism toward Bitcoin. He has argued that Bitcoin will not become a valuable digital currency in the long run.

3. ‘Pump and Dump’ Schemes By Social Media Influencers

A stock fraud case in the US in 2022 stemmed from investors following the recommendations of several social media influencers who manipulated the stock market for personal gain.

The scam, masterminded by eight influencers, ran on the following modus operandi:

1. Selecting a stock to manipulate

This group identified small-cap stocks (typically worth only a few million dollars). These are easier to manipulate due to their low trading volume and lack of attention from mainstream investors.

The influencers would first buy shares in these companies at very low prices in preparation for the next step.

2. Promoting the stocks on social media

Next, the group would hype these stocks to their followers on platforms like Twitter and Discord, generating positive sentiment in the market.

What was the immediate effect of these promotions?

The stocks would surge dramatically! This is the ‘pump’ phase of the ‘pump and dump’ operation.

3. Selling off the stocks

What comes after the pump? The ‘dump’, which is selling the stocks to cash in.

And the victims?

Their unsuspecting followers were left holding rapidly devaluing shares after the influencers had sold out.

This group profited around $114 million from this scheme, which ran from January 2020 to April 2022.

As a result, in December 2022, the US Securities and Exchange Commission (SEC) announced charges against all eight influencers for their roles in this securities fraud.

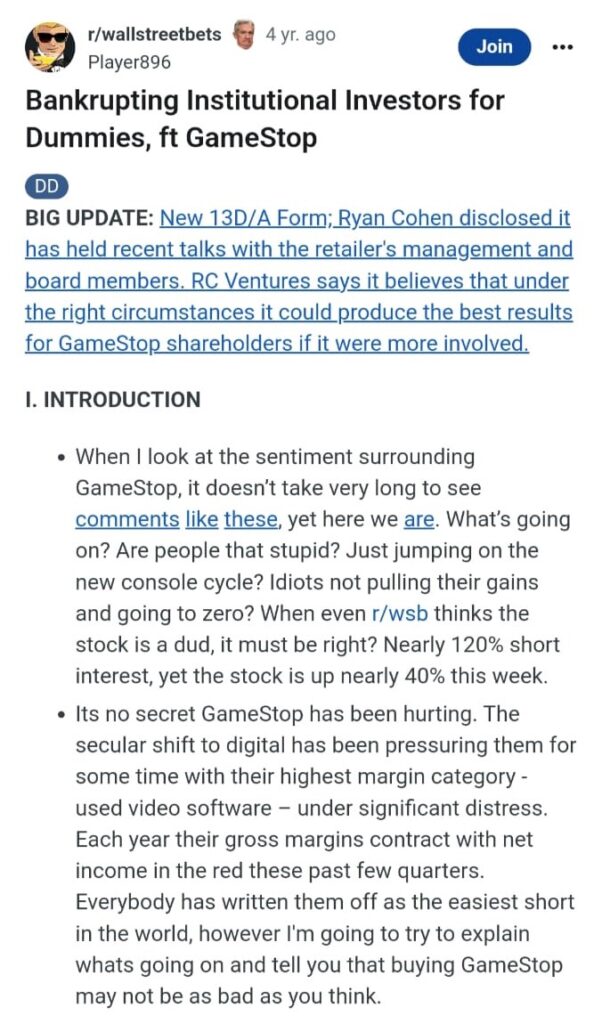

4. Redditors Take On Hedge Funds

The GameStop stock drama was a fascinating episode for Reddit trolls, market watchers, analysts, and GameStop. Not so much for short sellers, who took heavy losses.

In January 2021, struggling video game retailer GameStop found itself at the centre of a Wall Street storm.

Several large hedge funds had heavily shorted GameStop shares, betting the price would continue to fall due to its weakening business model, the rise of digital gaming, and competition from online retailers.

However, a group of retail investors on the subreddit r/WallStreetBets, which often targets heavily shorted stocks, noticed the extreme short interest in GameStop.

These Redditors banded together and encouraged each other to buy GameStop shares, aiming to trigger a short squeeze – a rapid price increase that would force short sellers to cover their positions at much higher prices.

This operation gained momentum via posts on Reddit and other platforms like Discord and Twitter. The result? GameStop’s share price skyrocketed.

The story grabbed global headlines, with a narrative of ‘retail investors versus Wall Street’ sparking widespread interest, especially among amateur traders who joined the buying frenzy.

Caught off guard, short sellers were forced to buy back shares to close their positions, adding fuel to the rally.

The GameStop saga is a powerful example of how social media can unite retail traders to shift market trends in unexpected ways.

5. From Reality TV To Crypto Promotion

Who hasn’t heard of Kim Kardashian?

Whether or not you’re a fan of The Kardashians, Kim’s misstep in the crypto world once again brought her name to the headlines.

Remember the ‘pump and dump’ tactic we discussed earlier?

Essentially, the same thing happened here, with Kim K playing the role of the star promoter for a cryptocurrency called EthereumMax, or E-Max.

Just look at this Instagram story from Kim:

In reality, the ‘my friends’ she referred to were E-Max founders who had paid Kim $250,000 to use her name and platform to promote the cryptocurrency.

Although she used the hashtag #ad, the SEC said that disclosure wasn’t sufficient, especially since Kim failed to tell her followers she had been paid to make the post.

As a result, Kim was fined $1.26 million by the SEC and banned from promoting any cryptocurrency for three years.

In addition, she faced a lawsuit from E-Max investors. She was accused, along with the project’s founders, of promoting and selling the cryptocurrency with deceptive intent.

The lawsuit also claimed that E-Max was a classic pump-and-dump scheme, where slick marketing boosted the asset’s price before it was sold to unsuspecting investors for a quick profit.

Final Thoughts

A single social media post can change the world. Or at least the financial markets.

If you want to become a more informed trader, pay attention to high-profile individuals whose social media activity could move the markets.

Or, if you’re taking financial advice from influencers, make sure they have real experience and a solid track record in investing.

Bonus points if they’re licensed by a regulatory body like the Securities Commission of Malaysia.

Above all, ensure your fundamental and technical knowledge is strong enough to guide your trading strategy.

Ready to trade? Open a live account with VT Markets today.