The recent stock market rally is being fuelled less by corporate performance and more by shifting expectations around US interest rate policy. Traders are betting that Federal Reserve Chair Jerome Powell will soon be forced to step back. Figuratively for now, but perhaps literally too, as political pressure builds and the Fed navigates a narrow path between inflation control and fiscal constraints.

At the centre of this tension is a growing standoff between President Donald Trump and Powell. Although Powell’s term officially runs until May 2026, there are growing rumours that Trump could pre-emptively name a successor as early as this September or October.

While the US Supreme Court recently reaffirmed the Fed’s institutional independence, markets are watching closely. An early announcement could significantly undermine Powell’s authority and reorient investor focus toward the likely policy stance of a more politically aligned Fed Chair.

Trump’s agenda hinges on aggressive monetary easing. He argues that a 2–3 percentage point reduction in interest rates could save the US Treasury nearly $900 billion a year in debt servicing. With Treasury Secretary Scott Bessent extending cash management to 24 July to avoid breaching the debt ceiling, the argument is gaining ground. Annual interest payments are on course to exceed $950 billion, a record figure threatening to squeeze discretionary government spending.

Still, Powell remains guarded. In recent testimony, he maintained a data-driven stance, suggesting cuts could come ‘sooner rather than later’ if inflation continues to ease, but reiterating there is ‘no rush’ to act prematurely.

The Fed expects inflation to pick up in the latter half of 2025, partly due to renewed tariffs. Combined with a still-resilient labour market, this has encouraged a cautious tone.

Traders Prepare For A Trim

Markets, however, appear sceptical. According to the CME FedWatch Tool, there’s a 91.5% chance of a cut at the 17 September FOMC meeting, and expectations are building for a second cut before year-end. Although just 19.1% of traders expect action at the 30 July meeting, this divergence between Fed communication and market pricing is widening, driven in part by Trump’s growing influence.

Currency markets have already responded. Bloomberg’s Dollar Index has declined over 8% year-to-date, with losses accelerating as speculation mounts about Powell’s possible replacement. Should Trump appoint a dovish successor, the greenback could face further weakness, especially if economic data starts to falter.

Equities tell a different story. The S&P 500’s climb appears tied more to hopes of looser monetary policy than robust earnings. With M2 money supply inching higher and borrowing costs poised to fall, investors are piling into rate-sensitive assets, anticipating a liquidity-driven rally. Yet this optimism remains speculative and not grounded in confirmed policy moves.

Market Movements This Week

The US Dollar Index (USDX) is testing key support at 96.50. A rebound toward 97.70 could present short-term bearish trade opportunities. However, if the downtrend extends, 95.40 will be the next level to monitor. Political factors are now playing a greater role in the dollar’s direction than inflation data or Fed guidance.

EUR/USD is struggling to break above resistance at 1.1770. A pause or pullback here would be natural, but if price consolidates, the 1.1605 zone becomes critical for bullish continuation patterns. Traders appear hesitant to overcommit, likely waiting for confirmation that the ECB’s easing path is not outpacing the Fed’s.

GBP/USD faced resistance at 1.3790 this week. Price action suggests a potential pullback, and if the pair consolidates downward, 1.3605 could become a viable entry for medium-term bulls. With Bank of England commentary due next week, sterling may remain directionless until fresh forward guidance is provided.

USD/JPY remains mixed. A decline could see buyers re-enter around 143.10, while rallies toward 145.20 or 145.75 may trigger selling. With Japan having initiated its easing cycle earlier than most, the yen is increasingly traded on rate differentials rather than risk sentiment alone.

USD/CHF continues to struggle. Any bounce toward 0.8050 or 0.8110 is expected to face renewed selling pressure, assuming the dollar’s weakness and SNB’s slow pace of easing persist.

In the commodity-linked pairs, AUD/USD and NZD/USD are both setting up potential bullish trades if price consolidates near 0.6490 and 0.6455 for AUD, and 0.6005 or even as deep as 0.5730 for NZD. Sentiment remains tied to Chinese demand and broader commodity flows, but the FX reaction is more measured than enthusiastic.

USD/CAD made a run higher, breaching the 1.3754 swing high before pulling back. Sellers remain present but weak. Should price revisit 1.3810 and consolidate, that area may offer a bearish setup, particularly if oil prices stay elevated or Canadian employment data remains firm.

Turning to crude oil, the price has approached the upper range with resistance at 71.80 and 73.40. Consolidation near these levels could attract sellers, but on the downside, 63.35 and 61.00 remain long-term support levels to monitor. Oil has been stuck between fundamental headwinds and seasonal demand optimism.

Gold is consolidating near 3,330, with bearish setups possible on a break lower. Support lies around 3,220 or as far as 3,175. Despite dollar softness and rising political uncertainty, gold remains in a holding pattern without a clear trend.

The S&P 500 has pushed higher into overbought territory. Watch 6,200, 6,400, and 6,630 as inflection points. The rally is speculative, driven by rate cut hopes, but extended technicals suggest a pullback may be on the horizon, particularly if labour data surprises to the upside.

Bitcoin broke to a new swing high after consolidating. It now eyes 109,650 as the next key level, with 111,300 seen as the line in the sand for determining further upside. Crypto markets have benefited from the dollar’s softness and broader appetite for decentralised stores of value—but they remain vulnerable to Fed communications that surprise on the hawkish side.

Natural Gas (NG) skipped consolidation entirely and surged toward 3.65. Momentum remains strong. If the rally continues, 3.75 is the next resistance level to watch, with 4.046 being the breakout high that may act as a longer-term barrier.

The Nasdaq is riding the same bullish wave as the S&P, breaking higher and targeting 22,600, then 23,330, with a stretch toward 24,600 if tech continues to lead. While semiconductors and AI-linked stocks are propelling the move, breadth still lags.

Silver dropped from the 36.70 resistance zone and slid below 35.85. A consolidation near 36.45 may offer a bearish continuation setup. The precious metals complex is still in a wait-and-see mode, tracking inflation expectations and real yields.

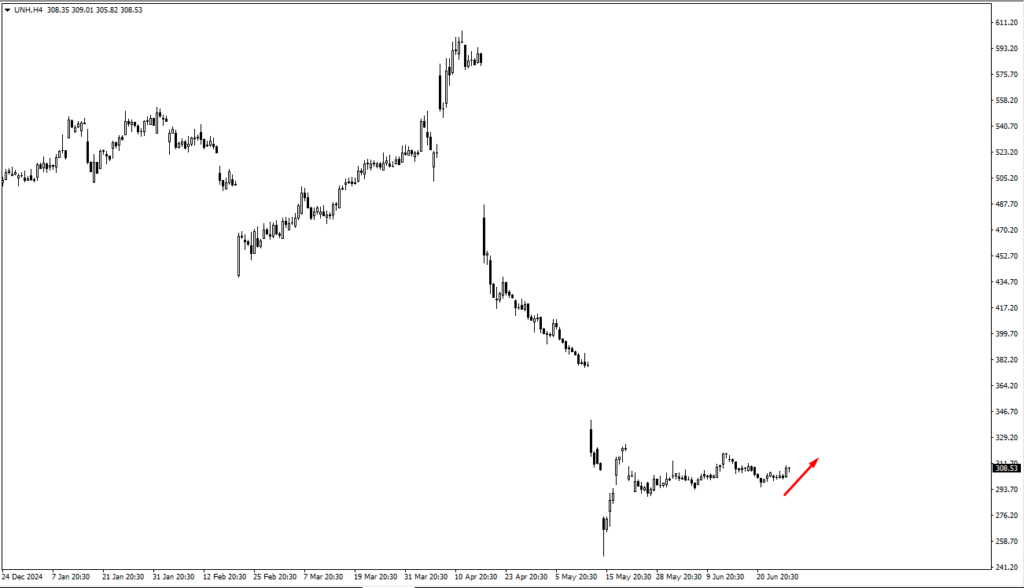

Among individual equities, UnitedHealth (UNH) is trading far below its estimated fair value of $570, currently between $275 and $324. A break above $324.41 could offer technical upside, while long-term investors may find value in phased accumulation.

Novo Nordisk (NVO) is trading around 67.80. Like UNH, its market value remains far below its estimated intrinsic value of $150, and long-term investors may look to accumulate gradually at these levels.

Ethereum is also climbing, with $2,580 highlighted as a critical area. A breakout beyond that could trigger the next wave of bullish interest, though like Bitcoin, ETH remains tethered to the broader macro narrative of rate shifts and risk appetite.

Key Events This Week

This week’s calendar offers a tight cluster of high-impact events, concentrated around central bank commentary and labour market data, each carrying the potential to recalibrate expectations around rate cuts, both in the US and abroad.

The action begins Tuesday, 1 July, with Bank of England Governor Andrew Bailey and Bank of Japan Governor Kazuo Ueda both scheduled to speak. With the yen recently under pressure and sterling showing resistance near key levels, traders will be listening closely for any hint of policy recalibration. Ueda’s tone, in particular, will be watched for signs of discomfort with persistent yen weakness—a scenario that could alter near-term FX dynamics in Asia-Pacific pairs.

Later that day, all eyes will turn to Federal Reserve Chair Jerome Powell, whose remarks are expected to reiterate the central bank’s “data-dependent” approach. Market pricing remains heavily tilted toward a September cut, but the tone Powell strikes could widen or narrow that window sharply.

Also on Tuesday, the latest JOLTS job openings report is due. Consensus stands at 7.45 million, up modestly from 7.39 million previously. While hardly a blockbuster release on its own, in the current environment of heightened sensitivity to labour data, a softer reading could reinforce the case for earlier rate relief. Conversely, a surprise beat may embolden Powell’s caution and press pause on the bond market’s easing bias.

Thursday, 4 July, delivers a more concentrated cluster of labour data, including CPI (m/m) for Switzerland, as well as the US unemployment rate and non-farm employment change. Expectations here are subdued: the US unemployment rate is forecast to tick up to 4.3% (from 4.2%), and NFP is expected at 120,000 (down from 139,000). If both figures come in weaker than expected, the July FOMC meeting could return to the spotlight as a live event. But Powell has made it clear that one poor print won’t drive policy.

It would take meaningful, sustained deterioration to warrant a July move, and as such, this week’s data may shape tone more than trigger action.