Not everything that shines is gold. Silver is stepping back into the spotlight, too.

Traditionally viewed as a crisis hedge, both metals have shifted into the mainstream. Since 2023, gold has surged by 103% compared with a 72% rise in the S&P 500.

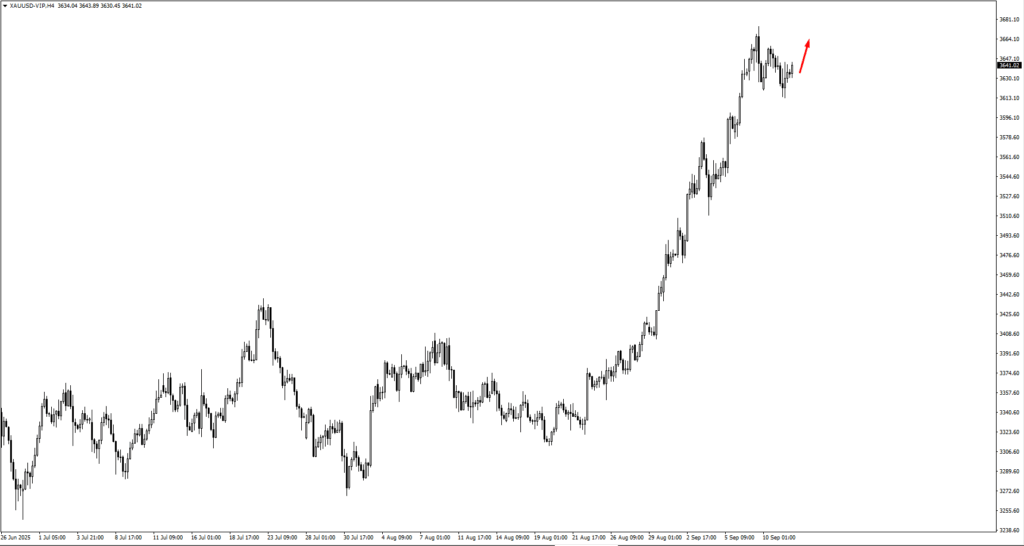

In 2025 alone, gold has climbed 40% and silver 44%. Gold has smashed through $3,600 per ounce to all-time highs, while silver trades around $41, its strongest level since 2011.

The takeaway is clear: investors are reassessing what constitutes stability in a world of deficits, sticky inflation, and heightened political risk.

The Three Drivers Of The Rally

Three forces underpin this bull run. First, relentless deficit spending has pushed the US fiscal shortfall close to $2 trillion annually, flooding markets with Treasuries and sending yields to their highest in 11 years.

With real returns eroded, bonds no longer look compelling, prompting a shift into tangible assets.

Second, gold’s relationship with equities has evolved. In 2024, its correlation with the S&P 500 hit 0.91, showing that gold is no longer just a backstop against weakness but also a parallel hedge against inflation and debt-fuelled expansion.

Third, safe-haven flows have gained new importance as bonds lose their anchor role in global portfolios.

Central Banks In The Lead

The official sector is a key engine of demand. For the first time since 1996, gold now outweighs US Treasuries in global reserves.

Gold accounts for around 20% of FX reserves, overtaking the euro’s 16%. The rationale is straightforward: Treasuries and SWIFT access can be frozen, whereas gold stored domestically cannot.

Purchases have been unrelenting, surpassing 1,000 tonnes annually for three consecutive years, more than double the pace of the previous decade.

China leads the charge with continuous monthly purchases, while Russia, Turkey, and India have also been steadily increasing their holdings.

A World Gold Council survey shows 95% of central banks expect global gold reserves to continue rising, with nearly half planning to increase their own.

This persistent demand suggests gold’s rally is not just cyclical but signals a deeper structural rebalancing of global reserves.

Silver’s Twin Appeal

Silver is benefitting both from investment flows and industrial use. ETFs alone added almost 1,000 tonnes in June 2025, bringing total holdings to around 24,000 tonnes.

Retail demand for coins and bars remains strong, while lease rates have surged above 5% from near zero, pointing to scarcity. A $1.20 premium has also opened up between COMEX futures and London spot prices.

Beyond financial flows, silver is central to the green transition, used in solar panels, EVs, and electronics, providing a solid demand floor.

Where Prices Could Head

The outlook for the months ahead hinges on inflation trends and central bank policy. If inflation remains elevated and the Fed pivots towards easing, gold could advance towards $4,000 by year-end.

If inflation cools and real yields strengthen, consolidation is more likely. Silver should broadly follow gold but with more volatility. A firm break above $40 could open the door to $50 – last seen in 2011 – although weaker industrial demand would expose it to sharper setbacks.

At present, the bias remains constructive. Gold enjoys strong support from deficits, inflation risks, and central bank demand.

Silver, with its mix of monetary and industrial appeal, carries higher volatility but also the potential for outsized returns if momentum continues.

Market Movements Of The Week

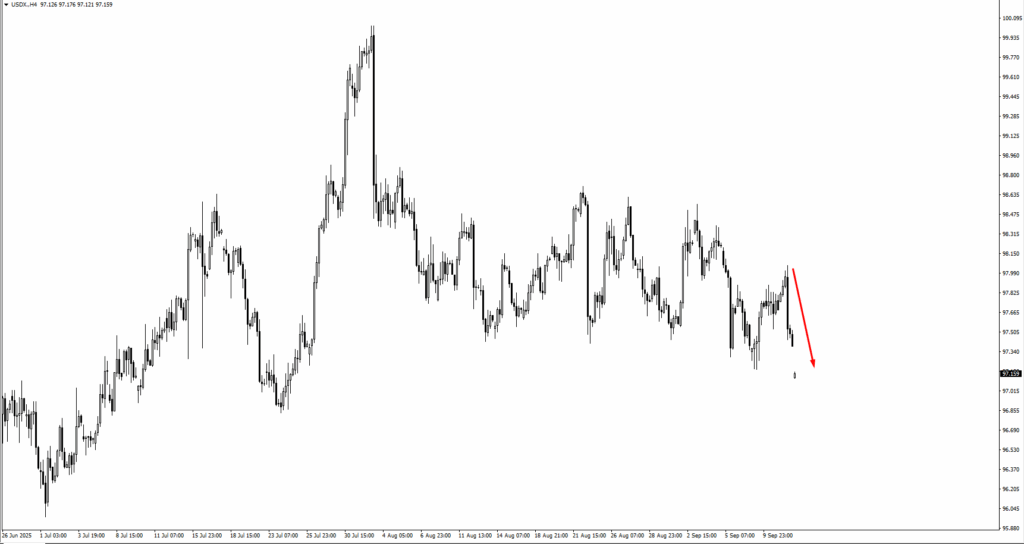

The US Dollar Index has retreated from 97.90 and risks slipping through 96.834 if weakness deepens. EURUSD is edging up from 1.1675 with scope to test 1.17795, while GBPUSD is climbing from 1.3510 and eyeing 1.35901.

USDJPY has dropped from 148.10, with a close below 147.058 opening the way towards 146.298. USDCHF is also under pressure, threatening 0.79148 if 0.7957 gives way.

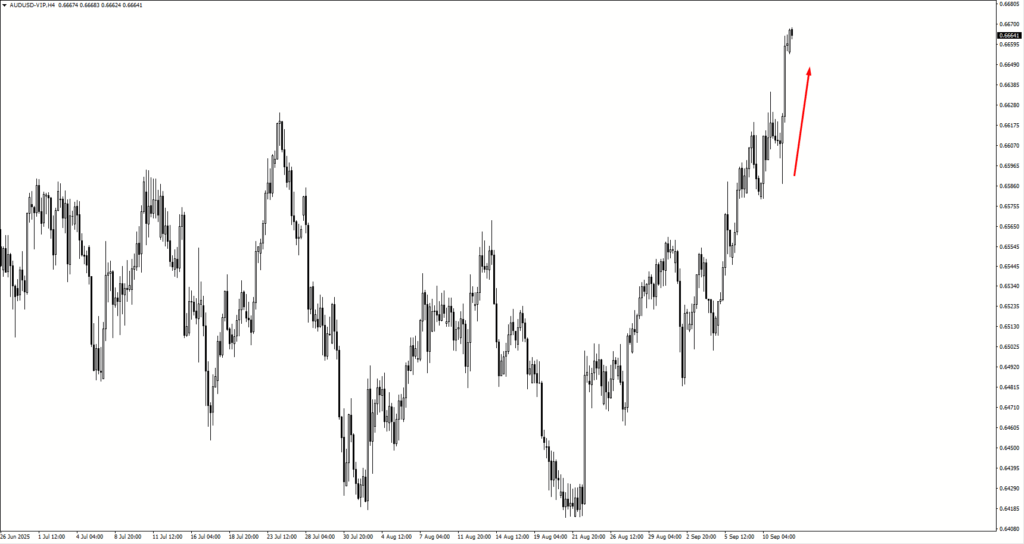

Commodity currencies are gaining ground. AUDUSD is aiming for 0.6690, NZDUSD is pushing toward 0.6000, and USDCAD has slipped under 1.38574 with 1.3820 now in focus.

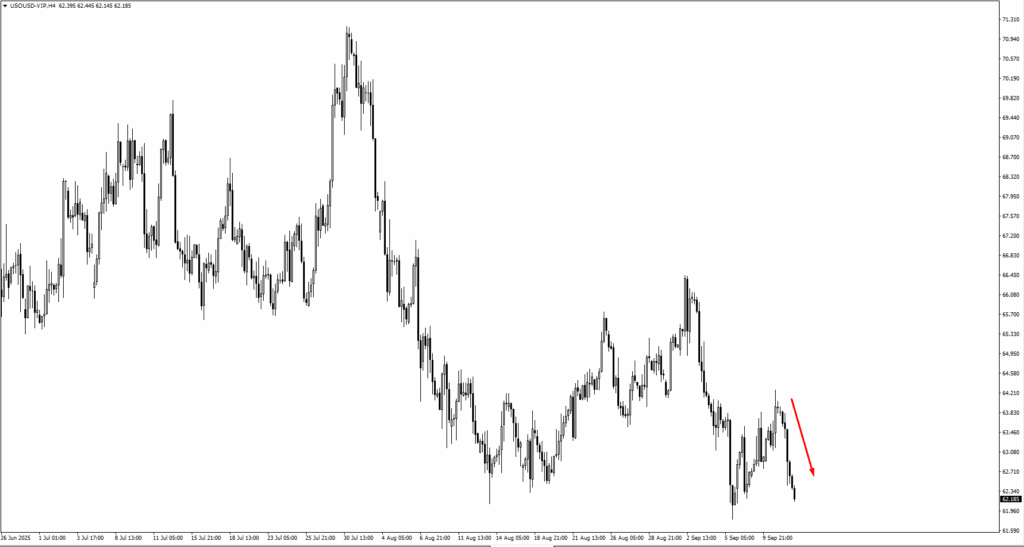

Oil remains volatile, rebounding from $62.70 before stalling at $64.35. A break under $61.804 could bring $58.40 into play.

Gold is consolidating with support at $3,585 and $3,550, while a breakout could aim for $3,835. Silver is holding above $40.511, with bulls targeting $42.55.

US equities remain buoyant: the S&P 500 is testing 6,870, while the Nasdaq is pushing towards 25,450.

Crypto is firm, with Bitcoin bouncing from 110,250 toward 116,200 and Ethereum breaking higher with 4,585 in sight. Natural gas remains under pressure near 2.97.

On the equity front, UnitedHealth is holding above 326.22 with an intrinsic value closer to 410, while Novo Nordisk has rallied from 52.80 toward a fair value of 90. Earnings momentum is keeping both names supported.

Key Events Of The Week

On Tuesday, September 16, attention turns to Canada’s median CPI y/y and US retail sales m/m. For the CAD, a hot inflation print could reinforce expectations that the Bank of Canada stays cautious, giving the loonie a lift.

For the USD, retail sales will be closely watched as a barometer of consumer strength, where any slowdown could weigh on the dollar.

Wednesday, September 17 brings the Bank of Canada’s overnight rate decision. Markets are split on whether policymakers can hold steady or hint at easing, given growth headwinds.

The CAD is likely to stay sensitive to both the policy tone and inflation context.

Thursday, September 18 is stacked with event risk. The US Federal Reserve announces its federal funds rate, where traders will parse not only the decision but the language around growth and inflation. New Zealand releases its GDP q/q, a key test for the NZD after recent soft spots in data.

The Bank of England also sets its official bank rate, where the balance between inflation control and growth concerns will be critical for GBP traders.

Friday, September 19 closes the week with the Bank of Japan’s policy rate. Even small shifts in tone can rattle JPY markets, given the yen’s sensitivity to global yield differentials. Any signal that the BOJ may adjust its stance would reverberate across FX markets.

Create your live VT Markets account and start trading now.