Forget the hype and the memes. Bitcoin has powered its way to $120,000, more than doubling over the past year. Yet this rally carries a different tone.

The speculative mania that once defined crypto booms has taken a back seat. Instead, late 2025 is being driven by global liquidity, institutional demand, and a regulatory landscape that is at last opening the door to mainstream finance.

Liquidity And Scarcity

Liquidity worldwide is expanding at an unprecedented pace, with central banks injecting trillions into economies to plug fiscal holes and offset sluggish growth.

In the United States, the federal deficit has already topped $1 trillion in just nine months, pushing money supply to fresh records.

As currencies lose purchasing power, investors have been rotating into scarce assets. Gold has long played that role, but Bitcoin’s finite supply of 21 million coins gives it a digital scarcity that appeals to those seeking protection.

With a market capitalisation of $2.3 trillion, Bitcoin still represents only a fraction of gold’s $23 trillion. The gulf highlights both the scope for further upside and the risks involved.

Persistently high inflation and loose monetary policy continue to suppress real yields, creating favourable conditions for alternatives. However, should central banks shift course, the balance could change quickly, keeping forecasts on the cautious side.

Institutional Flows

Institutions are spearheading this cycle. US-listed spot Bitcoin ETFs have already pulled in over $100 billion within just a few months.

Another milestone arrived in August when the US government authorised crypto allocations within 401(k) retirement schemes, unlocking access to trillions of household savings.

Large asset managers, including BlackRock and Fidelit,y are developing retirement-oriented crypto products, embedding digital assets into the fabric of long-term investment planning.

Unlike past surges, these inflows represent patient, regulated, and more persistent capital. That could help temper volatility, but the picture depends heavily on political and regulatory stability.

A shift in the tone of lawmakers or watchdogs could slow momentum, keeping the outlook evenly balanced between optimism and caution.

Retail On The Sidelines

Retail traders, once the lifeblood of parabolic rallies, have yet to re-engage. Downloads for trading apps like Coinbase and Robinhood remain subdued, while Google search activity lags behind prior bull markets.

This is striking given Bitcoin has outpaced the S&P 500 by a factor of five over the past year. The muted retail presence suggests pent-up demand; traders waiting for a catalyst.

If headlines of record highs or big corporate adoption hit the mainstream, retail flows could return rapidly. With ETFs and fintech apps lowering barriers to entry, participation has never been easier.

Most analysts expect retail involvement to reappear eventually, though when it does, it could revive the volatility seen in earlier cycles.

Regulation Opens The Door

The regulatory backdrop is shifting, too. The US Securities and Exchange Commission has streamlined rules for commodity-based ETFs, explicitly extending coverage to digital assets.

Exchanges such as Nasdaq, NYSE Arca, and Cboe can now list funds much faster, sidestepping the lengthy approval process.

Grayscale’s Digital Large Cap Fund, holding Bitcoin, Ethereum, Solana, and XRP, has already reaped the benefits.

This sets the stage for a wave of multi-crypto ETFs, giving institutions fresh allocation routes and retail investors simpler access through established brokerage accounts.

The cautious take is that while more products will attract flows, demand could thin out if too many arrive at once.

Market Movements This Week

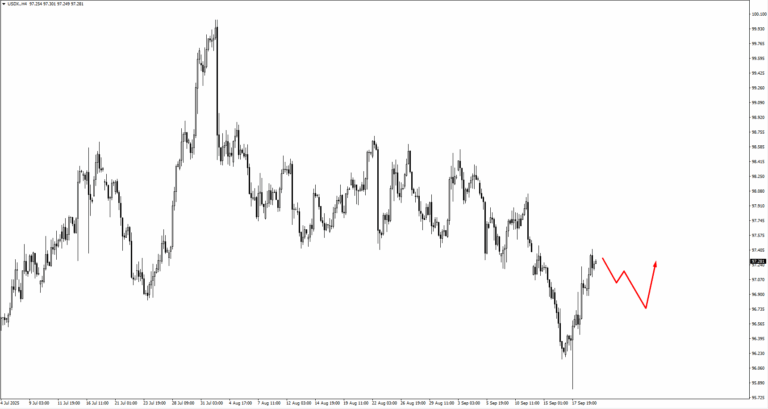

The dollar index is holding near 96.60, with bullish setups possible if consolidation continues.

EURUSD risks slipping below 1.17932, while GBPUSD faces pressure near 1.3540, with 1.3515 and 1.3605 also in play.

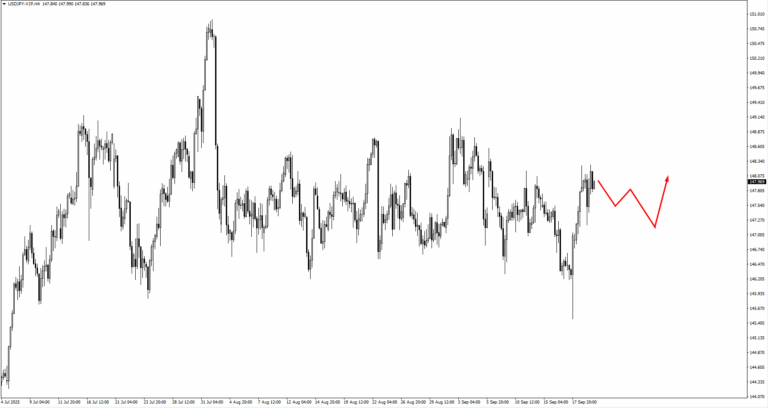

USDJPY broke the 146.298 swing low before rebounding, leaving 147.00–147.35 as key levels to monitor.

USDCHF is building support at 0.7915–0.7890, while AUDUSD and NZDUSD remain under pressure near 0.6640 and 0.5900–0.5920 respectively. USDCAD could break higher through 1.37666 or attract buyers near 1.3700.

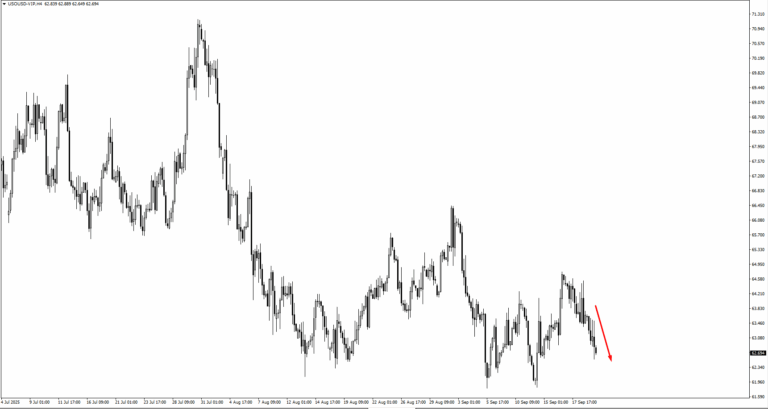

Oil is balanced at 62.40, or 61.825 if it breaks lower. Gold retains scope toward 3740, 3810, and 3835, while supports sit at 3590 and 3550.

Natural gas stays weak after breaking 2.84, with 2.95–2.98 acting as short-term resistance. The S&P 500 is aiming for 6750 and 6840, though stretched valuations may weigh.

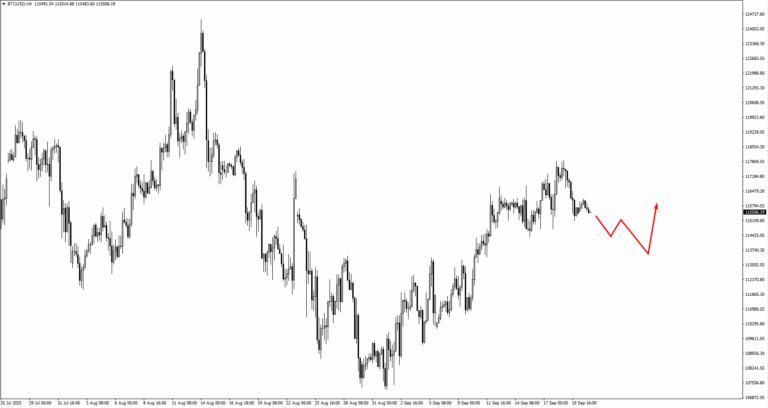

Bitcoin is consolidating after trading down from 118,050, with 112,650 the next area to test.

Key Events This Week

The week begins in Australia, where RBA Governor Michele Bullock is due to speak on Monday, 22 September. Markets will listen closely for any hints that the central bank is leaning toward cutting rates. With growth slowing and external headwinds mounting, even a small shift in language could move the Australian dollar.

On Tuesday, 23 September, attention turns to the UK, where Bank of England Governor Andrew Bailey is expected to speak. Most analysts see no further cuts from the BoE this year, and traders will be watching closely to see whether his remarks confirm that stance.

The same day brings a heavy run of flash PMIs. In Germany, manufacturing is forecast at 50.0 versus 48.8 previously, while services are seen at 49.5 versus 49.3.

For the eurozone, manufacturing is expected at 47.2 versus 47.0, and services at 53.6 compared with 54.2 prior. The UK’s own releases are forecast at 47.2 for manufacturing and 53.6 for services. In the US, manufacturing is projected at 51.8 versus 53.0 previously, with services at 53.8 compared with 54.5. These figures will provide a crucial test of global momentum after the softer US jobs report raised expectations for Fed cuts.

Midweek on Wednesday, 24 September, the calendar is quiet, offering markets a pause to digest the PMI releases before the next round of central bank decisions.

Thursday, 25 September, sees the Swiss National Bank policy decision, with the rate expected to remain steady at 2.15 percent. Later in the day, the US publishes its final Q2 GDP print, with forecasts unchanged at 3.30 percent. While the headline is steady, traders will be combing through the details for clues on underlying demand.

The week concludes on Friday, 26 September, with the release of the Core PCE Price Index, the Fed’s preferred inflation measure. A reading of 0.2 percent month-on-month versus 0.3 percent previously would reinforce expectations that the central bank could cut rates twice before the end of the year. An upside surprise, however, could challenge that view and slow the dollar’s recent decline.

Next week brings further tests, with the RBA cash rate, US JOLTS job openings, and the key non-farm payrolls report on October 3. These releases will be decisive in shaping central bank expectations into the final quarter of the year.