The bubble debate has resurfaced with intensity. Both the S&P 500 and Nasdaq have surged this year, fuelled largely by gains in technology and AI-related stocks. Some commentators are drawing parallels with previous market bubbles.

However, Goldman Sachs executives maintain that the rally remains anchored in earnings growth and broader economic optimism rather than speculative mania. JPMorgan’s Jamie Dimon, meanwhile, sounded a more cautious note, suggesting that a notable correction could materialise within the next six to twenty-four months. While many investors continue to bet on further upside, others argue that the risks of a downturn are not being fully priced in.

Market Structure: Narrow And Top-Heavy

A key warning sign lies in market breadth, the extent to which gains are shared across different stocks. Currently, only a handful of large-cap names are carrying the indices higher, leaving the broader market behind. This kind of concentration often raises concerns, as narrow leadership can signal fragility beneath the surface.

Technical indicators are also flashing warning lights. Momentum gauges across several markets are showing signs of exhaustion, suggesting that prices could be vulnerable to a pullback.

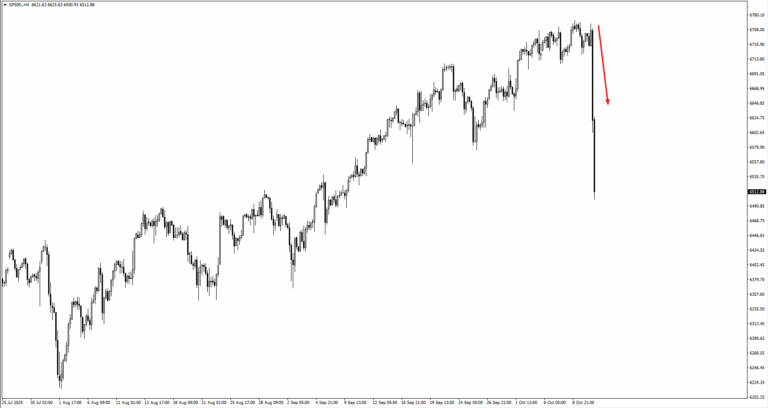

Recent developments have only added to the tension. The renewed trade dispute between the US and China, including threats of 100% tariffs and potential export controls, spooked investors last Friday. The S&P 500 fell 2.7%, the Nasdaq tumbled 3.6%, and the Dow lost nearly 1.9%. The sharp reversal served as a reminder of how swiftly market sentiment can change.

Earnings, Policy, And The Path Forward

The approaching earnings season could prove pivotal, offering the first major test of the market’s resilience. Should corporate outlooks disappoint or profit margins show signs of erosion, investors’ enthusiasm could quickly fade.

Central banks also hold considerable sway over the next move. Upcoming remarks from the Federal Reserve and other policymakers will be closely monitored. A dovish tone could sustain risk appetite, while any unexpected hawkishness might send markets lower.

Trade policy remains another wild card. Escalating rhetoric between Washington and Beijing adds a layer of uncertainty at a time when valuations already appear stretched. Recent market reactions suggest that investors remain highly sensitive to political and policy headlines.

In short, while the broader trend could still point upward, the risk-to-reward balance is becoming less favourable. Traders may want to focus on hedging strategies, prioritise relatively stronger sectors, and be wary of chasing high-momentum names that could be vulnerable to abrupt corrections.

Key Symbols To Watch

– DJ30

– NAS100

– SP500

– VIX

– ARKK

Market Movements Of The Week

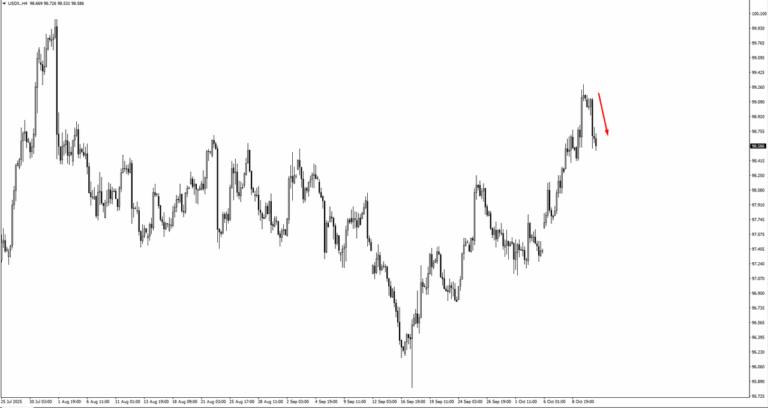

USDX retreated from 98.90–99.00. Support now rests near 98.20, with the next downside target at 97.90 if momentum continues lower. Bias stays bearish below 98.90. Traders should watch for any consolidation between 98.20–98.70 before re-entry.

S&P 500 collapsed from the 6,750 monitored resistance, plunging toward 6,510 on heavy risk-off flows. Momentum stays bearish while below 6,600–6,620. Next downside zones sit near 6,440 and 6,395. Short-term traders may seek relief rallies into 6,600 to fade. Only a clean break above 6,660 would ease pressure.

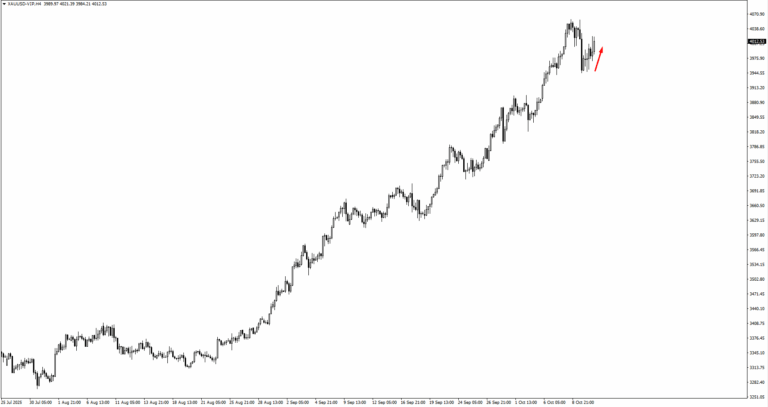

Gold’s price paused around 4,010 after a steep run, consolidating above 3,985–3,995 on H4. Bias stays upward while above 3,980. A push through 4,045 would refocus 4,080, then 4,100.

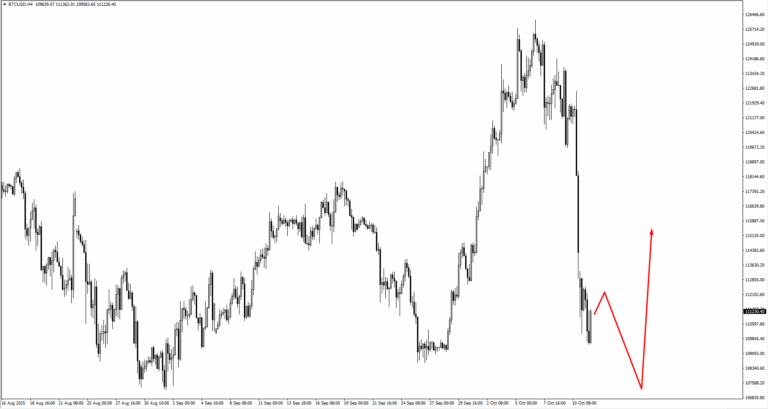

Bitcoin fell sharply from 122,700, hitting a low near 109,600 before stabilising around 111,200. Short-term structure favours a bounce if 108,600 – 107,240 holds as support. Bias stays cautious. Expect intraday rebounds toward 113,000 – 115,000, but sustained recovery depends on broader risk sentiment.

EURUSD steadied near 1.1620, rebounding from the 1.1580–1.1600 monitored support area. Short-term bias turns mildly bullish toward 1.1660. A clean break above this level could extend to 1.1700. Watch for consolidation between 1.1580–1.1660. A drop below 1.1580 would reopen the path to 1.1520.

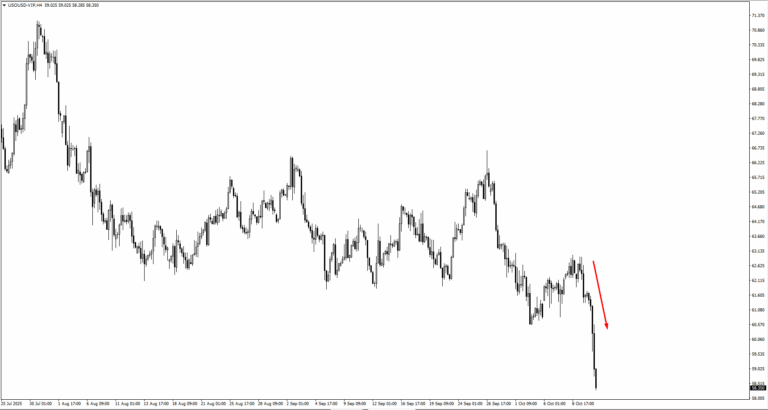

Oil extended losses, breaking below the 60.55 monitored level and now testing 58.35 support. If consolidation fails above 58.00, price could slide toward the next key area near 53.00. Short-term rebounds may face resistance around 59.80–60.50. Trend bias stays bearish while below 60.55.

Key Events This Week

| Date | Currency | News |

| 13 October | Bank holiday for Japan, Canada, US | |

| 14 October | No news | |

| 15 October | USD GBP | Fed Chair Powell speaks BOE Gov Bailey Speaks |

| 16 October | AUD GBP USD | RBA Gov Bullock speaks GDP m/m PPI m/m, Retail Sales m/m |

| 17 October | CAD | BOC Gov Macklem speaks |