The swift shift in expectations for the Federal Reserve followed an unusually dovish tone from typically centrist policymakers, including New York Fed President John Williams and Governor Christopher Waller.

Their latest comments suggested that interest rates may need to be lowered “in the near term” as labour market conditions weaken and inflation eases. This has prompted institutions such as JPMorgan to bring forward their forecast for the first rate cut to December.

Rising Expectations Of A Cut

FedWatch probabilities have pivoted sharply over the past fortnight. Futures markets now price in roughly an 87% likelihood of a 25-basis-point cut at the 10 December FOMC meeting, a significant jump from the 40–50% range only a week ago, as traders reacted to dovish signals from Fed officials and softer-than-expected economic data.

Lower rate expectations have filtered through the Treasury market. The 10-year yield has drifted back towards the 4.0% area, while the 2-year yield is sitting near 3.5%, levels more aligned with a policy path that includes several reductions over the coming year.

This decline in yields has reignited appetite for growth stocks and duration-sensitive assets. US technology shares have just seen their strongest daily gain in six months, with the Nasdaq climbing around 2.7% and the S&P 500 gaining 1.6% in a single session, driven by strong performances from AI-linked giants such as Broadcom, Alphabet, Microsoft, and Tesla.

Meanwhile, cryptocurrencies remain near their November lows, indicating persistent risk-off caution despite improving liquidity conditions. Volatility is still elevated ahead of upcoming US releases.

Market Movements Of The Week

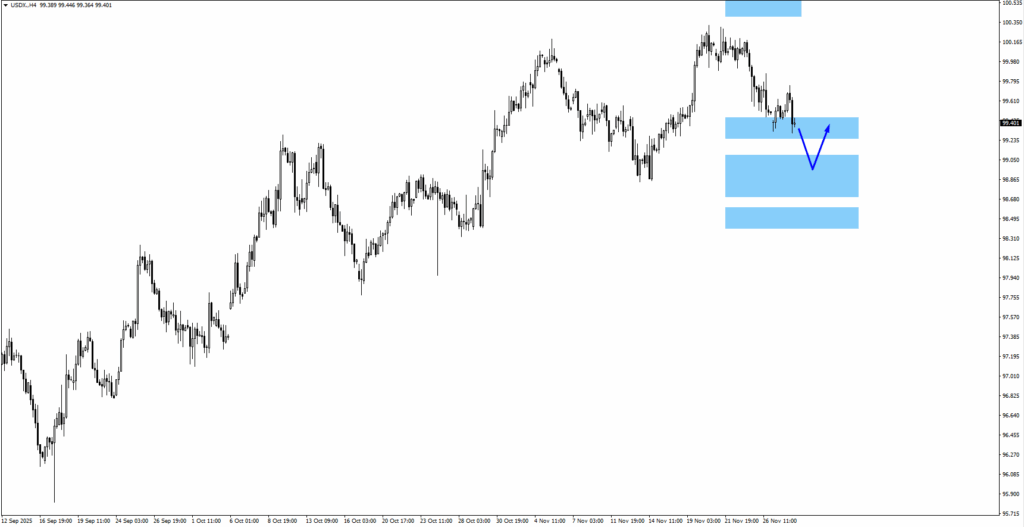

USDX

– USDX traded up and retested the 99.45 zone, showing hesitation as the index reacts to shifting US rate expectations.

– If the index pulls back, traders should watch the 99.00 support area, where bullish price action may re-emerge.

– If momentum continues higher, USDX could push toward 100.50 or even 100.90, especially if upcoming US data surprises to the upside.

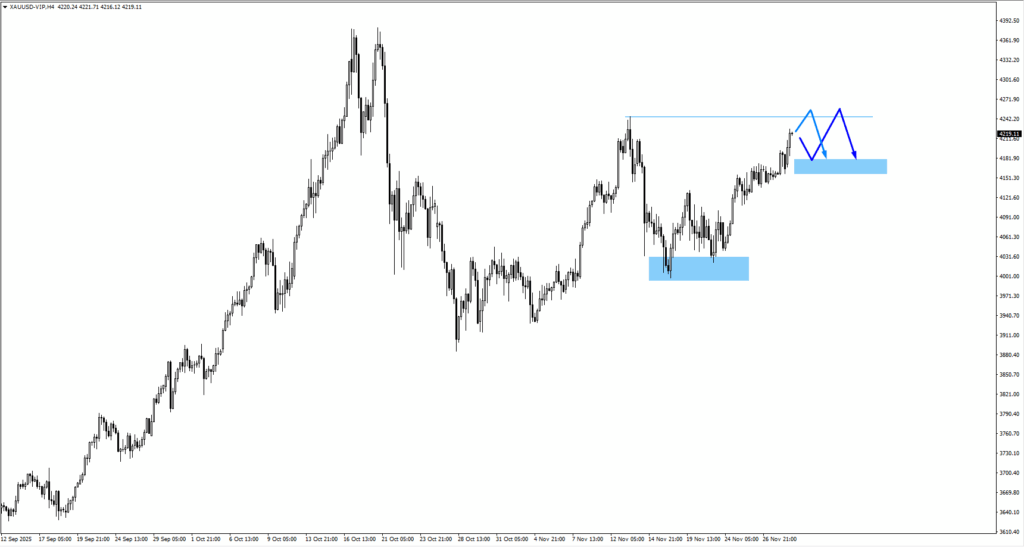

Gold (XAUUSD)

– Gold traded above the 4,190 monitored area, supported by softer Treasury yields and rising expectations of a December Fed rate cut.

– Price could extend toward the 4,245 resistance zone before any corrective pullback, especially if upcoming US data shows further cooling in services activity or hiring.

– If gold consolidates first, watch for bullish price action around 4,170, as weaker US employment or ISM readings this week may reinforce demand for safe havens and keep the uptrend intact.

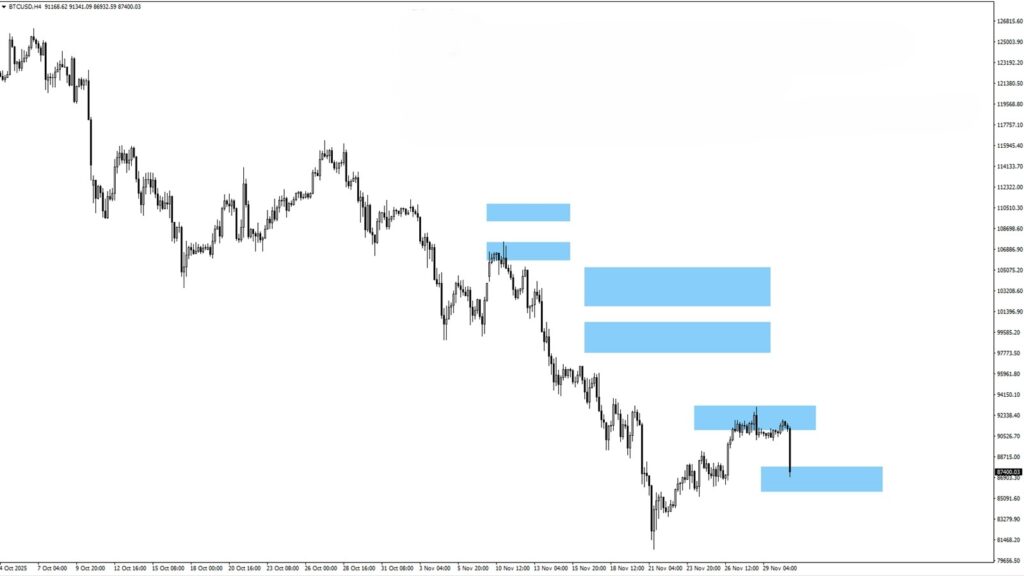

Bitcoin (BTCUSD)

– Bitcoin traded down from the 92,450 monitored area after consolidating for more than a week, reflecting reduced risk appetite as traders reassessed the Fed’s mixed signals.

– Price is now testing the 87,070 monitored area, a key level that aligns with broader uncertainty ahead of major US data releases this week (ISM Services, ADP jobs, and PCE).

– If BTC shows another consolidation pattern at current levels, it could pave the way for a new swing low, especially if US data comes in stronger and dents December rate-cut expectations.

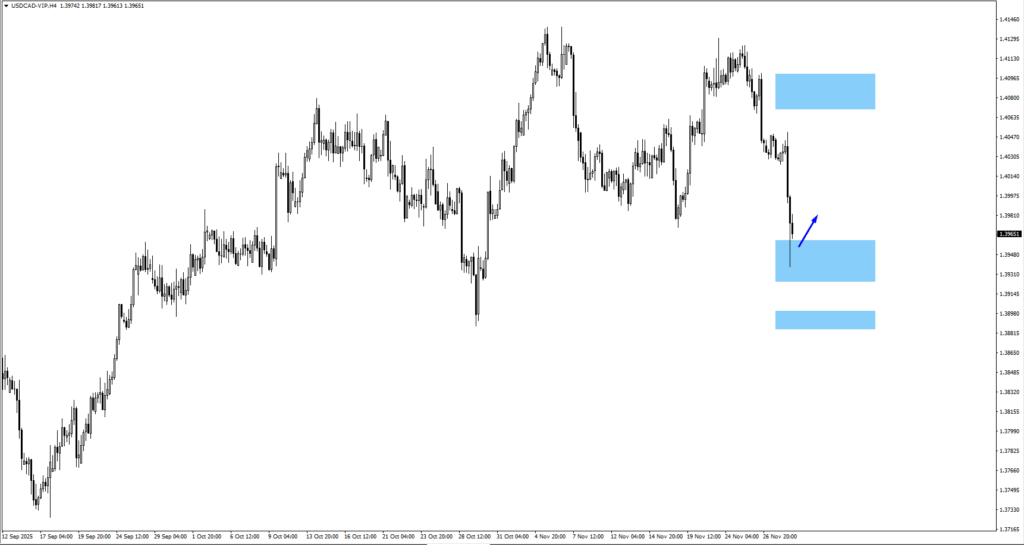

USDCAD

– USDCAD extended its downside move after taking out the 1.3970 liquidity zone, signalling that bearish pressure is still in play.

– If price consolidates at current levels, a push lower toward the 1.3900 support becomes likely, especially if USD sentiment stays soft.

– Traders will watch Canada’s Employment Change data on 5 December, where a stronger jobs print could add further downside pressure on USDCAD, while a weak report may trigger a corrective bounce.

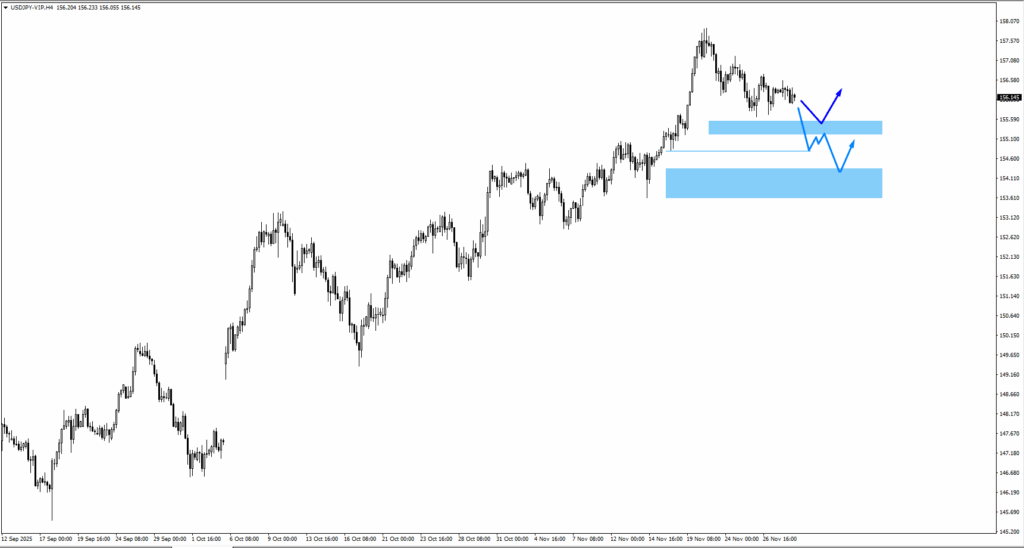

USDJPY

– USDJPY dropped further and tested the 155.50 zone after BoJ Governor Ueda signalled that a December rate hike remains possible, boosting the Japanese Yen during the Asian session.

– The pair is also under pressure from a broadly weaker US Dollar, as markets price in a high probability of a Fed rate cut next week, reducing yield differentials that previously supported USDJPY.

– If the downward trend keeps going, traders should pay attention to price movements around 155.35 and 154.65, where positive reactions might happen, but ongoing strong signals from the BoJ could keep pushing prices lower.

Key Events This Week

1 December

1. US ISM Manufacturing PMI, Forecast: 49.0, Previous 48.7

Watch for USD volatility.

3 December

1. AU GDP q/q, Forecast: 0.7%, Previous: 0.6%

Weak GDP could add downside pressure.

2. US ADP Non-Farm Employment Change, Forecast: 19K, Previous: 42K

Jobs surprise can swing USD.

3. US ISM Services PMI, Forecast: 52.0, Previous: 52.4

Softer data boosts risk.

4 December

1. US Unemployment Claims, Forecast: 220K, Previous 216K

Higher claims add dovish bias.

5 December

1. CA Unemployment Rate, Forecast 7.00%, Previous 6.90%

Strong jobs will boost CAD.

2. US Core PCE Price Index m/m, Forecast: 0.20%, Previous: 0.20%

Softer PCE may lift gold.

Bottom Line

The data due this week will determine whether the Fed’s dovish turn has more room to develop or requires reassessment, while important international figures will also influence cross-asset flows.

With central banks in Japan, Australia, and Canada shaping the broader sentiment, traders should remain agile and ready for renewed volatility as the macro landscape becomes clearer.

For market participants, staying adaptable, keeping a close eye on key levels, and responding swiftly to data surprises will be crucial as positioning builds ahead of the final major event of the year.