The economic calendar looks relatively light in the days ahead, yet price action may tell a different story. As year-end approaches and liquidity continues to thin, even small data surprises could be enough to knock the US dollar, gold, or cryptocurrencies out of their recent trading ranges.

On 19 December, the Bank of Japan lifted its policy rate to 0.75%, the highest level seen in more than 30 years, signalling a cautious but deliberate move away from ultra-accommodative policy settings.

While some investors had braced for a disorderly reversal of the yen carry trade, market reactions remained controlled.

US equity futures edged higher and Bitcoin advanced following the announcement, suggesting the rate hike had already been largely discounted. Governor Kazuo Ueda further calmed markets by emphasising that policy rates are still below the estimated neutral level.

Japan’s real yields remain in negative territory, keeping overall financial conditions supportive.

For traders, this is significant. Without a meaningful yield advantage, the yen still lacks the pull needed to trigger widespread forced deleveraging across global markets. Any unwinding of carry trades is therefore more likely to play out gradually over months rather than abruptly.

US Growth Signals Move Into Focus

Attention now shifts to the preliminary US GDP reading for the third quarter, expected at 3.2%, down from the previous 3.8%. A softer outcome would reinforce the view that US economic momentum peaked earlier this year.

The dollar index bounced from the 97.40 area last week, but the rebound appears tentative. Should GDP data confirm slowing growth, renewed USD weakness could emerge, offering support to commodities and risk assets as the year draws to a close.

Liquidity is also set to decline sharply over the coming sessions, a seasonal pattern that often amplifies technical moves around key price levels.

Risk Assets Stay Resilient

Equities and cryptocurrencies continue to adjust to the idea that global monetary tightening has become more predictable. The absence of a policy shock has helped maintain risk appetite, although further gains may depend on whether incoming growth data continues to soften.

Bitcoin remains locked in a range, reflecting equilibrium rather than strong directional conviction. Gold, meanwhile, continues to attract buyers on pullbacks as expectations for real yields remain capped.

Market Movements Of The Week

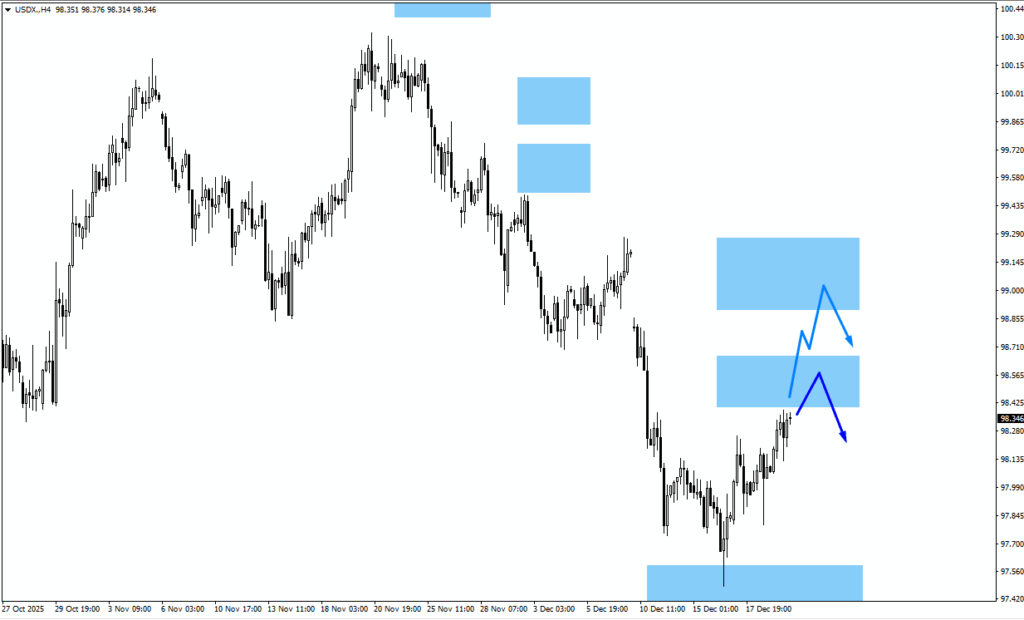

US Dollar Index (USDX)

– USDX rebounded from the 97.40 monitored zone last week.

– Resistance sits near 98.55, with scope toward 99.10 if momentum holds.

– A weak GDP print could reverse gains back into range.

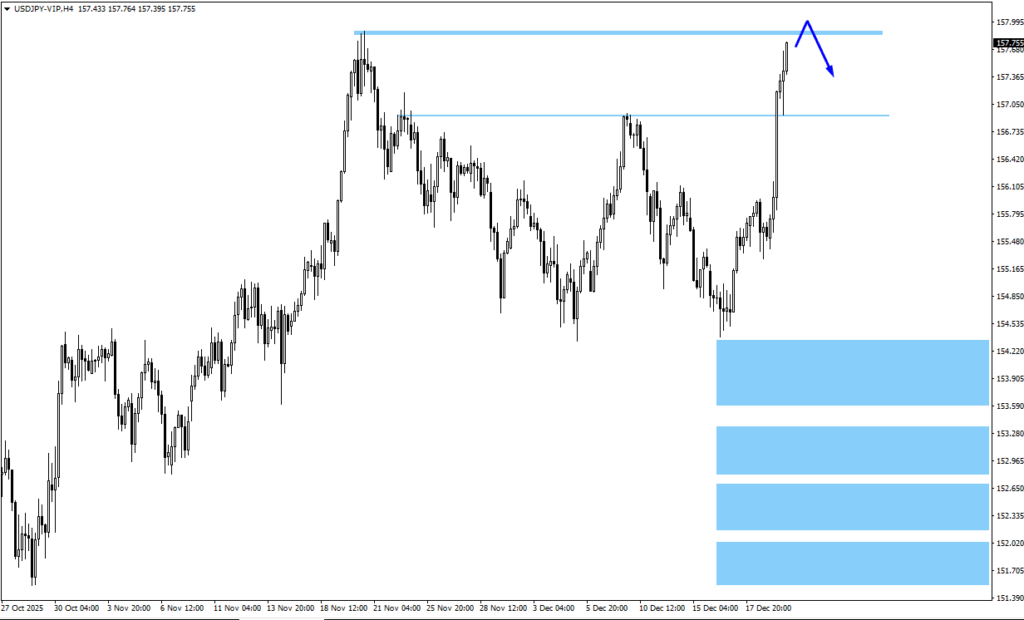

USDJPY

– USDJPY pushed higher following the BOJ decision.

– Price may test above 157.88 before encountering selling pressure.

– Failure to hold above recent highs may signal consolidation rather than trend.

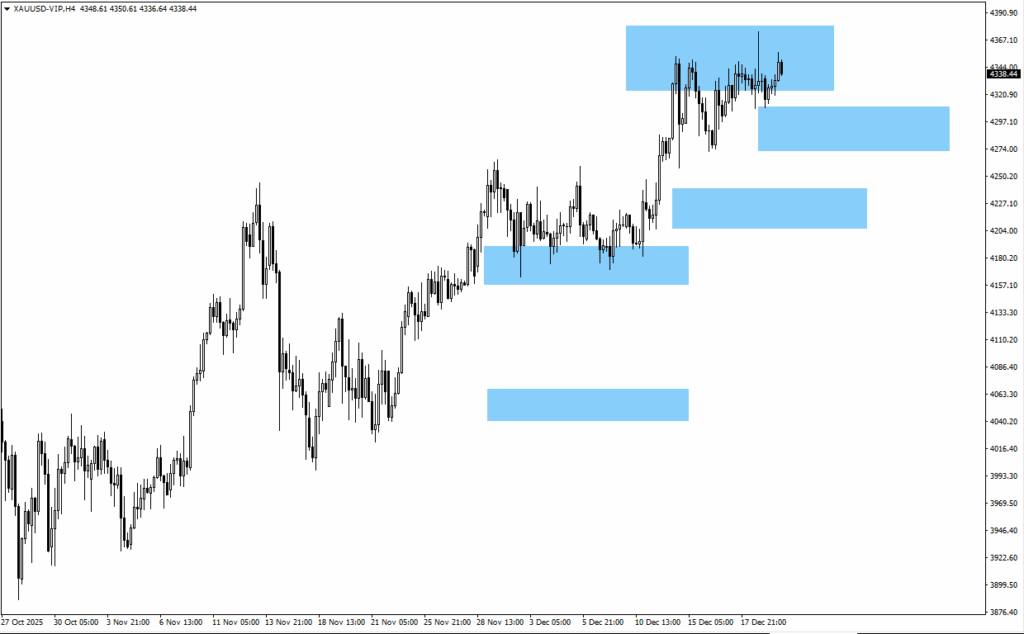

Gold (XAUUSD)

– Gold bounced from the 4290 zone but lacks strong continuation.

– Pullbacks toward 4290 or 4215 may attract dip buyers.

– Direction depends on US data and USD reaction.

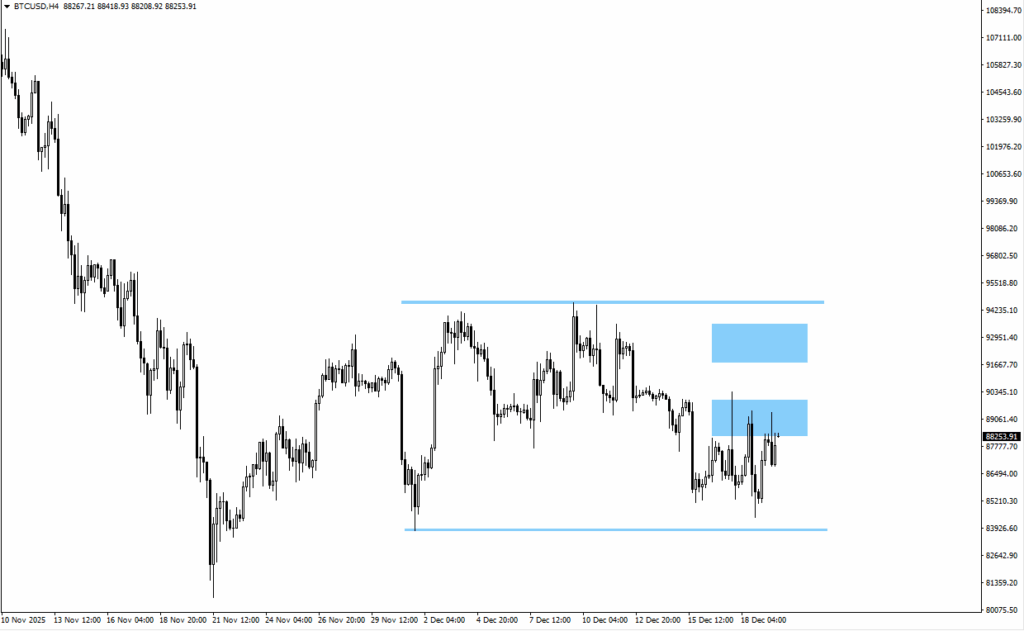

Bitcoin (BTCUSD)

– Bitcoin remains range-bound near 89,250.

– A close below 83,814 opens downside toward 75,850.

– A break higher places focus on 91,780 resistance.

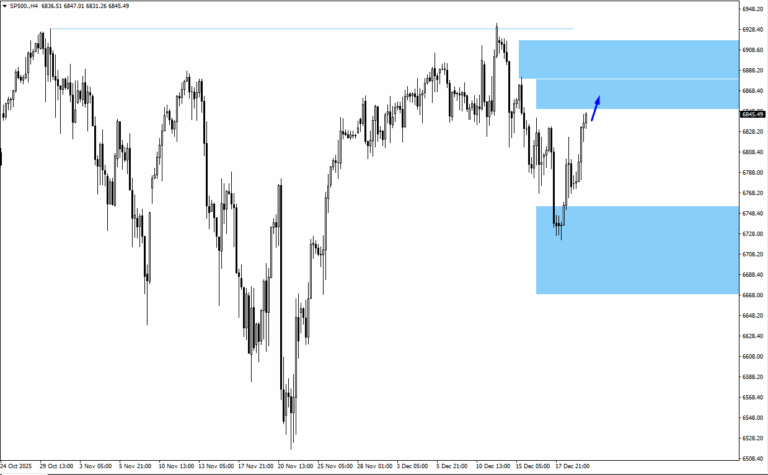

S&P 500 (SP500)

– Index rebounded strongly from recent lows.

– Upside levels to monitor sit near 6,870 and 6,905.

– Holiday liquidity may exaggerate intraday moves.

Key Event This Week

23 December

1. US Prelim GDP q/q, Forecast: 3.20%, Previous: 3.80%

Softer growth may cap USD upside.

Bottom Line

Markets enter the week in a period of transition, shifting away from policy-driven volatility towards a more technically driven environment. Japan’s gradual move away from ultra-loose policy has so far avoided market disruption, allowing risk sentiment to remain relatively stable as investors reassess their positioning.

The spotlight now falls on US growth data and the dollar’s response. A weaker GDP print could limit further USD upside and lend support to commodities and risk assets, while thin holiday liquidity raises the risk of outsized moves around key technical zones.