Gold (XAUUSD) inched higher towards the $5,045 mark during early Asian trade on Monday, extending its recent recovery. The move has been underpinned by a softer US dollar and ongoing accumulation from central banks. Attention now shifts to the postponed US January jobs report, due for release on Wednesday.

At the same time, US Treasury Secretary Scott Bessent said on Thursday that a criminal investigation into Kevin Warsh, President Donald Trump’s nominee for Federal Reserve Chair, could not be ruled out should Warsh ultimately resist pressure to lower interest rates. Persistent concerns over the Federal Reserve’s independence have continued to weigh on the dollar, providing indirect support to dollar-priced assets, including gold.

Nikkei Jumps To Record Levels As PM Takaichi Secures Election Win

Japan’s ruling coalition, led by Prime Minister Sanae Takaichi, is heading for a commanding victory in Sunday’s snap general election.

Projections from public broadcaster NHK indicate that the coalition led by Takaichi’s Liberal Democratic Party (LDP) has captured 352 of the 465 seats in the House of Representatives, with the LDP itself securing a clear majority of 316 seats.

Japanese equities recorded their strongest advance since April, as Takaichi’s landmark election win boosted expectations of expanded fiscal spending across major sectors of the economy.

The Nikkei 225 jumped as much as 5.7% to a new all-time high of 57,337.07 by mid-morning local time, while the broader Topix index gained up to 3.4% to reach a record level. Technology and machinery stocks led the rally, with several semiconductor equipment makers posting gains of more than 10%.

Market Movements Of The Week

Gold (XAUUSD)

– XAUUSD found strong support at the 4650 level.

– If bullish momentum holds, it could head toward the 5070 resistance level.

– A breakout of the 5070 resistance level could mean higher prices.

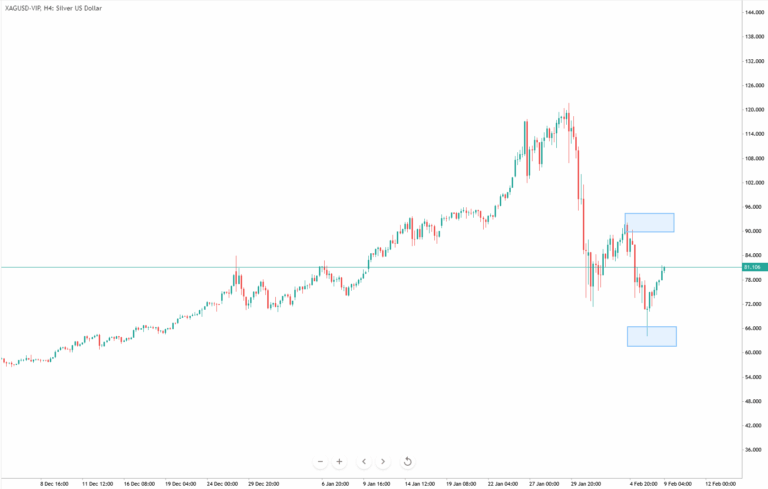

Silver (XAGUSD)

– XAGUSD found support at the 65 level.

– Buyers could be pushing Silver back to the 91 level.

– Upcoming NFP data is crucial for Silver’s movements.

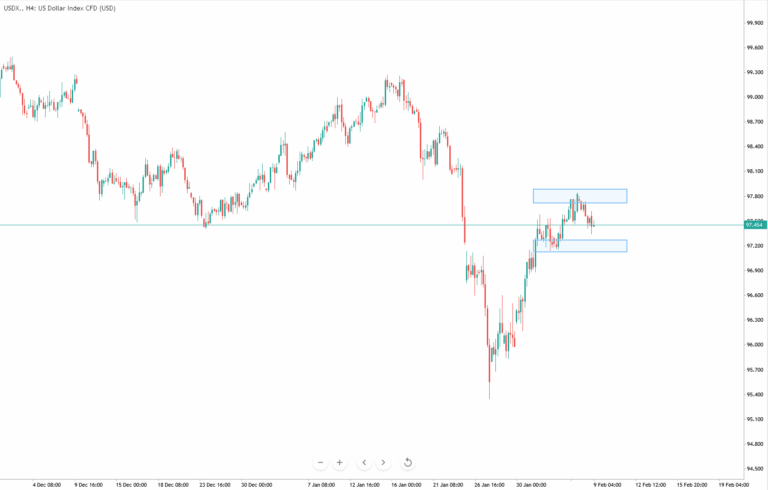

US Dollar Index (USDX)

– USDX surges past and has retested the 97.2 level.

– USDX fails trade higher than the 97.85 resistance level.

– 97.85 resistance level is crucial for USDX, upcoming CPI could decide USDX’s movements.

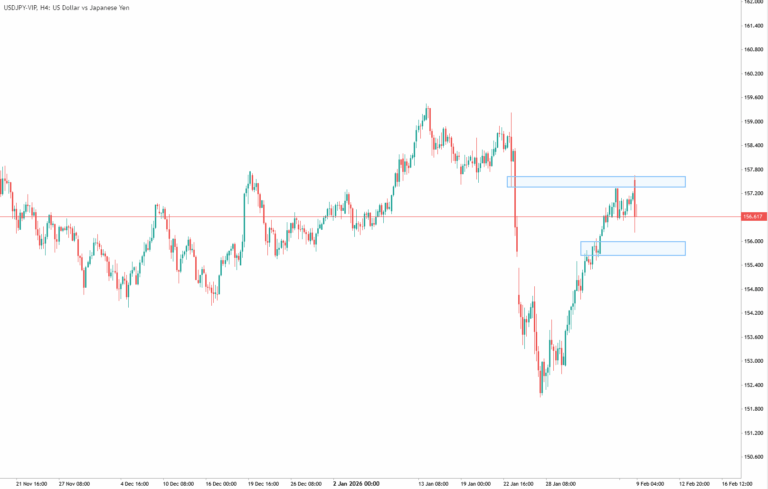

USDJPY

– USD/JPY rejects trading higher facing 157.600 resistance level.

– USD/JPY currently trades above 156.000 support level.

– If USD/JPY fails to hold above 156.000 it could seek for previous lows.

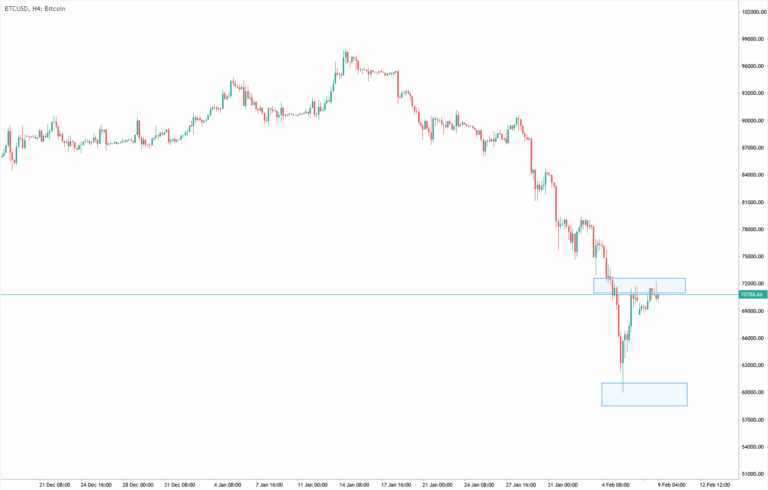

Bitcoin (BTCUSD)

– Bitcoin traded below $60,000 but has quickly rebounded.

– The current $70,000 level is crucial for Bitcoin as it has failed to break it several times.

– Current condition for Bitcoin is still very bearish; it could still retest the $60,000 level.

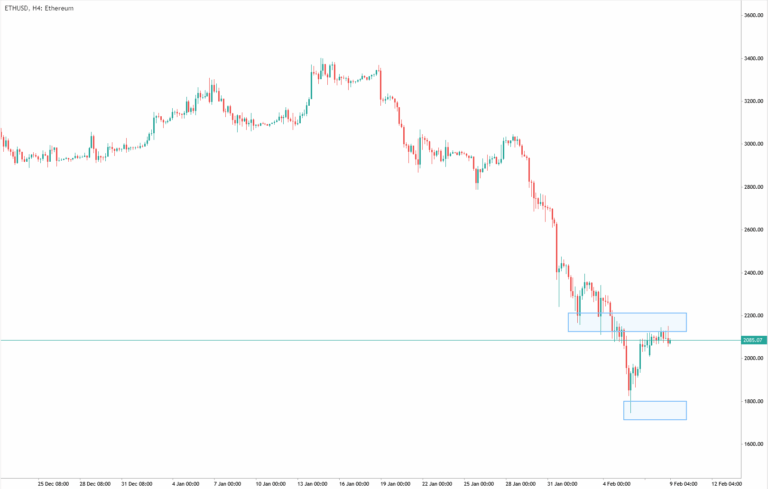

Ethereum (ETHUSD)

– Ethereum traded to a low of $1750 but has rebounded above $2,000.

– Ethereum is testing the resistance level priced at $2,000.

– The next resistance level is priced at $2,400 if buyers strengthen.

Key Events This Week

10 February

1. US Retail Sales, Forecast: 0.40%, Previous: 0:60%

Weaker consumer activity could put pressure on the Dollar.

11 February

1. US Average Hourly Earnings m/m, Forecast: 0.30%, Previous: 0.30%

High wages would favour Warsh’s hawkish side

2. US Non-Farm Employment Change, Forecast: 70K, Previous: 50K

A strong beat could seal Gold’s fate below $5,000.

3. US Unemployment Rate, Forecast: 4.40%, Previous: 4.40%

A rising rate could reinforce a softer Fed tone.

13 February

1. US Core CPI, Forecast: 0.30%, Previous: 0.20%

A higher inflation rate could resume rate hikes.

Bottom Line

Anticipation of more aggressive interest rate cuts by the US Federal Reserve in 2026, reinforced by emerging signs of softness in the US labour market, has become an additional pillar of support for the non-yielding yellow metal.

Meanwhile, the White House reiterated that diplomacy remains President Donald Trump’s preferred route in managing relations with Iran, while stressing that military options remain available if needed.

This combination keeps geopolitical risks elevated and continues to underpin demand for gold as a safe haven.

Further tailwinds come from renewed selling pressure on the US dollar, which offers additional support to precious metals. That said, expectations that incoming Fed Chair Kevin Warsh may take a firmer, less dovish policy stance could cap further upside in gold, suggesting a more cautious approach is warranted when positioning for additional gains.