Oil markets extended their cautious climb on Wednesday, with West Texas Intermediate (WTI) advancing 0.3% to $63.62 a barrel and Brent crude also up 0.3% at $67.82. It marked the second consecutive session of gains.

The move higher was driven by tightening supply conditions combined with renewed geopolitical uncertainty.

Fresh figures from the American Petroleum Institute (API) showed a drawdown of 3.82 million barrels in US crude inventories last week, adding fuel to already bullish sentiment.

Gasoline stocks fell by just over 1 million barrels, although distillates recorded a modest build. Traders are now awaiting official confirmation from the Energy Information Administration (EIA) later in the day, which is expected to set the tone more clearly.

On the supply side, progress in restarting oil exports from Iraq’s Kurdistan region has hit a stumbling block. Despite earlier optimism, leading producers are withholding around 230,000 barrels per day until debt repayment guarantees are secured.

The key pipeline to Turkey has been offline since March 2023, and this latest snag underscores fragility across the global supply chain.

Concerns were also heightened by Venezuela, where Chevron confirmed it would only be able to ship half of its 240,000 bpd quota due to newly imposed restrictions, tightening the flow of heavy crude into the US.

Technical Analysis

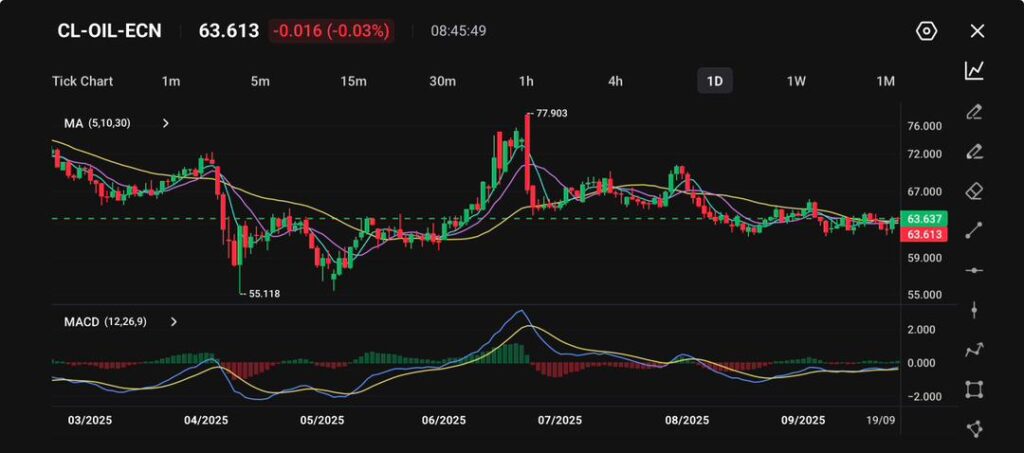

Crude oil (CL-OIL) is trading at $63.61, down 0.03% on the day, showing continued consolidation after a volatile year. Prices fell sharply to a low of $55.11 in April, before surging to $77.90 in July, only to retrace back into the low-to-mid 60s range.

The moving averages (5, 10, 30) are compressed and flat, suggesting a lack of clear momentum. The MACD histogram is hovering around the zero line, confirming neutral momentum and the absence of a decisive trend. This signals that oil is stuck in a sideways market, waiting for a catalyst.

Immediate support lies around $61.50–62.00, a zone that has held multiple times. A break below could reopen the path toward the $59.00 handle. On the upside, resistance sits at $66.50, followed by the more significant $70.00 level.

Overall, oil is consolidating within a tight range, with traders watching whether macroeconomic cues, such as US inventory data or OPEC+ policy will drive the next breakout.

Cautious Outlook

In the short term, crude prices are expected to trade within a $59–68 band, underpinned by ongoing supply constraints but limited by uncertainty over the US Federal Reserve’s policy direction.

As long as Kurdistan’s shipments remain halted and Venezuelan flows restricted, downside risks seem contained. Still, many market participants are waiting for confirmation from official US inventory figures before making firmer bets on a breakout.

Create your live VT Markets account and start trading today.