Trading crude oil presents profit opportunities across various market conditions due to oil’s unique position in the global economic and political system.

With the right strategy and risk management in place, volatility in the energy sector can generate consistent returns for short-term swing traders and long-term investors.

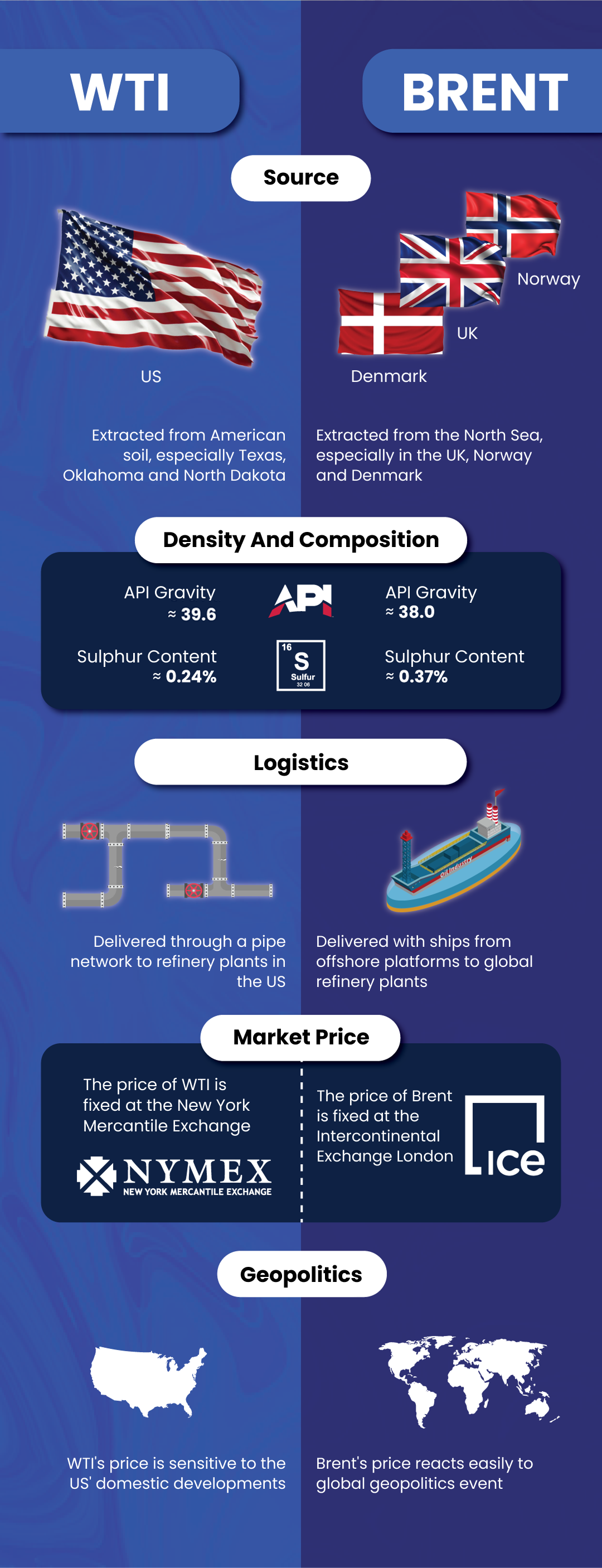

In oil trading, two main benchmark assets are commonly used to track oil prices: WTI and Brent.

The illustration below highlights the key differences between these two types of crude oil:

Trade Oil with VT Markets

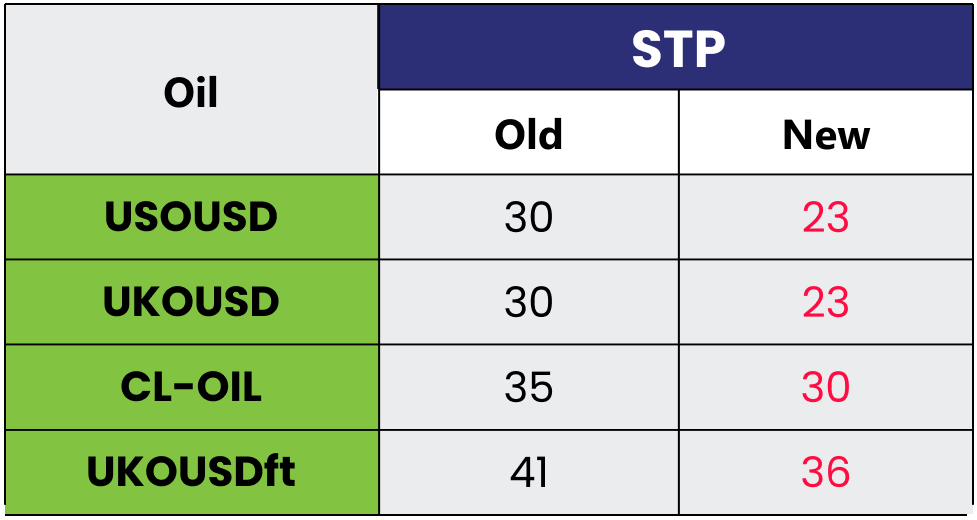

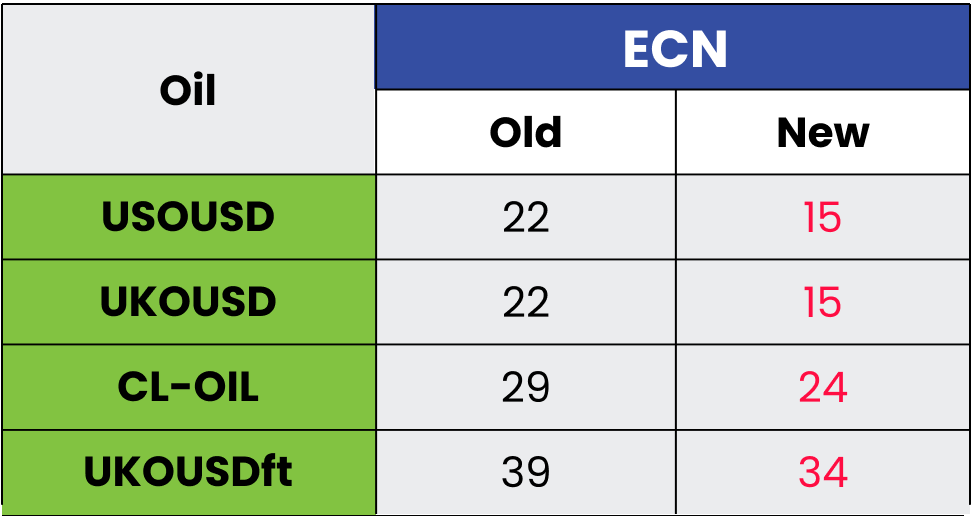

VT Markets has reduced the spreads on related assets to offer traders more competitive spreads on oil trading.

Currently, spot oil spreads have been lowered by 5 points, while futures oil spreads have been reduced by 7 points:

Additionally, VT Markets offers some of the highest leverage available for oil trading of up to 1:500.

Further reading: VT Markets Energy Trading

Open a live account with VT Markets today and start your oil trading journey with us!