When ‘Tariff Liberation Day’ saw the light on 2nd April 20205, global markets immediately shifted into risk-off mode. Stocks immediately fell as investors and traders anticipated a potential trade war following the tariff announcement. Critical market indexes continued to drop significantly in the days following.

Immediately, capital began flowing into traditional safe-haven assets, as investors and traders looked to shield their portfolios from potential volatility.

But what are safe-haven assets? And why does their demand climb during economic uncertainties?

Defining Safe Haven Assets

A safe-haven asset tends to retain or even increase in value during periods of economic uncertainty, market volatility, or geopolitical stress. These assets are viewed as reliable stores of value that can help cushion a portfolio from losses when broader markets decline.

However, they may not have the same growth potential as other assets in an optimistic economic environment.

For traders, understanding safe-haven assets can be crucial. These assets offer potential downside protection and present unique trading opportunities during uncertain times.

Essential Characteristics Of A Safe-Haven Asset

1. Liquidity

The ease of buying and selling an asset is a cardinal rule in trading. This fact holds water in a crisis since you can easily liquidate your assets if you need instant cash.

2. Limited Supply

Assets with a capped or controlled supply tend to hold value better, as scarcity supports price stability or appreciation. For example, gold’s finite supply makes it a classic safe-haven asset.

3. Functionality

Assets with practical applications or intrinsic value (eg, gold in industry and jewellery) tend to have steadier demand and less speculative volatility, enhancing their reliability.

4. Stability Of Issuer Or Backing Entity

The issuing country’s political and fiscal stability is crucial for government bonds or currencies. US Treasury bonds and currencies like the Swiss franc or Japanese yen are often favoured due to stable governance.

5. Permanence

The asset should not physically degrade or lose value over time due to decay or obsolescence. Precious metals and government bonds fit this criterion well.

6. Low Or Negative Correlation With Risky Assets

A reliable safe-haven should appreciate or at least retain value when equities or other risky assets decline, providing true portfolio diversification and protection.

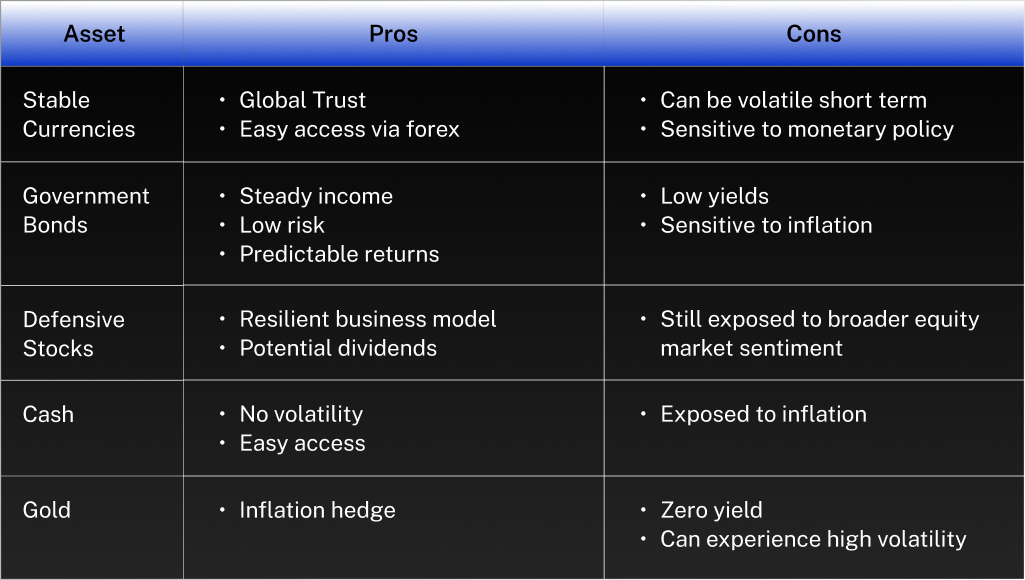

Five Types Of Safe-Haven Assets

Pros And Cons Of Each Safe-Haven Asset

Are There Scenarios Where Safe-Haven Assets Lose Their Appeal?

Yes, safe-haven assets aren’t untouchable. Several situations strip the appeal of safe-haven assets:

1. Rising Interest Rates And Inflation Expectations

Safe havens like gold often falter during rising real interest rates because they do not yield income, making them less attractive than interest-bearing assets.

When central banks tighten monetary policy and increase rates, gold prices can decline, reducing its role as a reliable safe-haven asset.

Similarly, government bonds, especially long-duration ones like US Treasuries, can suffer price declines when interest rates rise, undermining their traditional status as safe havens.

2. Political And Fiscal Instability

Even US Treasuries, historically the gold standard of safety, can become volatile and lose their safe-haven appeal if there are concerns about government deficits, erratic policy shifts, or political risk.

For example, fiscal uncertainty or political turmoil can lead to sell-offs in Treasuries, diminishing their protective qualities.

3. Unique Crisis Characteristics And Market Conditions

Each market crisis is unique, and a safe-haven that worked well in one may not perform similarly in another.

For instance, during the 2022 stock market plunge, gold, the US dollar, and defensive equities outperformed, but bonds and some non-USD currencies declined.

4. Structural Changes And Geopolitical Shifts

The dominance of the US dollar as a safe-haven is challenged by structural factors such as de-dollarisation efforts by some countries and the weaponisation of financial systems through sanctions.

This can reduce the dollar’s reliability as a safe-haven asset in certain geopolitical contexts.

5. Investor Behaviour And Market Sentiment

In some volatile periods, investors may rapidly exit traditional safe-havens, as seen in episodes where gold prices fell alongside stock market declines, and safe-haven currencies weakened, indicating a loss of confidence or a flight to other assets.

Wrapping Up

Safe-haven assets serve a vital role in investment and trading strategies, particularly in times of uncertainty. Whether you’re using CFDs to hedge against market volatility or diversifying your exposure, understanding how these assets work and when they’re most effective can be a valuable tool in your portfolio.

However, it’s important to remember that no asset is completely risk-free!

Each comes with its trade-offs, and the performance of safe-havens can vary across different economic scenarios. Incorporating a thoughtful approach to risk management is just as critical as choosing the right assets.

Explore our range of safe-haven assets, like precious metals, currencies and bonds. Open a live account with us to start trading them.