The Japanese Yen (JPY) is strengthening against the US Dollar (USD) amid expectations of interest rate hikes by the Bank of Japan (BoJ). Increased JGB yields support the JPY, although US Dollar selling is not benefiting the USD/JPY pair, which is struggling to maintain levels near 151.00.

BoJ Governor Kazuo Ueda warned of the uncertainties in global economic policy, affecting JPY’s rises. Traders are cautious, waiting for upcoming US macro data, starting with the ISM Manufacturing PMI, which holds relevance for future market direction.

Japan Economic Growth And Inflation

Japan’s recent economic data shows growth and persistent inflation, supporting the case for further BoJ rate increases. The au Jibun Bank Manufacturing PMI reported a final reading of 49.0 for February, indicating the softest contraction in three months.

President Trump announced tariffs on Canada, Mexico, and increased tariffs on China, adding pressure on the USD. The Personal Consumption Expenditures Price Index declined slightly to 2.5% in January, while core PCE rose to 2.6%, influencing market speculation on Federal Reserve interest rate cuts in 2025.

Technically, the USD/JPY pair is facing resistance near 151.00 and has shown lower oscillators, suggesting a possible downward trend. A drop towards 150.00 is feasible, while strong momentum beyond 151.00 could signal a rally towards higher resistance levels.

Impact Of ISM Manufacturing PMI

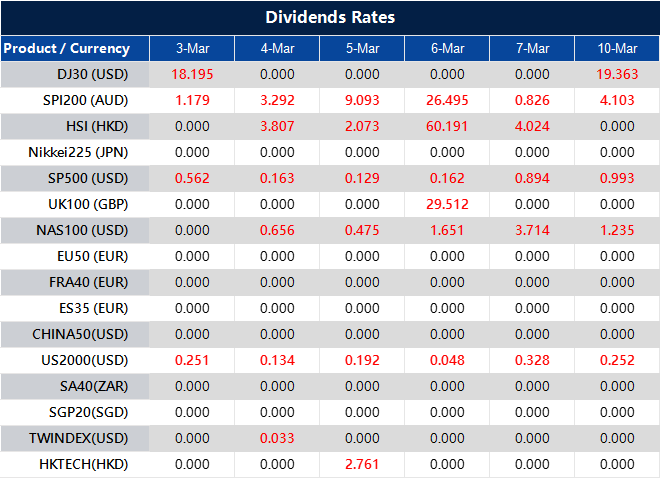

The ISM Manufacturing PMI, a key economic indicator, will be released on 3 March 2025 with expected readings of 50.8, indicating potential economic expansion.

PMI readings above 50 denote growth, influencing market sentiment towards the USD. Stronger results could reflect positively on both the manufacturing sector and the dollar’s standing.

The yen has been gaining strength against the dollar as markets anticipate that the Bank of Japan will push ahead with interest rate increases. Higher Japanese government bond yields are reinforcing the currency’s position. Yet, despite weakened demand for the greenback, the dollar-yen pair is struggling to hold levels near 151.00.

Kazuo, leading the Bank of Japan, has pointed out the challenges that global economic policies bring. His remarks have introduced some turbulence into the yen’s rise. At present, traders are hesitating, watching closely for new economic data from the United States. The ISM Manufacturing PMI is the first major report on the schedule, and it is expected to shape market direction in the coming days.

Japan’s economy has continued to expand, and inflation has remained steady. Both factors make further rate hikes more likely. A recent survey tracking activity within Japan’s manufacturing sector posted a reading of 49.0 for February. While still representing a decline in activity, it was the mildest contraction in months.

Donald has made a fresh push on tariffs, imposing new trade measures on Canada and Mexico while increasing levies against Chinese goods. These decisions have added more weight on the dollar. Meanwhile, the latest PCE Price Index figures have shown mixed results. The main index softened to 2.5% in January, but the core measure, which strips out volatile food and energy prices, ticked up to 2.6%. This has nudged markets towards greater speculation regarding potential Federal Reserve rate cuts next year.

From a technical perspective, the dollar-yen pair is finding resistance around the 151.00 mark. Indicators hint at weaker momentum, creating conditions for a possible move lower. A drop towards 150.00 would not be out of place, although if buyers push through, an advance into higher levels could develop.

The focus now turns to upcoming US data, particularly the ISM Manufacturing PMI set for release on 3 March 2025. Forecasts suggest a reading of 50.8, which would signal expansion within the sector. When these figures climb above 50, they highlight growth, which in turn affects investors’ confidence in the dollar. If the report exceeds expectations, it could offer support for the currency and influence sentiment across the board.