After Ueda’s conference, USD/JPY stabilised after a dip, finding support from buyers near 147.20.

Expectations for interest rates shifted as banks anticipate cuts before year-end, with mixed probabilities

Central Bank Rate Expectations

The European Central Bank and the Swiss National Bank are likely to keep their rates the same, with probabilities of 99% and 95%, respectively. Meanwhile, the Bank of England and the Bank of Canada are also expected to hold rates steady but might make small cuts by year-end, projected at 7 bps and 20 bps. The Reserve Bank of Australia forecasts a 30 bps cut by the end of the year. Looking ahead to 2026, the market expects a total easing of 113 bps from the Fed, although there is disagreement between market projections and the Fed’s outlook. For the Bank of Japan, an 18 bps increase is anticipated by year-end. Despite differing opinions within the Bank of Japan, the overall market adjustment has been small, as a rate hike was expected. Governor Ueda has minimized the impact of these differing views. The market is expecting 113 basis points of cuts from the Fed by the end of 2026, which is more aggressive than the Federal Reserve’s own predictions. This disagreement mirrors a similar situation in 2024, when the market expected significant cuts that didn’t occur until later. The recent US jobs report for August showed robust growth with 195,000 new jobs added, suggesting that further signs of economic strength could lead traders to reconsider these anticipated cuts. In Japan, the two dissenting votes for an immediate rate hike indicate that pressure to tighten policy is increasing faster than expected. Although Governor Ueda downplayed this, the market is pricing in a nearly certain 18 bps hike by year-end. This hawkish sentiment could support the yen, especially against currencies from central banks that are leaning towards easing.Economic Implications

New Zealand’s unexpected 0.3% decline in second-quarter GDP has reinforced expectations for RBNZ rate cuts. There is now a 78% probability of a cut at the next meeting, with a possible significant move of 50 basis points. This positions shorting the New Zealand dollar as an appealing strategy for the upcoming weeks. In Europe, the outlook remains stable, with no major rate changes expected from the European Central Bank, the Bank of England, or the Swiss National Bank this year. Inflation reports from the Eurozone and the UK have shown little movement, allowing these central banks to stay put. Traders may want to consider range-bound or low-volatility strategies for the euro, pound, and Swiss franc. The Bank of Canada and the Reserve Bank of Australia are adopting a dovish stance, but their trajectories are less clear. Market expectations suggest small cuts for both by December, making forthcoming inflation and employment data vital. These positions are not yet strong convictions and should remain flexible as the data will influence future decisions. Create your live VT Markets account and start trading now.Ueda did not comment on market movements, saying that data is needed to assess the effects of tariffs.

Implied Volatility and Market Effects

With the Bank of Japan’s governor maintaining a wait-and-see approach, we expect implied volatility on USD/JPY options to rise. Traders might want to buy volatility, possibly through straddles, to profit from significant price swings, regardless of direction. The market is preparing for a big move, and these comments increase that anticipation. The disagreement among board members like Takata and Tamura is growing more important. Recent data from August 2025 showed core inflation at 2.8%, staying above the BOJ’s 2% target for over two years. This internal pressure raises the chances of an unexpected hawkish shift at an upcoming meeting. Betting on higher Japanese interest rates through futures could be a profitable strategy.Strategic Market Positioning

The USD/JPY rate of 147.88 is approaching a level where we’ve seen action before. Recall that the Ministry of Finance intervened to strengthen the yen when the rate exceeded 150 during the 2022-2023 period. Buying JPY call options (or USD/JPY put options) could be a smart move against a potential sharp reversal due to intervention in the coming weeks. If rate hikes are enforced, the yen would likely strengthen, negatively impacting Japan’s export-driven stock market. We see this as a chance to buy put options on the Nikkei 225 index. This could either be a direct bet on the consequences of a hawkish policy shift or a hedge for existing Japanese equity investments. The governor’s mention of possible U.S. tariffs adds another layer of complexity. The current U.S. administration is reviewing tariffs on Japanese autos, a crucial export sector. If these tariffs are enacted, they could weaken Japan’s economic outlook and the yen, which would counter the pressure to hike rates and push USD/JPY higher. Create your live VT Markets account and start trading now.European indices opened slightly higher, while US futures declined, which may affect trading sentiment.

Cautious Market Environment

The markets are showing a cautious mood. In Europe, we see small gains that could easily be lost if negative feelings from the US spread. This often happens before major economic reports are released, and with everyone paying close attention to central bank comments, the market is unsure about its next move. The VIX index, which measures market fear, has risen to around 17 this month. This suggests that traders are preparing for more volatility ahead. Given this uncertain atmosphere, it’s a good time to protect your current stock portfolios. We recall how quickly markets fell in late summer 2023. Buying put options on indices like the Euro Stoxx 50 or the S&P 500 can act as effective insurance. This tactic allows you to benefit from any unexpected gains while also setting a limit on potential losses if selling increases.Trading Strategies

If we think this sideways movement will continue, selling volatility might be a better option. For instance, the German DAX has been stuck in a narrow 300-point range for most of September without making a clear move. Using a strategy like an iron condor, where you sell both an out-of-the-money call and put option, can profit from limited price movement and the passage of time. Create your live VT Markets account and start trading now.Gold stays close to record highs as traders analyze upcoming data for market direction changes.

Gold And Economic Data

Fed Chair Powell referred to a rate cut as a way to manage risks amid signs of a weakening labor market. Strong economic data could lead to higher interest rate expectations, which would affect gold prices. On the other hand, weaker data might boost gold. In the long run, gold is likely to keep rising due to falling real yields, although short-term interest rate expectations could trigger market corrections. From a technical standpoint, gold’s daily chart shows a new peak before retreating after the FOMC decision. Buyers must manage risks around key trendlines, while sellers may target a drop to the 3,120 level if US data is strong. The four-hour chart indicates a small upward trendline that supports a bullish outlook, with important support at 3,615. The one-hour chart reveals a 3,672 swing level; if this is crossed, buyers might aim for new highs, while sellers focus on support around 3,615. Since gold has pulled back from its all-time highs after the recent Fed meeting, the market is now closely watching economic data. Expectations for interest rate cuts have softened. The immediate risk is a correction if upcoming US economic reports show strength. This focus on data is crucial, as recent figures challenge the idea of a weakening economy. The August 2025 CPI report, released last week, came in slightly higher than expected at 3.4%. Additionally, the August Non-Farm Payrolls added a solid 210,000 jobs, beating forecasts. This suggests the Fed has little reason to speed up rate cuts, which could put downward pressure on gold in the short term.Trading Strategies And Market Volatility

For traders assessing the upcoming weeks, buying put options with strike prices below the $3,615 support level may be wise. This allows for potential profit if prices drop towards the major trendline due to another strong inflation or jobs report. This strategy offers a way to manage risk while positioning for a potential shift towards higher interest rates. Conversely, if economic data weakens unexpectedly, a fast rally may occur. To prepare for this scenario, traders should monitor the key $3,672 resistance level. A strong break above this level could signal the time to enter bullish positions, such as buying call options, to take advantage of a move toward new all-time highs. It’s also important to watch the CBOE Gold Volatility Index (GVZ), which has climbed to 18.5, indicating greater market uncertainty. A similar trend was observed in 2022 when the Fed’s hawkish stance initially depressed gold prices before market focus shifted. The current high volatility makes option spreads a smart strategy for managing costs while positioning for significant price movements. The key area to keep an eye on is the support around the $3,615 level and the broader upward trendline. A sustained break below this zone would likely confirm a deeper correction. This would signal that bearish trading strategies could be more effective. Create your live VT Markets account and start trading now.Ueda mentioned that there are disagreements on the board, and inflation is still below 2%, even though it is getting close to that limit.

Bank’s Asset Strategy

The Bank will keep selling ETFs and J-REITs until their holdings are fully sold off. This sale won’t affect the pace of monetary policy changes. At the current rate, it will take 112 years to fully offload these assets. Ueda’s comments align with the majority opinion, downplaying any opposing views. As a result, the USD/JPY has recovered earlier losses and now stands at 147.95. Governor Ueda’s statements suggest that the Bank of Japan is in no hurry to change its current approach. He is clearly opposing the more aggressive board members and reinforcing the majority view to gather more data before raising rates. The market reacted quickly, strengthening the USD/JPY as hopes for a near-term rate hike faded. This reinforces the belief that taking a short position on the Japanese Yen is currently the easiest strategy. The interest rate gap between Japan and the US remains significant, with the Federal Reserve keeping its key rate around 4.5% while the BOJ stays near zero. This situation makes the carry trade—borrowing yen cheaply to invest in higher-yielding US dollars—very profitable. For derivative traders, buying USD/JPY call options is an appealing strategy. This allows for profit if the pair moves higher toward the 150 level, while limiting our risk if the BOJ unexpectedly changes its policy. Implied volatility may be low due to the BOJ’s steady approach, making options relatively affordable.Internal BOJ Dynamics

However, we need to keep a close eye on dissent from members Takata and Tamura. While Ueda is downplaying this dissent now, it clearly shows a crack in the BOJ’s previously united dovish stance. A surprisingly strong inflation report could encourage these more hawkish members to shift the board’s consensus much quicker than the market anticipates. The current data supports Ueda’s cautious stance for now. The latest core CPI report for August 2025 was 1.9%, reaffirming that inflation is still below their 2% target. Additionally, the most recent Tankan survey revealed a slight decline in confidence among large manufacturers, who are worried about global tariffs. Looking back, this period of inactivity resembles the long pause after the initial small rate hike in March 2024. The BOJ has a history of moving more slowly than other central banks. For now, we should expect this trend to continue until inflation data clearly forces their hand. Create your live VT Markets account and start trading now.Business confidence in France stays steady at 96, with minor differences in services and industrial ratings.

French Business Confidence

French business confidence is stable at 96, which is below the long-term average of 100. This indicates that the overall economy isn’t growing or shrinking much. For traders, this suggests that the CAC 40 index is likely to stay within the narrow trading range seen for most of the third quarter of 2025. A key point is the difference between the rising services sector, now rated at 98, and the declining industrial sector, down to 96. This suggests a two-speed economy where consumer-focused businesses are doing better than manufacturers. This situation presents opportunities for pairs trades, such as buying calls on service-oriented companies while buying puts on industrial names. This report offers little motivation for the European Central Bank to change its current wait-and-see stance, especially since Eurozone inflation has eased to 2.5% earlier this year in 2025. We expect the ECB to keep interest rates steady at its next meeting. Therefore, using options strategies on the Euro, such as selling strangles on EUR/USD futures, could be a good way to profit from low currency volatility.Market Implications

The unchanged headline number eliminates a potential trigger for a major market shift. Implied volatility on European stocks, as shown by indices like the VSTOXX, has dropped over 8% in the past month, suggesting it may continue to fall. Selling VSTOXX futures or writing options on the Euro Stoxx 50 could be a strategy to take advantage of this anticipated calm. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – Sep 19 ,2025

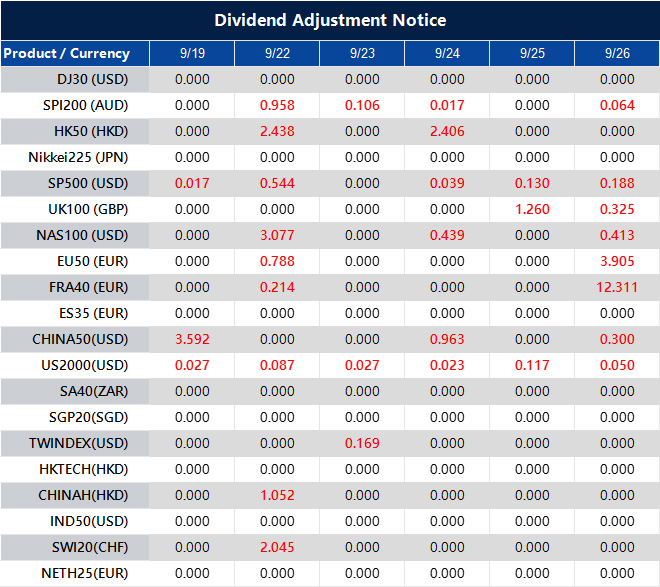

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].