Major currencies in Europe see sluggish trading due to cautious market sentiment and upcoming events

Notification of Server Upgrade – Aug 21 ,2025

Dear Client,

As part of our commitment to provide the most reliable service to our clients, there will be maintenance this weekend.

Maintenance Details:

Please note that the following aspects might be affected during the maintenance:

1. The price quote and trading management will be temporarily disabled during the maintenance. You will not be able to open new positions, close open positions, or make any adjustments to the trades.

2. There might be a gap between the original price and the price after maintenance. The gaps between Pending Orders, Stop Loss, and Take Profit will be filled at the market price once the maintenance is completed. It is suggested that you manage the account properly.

3. During the maintenance period, VT Markets APP will not be available. It is recommended that you avoid using it during the maintenance.

4. During the maintenance hours, the Client portal will be unavailable, including managing trades, Deposit/Withdrawal and all the other functions will be limited.

The above data is for reference only. Please refer to the MT4/MT5 software for the specific maintenance completion and marketing opening time.

Thank you for your patience and understanding about this important initiative.

If you’d like more information, please don’t hesitate to contact [email protected].

Société Générale highlights Jackson Hole’s focus on labor market discussions amid Fed’s internal debates

UK’s flash services PMI surpassed predictions at 53.6, while manufacturing PMI declined below expectations

Payroll Numbers Decline

Payroll numbers are down due to weak order books and worries about rising staff costs tied to the autumn Budget. These issues contribute to ongoing inflation pressures, which reached 3.8% in July. The prospects for further interest rate cuts this year are unclear, as we need more data to assess the sustainability of growth and inflation. The economic data from August shows unexpected growth at its fastest pace since last year, mainly thanks to the services sector. This makes us reconsider the likelihood of the Bank of England lowering interest rates again this year. The key takeaway is that policy may remain tighter for longer than we initially thought. The Bank of England has cut its main interest rate twice since spring 2025, bringing it down to 4.0% to stimulate the economy. However, this recent report, following July’s inflation figure of a stubborn 3.8%, challenges expectations for another rate cut before winter. This suggests that speculations about immediate price cuts in short-term interest rates may need to be revised.Currency Traders and the Pound

For currency traders, this unexpected strength might support the pound. As the chance of another rate cut decreases, sterling may perform better against currencies from central banks still expected to ease policy. Options strategies to protect against a sharp drop in GBP or position for modest gains may now be more suitable. The outlook for UK stocks has become more complex, indicating higher volatility. While stronger economic growth is beneficial for company earnings, the ongoing weakness in manufacturing and reports of significant job cuts are concerning. With the UK unemployment rate already at 4.5% in Q2 2025, this tension between a robust service sector and a fragile industrial base could lead to unpredictable market movements, making volatility-focused options on the FTSE index more appealing. We must heed the report’s warnings about weak demand and sharply falling goods exports. Since early 2025, UK goods exports to the EU have declined by over 5%, significantly affecting manufacturers. As such, any investment strategies should be tactical, as the upcoming official inflation and labor market reports will be crucial in determining if this economic strength can be maintained. Create your live VT Markets account and start trading now.In August, manufacturing thrived, enhancing the eurozone economy, while services showed consistent growth trends.

Manufacturing Output Improvement

The manufacturing output index improved, hitting a 41-month high, even as cost pressures in the services sector increased. Despite challenges like U.S. tariffs and uncertainty, economic activity is gaining momentum, with both manufacturing and services experiencing growth. Germany is at the forefront of this manufacturing increase, while France seems to be stabilizing after facing difficulties. Trade policies are impacting foreign orders in the manufacturing sector, which declined for the second month in a row. Both Germany and France are grappling with foreign demand challenges, despite some signs of recovery. The unexpected strength in manufacturing is making the overall economy look better than expected. This may pose risks for those betting against European stock indices like the DAX. The robust manufacturing performance, the best in over three years, could be a good reason to consider buying call options or selling put spreads.Implications for the European Central Bank

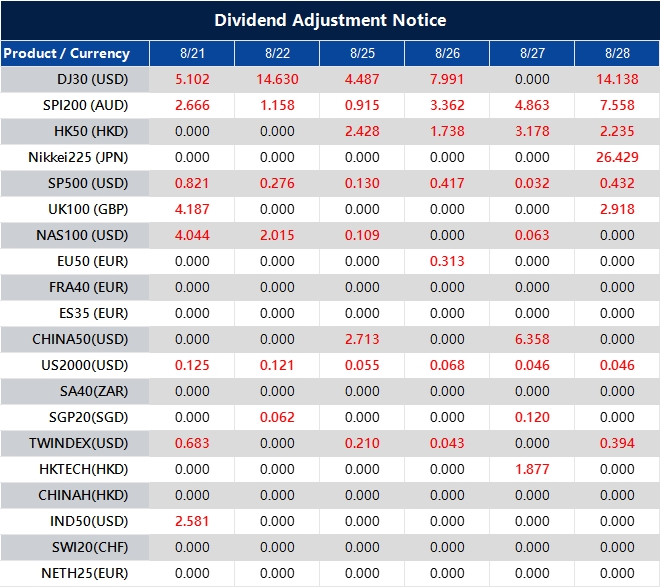

The rise in price pressures, especially in services, complicates the European Central Bank’s (ECB) outlook. Expectations for near-term interest rate cuts may need to be reconsidered, as the ECB remains focused on wage growth. Eurozone core inflation dipped to 2.8% last month in July 2025, but this report suggests it could become sticky, making interest rate swap markets interesting. The outlook for the euro is mixed, which is ideal for traders seeking volatility. Strong domestic data boosts the currency, but the decline in foreign orders linked to U.S. trade policy and the aftermath of the 2024 election cycle pulls it down. This situation hints that buying straddles or strangles on EUR/USD could be a smart strategy for potential big moves in either direction. It’s important to watch the gap between Germany and the rest of the Eurozone. With German manufacturing reaching a 38-month high, derivative plays favoring German industrial stocks over the broader Euro Stoxx 50 index may perform well. This aligns with Germany’s surprisingly strong factory orders data from June 2025, indicating relative strength that can be leveraged. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – Aug 21 ,2025

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].