Miran believes inflation is manageable and avoids discussing rate policy during his nomination.

The USD strengthens as Japan’s GDP boost supports its currency, while EUR/USD and GBP/USD encounter resistance

Scheduled Economic Data Release

Important economic data will be released at 8:30 AM ET, including NY Fed Manufacturing for August, Import and Export prices for July, and Retail Sales. For June, Canadian Manufacturing Sales are expected to be at 0.4%. Fed’s Goolsbee will speak today after a neutral tone in yesterday’s comments. The PPI report suggests core PCE increases around 0.26% expected later this month. The Fed is highly likely to cut interest rates by 25 basis points, with a 94% probability, and there’s a lower chance of further cuts this year. The Trump-Putin Summit on Ukraine today aims for a ceasefire and a follow-up meeting with Zelenskiy, with possible talks on arms control. Potential sanctions on Russia, especially regarding oil imports, may escalate.Market Reactions and Opportunities

US stocks are mixed: the Dow is up 277 points, S&P is up 10.46 points, and Nasdaq is down 4.44 points. Yields in the US debt market show little change across different durations. With the Federal Reserve likely to lower rates by 25 basis points this year, we should focus on the pace of future cuts. Core inflation, like the PCE deflator, has decreased from over 3.5% in 2024 to 2.8% in Q2 of this year. Therefore, options on SOFR futures could be used to prepare for a slower rate-cutting pace than the market anticipates. Today’s Trump-Putin summit on Ukraine poses a significant risk for energy markets in the coming weeks. If talks collapse, severe sanctions on Russian oil exports could result, reminiscent of the volatility seen in 2022 when WTI crude futures surged past $120 per barrel. Buying call options on oil or energy shares is a strategy to hedge against price spikes if diplomacy fails. Though the S&P 500 is at a record high, there are signs of complacency that derivative traders should consider. The VIX, which measures expected market volatility, has stayed below 14 for most of the summer, a level not seen consistently since before the pandemic. This indicates that index put options are relatively inexpensive and could be an effective hedge against negative market shocks. In the currency market, the EURUSD is testing the 1.1700 resistance level again, supported by a European Central Bank that is more hawkish than the Fed. Eurozone services inflation remains stubbornly above 4% according to the latest July 2025 report, limiting the ECB’s potential for rate cuts. A strong breakout above this level could lead to further gains, making short-term call options on the euro an appealing option. We are also monitoring the GBPUSD, which is again struggling at the resistance area between 1.3576 and 1.3591, a pattern we have observed multiple times this month. The Bank of England has indicated that rates will remain steady through autumn, creating a clear range for the currency. This environment is suitable for traders looking to sell option premiums, such as through an iron condor strategy, to profit from the pound staying range-bound. Create your live VT Markets account and start trading now.European markets experienced a decline in the dollar, while equities steadied before upcoming US retail data.

USD Pairings Movements

USD pairings had mixed results. USD/CHF dropped 0.2% to 0.8055, GBP/USD increased by 0.2% to 1.3555, and AUD/USD rose 0.3% to 0.6510. Market activity was quiet due to a bank holiday in much of Europe, with focus shifting to the upcoming US retail sales data. Both US and European stock markets remained steady, continuing the positive trend from the previous week. The market has largely priced in a 25 basis point cut from the Fed in September, with the CME FedWatch tool showing an 88% probability. This explains the halt in the dollar’s recent rise. It could be strategic to sell out-of-the-money options that bet on a larger 50 basis point cut to gain premium. With Wall Street near all-time highs, the upcoming US retail sales report is a crucial point of risk. Economists expect a headline increase of about 0.6% for July, but any shortfall could unsettle investors. The VIX index is around 14, which means protective put options on the S&P 500 are relatively cheap as a safeguard against a market drop. Differences between central banks are creating chances in currency options. Japan reported a strong Q2 GDP of 2.5%, while Switzerland’s growth was only 0.1% for the quarter, and the Fed is easing. This makes put options on USD/JPY appealing for those betting on the yen gaining strength against a weak dollar.China’s Monetary Policy and Commodity Outlook

China’s push for a looser monetary policy is a significant sign for commodity traders. This comes after last week’s disappointing industrial production numbers, indicating that authorities want to support growth. While this could boost assets like copper and oil in the medium term, concerns about a possible slowdown in US consumer spending are keeping WTI crude around $63. Looking ahead, the main focus is on transitioning from watching data to confirming an easing cycle. Back in late 2023, we saw markets climb for months in anticipation of the first rate cut, often ignoring mixed economic data. Therefore, any dip from strong economic news could be seen as a chance to position in rate-sensitive assets. Create your live VT Markets account and start trading now.Retail sales are expected to rise due to strong auto sales and changing consumer spending patterns.

Deutsche Bank Projections

Deutsche Bank expects strong motor vehicle sales in July, predicting a 1.2% rise in overall retail sales, which is higher than the 0.6% estimate. Without auto sales, they forecast a 0.4% rise instead of the predicted 0.5%. The retail control group is expected to grow by 0.5%. These projections factor in strong results from non-store retailers, benefiting from an extended Amazon Prime Day. The mixed signals from retail sales forecasts further suggest that consumers are weakening, despite a solid headline figure. This is in line with other recent data, such as the July jobs report from early August 2025, which revealed that non-farm payrolls moderated to 160,000, falling short of consensus estimates. This situation strengthens the argument for the Federal Reserve to implement a 25 basis-point interest rate cut at its September meeting. Given this outlook, derivatives pricing will likely continue to reflect the possibility of a rate cut. As of this morning, August 15, 2025, the CME FedWatch tool indicates an 85% chance of a cut next month, a notable increase from just under 70% a week ago. Traders should think about positioning themselves in short-term interest rate futures, such as the September SOFR contracts, to take advantage of this anticipated policy shift.Market Strategy Implications

This environment also supports bullish positions in long-term government bonds, which increase in value as interest rates drop. We saw a similar pattern in mid-2019 when the Fed started cutting rates to guard against slowing global growth, well before any recession was on the horizon. Traders who anticipated the cuts by investing in Treasury futures or buying calls on bond ETFs saw positive results. However, we should remain alert for any unexpected increases in spending, especially from the non-store retail sector, which thrived during the extended Amazon Prime Day event in July. While the recent July core CPI reading dropped to an annual rate of 2.8%, allowing the Fed to ease policy, any surprising inflation or job data in the upcoming weeks could quickly challenge the narrative of a rate cut. This makes options strategies that can benefit from rising volatility a wise consideration. Create your live VT Markets account and start trading now.The PBOC intends to improve supportive monetary strategies while tackling economic risks and challenges.

Interest Rate Policy Implementation

The PBOC will actively implement and supervise interest rate policies. Its goal is to stabilize market expectations and effectively deal with any market disruptions. The report shows Beijing’s support for the economy, advocating for a “moderately loose” monetary policy in the near future. The main challenge remains boosting domestic demand while carefully managing debt reduction and addressing deflation. The People’s Bank of China aims to keep monetary policy supportive, which should help stabilize Chinese equity markets for now. However, with Q2 2025 GDP growth at 4.2%, which fell short of expectations, we do not expect a strong and sustained market rally. This suggests a preference for using options to manage risk instead of holding extensive long futures positions.Opportunity for Range Bound Strategies

We view this as a chance to use range-bound strategies on indices like the CSI 300 and Hang Seng. The central bank’s commitment to “ample liquidity” indicates limited downside risk, while its cautious message curbs immediate upside potential. Selling iron condors or buying call spreads are smart ways to trade under the assumption that markets will rise gradually in the coming weeks without making explosive gains. The clear goal to “stabilize market expectations” signals that the PBOC will act to reduce excessive market volatility. This makes selling volatility on major Chinese ETFs an appealing strategy, especially if implied volatility increases due to negative news. We saw this in late 2024 when the government intervened to stabilize markets, benefiting those who had taken short volatility positions. For currency traders, the “moderately loose” policy is likely to keep gentle pressure on the Yuan, which is currently above 7.45 against the USD/CNH. The central bank will want to prevent a chaotic decline, so strategies that profit from a gradual weakening, such as long-dated USD/CNH calls, are preferred over betting on a sudden drop. A controlled decline is necessary to support exports while preventing capital flight. This policy should also benefit industrial commodities, as China plays a significant role in demand. With China’s July 2025 CPI showing only 0.5%, Beijing needs to stimulate industrial activity to combat deflation risks. Therefore, we see this as a positive sign for copper, making long positions in copper futures or calls a sensible choice as this stimulus moves into the real economy. Create your live VT Markets account and start trading now.Expected US retail sales data for July highlights consumer resilience and growth in auto sales.

Impact of Auto Sales

Auto sales and higher prices may impact retail sales significantly. These factors might mask a drop in overall consumer spending, yet the outlook remains optimistic. Unless the actual data diverges significantly from expectations, it should reinforce the idea of healthy consumer activity. Morgan Stanley believes retail sales will exceed estimates, forecasting a +0.8% increase, partly due to a +3.4% rise in auto sales. They anticipate a +0.4% rise in the control group, supported by income growth and moderate inflation. With a 25 basis point rate cut expected in September, positive results would align with predictions, showing stable consumer resilience. This scenario would help maintain the Federal Reserve’s current stance without raising economic alarms. As we await the July retail sales data, we’re curious to see how US consumers are doing. Markets want a “Goldilocks” number—not too strong and not too weak—so that the September rate cut remains a possibility. For derivative traders, a report close to the +0.5% consensus could reduce market volatility, making strategies like selling short-dated strangles on the SPX index appealing. This expectation is backed by recent economic reports from this summer. The July Consumer Price Index indicates that inflation has cooled to a 2.8% annual rate. Additionally, the latest jobs report showed a gain of 190,000 positions, with wage growth steady at 3.9%. This combination of easing inflation and a solid job market supports the market’s expectation of a 25 basis point cut from the Fed next month.Analyzing Consumer Strength

We should look beyond the main figure. A significant jump in auto sales might obscure weaknesses in other areas. If the control group number, which affects GDP, falls short, it could signal trouble, even if the headline number looks good. In that case, we might consider buying puts on consumer discretionary ETFs to hedge against a potential decrease in consumer strength. This situation is reminiscent of the “insurance cuts” the Fed implemented in 2019 when the economy was slowing but not in crisis. If today’s report confirms a gentle slowdown, implied volatility for interest rate options could decline after the September meeting. A prudent approach for the coming weeks might involve positioning for that calm by selling volatility on futures set for October expiration. Create your live VT Markets account and start trading now.The dollar declines after recent gains as market sentiment about future rate cuts stays cautious

Market Sentiment Analysis

Market sentiment shows a cautious view of the dollar as traders pressure for a Federal Reserve rate cut in September. While a 25 basis points cut is now expected, this limits how much lower the dollar can go with the current Federal Reserve policy. There are still concerns about the dollar’s broader implications, including the independence of the Fed and the credibility of the Bureau of Labor Statistics, which face political scrutiny. Until we see more clarity, especially from the Jackson Hole meeting and the US jobs report on September 5, traders may continue to face uncertainty. Today, the dollar is under pressure, especially in the USD/JPY pair, which has dropped decisively below 147.00. This movement is largely due to speculation that the Bank of Japan might raise rates sooner than anticipated, especially since Japan’s core inflation is stubbornly above the central bank’s target, recently at 2.8%. For traders, shorting USD/JPY is becoming a popular but sensible option. On the US side, traders are heavily expecting a Federal Reserve rate cut in September. This perspective was bolstered by last week’s July jobs report, which showed a modest increase of 175,000 jobs, and the latest CPI data indicating inflation has eased to 3.1%. The CME’s FedWatch tool now shows an 85% chance of a 25 basis point cut, which may limit further weakness of the dollar.Market Strategy and Positioning

This environment of uncertainty makes short-term bets risky, leading traders to use options for risk management. With a Fed cut nearly certain, there may be limited downside for the dollar, creating chances to sell dollar puts at key levels. Implied volatility is rising as the market anticipates larger price swings around the Jackson Hole meeting, making options more expensive but valuable for hedging. For EUR/USD, the increase to 1.1680 is heightened by notable option expirations around the 1.1700 strike. This creates a gravitational pull on the price as we approach the cutoff time. Traders should be cautious of these technical movements, which can briefly distort the overall trend. A looming concern is the perceived risk to the Federal Reserve’s independence and the Bureau of Labor Statistics’ credibility. There’s worry that political pressure could result in policy mistakes, a risk not seen directly since the 1970s. This uncertainty likely caps any significant rallies for the dollar in the medium term. In conclusion, we are in a waiting phase until we gain more clarity from the Fed at Jackson Hole later this month. All attention will turn to the US jobs report on September 5. Any major surprises in that report could be the next big driver for the currency markets. Create your live VT Markets account and start trading now.Traders reassess Fed rate cut expectations after US PPI data, anticipating possible inflation changes ahead

Rate Cut Predictions

Trader expectations for a September rate cut have decreased, with the odds now around 93%, down from earlier predictions of a guaranteed cut. By the end of the year, about 57 basis points of cuts are expected, consistent with pre-CPI levels and lower than the 61 basis points forecasted after the inflation reports. There is still strong anticipation for a September rate cut, especially with the labor market showing signs of softening and tariff-driven inflation not yet showing in consumer prices. The Fed faces a tough decision: a cautious 25 basis point cut could help balance temporary inflation caused by tariffs with market needs. Policymakers agree that a 50 basis point cut isn’t supported by current data. Attention is now on Powell’s upcoming speech for direction, although it may not provide clear guidance for September. The US jobs report on September 5 will be crucial. The producer price data from yesterday complicates the situation, as it shows a disconnect with the milder consumer price report earlier this week. Producer costs are rising, but consumers aren’t feeling the effects yet, complicating the Fed’s inflation picture. As a result, we have lowered our expectations for aggressive rate cuts.Market Volatility

The chances of a September rate cut have decreased from fully priced in to about 93%, according to Fed funds futures. This pattern is familiar; we noticed a similar delay in 2022, where producer price hikes led to higher-than-expected consumer inflation. Derivative traders may want to cut back on strategies that depend on a very dovish Fed, as the central bank may take a more measured approach. This uncertainty is also creating opportunities in the volatility market, as the VIX index has risen to nearly 16 from its recent lows. This suggests that options strategies, which can benefit from large price changes, may be wise. Hedging long portfolios with put options or using straddles around important data releases could help guard against unexpected hawkish moves from the Fed. All attention will be on Fed Chair Powell’s upcoming speech at Jackson Hole and, more importantly, the jobs report due on September 5. July’s jobs report showed a slight decline, with non-farm payrolls at 165,000. Another weak report would strengthen the argument for a rate cut. Until then, the market is likely to remain uncertain. In practical terms, positions betting on a 50 basis point cut in September are now very speculative and should be reconsidered. A more balanced approach—such as using interest rate options to bet on a single 25 basis point cut while hedging against the chance of no cut—makes more sense. It’s wise to wait for the next labor market data before making strong directional bets. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – Aug 15 ,2025

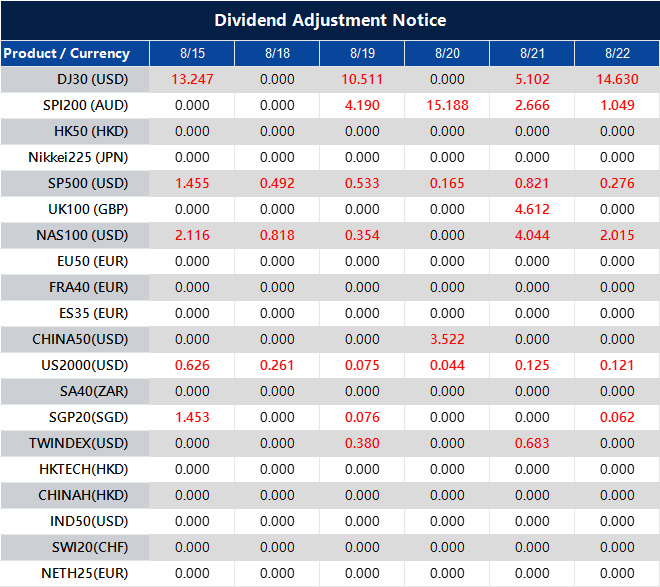

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].