The US chooses not to buy crypto and will instead use confiscated assets, affecting Bitcoin.

USD shows mixed performance against major currency pairs ahead of US data releases

US Producer Price Index Expectations

Analysts expect the US Producer Price Index (PPI) to rise by 0.2%, including both the headline and the core figures excluding food and energy. Year-over-year, it’s predicted to reach 2.5%, up from 2.3% last month, while the core measure is set to rise to 2.9% from 2.6%. Initial jobless claims data will also be released, with forecasts predicting 228,000 claims, compared to last week’s 226,000. In pre-market trading, US stocks are showing slight gains. The Dow is up by 30 points, the S&P by 2.67 points, and the Nasdaq by 16 points. The dollar’s performance is mixed as we await important inflation and labor market figures. A higher-than-expected PPI could indicate strong inflation, likely strengthening the US dollar as it would encourage a more hawkish stance from the Federal Reserve. We are preparing for possible volatility when the data is released at 8:30 AM ET.Market Reaction and Strategies

We’ve seen similar patterns before, especially after last month’s CPI report, which showed a 3.4% increase. This slight rise kept policymakers on alert. The market remembers that, in its late July meeting, the Fed noted that inflation risks remain on the rise. A high PPI today could reinforce this sentiment and lead to a significant market reaction. In this context, traders should think about using derivatives that benefit from price swings. There’s a growing demand for at-the-money options straddles on the EURUSD pair to capture sharp price movements. The CBOE EuroCurrency Volatility Index (EVZ) has risen to 7.9 this week, up from a low of 6.5 in late July, indicating that the market is preparing for volatility. The recent drop in the USDJPY is particularly striking, especially after breaking below the critical 145.00 support level, which had held during the second quarter of 2025. This decline seems driven by more than just dollar weakness, as speculation mounts that the Bank of Japan is getting ready for a significant policy change away from its ultra-loose approach—a stance we haven’t seen from the BOJ in over a decade. On the other hand, the EURUSD found support near the 1.0750 technical zone. This strength follows an unexpected 0.5% increase in June’s German industrial production, easing fears of a deep Eurozone recession. However, a strong US PPI report could easily erase these gains and push the pair below this support level. The expected initial jobless claims figure of 228K will provide key insights into the US labor market’s health. In 2024, claims consistently stayed below 220K, so the recent upward trend is being watched closely. For now, equity markets remain calm, with futures showing slight gains, suggesting a wait-and-see attitude ahead of the upcoming data. Create your live VT Markets account and start trading now.European markets show mixed reactions as they await US data, while cryptocurrencies experience a slight decline

Muted Movements in US Futures

US futures saw little movement as investors awaited new data, including retail sales figures. European stocks gained from Wall Street’s positive vibes, though other markets remained cautious. Gold stayed steady, while cryptocurrencies like Bitcoin and Ethereum faced slight declines from their recent peaks. The Fed appears hesitant about a September rate cut, leaning towards minor adjustments rather than big changes. This uncertainty suggests we should brace for possible market volatility with upcoming US PPI and retail sales data. The VIX index is creeping up from its summer lows, now around 17, signaling traders are preparing for movements. The US dollar is fluctuating, creating opportunities in currency options. The yen’s strength stems from speculation about a potential shift in the Bank of Japan’s policy, supported by strong wage growth data from Japan last week. A surprising rise in US inflation could quickly reverse the dollar’s slide against the yen, making USD/JPY call options appealing.Diverging Global Economies

The Eurozone economy is barely growing, with the latest 0.1% GDP figure keeping EUR/USD close to 1.1700 due to significant option contracts. Meanwhile, the UK’s unexpected 0.3% GDP growth marks a notable recovery, as it narrowly avoided a recession in late 2024. This divergence could benefit the pound over the euro in the coming weeks. In equity markets, activity has stalled, with US index futures flat ahead of economic data. This atmosphere, where the market anticipates a rate cut not yet confirmed by officials, resembles the situation in late 2018 before the Fed shifted in 2019. For now, using options to manage risk, such as purchasing puts on the S&P 500, may be a wise strategy against potential hawkish surprises. Create your live VT Markets account and start trading now.The USD faces pressure as dovish expectations rise, while GBP/USD fluctuates near the 1.3590 resistance level.

Technical Analysis

Looking at the daily chart, GBP/USD has hit a swing level at 1.3590. Sellers are looking to push the price down to 1.3368, while buyers hope for a rise to 1.38. The 4-hour chart shows a slight upward trend, indicating bullish momentum. On the 1-hour chart, the price is moving in a narrow range, suggesting a strong move could happen if it breaks out in either direction. Upcoming US economic releases include PPI, Jobless Claims, Retail Sales, and Consumer Sentiment. With GBP/USD testing the important 1.3590 resistance level, our immediate attention is on the Jackson Hole Symposium. The market has priced in a strong chance of a Federal Reserve rate cut this September, which is creating a crowded trading opportunity. Recent US initial jobless claims rose to 221,000, indicating a softening labor market, which reinforces this sentiment. On the UK side, the Bank of England is dealing with a complex situation, which opens opportunities. The BoE cut rates last week but issued firm warnings about ongoing inflation, a concern that has persisted since the pandemic. Looking back, UK core inflation has remained stubbornly high throughout 2023 and 2024, lending credibility to the BoE’s renewed worries despite its easing.Strategic Approaches

In light of this fundamental conflict, we see 1.3590 as a key pivot point for trading strategies in the coming weeks. Traders who expect resistance at this level to hold can buy put options with a strike price slightly below 1.3590 for a low-risk way to prepare for a price drop. This strategy aims for a target of 1.3368, as mentioned in the technical analysis. Alternatively, uncertainty regarding Fed Chair Powell’s upcoming speech may increase volatility significantly. A straddle strategy—buying both a call and a put option at the same strike price and expiration—might be wise. This approach profits from large price movements in either direction, without needing to predict the speech’s outcome accurately. The key point is that the US dollar is generally expected to weaken, while the pound’s strength is built on fragile and conflicting grounds. If Powell hints at a delay in the September cut, the dollar could surge sharply, potentially surprising many traders. Therefore, using options to manage risk is more important than ever in this environment. Create your live VT Markets account and start trading now.Crude oil prices are affected by supply concerns and upcoming geopolitical events that influence market sentiment.

Market Dynamics

The market is feeling the effects of higher supply and lower demand, even with upcoming Federal Reserve rate cuts. If the summit produces positive results, it could help stabilize prices, bringing focus back to rate cuts that could drive demand up. Currently, crude oil is trading below the crucial $64.00 support level, and if sellers remain active, prices could drop to $55.00. On the daily chart, it’s important to maintain a price above $64.00 to shift from a bearish to a bullish trend, with a target of reaching the $72.00 resistance level. The 4-hour chart shows a slight downward trend, where sellers are likely to act near the $64.00 resistance, while buyers might look for chances to push prices higher. On the 1-hour chart, sellers are focusing on resistance levels, while buyers are looking for breakout opportunities. Upcoming US economic reports and the Trump-Putin summit could shape market direction. Crude oil has been dropping since early August, mainly due to fears of slowing growth. The Non-Farm Payrolls report released on August 1, 2025, showed a gain of only 145,000 jobs, which was below expectations and raised concerns about future demand. This has created a bearish sentiment over the past two weeks. On the supply side, OPEC+ has confirmed its production increase of 400,000 barrels per day for August. Additionally, yesterday’s EIA report revealed a surprising rise in U.S. crude inventories of 2.1 million barrels, against expectations of a decrease. This combination of increased supply and reduced demand keeps sellers in control of the market.Market Outlook

The main focus now is the Trump-Putin summit in Alaska tomorrow, where traders are hoping for a possible ceasefire and relaxation of sanctions on Russia. This potential increase in supply has already contributed to recent price drops. The market is heavily influenced by these supply factors, alongside upcoming Federal Reserve rate cuts. From a trading standpoint, $64.00 is the key level to watch. It has shifted from being a price floor to a ceiling. As long as prices stay below this resistance, the most likely move is downwards, making this area a strategic point for bearish positions. Traders should think about using put options or short futures contracts to target a move towards $55.00 in the upcoming weeks. A stop-loss just above the $64.00 resistance would help manage risk for this strategy. The downward trendline on the 4-hour chart reinforces confidence for sellers. However, we need to be ready for a reversal if the summit results are favorable, leading to a “sell the rumor, buy the fact” scenario. A strong break above the $64.00 resistance would indicate that bearish momentum is fading, suggesting it might be a good time to consider call options or long positions, with an initial target around the $72.00 resistance level. A positive outcome from the summit would shift market focus back to fundamentals, especially the anticipated Fed rate cuts. Currently, there is over a 90% chance of a rate cut in September, which would likely boost economic activity and oil demand. This potential bullish catalyst should not be overlooked if geopolitical tensions ease. Create your live VT Markets account and start trading now.Revised Q2 Eurozone GDP stays at +0.1% quarterly and +1.4% annually, unchanged from preliminary figures.

Eurozone Quarterly GDP Analysis

In the previous quarter, GDP growth was reported at 0.3%. Eurostat released these figures on August 14, 2025. The confirmed data indicates that the Eurozone economy barely grew in the second quarter of 2025, expanding by only 0.1%. This marks a significant slowdown from the 0.3% growth seen in the first quarter. It reinforces the idea that the economy is stagnating, limiting growth potential. This weak performance may keep the European Central Bank cautious, delaying any interest rate hikes. If upcoming inflation data continues to decline, we might even see discussions about possible rate cuts before the year ends. This contrasts with the latest US inflation figures from July 2025, which stand at 2.8%, allowing the Federal Reserve less room to ease its policies.Investment and Market Strategy

For those involved in trading equity derivatives, this suggests a tough time for European corporate earnings. It may be wise to buy put options on broad indices like the EURO STOXX 50 to protect against potential downside risks in the coming weeks. We can look back at the economic slowdown of 2023, where defensive stocks did better than those sensitive to the economic cycle. The weak growth outlook puts pressure on the Euro, particularly against the US dollar. We expect the EUR/USD exchange rate to face downward pressure, making short positions or purchasing EUR put options an intriguing option. The differing policies of a cautious ECB and a more aggressive Federal Reserve support this viewpoint. In the bond markets, this economic scenario highlights the attractiveness of government debt as a safe investment. We anticipate yields on German Bunds to stay low or possibly drop further from their current levels. Going long on Bund futures appears to be a sensible trade for the next month. While the confirmation of slow growth isn’t a huge surprise, it reinforces the idea of low volatility for now. Traders should be ready for quick, short-lived spikes in volatility due to unexpected data releases, such as the surprising drop in the German manufacturing PMI seen in June 2025. These events can create tactical opportunities in an otherwise quiet market. Create your live VT Markets account and start trading now.Fed policymakers hesitate on September rate cuts despite market pressures and uncertain data

Diverging Views

Non-voting members of the Fed, like Richmond Fed President Barkin and Atlanta Fed President Bostic, also share uncertainty. Barkin pointed out that the balance between inflation and unemployment is unclear, while Bostic mentioned that the bank prefers to wait for more data before making any policy changes. Fed governor nominee Miran downplayed the impact of tariffs on inflation as shown in CPI reports. Meanwhile, Bullard cautioned that making a large rate cut might seem “panicky.” Fed policymakers are being careful not to go against market expectations. This week, important U.S. economic data will be released, including PPI, jobless claims, and retail sales. With little time before the Jackson Hole symposium and the upcoming labor report, the Fed has few chances to influence market expectations. The FOMC blackout period starts on September 6, with a policy decision set for September 17.Market vs Fed Dynamics

Today, St. Louis Fed President Musalem and Richmond Fed President Barkin will speak, possibly offering more insights. As of August 14, 2025, there’s a noticeable gap between market hopes and Fed announcements. Fed funds futures estimate an 85% chance of a 25 basis point cut on September 17. However, officials like Schmid and Goolsbee show clear uncertainty. This difference between market belief and Fed signals often leads to volatility in the coming weeks. Market optimism is currently driven by the July CPI report, which showed inflation easing to 3.1%. However, the labor market remains strong, with the last jobs report indicating 190,000 new jobs and weekly jobless claims steady at around 225,000. This allows policymakers like Bostic to state they can “wait” for more information before taking action. For derivative traders, seeking volatility may be appealing. The VIX index is currently low at about 14, suggesting that options pricing may underestimate the potential for significant market shifts after key announcements. If the Fed decides not to change rates or cuts more than expected, it could lead to major adjustments across asset classes. The upcoming highlights to watch are the Jackson Hole symposium later this month and the jobs report on September 5. These events represent the Fed’s last chances to direct market expectations before their pre-meeting blackout begins. Any notable changes in the data could compel the Fed to take decisive action and resolve the current uncertainty. A similar situation occurred in late 2018, when the Fed adopted a cautious approach before making significant changes in early 2019 as market conditions changed. Although past events don’t repeat exactly, they indicate that ongoing market pressure can influence policy decisions. The Fed’s current hesitance may just be temporary before they align with market expectations. As a result, strategies like long straddles or strangles on major indexes, which profit from large moves in either direction, might be wise to consider ahead of the September FOMC meeting. Traders may also explore calendar spreads to capitalize on the expected volatility spike surrounding early September data. This allows traders to position themselves for the belief that current calm states won’t continue. Create your live VT Markets account and start trading now.Daly questions the need for a significant interest rate reduction next month

Steady Approach Over Quick Shift

This suggests a steady approach instead of a quick change in monetary policy. Current data does not support a significant rate cut right now. It looks like a 50 basis point cut for September is unlikely. Previously, markets, including the CME FedWatch tool, thought there was almost a 40% chance of such an aggressive move. This shows that the Federal Reserve doesn’t feel the need to take bold actions. Honestly, the economic data does not call for panic. July’s job report added a solid 195,000 jobs, keeping unemployment at 3.8%. With the latest core inflation at 2.4%, the figures don’t suggest an urgent need for action. This points to a strategy of selling volatility in the weeks ahead. A “gradual” approach signals the Fed’s plans, reducing market uncertainty and large price swings. This situation is very different from the unpredictable market fluctuations we witnessed in 2022 and 2023.Reevaluating Positions In Light Of Cautious Reality

Traders should rethink positions that expected major cuts. The focus will likely move to pricing in a standard 25 basis point cut in September, or possibly a pause. We can expect changes in Fed Funds futures and options on SOFR to reflect this more cautious outlook. For equity options, this perspective makes a strong case for limited upside moves due to aggressive easing. Strategies that work well in a steady, mild market rather than a volatile one are more suitable now. We believe a slow and steady policy path offers a solid foundation for the market. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – Aug 14 ,2025

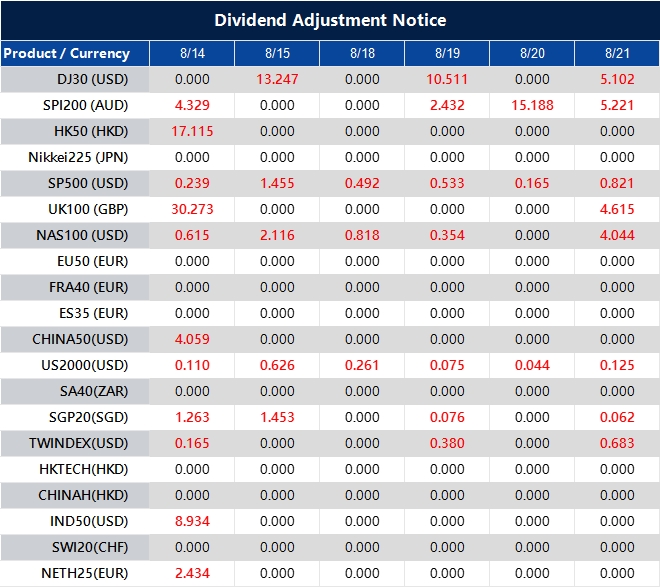

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].