In August 2023, GBP/USD and AUD/USD rise unexpectedly, challenging historical trends and influences.

Expectations suggest potential rate cuts for the Fed, RBA, and RBNZ, while others may stay the same.

Bank Of Japan Rate Expectations

The Bank of Japan plans to raise rates by 13 basis points and has a 90% probability of not changing rates soon. The recent rate cut by the Bank of England came as a surprise due to their more aggressive stance. Attention is now shifting to the upcoming US Consumer Price Index (CPI) report and the Jackson Hole Symposium. Given the current market conditions as of August 8th, 2025, we think traders should prepare for a weaker US dollar. The market predicts a 59 basis point cut from the Federal Reserve by year-end, with a 92% chance of a cut at the next meeting. This expectation follows last week’s weak Non-Farm Payrolls report, which indicated slower-than-expected job growth. The Australian and New Zealand dollars may also weaken, as their central banks are expected to cut rates aggressively. There’s a 98% probability for a rate cut from the Reserve Bank of Australia at its next meeting, driven by recent data showing domestic inflation decreasing quicker than expected. This stands in stark contrast to other major central banks that are maintaining their rates.Europe’s Economic Stance

In Europe, we expect the ECB and the Bank of England to keep rates steady in the near future. Recent inflation rates in the Eurozone and the UK, both lingering above 2.5%, support this cautious approach. This difference in policies may strengthen the euro and the pound against the US, Australian, and New Zealand dollars. The main focus now is next Tuesday’s US Consumer Price Index report, which will be crucial for the Fed’s direction. We anticipate increased volatility around this report, and traders might consider using options to protect their positions. We remember how the Jackson Hole Symposium in August 2022 caused significant market movements, and this year’s event later this month could have a similar impact. The Bank of Japan stands out as the main exception, with the market anticipating a modest 13 basis point hike by the year’s end. This follows a year of Japanese core inflation staying above the 2% target, marking a significant change from the deflationary trends seen in early 2020s. Any unexpected hawkish move from the BoJ could result in a sharp rise in the yen. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – Aug 08 ,2025

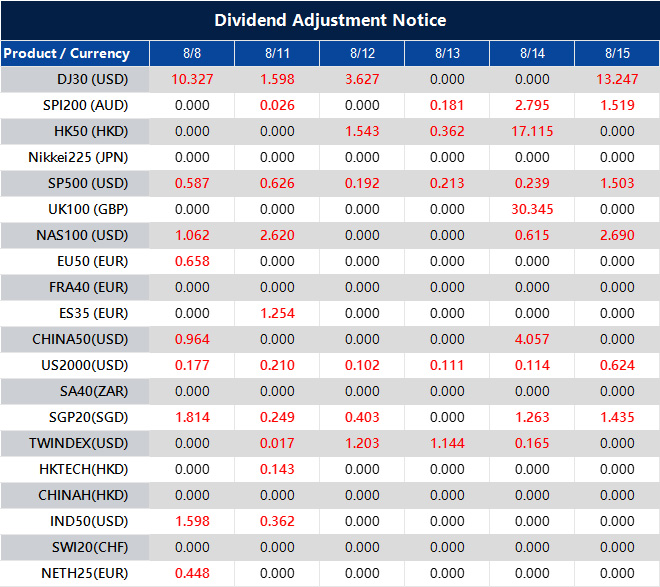

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].