AUD/USD rebounds from early declines as focus shifts to upcoming US economic indicators

Gold rebounds in European trading as traders remain cautious ahead of upcoming US economic data releases

The Fed Decision and Gold Market Reaction

The Fed’s recent decision wasn’t very dovish but fits well with what the market expected. Unless upcoming U.S. economic reports suggest otherwise, the broader outlook remains steady. Once the Fed starts easing monetary policy, it often keeps going in that direction. This could push gold prices higher, with estimates even suggesting a spike to $4,000. A small price pullback could happen before the stronger months of December and January. After the Fed’s decision on September 17, gold went below its key near-term moving averages, but buyers quickly reversed that trend. This price movement indicates that the market views the dip as a chance to buy, not a sign of a changing trend. The focus now is on how prices react to today’s U.S. weekly jobless claims data. The overall picture remains unchanged since the Fed’s easing policy aligns with recent economic trends. The last Non-Farm Payrolls report for August 2025 noted a slowdown in job growth to 155,000, reinforcing the need for a more supportive monetary policy. This environment should continue to benefit gold, which tends to do well when interest rates are low.Market Strategies and Seasonal Trends

Remember, when the Fed starts easing, it often continues for a while. Looking back at the cycle that began in mid-2019, the Fed cut rates three times in a row, significantly boosting gold prices over the next year. History indicates this current easing cycle still has room to grow. With many analysts targeting $4,000, traders might consider buying call options that expire in December 2025 or January 2026 to take advantage of this anticipated rise. An alternative strategy could be selling out-of-the-money put options below the recent low of $3,634, allowing traders to collect premiums while betting that solid support will hold during any dips. However, it’s wise to prepare for a possible short-term pullback before the market enters its stronger seasonal phase. A smart move would be to buy some cheaper, shorter-dated put options with October or November expirations to guard against unexpected price moves. This creates a safety net for long positions without sacrificing too much potential upside. Historically, the seasonal trend for gold is strong in December and January, with data from the last 15 years showing positive average returns during this period. Therefore, any market weakness in the coming weeks could be a chance to strategize. Traders might see dips towards the mid-$3,600s as a final opportunity to build positions before this busy season. Create your live VT Markets account and start trading now.US futures rise as traders anticipate rate cuts due to upcoming data and jobless claims

Market Volatility After the Fed Decision

The market has been volatile since the Federal Reserve’s decision, yet stock prices have been steadily climbing. The current mood among investors seems to support buying now and dealing with risks later. Today’s economic reports, such as weekly jobless claims, will likely affect how the market feels. However, more detailed insights are expected with the non-farm payrolls report on October 3rd, which may shift market expectations about Federal Reserve actions. The Federal Reserve didn’t introduce any surprising hawkish tones, allowing equities to trend higher for now. The market continues to price in about 45 basis points of rate cuts by the end of the year. This “buy now, worry later” mentality is fueling the stock market futures. This rally now hinges on US economic data supporting the Fed’s potential move to cut rates. Today’s initial jobless claims data came in at 225,000 for the week ending September 13th, slightly above the expected 220,000, adding to market momentum. However, the true test will be the non-farm payrolls report set for October 3rd.Trading Opportunities in Volatility

The CBOE Volatility Index (VIX) is currently low at 14, indicating a rising sense of complacency. This situation creates an opportunity for traders to consider purchasing volatility ahead of the important jobs report. Buying VIX calls or SPX straddles that expire after the report could be a smart move for those anticipating price swings. This scenario feels similar to the market conditions we experienced in late 2023, where weaker economic reports were seen as positive since they boosted the chances of policy easing. After the August jobs report showed only a gain of 150,000 jobs, we should anticipate a similar reaction. A weak October report could lead to a significant market rally, while a strong report might trigger a sharp downturn. The recent drop of the US dollar from its highs also suggests that traders are preparing for a more dovish stance from the Fed. We expect an uptick in activity with options on currency futures, especially for the Euro, as we approach the first week of October. A weak payrolls report would likely further weaken the dollar, pushing the EUR/USD pair closer to the 1.2000 level. Create your live VT Markets account and start trading now.The BOE is expected to keep the bank rate, paying attention to dissenting votes.

Approach to Inflationary Pressures

The BOE should take a careful and gradual approach while addressing ongoing inflation issues. The voting outcome on the bank rate is likely to be 7-2, with Dhingra and Taylor supporting a rate cut. Ramsden might join them, which could lead to a 6-3 vote. This voting scenario is intriguing, especially after last month’s split vote that required a second round. Some hawkish views were present in August, which could affect the BOE’s September approach, especially with slightly rising inflation. The central bank is expected to announce its decision cautiously. We expect the Bank of England to keep rates at 4.00% today, which aligns with market expectations. The latest inflation data for August 2025 showed a rise to 3.1%, giving the central bank reason to be careful and avoid premature rate cuts. This slight increase from July highlights that returning to the 2% target won’t be straightforward. The split in the vote will send significant signals for future policy. A 7-2 vote to hold rates is our baseline, but a 6-3 vote would indicate a dovish shift, likely leading markets to expect a higher chance of a rate cut before year-end. This would make betting on lower rates in November, such as options on SONIA futures, more appealing.Inflationary Concerns Amid Economic Slowdown

Inflation is a concern right now, even as the economy slows. Recent data shows the unemployment rate rising to 4.5%, and GDP growth is stagnant at just 0.1%. This creates uncertainty, as traders evaluate the risk of ongoing inflation against the possibility of a recession. The current situation offers opportunities for traders dealing with volatility in sterling-denominated assets. Reflecting on the aggressive rate hikes of 2022 and 2023, which aimed to combat high inflation, the Bank is cautious about easing policy too soon, even with a weak economy. This means that the threshold for a rate cut remains high, and any hawkish wording in today’s statement may delay market expectations for a cut until early 2026. In the coming weeks, we should focus not on the decision to hold rates but on the details surrounding it. A more divided vote could steepen the yield curve as the market anticipates future cuts. We should be ready to act on any changes in tone, as this could shape UK rates for the rest of the year. Create your live VT Markets account and start trading now.De Guindos from the ECB states that current policy is suitable amid uncertainty and high market valuations.

Market Valuations

Market valuations are quite high, which requires close attention. The current economic conditions call for a careful and cautious strategy going forward. Right now, the European Central Bank’s policy suggests no major changes are coming soon. The ECB is in a wait-and-see mode, having kept the main deposit rate steady at 3.00% earlier this month. This strategy reflects the uncertain economic climate. The growth outlook is not strong. The second half of 2025 is expected to show the same weak growth of 0.1% we saw in the second quarter. With inflation in August still at 2.2%, the bank has no reason to cut rates, which could cause prices to rise again. This keeps short-term interest rates in a tight range. For traders, this indicates that the implied volatility in front-month EURIBOR options might be too high. It creates a chance for premium-selling strategies. Selling strangles or straddles could lead to profits as long as the ECB stays cautious. We don’t expect any major policy changes until at least spring 2026.Market Vulnerability

There are also concerns about elevated equity market valuations. The STOXX 600 index is near its all-time high of 530, which seems out of sync with the sluggish economy. This gap makes the market weak and prone to corrections with any bad news. Given this risk, buying protective put options on major European indices like the Euro STOXX 50 is a smart move. The cost of this protection is low since the VSTOXX volatility index is at a subdued level of 19. The potential for downside protection is becoming more appealing. Additionally, fiscal policy risks are becoming more apparent, especially with budget concerns arising in Italy and France. This could lead to conflicts between national spending plans and the ECB’s inflation goals in the future. We experienced a similar period of central bank pauses and economic uncertainty in late 2023, which caused uneven market conditions before a clear trend began to emerge. Create your live VT Markets account and start trading now.In July, the eurozone current account surplus fell to €27.7 billion from €35.8 billion.

Breakdown Of The Eurozone Surplus

Here’s how the surpluses break down: – Goods: €25 billion – Services: €12 billion – Primary income: €7 billion However, these surpluses were partly offset by a €16 billion deficit in secondary income. The European Central Bank (ECB) released this data with a slight delay. The smaller current account surplus in July 2025 shows the Eurozone’s weakening external position. This hints at less demand for the Euro. Therefore, it’s wise to prepare for a potential drop in the currency in the coming weeks. Consider short positions on EUR/USD through futures or CFDs to reflect this view.Strategies For Trading The Euro

If you’re using options, buying EUR/USD put options that expire in October 2025 provides a clear, risk-defined way to trade this expected decline. The Cboe EuroCurrency Volatility Index (EVZ) increased to 8.5 this month, up from a low of 7.2 in August 2025, indicating that the market expects more volatility. Selling out-of-the-money call spreads could also be a good strategy to earn premium while keeping a bearish outlook. This data comes at a challenging time for the European Central Bank, also dealing with the August 2025 inflation rate of a persistent 2.6%. Meanwhile, the US Federal Reserve is likely to keep rates steady due to a strong labor market. This creates a clear difference in policy favoring the US dollar. As a result, the case for a lower EUR/USD exchange rate strengthens, with the rate already having dropped 1.2% in the past month. Additionally, other recent data confirms a slowdown. For instance, German factory orders fell for the third consecutive month in July 2025, according to the latest figures from Destatis. This situation resembles the period of 2014-2015 when differing central bank policies caused the Euro to weaken significantly against the dollar. Therefore, it’s essential to keep an eye on upcoming sentiment indicators, such as the ZEW Economic Sentiment survey, for further confirmation of this trend. Create your live VT Markets account and start trading now.The Fed’s decision seemed neutral to aggressive, balancing concerns about the labor market and inflation.

Fed Decision Divisions

In 2025, only a small majority supported the three cuts. Ten members expected two or more cuts, while nine projected one or fewer. This shows a range of opinions within the Fed on future rate cuts. Chair Powell, in line with his Jackson Hole speech, highlighted the labor market’s struggles linked to weak job reports, mainly due to changes in immigration. He called rate cuts “risk management” actions, suggesting there might be fewer cuts if data improves. Powell aimed to balance various economic factors, leaving future monetary decisions up to new economic data. This week’s Federal Reserve decision seems neutral to slightly hawkish, despite the announced rate cut. While the market anticipated three more cuts for 2026, the Fed forecasts only one more. This disconnect is something traders should monitor closely in the coming weeks. The Fed is responding to clear signs of a weakening labor market. Recent Non-Farm Payroll reports fell short of expectations, with the August 2025 report showing only a gain of 140,000 jobs. Initial jobless claims have also risen, remaining around 245,000. However, Powell views this as a manageable slowdown rather than a crisis requiring drastic cuts.Inflation Concerns Remain

The central bank’s caution makes sense, given that core inflation, while lower than before, is still stubbornly high at 3.1% year-over-year according to the latest CPI data. After aggressive rate hikes throughout 2023 to control rising prices, the Fed is reluctant to ease policies too quickly. This suggests they can tolerate a weaker labor market better than a surge in inflation. This situation offers opportunities for derivative traders, with an uncertain path ahead influenced by the next few data reports. The rate cut was described as a “risk management” move, which means strong NFP or high inflation numbers in October could quickly shift the current soft stance. Therefore, strategies like straddles or strangles on interest rate futures, which profit from increased volatility, may be appealing. We should also remember the committee’s divisions, as a narrow 10-9 majority supports the three cuts proposed for 2025. This fragile agreement means the median dot plot could change quickly if just one or two members alter their views. Thus, planning for a smooth and predictable series of rate cuts may be premature. Create your live VT Markets account and start trading now.European stock markets increase as investors react to the Fed’s recent decision and US futures

Market Reaction

Markets are responding well to the Fed’s recent decision. Indices like the DAX and Eurostoxx are showing strong gains. We see this as a temporary uptick since the central bank avoided any surprises. This clarity now shifts the market’s attention to the upcoming major US economic data. With the key risk now behind us, implied volatility has decreased. The VIX has fallen below 15 from its highs before the meeting. This drop gives traders a chance to sell options, like short-dated credit spreads on the S&P 500. However, low volatility might be misleading ahead of the important inflation and jobs data set to be released in early October.Market Patterns and Strategy

The market’s current outlook for the rest of the year will soon be tested, especially with the last core CPI reading sticking at 3.1%. Additionally, the job market showed strength, adding 190,000 jobs in August. This gives the Fed little reason to act quickly on rate cuts. Traders might want to buy inexpensive out-of-the-money puts on indices as protection against any data that surprises on the upside. We should keep in mind the market trends from 2023. After Fed meetings, rallies often didn’t last long and reversed quickly when strong economic data emerged. These periods remind us that initial positivity can disappear once the data forces a rethink of the Fed’s policies. Therefore, while we can enjoy the current upward trend, it’s wise to keep protective positions in place over the next few weeks. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – Sep 18 ,2025

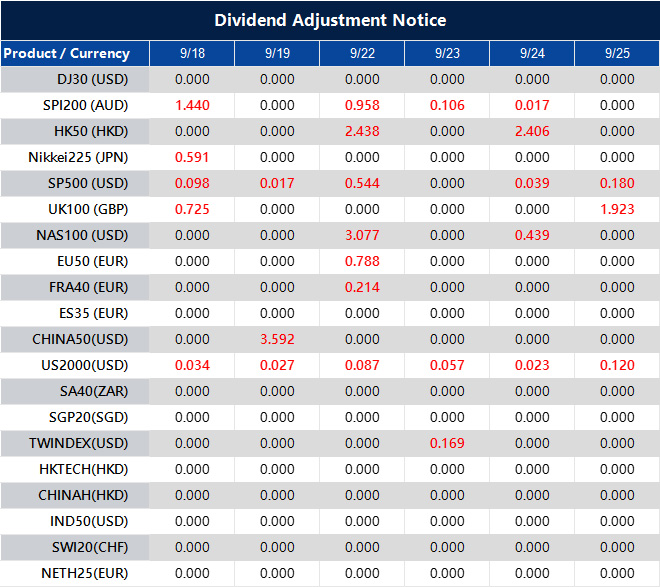

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].