Ueda says the yen’s weakness isn’t a concern, suggesting inflation is temporary during press conference

Gold faces losses from rate expectations, with limited upside and bearish pressures on trends

Technical Analysis

On the daily chart, gold prices are approaching a support level of 3,245. Buyers may come in at this level, keeping risks defined below, with hopes of a recovery back to resistance. On the other hand, sellers are looking to break below this support to push prices down towards 3,120. The 4-hour chart shows a downward trendline that is guiding the bearish trend. Sellers are likely to depend on this trendline to lower prices, while buyers will aim to break above it, targeting the 3,333 swing point and possibly rallying to 3,438 resistance. In the 1-hour chart, the trendline remains the focus, with sellers expecting rejection and buyers hoping for a breakout. Upcoming US economic reports could further sway gold’s movement.Market Expectations

As of today, July 31, 2025, gold has further declined due to strong US economic data, which delays expectations for interest rate cuts. For instance, today’s Personal Consumption Expenditures (PCE) price index showed core inflation steady at 2.9% year-over-year, making a quick decline unlikely. This strengthens the Federal Reserve’s hawkish stance, making it tough for gold to rise in the short term. All attention is now on tomorrow’s Non-Farm Payroll (NFP) report for August 1, 2025, which will be crucial. With initial jobless claims low, averaging around 230,000 recently, a robust jobs report could push gold below significant support. Traders might look into buying puts or selling short-dated call options to hedge against a potential drop toward the $3,120 level. For those anticipating a decline, the downward trendline on the 4-hour chart is a crucial indicator. Selling futures with a stop-loss above this trendline could be a smart strategy in the coming days. A decisive break below the $3,245 support level would likely increase selling pressure. Conversely, the $3,245 level is a key support area where buyers could step in. A trader expecting a reversal might buy call options with a near-term expiration, using a break of this support as a clear exit signal. A bounce from this level would first aim for the swing point at $3,333. Despite short-term pressures, we recall the trend from late 2023 and 2024 when hawkish policies from the Fed eventually led to easing. The overall expectation remains for falling real yields, which should support gold in the end. Therefore, using these price dips to buy longer-dated call options, such as those expiring in early 2026, could be a wise move for positioning in the future uptrend. Create your live VT Markets account and start trading now.Governor Ueda highlights inflation risks and recognizes improved conditions from recent trade agreements.

European equities rise as Eurostoxx and DAX show optimism from positive earnings reports

Tech Sector Performance

These increases are mainly driven by the tech sector, thanks to the results from Microsoft and Meta. Dow futures have climbed by 0.3% as the month comes to a close, enhancing overall market optimism. With Microsoft’s and Meta’s strong earnings, there’s a noticeable risk-on sentiment as we finish the month. The rise in Nasdaq futures suggests that short-term strategies, such as buying call options on tech-focused indices, are appealing. These gains are not just temporary: Microsoft’s Azure cloud business grew 25% last quarter, and Meta reported over 4.2 billion daily active users, providing solid support for this rally. This positive energy is spreading to Europe, where both the DAX and Eurostoxx are showing robust growth. Spain’s IBEX is particularly strong, leading the gains this morning. With the European Central Bank maintaining the key rate at 2.25% last week, a stable policy environment bodes well for further gains in European stocks in the weeks ahead. We also need to consider volatility. The VIX index, which measures market fear, has dropped to around 14, much lower than the low 20s earlier this year during uncertain times. This makes options cheaper, favoring strategies that depend on market direction rather than on volatility.Market Outlook

As we approach August, we should stay cautious. Historically, August is known for its sudden swings. The unexpected downturn in August 2024 serves as a reminder of the dangers of complacency. A wise strategy would be to lock in some profits by buying inexpensive out-of-the-money S&P 500 put options as a hedge. This rally feels similar to the tech-driven rise in late 2023, but it has stronger foundations. Recent US inflation data for June showed a manageable 2.8%, giving the Federal Reserve little reason to change its path. This indicates that the market’s strength is backed by solid corporate performance and a stable economic outlook. Create your live VT Markets account and start trading now.Ueda explains that future policy decisions will depend on data rather than solely on inflation forecasts, indicating a gradual rise in inflation and uncertainty regarding tariff effects.

Anticipated Interest Rate Moves

The Bank of Japan seems to be hinting at another interest rate increase, even while remaining vague. Their attention on underlying inflation suggests they are looking beyond temporary data fluctuations. Traders should prepare for a stronger yen in the weeks to come. This perspective is supported by recent data showing Japan’s core inflation for July 2025 reached 2.7%, surpassing expectations. We also received results from the spring “shunto” wage negotiations, which secured an average pay increase of over 4.5%, the highest in decades. These figures give the BOJ the justification it needs for another policy adjustment. Looking at USD/JPY, we notice similarities to late 2023 when the pair struggled near the 149-150 level before verbal intervention began. The current price action below 149.00 indicates that the market is already anticipating a more hawkish BOJ. We expect further tests of key support levels as speculation about rate hikes builds.Trading Strategies for Yen Appreciation

For derivative traders, this suggests it’s time to consider buying JPY call options or USD/JPY put options to bet on further yen appreciation. Given the BOJ’s meeting-by-meeting strategy, implied volatility is expected to increase ahead of their next decision in September. Strategies that benefit from this rise in volatility could also be profitable. It’s worth noting that the BOJ ended its negative interest rate policy in March 2024, marking its first hike in 17 years. The governor’s current language indicates that we are now entering the next phase of policy normalization. This isn’t just a one-time adjustment but a gradual shift that will continue to support the yen. Create your live VT Markets account and start trading now.France’s July preliminary CPI meets expectations, raising concerns about services price inflation and its impact on ECB outlook

Service Price Inflation

Service price inflation is still a major concern, but this data is not expected to change the European Central Bank’s current viewpoint. While this inflation number from France doesn’t alter the overall situation, it does confirm our observations. Prices for services are staying high, which is a critical issue for the European Central Bank. Since this figure was anticipated, there is no sudden shock to the market. Looking back, this aligns with the June 2025 Eurozone inflation that was reported at 2.3%, leading the ECB to pause its rate-cutting strategy. Germany’s preliminary July inflation also came in stubbornly at 2.5%, reinforcing the idea that the inflation battle is ongoing. The ECB, currently holding its deposit rate at 2.75%, is likely to stay this way for now as it watches if this trend continues into the August data release.Implications For Interest Rate Markets

For interest rate markets, this suggests that the likelihood of an ECB rate cut in September is decreasing. We may see short-term rate futures, like the December 2025 €STR futures, dip slightly as traders adjust their expectations for further easing. This supports a view of “higher for longer” rates for the rest of the year. Ongoing inflation lends some support to the Euro against currencies like the US dollar, where the Federal Reserve indicates a more stable policy outlook. Traders might start buying short-term call options on the EUR/USD, anticipating a gradual increase. The market may have become too complacent in pricing in ECB cuts that may not happen as soon as expected. For stocks, this news isn’t positive since stubborn inflation and higher rates can squeeze corporate profits. It may be wise to consider buying protective puts on the Euro Stoxx 50 index as a safeguard against a market pullback. Memories of the high inflation seen in 2022 and 2023 mean that any sign of its return will make investors anxious. Create your live VT Markets account and start trading now.Ueda highlights the benefits of the US-Japan trade deal as Japan’s economy shows moderate recovery amid uncertainties

US-Japan Trade Deal Progress

The US-Japan trade deal represents progress and reduces uncertainty about the economic forecast. This suggests there may be future interest rate hikes, although the Bank of Japan is unlikely to commit to this immediately. Recent comments show a shift in the Bank of Japan’s thinking. Revised inflation forecasts indicate they may raise rates sooner than expected, signaling a move away from the very easy policies of the post-pandemic period. Data supports this shift. The national core-core CPI for June 2025 was 2.3%, staying above the 2% target for the fourth month in a row. This ongoing price pressure, along with average wage increases of 4.5% from spring Shunto negotiations, gives the Bank of Japan a solid reason to take action.Implications for Currency and Bond Markets

For traders, this points to a stronger yen in the coming weeks. After the USD/JPY rate approached 170 earlier this year, these new comments could lead to a significant reversal. It’s wise to prepare for a move back toward the 160-162 range using options or futures. We must keep a close eye on the Japanese Government Bond market. Since the end of Yield Curve Control in early 2024, the 10-year JGB yield has risen to about 1.1%. Another rate hike could push this closer to 1.25%, opening up opportunities in interest rate swaps and bond futures. The new US-Japan trade agreement is a key factor in this situation. By lowering tariffs and reducing economic uncertainty, it removes a major reason the Bank of Japan has had for not acting over the past year. This makes a policy change more likely than at any time since the last small hike. Create your live VT Markets account and start trading now.Retail sales in Switzerland increase by 3.8%, exceeding the expected 0.2% rise

Global Economic Effects

US tariffs on goods like copper are affecting prices worldwide, and India is facing a 25% tariff. Changes in UK tax laws are impacting wealthy individuals, leading to a 14% drop in butler jobs. Due to US tariffs, India’s rupee has hit a five-month low, which is impacting market expectations. In technology news, OpenAI’s revenues have skyrocketed thanks to an influx of ChatGPT users. Microsoft and Meta have also reported strong earnings, with Meta planning major investments in superintelligence technologies. Additionally, there’s a warning about the risks of foreign exchange trading. The ongoing US-Iran conflict signals high geopolitical risk, indicating a need for long volatility strategies. Buying VIX call options or options on major indices might be a wise hedge. Historical data shows that spikes in Middle Eastern tensions, like in early 2020, caused the VIX to jump over 30% in a week; we might see this pattern again.Federal Reserve Stance

The Federal Reserve is keeping its rates at 4.3%, which clashes with political calls for deeper cuts. This situation suggests opportunities for trading interest rate volatility through options on Fed Funds futures or SOFR futures. After the Fed’s latest statement, the chances of a rate cut in September have likely dropped below 20%. However, if Powell shows any uncertainty, it could lead to sudden market shifts. Switzerland’s retail sales have exceeded expectations with an impressive 3.8% annual growth instead of the anticipated 0.2%. This robust economic performance strengthens the case for the Swiss franc, particularly against weaker currencies. We might consider call options on CHF or short EUR/CHF futures, anticipating more strength ahead. High tariffs have significantly impacted copper prices, which have fallen by 50%, affecting industrial and emerging markets. Continued pressure makes put options on copper miners or shorting copper futures attractive. The new 25% tariff on India will likely further weaken its industrial demand, adding to the bearish outlook. We’re seeing a clear divide in the market: Big Tech is thriving, while the broader economy is under stress. Strong earnings from Microsoft and Meta and hefty revenue growth for OpenAI indicate that technology could be a safe haven amid uncertainty. This separation opens up a pair trade opportunity: going long on the Nasdaq 100 via futures while buying puts on more industrial-focused indices like the Russell 2000. India is certainly feeling the impact of US tariffs, with the rupee at a five-month low and a decline in the Nifty index. The grim growth outlook and a recent Reserve Bank of India report showing a 1.2% drop in manufacturing PMI might lead traders to consider buying USD/INR call options, betting on further rupee weakness toward the 88.00 level. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – Jul 31 ,2025

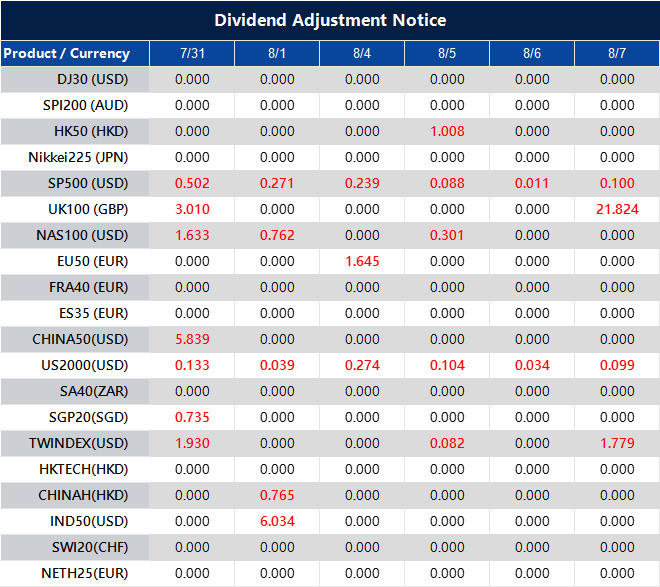

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].