Switzerland’s manufacturing PMI drops to 48.8, below the forecast of 49.7, indicating a decline in orders.

Crude oil prices changed as the market shifted focus from OPEC to expectations for economic growth.

Economic Data Focus

The spotlight is now on economic data and the Federal Reserve, which will influence future growth predictions. Tariffs have stabilized within a 10-20% range, with most effects already factored into prices. Expectations for growth and inflation are rising, as the Fed continues its easing policy, supporting a price range of $60-$80 for oil. Currently, crude oil is trading between the support level of $64.00 and the resistance level of $72.00. On the 4-hour chart, crude oil briefly climbed above $69.00 before pulling back. Buyers are looking to enter the market near support levels, while sellers are focused on resistance. On the 1-hour chart, a swing high at $67.80 may act as resistance, with sellers potentially targeting this level for a price drop. This week, we will see the US ISM Services PMI and Jobless Claims figures.Market Sensitivity

Friday’s market reaction illustrated that crude oil is sensitive to signs of economic slowdown. The decline following the August 1st Non-Farm Payroll report, which showed an increase of +155,000 jobs versus an expected +180,000, highlighted how quickly bullish positions can shift. This slight miss has raised concerns about growth for the upcoming weeks. OPEC+’s weekend decision to increase September production was expected. This move, reversing voluntary cuts from 2023, was already anticipated by the market months earlier. Thus, we should not expect a significant price reaction to this supply news going forward. With supply adjustments clarified and the trade tariff situation seemingly stable within a 10-20% range, we need to shift our focus. The main factors influencing oil prices will now be upcoming economic data and the Federal Reserve’s actions. The Fed’s guidance from its July 2025 meeting, which suggested a pause after keeping rates at 4.75%, still indicates a leaning towards easing. This outlook should help stabilize prices, as the potential for rate cuts supports growth expectations. However, there isn’t enough confidence for a big breakout, so we expect the market to remain range-bound. We anticipate crude oil will continue trading between $60 and $80 in the near future. For traders who are bullish, the strategy should be to wait patiently for prices to approach the strong support zone around $64.00. This area offers a solid entry point for buying call options or selling cash-secured puts with a defined risk below that level. A target for this trade would be a move towards the $72.00 resistance. Traders with a bearish outlook should view resistance levels as their chance to act. The recent swing high at $67.80 presents a short-term selling opportunity, possibly through purchasing puts or establishing bear call spreads. A confirmed break below $64.00 would be a stronger bearish signal, potentially opening the door for a drop towards $55.00. This week’s data will be crucial for testing our range-bound prediction. We will closely monitor the US ISM Services PMI tomorrow, as a strong report could push oil prices toward resistance. On Thursday, the latest US Jobless Claims data will provide more insight into the labor market and its impact on demand. Create your live VT Markets account and start trading now.European equities recover slightly after Friday’s decline, while US futures stay stable for now

Swiss Market Decline

Swiss stocks have opened lower, with the SMI dropping by 1.8%. This decline is mainly due to Switzerland being on holiday last Friday, causing it to miss the declines seen in other markets that day. After a significant drop last Friday, European stocks and U.S. futures are bouncing back this morning. The market is shifting its view from “bad jobs data is harmful” to “bad jobs data could lead to Fed rate cuts.” This change in perspective is creating quick opportunities in the derivatives market. The downturn was triggered by the U.S. jobs report for July 2025, released last Friday. It revealed that Non-Farm Payrolls grew by just 65,000, falling short of the expected 190,000. Additionally, the unemployment rate unexpectedly rose to 4.1%, the highest in over two years. This data represents the first real sign of weakness in the otherwise strong labor market. As a result, the CBOE Volatility Index (VIX) soared above 20 on Friday, a level not consistently seen since early this year. Traders should be on the lookout for chances to sell volatility via options or VIX futures, betting that the initial fear will fade as the market embraces the rate cut narrative. However, there is a risk if the jobs data hints at an actual recession.Fed Rate Cut Expectations

The immediate response is seen in interest rate derivatives, focusing on the Federal Reserve’s meeting in September. Fed fund futures are now indicating an almost 80% chance of a 25-basis-point cut, a stark rise from under 20% just a week ago. Traders will be actively purchasing SOFR and Fed fund futures contracts to prepare for this expected policy change. For equity index traders, this sets up a classic “Fed put” scenario, where the central bank is anticipated to support markets. One common strategy is to sell out-of-the-money put spreads on the S&P 500. This strategy bets that even if the economy slows, lower rates will help stabilize equity prices and avoid a larger sell-off. We’ve seen this approach before, especially in late 2023, when weakening economic indicators led to market gains based on expectations of a policy shift. That period showed how quickly markets can overlook bad news when monetary easing seems imminent. This historical context is encouraging traders to bet on a similar outcome now. The main risk is misunderstanding the Federal Reserve’s intentions, as core inflation still hovers above 3%. The Fed may prioritize fighting inflation over addressing a slight decline in the labor market, potentially undermining the “bad news is good news” viewpoint. Thus, maintaining some protection—like long-dated puts—remains a wise safeguard against an overly optimistic outlook. Create your live VT Markets account and start trading now.Gold rallies as buyers target key resistance levels after disappointing NFP data.

Gold’s Daily Technical Analysis

In our daily technical analysis, gold’s price rebounded before hitting the 3,245 support level, with buyers aiming for the 3,438 resistance. On the 4-hour chart, the price broke above a downward trendline, with support now around 3,334. Buyers may continue to push toward the 3,438 level, while sellers might look for a return to 3,245 support. On the 1-hour chart, the 3,334 level is crucial for buyers hoping for a rebound, with increased buying likely if the price rises above 3,369. Important upcoming data includes the US ISM Services PMI and US Jobless Claims. The market response to the recent NFP report has been significant. It showed softer than expected results, leading to market pricing of almost 60 basis points for interest rate cuts by year-end. This is a major increase from the 35 points priced in just before the report, driving gold’s recent rally. For traders who are optimistic about gold, this is a good chance to target the $3,438 resistance level. Buying call options or setting up bull call spreads below this level could help capture further gains if the positive trend continues. This strategy allows for defined-risk exposure as the market rallies towards this technical barrier.Monitoring Key Levels

It’s important to keep an eye on the $3,334 level, which now serves as a support base. If it breaks below this level, it could indicate that the recent rally is losing strength, potentially drawing sellers back in. Traders might consider put options to target a move back down towards the $3,245 support area. Upcoming data this week will be crucial for short-term trends and market volatility. If the US ISM Services PMI falls below 52.0 tomorrow, August 5th, it would strengthen the dovish viewpoint. Conversely, a reading above 54.0 could challenge that outlook. We will also monitor Thursday’s jobless claims; a rise above 235,000 would further support the argument for an earlier rate cut. Looking ahead, this environment feels reminiscent of the late 2023 pivot when rate cut expectations propelled gold prices upward. The long-term outlook for gold seems positive as the central bank considers easing policies. Yet, as seen in early 2024, the path can be unpredictable, with hawkish data potentially causing sudden pullbacks. All eyes will be on Fedspeak and the Jackson Hole Symposium later this month. We believe Fed Chair Powell might use this opportunity to hint at a possible rate cut in September if economic data remains soft. Any sign of caution or hawkishness from Fed officials could quickly shift the current market sentiment, making flexible trading strategies essential. Create your live VT Markets account and start trading now.The FX market expects a quiet week with important data releases from the U.S., New Zealand, and Canada.

U.S. Economic Outlook

In the U.S., the ISM services PMI is projected to be 51.5, up from 50.8. Rising costs are a worry, as the services sector has a hard time picking up speed, with high prices paid. A cautious outlook persists due to weak demand and mixed signals from the labor market. In New Zealand, an employment change of -0.1% is expected, with unemployment likely increasing to 5.3%. If the labor data is weak, it could lead to a policy rate cut at the next meeting. The BoE is expected to lower rates by 25 basis points, despite inflation concerns. In Canada, employment changes are anticipated to be 15.3K, with unemployment expected to be at 7.0%, reflecting an uneven labor market. While manufacturing is struggling, the services sector continues to create jobs. This week, we will be paying close attention to the U.S. ISM services PMI on Tuesday for clues about economic health. Recent flash PMI data for July suggested a reading around 52.2, which is better but still shows slowing momentum compared to earlier in the year. With high input costs and weak demand, it might be wise to consider options that bet on limited gains in U.S. equity indices in the coming weeks. For the New Zealand dollar, we are focused on the anticipated interest rate cut from the Reserve Bank of New Zealand. Wednesday’s employment data will be crucial; if the unemployment rate rises to the expected 5.3%, it would reach its highest level in over three years and likely confirm the rate cut. This suggests a straightforward strategy of buying put options on the kiwi or shorting NZD futures ahead of the decision.Bank of England Rate Decision

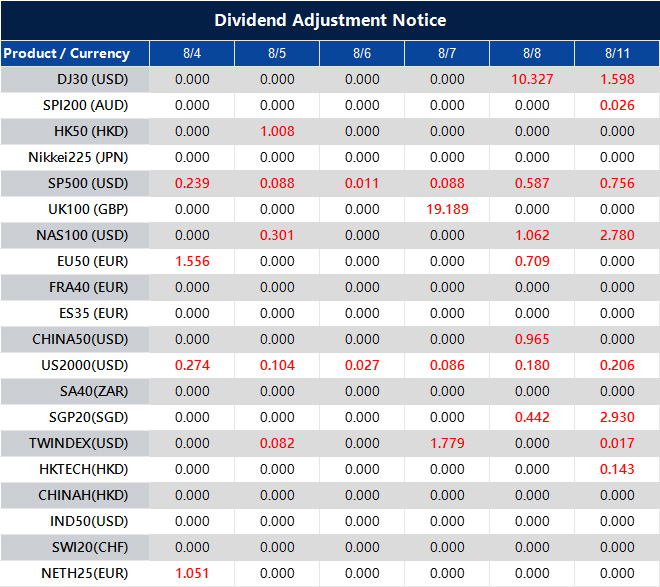

The Bank of England is set to cut rates by 25 basis points this Thursday, a move that the market has largely anticipated. With UK inflation in June steady at 3.1%, the real event will be the Bank’s future guidance rather than the cut itself. This opens up opportunities for volatility trading, using straddles or strangles on the British pound or FTSE 100 index futures around the announcement. In Canada, Friday’s labor data will likely reflect a significant slowdown, with only 15.3K new jobs expected. If the unemployment rate rises to 7.0%, it would mark a new multi-year high, confirming a cooling economy. Given the ongoing struggles in goods-producing sectors, traders might think about selling call options on the Canadian dollar, expecting any strength to be capped. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – Aug 04 ,2025

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].