Gold prices pull back from recent highs but still show weekly gains as traders await a Fed announcement.

Wage tracker predicts slowing wage growth, easing ECB monetary policy issues for 2026

Implications for ECB Monetary Policy

The ECB wage tracker shows that wage growth is likely to be lower and more stable in the first half of 2026. In 2024, negotiated wage growth was 4.1%, it’s estimated to drop to 3.8% in 2025, and then further to 2.5% in 2026, not counting one-time payments. For this year, wage growth is expected to be 4.3% in the first half and 3.3% in the second half. This trend suggests that wage pressures will ease over time. This situation gives the ECB more leeway in its monetary policy, especially if worries about consumer prices continue. For full details, you can visit the ECB Wage Tracker website. The latest wage data shows a clear slowdown into 2026, which supports the idea that the European Central Bank can lower interest rates more comfortably. As a result, we should see interest rate futures, like those linked to ESTR, reflecting a more lenient approach to monetary policy over the next year. The market may not fully account for the possibility of earlier or larger rate cuts in 2026.Impact on Financial Markets

The moderation in wages is significant, especially when combined with the latest economic data from this quarter. The Eurostat flash estimate for August 2025 showed inflation steady at 2.4%. Meanwhile, the Composite PMI data remains just above the 50 mark, indicating little economic growth. This mix of slowing wages and weak growth allows the ECB to focus more on promoting growth rather than worrying about inflation, a shift from their position in 2023. In foreign exchange markets, the growing gap between a more aggressive Federal Reserve and the ECB will likely weaken the Euro. It may be wise to consider strategies for a weaker EUR/USD, like buying put options to target the low levels seen in early 2025. The ECB’s shift toward a more dovish stance, now backed by wage trends, makes long positions in Euro look riskier. For equity derivatives, this outlook is positive for European indices like the Euro Stoxx 50. Lower financing costs for a longer time should boost corporate earnings and valuations. As the ECB’s policy path becomes clearer, we could also see reduced implied volatility, making it a good time to buy call options on these indices. Create your live VT Markets account and start trading now.ECB tracker shows steady wage growth expected for early 2026 to ensure stability

Cooling Wage Pressures In Eurozone

New data indicates that wage pressures in the Eurozone are easing. The latest tracker shows negotiated wage growth at 3.2% for all of 2025, dropping sharply to 1.7% in the first half of 2026. This is a significant drop from the 4.3% wage growth seen in the first half of this year. This data strengthens the case for the European Central Bank (ECB) to adopt a more lenient stance. With inflation figures from August 2025 already down to 2.3%, this wage information removes a major barrier to potential rate cuts. The aggressive rate hikes of 2023 and 2024 were largely due to concerns about a wage-price spiral, but this new data suggests those fears are diminishing. For traders, this signals that interest rates may stay lower for a longer time than the market currently anticipates. It might be wise to consider receiving fixed rates on Euro interest rate swaps, betting that market rates will decline further. Options that gain from falling bond yields, like buying calls on German Bund futures, now seem more appealing.Impact On The Euro

The Euro’s outlook is also affected, as lower rate expectations generally weaken a currency compared to others, like the US dollar. Derivative strategies could include buying put options on the EUR/USD. This gives you the right to sell the Euro at a certain price if it drops, allowing you to profit from a potential decline while limiting initial risk. All attention is now on the upcoming ECB meeting on October 23rd for any shifts in their official stance. We expect that market expectations for rate cuts in the first quarter of 2026 will increase in the coming weeks. Any comments from ECB officials before then will be closely monitored for indications that they recognize these cooling wage pressures. Create your live VT Markets account and start trading now.Escriva highlights the importance of agile monetary policy while reaffirming the ECB’s neutral stance on interest rates.

Inflation Risks

The risks to inflation appear balanced, although there may be a slight negative effect on growth. During an event, Escriva stressed the ECB’s neutral position, indicating that the bank is prepared to adjust if needed but is unlikely to respond to small deviations from targets unless unexpected events occur. With the European Central Bank maintaining a neutral stance, there seems to be little reason to change the current 2% interest rate in the near future. The latest flash estimate for Eurozone inflation in August 2025 is 2.2%, which is close to the target and doesn’t prompt a policy change. This suggests that interest rate fluctuations will likely stay low for now. In this situation, it may be smart to sell options to earn premium, as implied volatility might be higher than actual volatility. For example, strategies like selling straddles on short-term EURIBOR futures could be used, betting that rates will remain stable. However, this strategy carries significant risks if there is an unexpected economic shock.Main Risk to Stability

The biggest threat to this stable outlook is the central bank’s willingness to change direction. Any unanticipated geopolitical event or sudden rise in energy prices could quickly alter this balance and lead to a policy response. Therefore, holding some inexpensive out-of-the-money options might be a wise way to protect against sudden market changes. We are also monitoring the tension between slow economic growth and a tight labor market. The GDP growth for the second quarter of 2025 is only 0.1%, while unemployment is at a low of 6.3%. This puts the ECB in a challenging position. If forward-looking indicators like the Purchasing Managers’ Index (PMI) worsen further, it could lead to future rate cuts. Reflecting on the past, we recall the sharp rate hikes in 2023 that were necessary to combat high inflation. The following trend of disinflation enabled a series of cuts that brought us to the current 2% rate. This history serves as a reminder that while things seem stable now, the central bank is ready to act if the data changes. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – Sep 17 ,2025

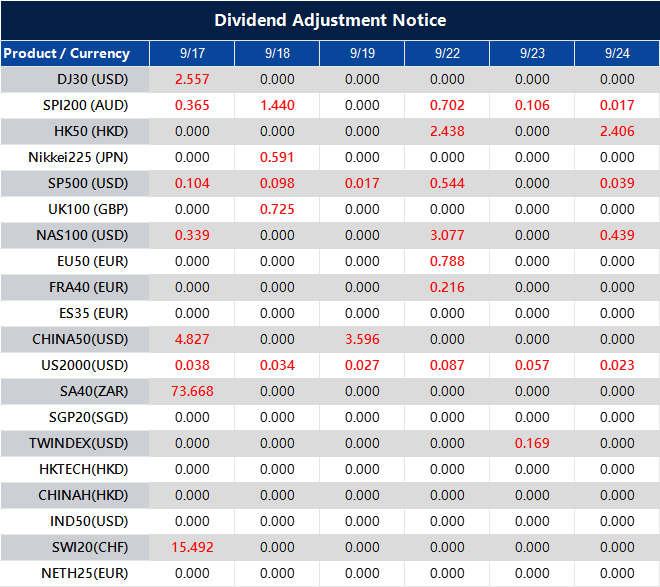

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].