Germany’s economy slightly shrank in Q2 due to ongoing manufacturing struggles, but fiscal prospects improve

European equities start slowly, showing mixed results amid flat US futures and uncertainty

European Market Indecision

European stocks are showing a sluggish trend as the market reflects on the overall economic situation. There’s uncertainty tied to the US-EU trade agreement, causing indecision in indices like the DAX and Eurostoxx. Recent data indicates that the Eurozone manufacturing PMI is at 48.2. Although this is a slight improvement, it still suggests a contraction in the sector. The trade deal, finalized in early 2025, hasn’t delivered the expected boost. Ongoing tariffs on industries like automotive parts and aerospace are still weighing down sentiment for European exporters. This situation makes long positions in these sectors risky without proper hedging. The upcoming Federal Reserve meeting is the big event everyone is keeping an eye on. The aggressive rate hikes in 2023 and 2024 helped reduce inflation, but the Fed’s current “wait-and-see” strategy brings uncertainty. Traders in currency markets, particularly with the EUR/USD, should expect volatility, as any signal of a policy shift could lead to rapid price changes.Market Strategies Amid Uncertainty

In the current sideways market, buying volatility seems like a smart option. Strategies like purchasing straddles on the Euro Stoxx 50 may be beneficial, as they benefit from significant price movements in either direction. Unexpected results from major tech earnings or statements from the Fed could easily push prices out of this tight range. Implied volatility reflects this tension, with Europe’s VSTOXX index trading around 18. This level is high compared to the calmer times of late 2024, indicating that option premiums are relatively expensive for good reasons. This suggests that complacency is not advisable, and selling uncovered options could be a costly error. It’s also important to remember that these fluctuations occur during month-end portfolio rebalancing, which can lead to exaggerated and misleading price movements in the coming days. Thus, it’s wise to be cautious about short-term noise and concentrate on the larger factors that will influence market trends as we move into August. Create your live VT Markets account and start trading now.Recent USD gains lack clear catalyst as focus shifts to potential BoJ rate hikes affecting JPY

Technical Analysis of USDJPY

Weak US economic data or rising inflation in Japan could strengthen the yen. Signals from the BoJ about rate hikes or fiscal support could also play a role. On the charts, USDJPY hits resistance at 148.30; sellers are aiming for a drop to 142.35, while buyers hope for a breakout toward 151.20. On the 4-hour chart, 147.00 provides minor support, where buyers may step in, while sellers are looking for another drop. The hourly chart shows a recent downward trend, with sellers pushing lower; buyers are looking for a breakout to reach higher levels. Upcoming important data includes US ADP, GDP, and the FOMC decision, followed by the BoJ decision, US PCE index, Jobless Claims, and others, wrapping up with NFP and ISM PMI on Friday. As of today, July 30, 2025, USDJPY is stalled at the crucial 148.30 resistance level. The market is calm before significant decisions from the US Federal Reserve today and the Bank of Japan tomorrow. This quiet period suggests that a major move is on the horizon in the coming weeks.Market Risks and Strategies

The main risk for traders is that many are betting against the US dollar, making it crowded. Data from the mid-July 2025 Commitment of Traders report revealed that speculative net short positions on the dollar were at a two-year high. A surprise move from the Fed could quickly reverse these positions, leading to a sharp rise in USDJPY. The outlook for the US economy is unclear, complicating the Fed’s job. The initial estimate for Q2 GDP showed growth slowing to 1.4%, but core PCE inflation remains stubborn at 2.9% year-over-year. This makes it hard for the Fed to justify aggressive rate cuts that many traders expect. Meanwhile, there are growing expectations that the Bank of Japan may finally raise interest rates. Japan’s national inflation just reported at 2.6%, increasing pressure on the BoJ to tighten policy now that uncertainties around the US-Japan trade deal have diminished. Any indication of a hike tomorrow could significantly boost the yen. For traders who believe that the 148.30 resistance will hold, buying put options offers a way to hedge against a potential decline. A weaker-than-expected US jobs report on Friday or a hawkish BoJ could easily push the pair back to the 142.35 support level. This strategy positions for a stronger yen or a weaker dollar. Conversely, traders worried about a dollar short squeeze might consider buying call options with a strike price just above 148.30. This would capitalize on potential gains if the Fed takes a less dovish stance than expected, breaking the resistance and reaching the 151.20 level. This is a direct play on the crowded positions unwinding quickly. Given the heightened event risk, the options market shows increased implied volatility. This makes strategies like a long straddle—buying both a call and a put—very relevant. Such a position will benefit from significant price swings in either direction after the central bank announcements without needing to predict the outcome precisely. We saw a similar trend in 2022 and 2023 when differing policies from the Fed and BoJ led to significant, multi-hundred-pip moves in one day. The current situation, where the Fed is looking to ease while the BoJ may be ready to tighten, has all the ingredients for that type of volatility to return. Create your live VT Markets account and start trading now.President Xi of China announces plans to boost consumption and tackle economic stagnation, reassuring investors

Economic Goals for 2025

Although specifics were not shared, we do know the economic focus for the second half of 2025. These goals suggest a strategic path for future economic policies. Given these comments, we can expect a short-term rise in optimism for Chinese investments. The clear push to boost consumption is a strong message that the market has been waiting for, likely leading to a rally in the coming days. This is a good time to consider short-dated call options on China-centric ETFs, like the Hang Seng TECH Index or the CSI 300 Index, to take advantage of the initial excitement. This policy shift is especially important because of the slow economic data we’ve seen in early 2025. Retail sales growth in Q2 was only 2.8%, and consumer confidence is low. Therefore, any effective stimulus will have a big effect. We should look at derivatives related to major consumer brands like PDD Holdings and Alibaba, as they’ll most likely benefit from policies aimed at encouraging spending. The call to address “involution” hints at a broader strategy beyond just temporary measures. This is a direct action against ongoing issues, including the high youth unemployment rate, which remains around 14.5% this year, according to recent data. Hence, we should also consider call options linked to sectors that create high-value jobs, such as advanced manufacturing and domestic technology ETFs.Market Outcomes and Strategies

However, we must proceed with caution, as we’ve seen similar situations before. At the Politburo meeting in July 2023, comparable promises led to a quick but temporary rally that faded when concrete plans were slow to come. Traders should be ready to take profits from the initial excitement and wait for definite policy announcements before making long-term investments. This sense of anticipation will likely increase implied volatility in Chinese equity options over the next few weeks. The Hang Seng Volatility Index (VHSI) has already started to rise and is expected to climb as the market looks for details. This makes selling out-of-the-money puts a smart strategy for those who are optimistic, allowing them to earn higher premiums while positioning for potential gains. Create your live VT Markets account and start trading now.Switzerland’s KOF index rises to 101.1 in July, surpassing expectations and signaling improved economic sentiment

Strong KOF Indicator

The strong KOF indicator means the Swiss economy is growing faster than expected. This is a big surprise and the highest reading since March. It suggests that the Swiss franc may strengthen in the coming weeks. This optimism seems connected to a better global trade picture, not just local factors. For example, Germany’s IFO Business Climate Index hit a 10-month high of 92.5 last week. This matches China’s Caixin Manufacturing PMI, which has shown steady factory growth for three months, currently at 51.9. This new information presents a challenge for the Swiss National Bank (SNB). They cut interest rates in March and June 2025 to control the franc’s strength. With this strong economic signal, they might need to adjust their approach in their next meeting.Investment Strategy

Considering this, we see good opportunities in buying call options on the Swiss franc against the euro or the dollar. This strategy allows us to benefit if the franc strengthens due to the positive economic outlook. It also limits our losses if the SNB successfully talks down the currency or if global sentiment changes suddenly. The key point is volatility, which may increase as the market speculates on the SNB’s next move. One-month implied volatility on EUR/CHF has already risen to 6.8%, and we believe it could rise further based on what we observed in 2022-2023 when central bank policies differed significantly. A simple long call strategy on the franc, or possibly a call spread to reduce costs, looks appealing right now. Create your live VT Markets account and start trading now.Preliminary CPI in Spain rises to 2.7%, slightly above expectations, indicating upward inflation pressure

Eurozone Inflation Concerns

The higher inflation rate in Spain indicates persistent price pressures across the Eurozone. This supports the ECB’s choice to pause further interest rate cuts. Consequently, we need to reassess expectations for imminent easing in the upcoming weeks. This Spanish report follows the Eurozone’s flash estimate for June 2025, which showed headline inflation at 2.6% and core inflation at 2.9%. These stubborn figures are causing market unease regarding the ECB’s next steps. Inflation remains consistently above the 2% target. In the rates market, we can expect short-term yields to rise. This signals the need to adjust positions in derivatives like EURIBOR futures to account for fewer significant rate cuts for the rest of 2025. The likelihood of a September rate cut from the ECB is rapidly decreasing.Impact on Financial Markets

Sustained inflationary pressure may act as a headwind for equity indices like the Euro Stoxx 50. It may be wise to consider buying put options for downside protection, as the VSTOXX volatility index recently reached 15. The chance of a market pullback in the coming weeks has increased. The Euro might gain strength from this data, as a hawkish ECB typically supports the currency. Traders could consider buying near-term EUR/USD call options to take advantage of potential gains, which might push the pair back towards the 1.10 level seen earlier this year. Looking back, the ECB’s June 2025 rate cut seems to have been based on data that has since changed. The market had anticipated another cut before the year ends, but that view is now quickly being reassessed. This shift in sentiment presents opportunities. Create your live VT Markets account and start trading now.Economic releases in Europe and the US could impact central banks’ upcoming decisions without major changes.

Focus On The FOMC Decision

The US Q2 GDP is projected to be 2.4%, bouncing back from -0.5%. While this is a lagging indicator, all eyes are on the FOMC decision later today. The Bank of Canada is likely to keep interest rates steady, backed by strong job data and inflation within their target. The market anticipates a 16 bps rate cut by year-end, indicating uncertainty over future cuts. The FOMC is also likely to maintain steady rates. Some members might disagree, and Fed Chair Powell could suggest a potential rate cut based on upcoming employment and inflation data. Currently, the market sees a 67% chance of a cut in September and a 95% chance by December. In Europe, the European Central Bank appears to be done with rate cuts for now. Recent flash estimates show Eurozone inflation at 2.6%, slightly above target, giving the ECB little reason to ease further. Traders should be aware that discussions might shift towards maintaining rates or even increases in 2026, marking a big change from recent trends. In the United States, the focus is shifting from today’s past data to the Federal Reserve’s plans. The advance Q2 GDP report is expected to reveal a recovery to 2.4% growth, a significant improvement from the -0.5% contraction in Q1. However, traders will likely overlook this as the FOMC’s policy decision is the highlight of the day.Market Expectations And Trader Strategy

For traders, a key factor is the market’s strong pricing for Fed rate cuts, with CME’s FedWatch tool showing a 67% likelihood of a cut by the September meeting. This creates a potential for volatility, similar to 2019 when market expectations for cuts outpaced the Fed’s actual comments. If Fed Chair Powell hints that the data does not support a September cut, it could lead to sharp adjustments in interest rate futures. Since a dovish outcome is largely expected, a smart strategy could involve positioning for a hawkish surprise. This might include using options to bet on increased volatility in short-term bonds or a scenario where rates do not drop as fast as expected. If Powell emphasizes the data and points to a robust labor market, the market’s strong belief in a September cut could be challenged. In contrast, the Bank of Canada is in a strong position and is expected to hold its interest rates steady. Recent data revealed that Canada added a solid 45,000 jobs, and core inflation remains steady near the BoC’s target at 2.8%. This strong economic environment means the BoC feels little pressure to signal any rate cuts. The difference between a Fed that may cut rates and a BoC that is holding steady provides a strong case for a stronger Canadian dollar against the US dollar. Derivative traders can explore options on the USDCAD pair, anticipating a decline in the coming weeks. The clear contrast in central bank policies offers a solid reason for this trade. Create your live VT Markets account and start trading now.China’s Politburo signals economic stability and plans to boost domestic demand with proactive policies.

Boosting Domestic Demand

They will work on unlocking domestic demand with a special initiative to increase consumption. Leadership highlighted the importance of stabilizing trade fundamentals and attracting foreign investment. Additionally, addressing local government debt risks and enhancing governance in key industries remain priorities. They are also focused on managing competition among businesses. These comments align with current policies and emphasize the revival of domestic demand and consumption. The Politburo’s stance offers support, which could help stabilize equity markets soon. Recently, markets have been volatile, with the CSI 300 index testing important support levels after disappointing industrial output data for June 2025. This reassurance is meant to boost confidence and reduce pessimism.Investment Strategies

Their focus on policy continuity suggests a possible decrease in implied volatility soon. The CBOE Hang Seng Volatility Index (VHSI) has been high, indicating potential opportunities to sell put options or create bullish put spreads on major Chinese indices. This strategy can leverage a slow upward trend and falling market anxiety. The announcement of a special initiative to boost consumption is a strong indicator. We should consider purchasing near-term call options on consumer discretionary ETFs or large-cap consumer stocks that have underperformed this year. Recent government data from Q2 2025 shows that household savings rates are high, indicating significant pent-up demand that targeted stimulus could unlock. Reflecting on the past, we recall the market rally that followed similar remarks from the Politburo in July 2023, which provided a short-term boost. While the fiscal policies detailed are not drastic, they show that authorities will avoid a sharp economic downturn. This history suggests that a positive, albeit temporary, market reaction is likely. The commitment to tackle local government debt risks and manage overcapacity in key industries is also important for traders of fixed income and commodities. A proactive fiscal policy may lead to increased government bond issuance, but the focus on debt management should keep yields stable. This backdrop is likely to support industrial metals like copper, making long positions in futures contracts a good hedge against inflation and a way to benefit from infrastructure spending. For currency traders, this emphasis on stability indicates that the People’s Bank of China will continue to carefully manage the Yuan. They have actively defended the 7.35 level for USD/CNH throughout 2025. Consequently, we shouldn’t anticipate significant currency depreciation, making it a stable option for carry trades. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – Jul 30 ,2025

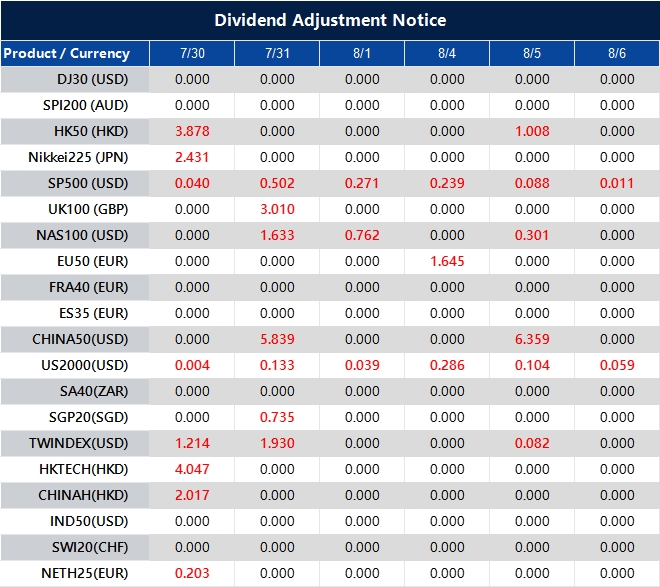

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].