CPI data impacts the decline of the Australian dollar, confirming expectations for an RBA rate cut.

Consumer prices in Australia rise slower than expected, suggesting a potential cash rate cut by the RBA

Upcoming RBA Rate Decision

Given the soft inflation numbers for Q2 2025, a rate cut by the RBA next month seems almost certain. The market is pricing in over a 90% chance of a 25 basis point cut at the August 12th meeting, which opens up clear opportunities in the coming weeks. Traders should prepare for falling interest rates by opting for fixed rates in the swaps market. This outlook is backed by recent data, including weak retail sales figures from June 2025, indicating less consumer activity. It’s best to take these positions before the RBA meeting. We also expect Australian government bond futures to rise, especially the 3-year contracts which are most responsive to cash rate changes. Bond prices typically go up as yields drop in anticipation of central bank easing. Looking back to 2019, we saw the market respond ahead of the RBA’s actions, and we anticipate a similar trend now.Impact on Currency and Stocks

The Australian dollar is likely to weaken further against the US dollar, especially since the Federal Reserve is expected to keep rates steady. This difference in policies makes buying AUD/USD put options an attractive way to profit from or protect against a declining currency. A drop below this year’s lows appears more likely. For the stock market, these factors favor the ASX 200 index. Lower borrowing costs will help rate-sensitive sectors like real estate and banking. We expect increased buying in ASX 200 futures as investors prepare for a more supportive monetary policy. This perspective is further supported by the latest jobs report for June 2025, which showed the unemployment rate rising to 4.2%. This gives the RBA strong reasons to cut rates, addressing inadequate inflation and a weakening labor market. Governor Bullock has already indicated a cautious, data-driven approach in recent speeches. Create your live VT Markets account and start trading now.PBOC sets central USD/CNY rate at 7.1441, injecting 309 billion yuan

Recent Financial Moves

The PBOC injected 309 billion yuan into the market through 7-day reverse repos at an interest rate of 1.40%. Out of this amount, 150.5 billion yuan will mature today, resulting in a net injection of 158.5 billion yuan. This yuan fixing sends a strong message from officials. The rate was set much stronger than expected, indicating a desire to prevent the currency from weakening further. This represents the largest difference between the official rate and market predictions in over a year. This action likely reflects that China’s Q2 2025 GDP growth surpassed expectations at 4.9%. This gives authorities confidence to strengthen the currency. The move aims to boost investor confidence and counter the ongoing capital outflows seen in the first half of 2025. It also strengthens Beijing’s position ahead of new trade talks with Washington next month. In the coming weeks, we should consider buying put options on the USD/CNY pair to bet on further yuan strength. With this surprising decision, implied volatility has likely risen, making it interesting to sell high-strike call options on USD/CNY for potential profit. The 7.20 level now looks like a strong ceiling for the dollar against the yuan.Strategic Financial Decisions

We’ve seen this strategy before, especially in 2019 and 2023, when the central bank acted to defend the currency against rapid declines. Historical patterns suggest these strong fixes are just the beginning of a policy effort that could last for several weeks. Therefore, we should not expect significant yuan weakness in the near future. A stronger yuan usually increases China’s buying power for commodities, which could support industrial metal prices. Copper, which was around $8,400 per tonne in July 2025, may find solid support here. We should also expect stronger currencies from key trading partners, like the Australian dollar. The large cash injection into the banking system is key to this strategy. It shows that while officials want a stronger currency, they aim to maintain domestic credit and not slow the economy. This dual approach tells us to focus on currency intervention rather than anticipating a broad tightening of financial policy. Create your live VT Markets account and start trading now.The US dollar continues to decline against major currencies as we await Australian inflation figures

US Dollar Loses Ground

The US dollar is losing ground, indicating a shift in market sentiment. Last week, the preliminary estimate for Q2 2025 GDP showed only a 1.4% growth, which was lower than expected. This has led to the belief that the economy may be slowing down. Traders seem to be adjusting their positions in anticipation of more significant data releases. This decline follows the Federal Reserve’s decision to keep interest rates unchanged during its July 2025 meeting, where the tone suggested a more cautious and data-focused approach. Currently, futures markets are reflecting a 65% likelihood of a rate cut by the end of 2025, a significant rise from the 40% chance just a month ago. This has been putting steady, albeit modest, pressure on the dollar. For those trading derivatives, implied volatility in key currency pairs is at a notably low level. The Currency Volatility Index (CVIX) is around 6.8, a figure we haven’t seen consistently since the calm periods of early 2024. In this environment, buying options is relatively cheap, helping traders position themselves for larger market moves with limited risk.Looking Ahead to Australian Inflation Data

We are closely watching the upcoming Australian inflation data for Q2 2025, which will be released soon. The market expectations are for a 0.8% quarterly increase, but if the data comes in higher than this, it could sharply boost the Australian dollar against the US dollar. Consider short-term AUD/USD call options as a way to take advantage of this event risk. Looking back to late 2023, we saw the market start anticipating the end of the Fed’s aggressive interest rate hikes. During that time, the dollar began a slow, steady decline as economic data softened. This pattern suggests that the current market conditions could lead to a longer-term trend rather than just a temporary dip. Create your live VT Markets account and start trading now.Confidence in New Zealand businesses increased to 47.8%, while activity decreased to 40.6%

Business Confidence vs. Activity

The increase in business confidence to 47.8% might be misleading. The more important figure, business activity, actually decreased, indicating that how businesses feel doesn’t reflect their actual performance. This suggests the economy is stagnant without clear progress. This mixed data means the Reserve Bank of New Zealand is likely to keep the cash rate at 5.50% for now. They face weak demand locally and persistent inflation, which suggests the New Zealand dollar will stay in a narrow range. We see limited chances for significant currency movement in the coming weeks.Sector Differences and Trading Opportunities

The key takeaway is the stark divide within the economy. Notably, agriculture is “storming ahead,” while construction and retail are facing a “renewed slump.” This difference between sectors offers clearer trading opportunities than betting on the economy as a whole. To take advantage of this, we are considering call options on agriculture-related companies. The recent 3.1% rise in the Global Dairy Trade auction supports the strength of this sector, providing a direct way to trade the positive trend mentioned in the survey. On the flip side, we are looking at put options for major retail and construction firms. Official data shows retail sales volumes fell by 1.2% last quarter and building consents are also declining. This confirms the reported slump, offering a clear opportunity to bet against these sectors. Create your live VT Markets account and start trading now.Modifications on ECN Account – Jul 30 ,2025

Dear Client,

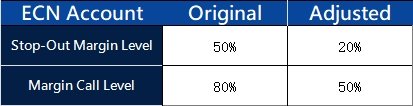

To provide our valued clients with an enhanced trading environment, VT Markets will adjust certain trading conditions for ECN account on August 2, 2025:

Friendly reminder:

1.All account settings stay the same except for the above adjustments.

2.All account types now have the same Stop-Out and Margin Call Level.

If you’d like more information, please don’t hesitate to contact [email protected].