The USD is recovering, while the JPY struggles before the BoJ and FOMC meetings this week.

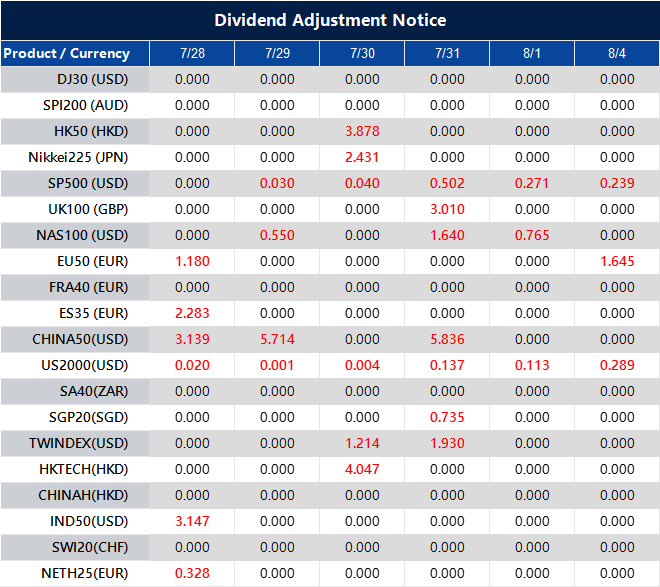

Dividend Adjustment Notice – Jul 28 ,2025

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].

Limited events expected with a focus on trade deals and a volatile manufacturing index release

Trade Predictions and Outcomes

This outcome matches expectations that tariff rates will stabilize between 10% and 20%. Trade discussions have been active since April 9, reaching a pivotal moment. The trend for risk assets is expected to continue, unless a new event emerges that could increase momentum or cause a shift. With fewer economic reports expected, the market seems to be waiting. The CBOE Volatility Index (VIX) stands near 13, significantly lower than the historical average of 20. This indicates that investors are feeling quite relaxed. In this low-volatility environment, there is a chance to take advantage before the next significant event occurs. We now shift our focus from the settled US-EU trade situation to domestic inflation data. The upcoming Personal Consumption Expenditures (PCE) price index is crucial, particularly since a recent report indicated core PCE at 2.8%, above the Federal Reserve’s target. If the number deviates from expectations, it could easily disrupt the current market calm and lead to noticeable changes.Investment Strategy Considerations

For those optimistic about the ongoing upward trend, buying call options on broad market indices like the S&P 500 could be beneficial. This approach allows for greater gains if positive economic news helps continue the rally. Given the current risk-on sentiment, this strategy seems promising. However, it’s wise to think about protecting against a downturn, especially since the article hints that the peak of this trend might be near. With volatility so low, purchasing put options on key indices or particular stocks is relatively affordable. This serves as a safety net against sudden market shifts caused by unexpected data. The main takeaway is that a substantial market move is more likely than a long period of stagnation. Therefore, we should explore strategies that profit from an increase in volatility, regardless of the market’s direction. This could involve investing in options that gain from a breakout out of the current narrow trading range. Create your live VT Markets account and start trading now.Stock futures rise in early European trading, showing optimism about a temporary US-EU trade agreement

Market Opportunity

The current market strength presents a short-term chance to ride this positive wave. We think this is a good time to use short-dated call options on the Eurostoxx 50 index. This strategy lets us join in on the immediate rally while also managing our risk. However, we need to keep in mind that this agreement is not permanent. The Euro Stoxx 50 Volatility Index (VSTOXX) has dropped below 17, suggesting less fear in the market. This might be a good opportunity to buy protection at a lower cost. The drop in implied volatility indicates that the market may be underestimating risks from possible future trade disputes. Still, there’s caution regarding the economy. The latest Eurozone Manufacturing PMI is at 47.3, which means it’s still shrinking. With core inflation stubbornly high, the base for a steady rally looks weak. These factors show that the current market optimism is on shaky ground.Strategic Hedging

Our strategy will be to protect any new positive positions. While we enjoy the current gains, we are also buying out-of-the-money puts that will expire next quarter. This acts as a budget-friendly insurance policy against a possible downturn when the initial excitement wears off. We’ve seen similar patterns in the past, like during the temporary US-China trade pause in late 2018. That situation caused a quick market boost that eventually faded when the core issues remained unsolved, resulting in renewed volatility. We expect a similar trend might happen in the coming weeks. Create your live VT Markets account and start trading now.Monthly Analyst Scope: Tariffs In The Era Of Trump And Reagan

Donald Trump has made his ambitions plain. He wants to go down in history as the greatest American president.

To realise that vision, he is taking cues from one of the most iconic Republican leaders of the modern era – Ronald Reagan.

Like Reagan, Trump is embracing a revivalist strategy focused on tax reductions, a strong military, and trade tariffs to boost domestic industry.

While the surface comparisons are tempting, the context, economic realities, and global environment diverge significantly.

A Common Tool With Different Goals

Ronald Reagan wielded tariffs with care. In the 1980s, his administration pushed Japan to impose voluntary export restraints (VERs), a form of negotiated limits on products like cars and steel.

These weren’t intended as permanent barriers, but rather as bargaining chips to help American firms gain better access to overseas markets.

Trump’s approach has been far more sweeping. In his first term, he engaged in trade battles with China, the EU, Mexico, and Canada. His latest proposals go further still.

For his 2025 campaign, Trump floated a ‘universal baseline tariff’ of 10% on all imports, which has since evolved into a layered system. The default now applies a 10% levy across the board.

Tariffs aimed at China are as high as 60%. But in most cases, they hover around 30%, with steeper rates directed at sectors like steel, semiconductors, and EVs.

Additional duties have been tacked on to specific goods and trading partners, such as 25% on cars, 50% on metals, and tariffs ranging from 11% to 50% for imports from Canada, Mexico, and the EU.

Unlike Reagan, Trump is not using tariffs as temporary pressure points. For him, they represent a long-term pillar of his economic strategy. It’s a far more entrenched policy shift.

Contrasting Economic Backdrops

Reagan entered office during a time of significant inflation of around 11%. The Federal Reserve, led by Paul Volcker, was determined to rein it in.

The result was eye-watering interest rates that peaked above 20%, pushing the economy into a deep recession in 1982.

That short-term pain laid the foundation for years of falling inflation, declining interest rates, and robust growth through the rest of Reagan’s presidency.

The Reagan administration also had more fiscal flexibility. With debt at roughly 30–40% of GDP, there was room to cut taxes and boost defence spending without pushing fiscal limits.

On the global front, economic integration was in its infancy. America still had a solid industrial core, and Japan, not China, was its main economic rival.

In contrast, Trump would return to office under very different circumstances. Debt levels are now above 120% of GDP, severely limiting fiscal headroom.

Interest rates remain elevated due to lingering inflation concerns, despite significant rate hikes by the Fed. Core inflation remains stubbornly above the 2% target.

Global supply chains are tightly interwoven, and the US is heavily reliant on imports from many of the countries targeted by Trump’s tariffs. Decades of outsourcing have weakened the domestic manufacturing base.

Meanwhile, Trump faces a fractured geopolitical backdrop: an emboldened China, a protectionist Europe, and an increasingly polarised domestic political scene, with little bipartisan unity on trade or fiscal matters.

Reagan caught a favourable economic cycle after a short downturn. Trump would be walking into stormy conditions of fiscal stress, high rates, global competition, and an industrial ecosystem that can’t be easily rebuilt.

Reagan’s Results: A Mixed Scorecard

History largely views Reagan’s economic stewardship favourably. After the deep recession of 1981–82, GDP growth rebounded strongly, averaging over 4% annually between 1983 and 1989.

Unemployment fell from a peak near 11% to around 5% by the end of his presidency. Inflation dropped, strengthening consumer purchasing power.

Markets also boomed. The S&P 500 rose beyond 250% during Reagan’s tenure, boosting investor sentiment.

However, that success came with costs. National debt soared from roughly $900 billion to $2.7 trillion, triggering long-term deficit concerns.

Inequality also widened. Wealth gains largely flowed to the top, fuelling criticism of Reagan’s ‘trickle-down’ policies.

Importantly, Reagan’s tariffs were targeted and temporary. They were lifted once objectives were achieved, not to become a permanent fixture of American economic policy.

Can Trump Repeat The Feat?

Trump’s blend of sweeping tax cuts and large-scale tariffs poses far greater risks today.

It may deliver a short-term boost in business confidence, but structural hurdles could quickly undermine any progress.

One concern is the reaction from bond markets. Piling tax cuts on top of already bloated deficits could spook investors, pushing Treasury yields higher.

This would negate the stimulative effect of tax policy, especially in sectors sensitive to borrowing costs, like housing and tech.

There’s also inflation to consider. Broad tariffs would likely raise costs for both producers and consumers at a time when the Fed is still fighting price pressures.

If inflation accelerates, the Fed might delay interest rate cuts or even resume tightening, putting further strain on growth.

Today’s US economy cannot replace imports at short notice. Rebuilding local capacity would take years. In the near term, tariffs may only serve to drive up prices and slow output.

Internationally, the stakes are even higher. The US now faces scepticism from allies, growing competition from China, and a more fragmented global order.

This is a far cry from the Cold War-era unity that Reagan could rely on.

For Trump to succeed, he would need to bolster fiscal credibility, craft robust industrial policies, manage inflation carefully, and reforge a coherent diplomatic strategy without alienating key trade partners.

Conclusion

Trump and Reagan both believed in America’s exceptionalism and the power of tariffs. But while Reagan operated in a period of low debt, falling inflation, and strong industrial capacity, Trump faces a vastly more fragile landscape.

Reagan delivered real growth and renewed confidence, though not without fuelling inequality and long-term debt.

For Trump, the path forward is steeper. If he hopes to equal or surpass Reagan’s legacy, he must show that aggressive tariffs and deep tax cuts can foster lasting prosperity without destabilising markets, fuelling inflation, or isolating America on the world stage.

Being bold is one thing. In today’s world, only disciplined policy, sound economics, and smart diplomacy will separate rhetoric from real results.

Notable USD/JPY FX option expiry at 148.00 may impact price action and trading focus

Impact Of Large Option Expiries

Large option expiries can affect short-term price movements, often keeping the currency pair close to a specific level. Even though the 148.00 level has passed, traders should keep an eye on other significant expiries, like the recent interest around the 157.50 and 158.00 levels. These can pull prices toward them, especially when there’s no major economic data released. The market is also keeping watch on the differences between the Federal Reserve’s and the Bank of Japan’s policies. Recent US inflation data, like the core Personal Consumption Expenditures (PCE) index dropping to 2.6% annually, suggests the Fed could lower rates later this year. However, comments from leaders like Chairman Jerome Powell stress a focus on data, adding some uncertainty. This situation is very different in Japan, where officials are worried about the yen’s weakness. We should be particularly alert for intervention, especially as USD/JPY nears the 158 level. This area prompted significant yen-buying by authorities in late April and May 2024. Statements from Finance Minister Shunichi Suzuki and Governor Kazuo Ueda indicate that they may not tolerate further depreciation.Trader Caution And Strategy

Given these circumstances, traders should be careful about driving the pair higher, as there is a notable risk of sudden drops due to official actions. Selling volatility through options might seem attractive because of the pinning effect of expiries, but holding long put options could serve as a good protection against intervention. This market requires a strategy that prepares for both calm periods and sudden price changes. Create your live VT Markets account and start trading now.VT MARKETS CHAMPIONS GROWTH IN ASIA THROUGH PARTNERSHIP WITH NEWCASTLE UNITED AS CSR INITIATIVES ARE LAUNCHED

July 28, 2025 , Sydney, Australia – VT Markets is using the ‘power of football’ to make a positive impact in communities across Asia, supported by a partnership with Premier League club Newcastle United.

Celebrating its 10th anniversary, VT Markets committed to donating 1,000 Newcastle United branded footballs to schools across Southeast Asia. The initiative aims to deepen the brand’s presence in Asia while creating opportunities for future generations to enjoy the sport.

Additionally, VT Markets proudly donated £20,000 to the Newcastle United Foundation, commemorating the club’s Carabao Cup victory and return to the UEFA Champions League. This contribution celebrates the club’s incredible achievement while supporting its official charity partner’s mission to harness the unifying power of football to connect, motivate, and inspire people through community, education, health, and sports programmes.

VT Markets’ Corporate Social Responsibility initiatives have been designed to champion growth through strategic partnerships and investments, with the aim of expanding the brand’s footprint in Asia, while helping to nurture economic development in the region. By driving growth through impactful collaborations, VT Markets is not only deepening its regional presence but also helping to build a stronger, more resilient future for these communities. With plans already underway to bring similar initiatives to Latin America, the brand is looking to replicate this positive impact across even more global markets.

As Newcastle United’s Official Financial Trading Partner, first-team players including Sandro Tonali, Jacob Murphy, Dan Burn, and William Osula, kicked off the initiatives during an exclusive Meet and Greet session hosted by VT Markets. Also in attendance was club legend Shola Ameobi, who brought his trademark charisma to connect with fans at the event. The Magpies were based in Singapore ahead of their first fixture in the nation since 1996, taking on fellow Premier League side Arsenal as part of the Singapore Festival of Football.

Speaking as the CSR initiatives were launched at an exclusive client engagement event in Singapore, hosted by VT Markets, Newcastle United player and Newcastle United Foundation ambassador Dan Burn shared: “Our fans are the soul of this club, wherever we go in the world. The support we’ve felt from everyone in Singapore has been unbelievable and that’s a big reason why projects like this mean so much.

“As players, football has helped to transform our lives so it’s really special to see VT Markets use their position to support young people and give back to these amazing communities – both in Newcastle and across Asia. We see the fantastic work that Newcastle United Foundation do back home and this donation will make a great contribution to changing their lives of many people in our community.”

VT Markets recently marked a thrilling debut year as Official Financial Trading Partner of Newcastle United by visiting St. James’ Park for the final match of the 2024/25 Premier League season. A history-making campaign saw Eddie Howe’s side win the club’s first domestic trophy in 70 years, which was quickly followed up with qualification for the UEFA Champions League.

This year also coincides with a significant milestone for VT Markets, celebrating a decade of innovation in the global financial markets. Over the past 10 years, the company has driven growth through collaborations, expanding its presence and making a lasting impact within the industry by helping to build a stronger, more resilient future.

“At VT Markets, we believe that true growth goes beyond numbers. Through our CSR initiatives, we aim to inspire, empower, and contribute meaningfully to the region’s development, laying the foundation for long-term opportunity and success. Our partnership with Newcastle United is about driving positive change both on and off the field, and we look forward to deepening our impact as we continue this exciting journey in Asia together,” Dandelyn Koh, Global Brand and PR Lead at VT Markets shared.

As Newcastle United prepare for a return to the UEFA Champions League, VT Markets remains a steadfast partner, supporting ambitions on the pitch while helping to drive positive social change off the pitch. The event in Singapore served as an opportunity to highlight shared values and the vision of both organisations, centred around growth, community, and giving back.

For media enquiries and sponsorship opportunities, please email [email protected], or contact:

Dandelyn Koh

Global Brand & PR Lead

Brenda Wong

Assistant Manager, Global PR & Communications