The USD remains weak, but Japanese data and political changes may affect future currency movements.

European stock indices fall as traders await trade developments and economic news

Stability In US Futures

US futures, in contrast, remained steadier, rising by about 0.1%. European stocks are especially influenced by the pending US-EU trade deal, which is not yet finalized as the weekend approaches. The overall drop in European indices signals increasing investor anxiety. This fear is reflected in volatility measures like Germany’s VDAX-NEW index, which has risen over 15% in the last month to above 17. Thus, we believe it is wise to prepare for more market fluctuations. Low’s comments about the German automaker’s issues highlight a broader weakness in the sector, which is highly sensitive to trade policies. Recent data from the European Automobile Manufacturers’ Association shows a 2.6% drop in EU car registrations over the last month, reinforcing this concern. We are considering buying put options on auto-focused ETFs to profit from potential further declines due to the mentioned tariff situation.Weakness In French Luxury Sector

The reported weakness in the French luxury giant is another important signal, as this sector often reflects global consumer confidence. Recent analyst reports raise concerns about declining demand from Chinese consumers, who represent about 20% of the European luxury market, leading us to be cautious. This scenario makes protective puts on major consumer discretionary stocks an appealing hedging strategy. Given the uncertainty about the US-EU trade deal, we expect continued market volatility. Past trade disputes, like those in 2018 with the former US president, caused the Euro Stoxx 50 Volatility Index (VSTOXX) to rise above 20. We are considering long positions in VSTOXX futures or call options as a hedge against potential breakdowns in negotiations. Create your live VT Markets account and start trading now.In July, French consumer confidence rose to 89, and savings intentions hit a record high.

Analysis Of Consumer Confidence

The small increase in consumer confidence is less significant than it seems. The main concern is that French household confidence remains low, which can hinder economic growth. We should remain cautious in the upcoming weeks. The high savings intentions are the most important takeaway. This suggests people are postponing spending, which is supported by recent Eurostat data showing that the French household savings rate is around 17%. We recommend considering put options on consumer discretionary stocks, particularly in the luxury sector. The decrease in unemployment worries adds some complexity to the situation, so we can’t be entirely negative. The mix of low consumer confidence and a slightly improved job outlook creates uncertainty, often leading to higher option premiums. We can take advantage of this by exploring strategies that sell volatility, especially since the CAC 40 index might face challenges in finding clear direction after its recent performance.Economic Sentiment And Market Implications

This situation resembles the aftermath of the 2011 sovereign debt crisis, when confidence remained low for a long time despite policy efforts. During that period, markets experienced extended periods of stagnation before a clear trend developed. History tells us that any recovery in spending is likely to be gradual rather than sudden. Create your live VT Markets account and start trading now.Today’s events appear uneventful, with only minor releases expected from Germany and the US.

Upcoming Economic Events

Next week looks busy with key releases, including the Non-Farm Payrolls (NFP) report and a tariffs deadline on Friday. There’s growing excitement about potential trade deals throughout the week. We view this calm period as a chance to prepare for upcoming market changes. The CBOE Volatility Index, or VIX, is currently below 15, which is historically low and suggests that the market is feeling secure. This may be a good time to buy options contracts for protection or speculation before the big events hit. The upcoming employment data is a key focus. Economists predict around 185,000 new jobs will be created. A significant difference from this number could shake up the markets and change expectations for what the central bank will do next. We’ve seen in the past that a surprise of 75,000 jobs or more can lead to a 1-2% move in index futures within the first hour after the release.Trade Policy Considerations

We should also prepare for possible outcomes related to trade policy. Any news, whether good or bad, about tariffs can lead to sharp price changes, especially during weekends. A neutral options strategy like a straddle might be a good way to benefit from a big price swing without needing to guess the outcome of the negotiations. Given the quiet before these events, it’s smart to take time to assess risk. Reducing exposure or buying protective put options on broader market ETFs can help shield a portfolio from negative surprises. This is like buying cheap insurance before a week filled with uncertainty. Create your live VT Markets account and start trading now.The BoJ expects a possible rate hike due to trade deals and economic data analysis.

Market Reactions to Rate Hike Speculation

Market reactions indicate that expectations for tightening have increased to 22 basis points by the end of the year, up from 14 basis points before the trade deal. The Japanese yen (JPY) could strengthen further if the US data weakens, suggesting more rate cuts by the Federal Reserve. Conversely, strong data from Japan could hint at more rate hikes by the BoJ. Political changes and more fiscal support may lead the market to expect even more rate hikes. It’s crucial to monitor both local and international data to understand these economic shifts. According to Dellamotta’s report, the market already reflects a possible rate change by the central bank. Traders should focus on the specific data that could trigger this change rather than if it will happen. The current pricing for 22 basis points of tightening shows that traders have positioned themselves for this adjustment. We believe that the next big opportunity will come from unexpected economic news rather than the anticipated announcement itself. Japan’s core inflation reached 2.5% in April, exceeding the BoJ’s 2% target. Any further gains in wages or prices could lead the market to expect even more. This makes buying call options on the yen an appealing strategy to protect against a quicker policy change.US Federal Reserve and Implications for Traders

On the US side, recent data such as the April Consumer Price Index (CPI), which dropped to 3.4%, has been mixed. This uncertainty prevents the Federal Reserve from making aggressive rate cuts, creating a holding pattern that tends to reduce volatility and lower options prices. We think this is a great time to consider strategies that could benefit from a sudden, large move, like long straddles on the USD/JPY pair. Historically, the Federal Reserve hasn’t raised rates since 2007, meaning most active traders lack experience in this kind of environment. This inexperience could lead to an overreaction when changes finally do happen. Thus, owning volatility could be smarter than betting on a specific direction. The political side is also something we’re closely watching. Any announcement about a significant fiscal stimulus package would likely encourage policymakers to make more decisive moves on rates. This would almost definitely result in a sharp increase in the currency’s value. Create your live VT Markets account and start trading now.ECB officials recommend keeping rates steady due to economic potential and ongoing monetary effects.

Potential for Economic Growth

There is untapped potential for economic growth, which affects the decision on interest rate changes. The chance of another rate increase is 50 percent, as current monetary policies and fiscal measures seem to support growth instead of decline. Comments from Kazāks suggest that the derivatives market might be underestimating the risk of higher rates lasting longer. It’s wise to shift focus from expecting aggressive rate cuts. Strategies that profit in a stable or slightly hawkish interest rate environment could be beneficial in the upcoming weeks. Recent data backs this careful approach. Eurozone inflation unexpectedly rose to 2.6% in May 2024, with persistent inflation in services being a major worry for policymakers. We believe this situation justifies keeping rates as they are, as inflation risks seem more significant now than before. Moreover, economic activity appears to be improving. The HCOB Flash Eurozone Composite PMI Output Index reached a 12-month high of 52.3, indicating a stronger economic bloc. This improvement lessens the need for more monetary support and suggests there is still potential for growth.Implications for Traders

For traders, betting on quick rate cuts is becoming a riskier move. It may be smart to sell volatility in interest rate futures like the EURIBOR, since a stable policy means less market movement. Money markets have already adjusted, now predicting fewer than two full cuts of 25 basis points by the year’s end. The central bank is also paying attention to wage growth, which rose to 4.7% in the first quarter. These domestic inflation pressures are why officials are cautious about promising rate cuts. The chance of the next move being a hike, rather than a cut, is a realistic scenario to prepare for. Historically, the central bank has made mistakes by acting too quickly, like in 2011 when they raised rates too soon. They are keen not to repeat that error, which supports the current strategy of waiting and evaluating data. This historical insight reinforces our belief that traders should brace for a long pause. Create your live VT Markets account and start trading now.Eurostoxx futures decline as early European trading reflects investor caution over trade deal uncertainties

Mixed Wall Street Results

Wall Street had mixed performances, with the Dow finishing 0.7% lower while the Nasdaq gained 0.2%. US futures rose by 0.2% today, but the effect on European stocks is noticeable before the markets open. The current decline in European futures shows growing caution. This trend isn’t only a response to Wall Street but also reflects uncertainty at home, especially with the approaching trade deadline. It seems wise to adopt a defensive approach in the coming weeks. Volatility is increasing, and options markets are reflecting this change. For example, the Euro Stoxx 50 Volatility Index (V2X), which measures fear in Europe, spiked over 17% in a week after a snap election was announced in France. This indicates that traders are willing to pay more for protection as potential political instability looms. In this context, buying protective puts on indices like the DAX and CAC 40 makes sense. This strategy helps limit potential losses to the cost of the option. It’s a sensible way to manage risk in these uncertain market conditions.Historical Market Patterns

This situation resembles the market environment in 2016 around the Brexit vote, when political news heavily influenced market movements for weeks. During that time, implied volatility was high, making it costly yet essential to hold protective positions in portfolios. We expect a similar pattern of volatility until political and trade issues clear up. The mixed results among industrial and technology stocks in the US indicate important differences that can be capitalized on. This implies that not all sectors will react the same way to current pressures, presenting opportunities for pairs trades—going long on a strong sector while shorting a weaker one. Create your live VT Markets account and start trading now.UK retail sales increased, showing recovery despite missing some growth forecasts this month.

Factors Driving Sales

The increase in sales was largely due to food stores, with good weather helping boost sales. Online sales, especially from non-store retailers, rose by 1.7%, marking the biggest rise since February 2022. Retailers pointed to promotions and good weather as reasons for this boost. Overall, the data reflects a recovery from a weak performance in May. However, these numbers may not influence the Bank of England’s current outlook. The latest retail figures showed a recovery from a poor May but missed analyst expectations. This suggests that while consumer spending is picking up, it isn’t strong enough to prompt any policy changes from the Bank of England. We agree with Low’s view that this report is unlikely to alter the central bank’s stance. With UK core inflation steady at around 2.3% for the past few months, this mild consumer activity offers no reason for a more aggressive approach. The Office for National Statistics confirmed that GDP growth was flat last quarter, highlighting a delicate economy. Therefore, we expect policymakers to keep interest rates steady through the summer.Market Implications

This situation reminds us of the prolonged economic stagnation in late 2023 and early 2024 when mixed data led to a long pause in policy changes. During that time, traders anticipating significant shifts were often let down by the central bank’s steady approach. History shows that without a major economic shock, it’s likely that they will wait for clearer data. For those trading short-term interest rate derivatives, this suggests lower volatility. We believe that instruments linked to the SONIA rate will likely trade in a narrower range compared to previous months. This environment might benefit strategies that capitalize on minimal price movement and time decay. The pound sterling is also unlikely to find strong support for a sustained rally based on this domestic report. Without the prospect of higher interest rates to attract investment, the currency may struggle, especially as the US Federal Reserve maintains a cautious approach. We would consider options strategies that benefit from range-bound price movements on currency pairs like GBP/USD in the near term. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – Jul 25 ,2025

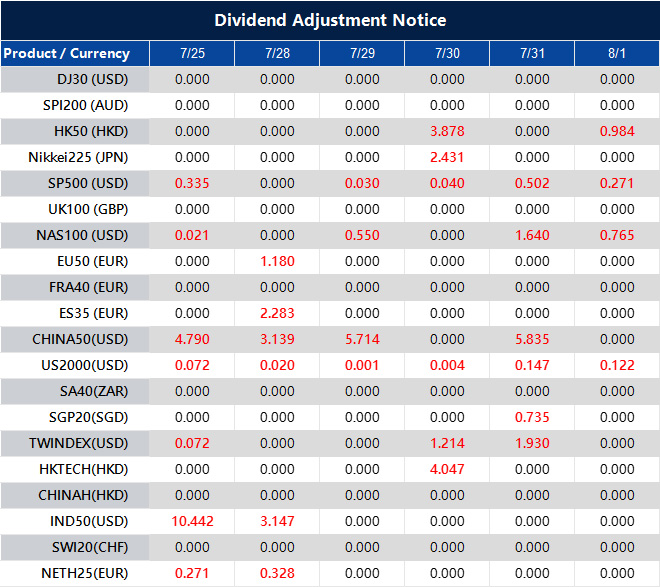

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].