Eurostoxx futures decline as early European trading reflects investor caution over trade deal uncertainties

UK retail sales increased, showing recovery despite missing some growth forecasts this month.

Factors Driving Sales

The increase in sales was largely due to food stores, with good weather helping boost sales. Online sales, especially from non-store retailers, rose by 1.7%, marking the biggest rise since February 2022. Retailers pointed to promotions and good weather as reasons for this boost. Overall, the data reflects a recovery from a weak performance in May. However, these numbers may not influence the Bank of England’s current outlook. The latest retail figures showed a recovery from a poor May but missed analyst expectations. This suggests that while consumer spending is picking up, it isn’t strong enough to prompt any policy changes from the Bank of England. We agree with Low’s view that this report is unlikely to alter the central bank’s stance. With UK core inflation steady at around 2.3% for the past few months, this mild consumer activity offers no reason for a more aggressive approach. The Office for National Statistics confirmed that GDP growth was flat last quarter, highlighting a delicate economy. Therefore, we expect policymakers to keep interest rates steady through the summer.Market Implications

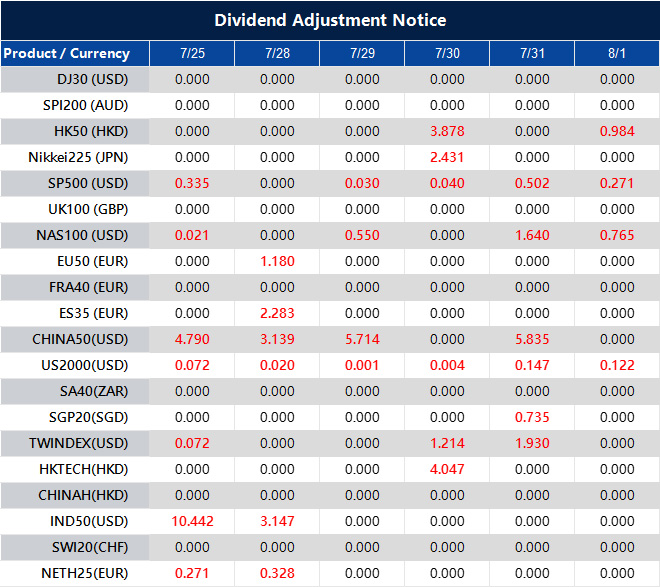

This situation reminds us of the prolonged economic stagnation in late 2023 and early 2024 when mixed data led to a long pause in policy changes. During that time, traders anticipating significant shifts were often let down by the central bank’s steady approach. History shows that without a major economic shock, it’s likely that they will wait for clearer data. For those trading short-term interest rate derivatives, this suggests lower volatility. We believe that instruments linked to the SONIA rate will likely trade in a narrower range compared to previous months. This environment might benefit strategies that capitalize on minimal price movement and time decay. The pound sterling is also unlikely to find strong support for a sustained rally based on this domestic report. Without the prospect of higher interest rates to attract investment, the currency may struggle, especially as the US Federal Reserve maintains a cautious approach. We would consider options strategies that benefit from range-bound price movements on currency pairs like GBP/USD in the near term. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – Jul 25 ,2025

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].