UK construction PMI for August rises to 45.5, up from July’s five-year low

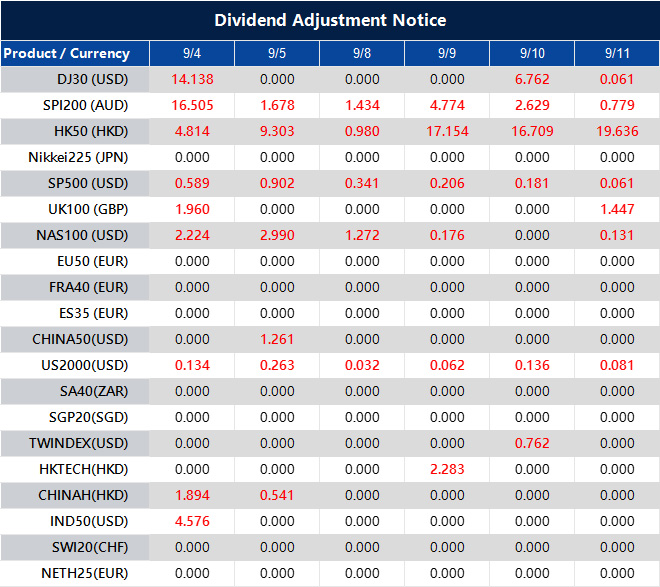

Dividend Adjustment Notice – Sep 04 ,2025

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].

Oil Eases As OPEC+ Supply Talk Shakes Confidence

Oil prices slipped again in early Thursday trading, with concerns over potential extra supply weighing on sentiment. West Texas Intermediate fell 1.0% to $63.32 a barrel, while Brent crude shed 0.9% to $66.96, erasing the prior day’s advance.

The weakness followed a Reuters report hinting that OPEC+ may discuss loosening its production limits at the next policy meeting.

No firm decision has been taken, but the prospect of more barrels hitting the market was enough to unsettle bullish traders.

Caution is high ahead of the US Energy Information Administration’s (EIA) inventory data later today. Investors are keen to see whether demand from the world’s largest consumer can offset last week’s unexpected stockpile increase.

Technical Analysis

Crude oil (CL-OIL) last traded at $63.26, down 0.75% on the session, with the market stuck in a consolidation phase after a volatile year. Prices tumbled to $55.11 in April before rebounding strongly to $77.90 in July.

Since then, the market has been moving sideways. The 30-day moving average has flattened, while shorter-term averages (5 and 10) are struggling to stay above it, a sign of hesitation.

The MACD indicator shows a modest bullish cross, but remains close to neutral, pointing to limited momentum. Immediate support is found at $60, with a firmer floor near $55. Resistance lies at $67, and higher up at $72.

A move above $67 could revive upward momentum, whereas a break below $60 would raise the risk of revisiting this year’s lows.

In the short run, oil is likely to continue swinging within its current band, with traders keeping a close eye on OPEC+ policy direction, US stock data, and wider demand cues.

Cautious Forecast

Unless OPEC+ walks back supply speculation, crude may remain under pressure into the weekend. A bearish EIA print could drive WTI toward the $60 handle, while any dovish surprise may offer brief reprieve. All eyes on Vienna and on barrels.

Create your live VT Markets account and start trading now.

IfW forecasts modest 0.1% economic growth for Germany this year, facing challenges ahead

Minimal Growth Expected

The Kiel Institute for the World Economy (IfW) predicts that the German economy will grow only 0.1% in 2025 after two years of decline. Better business expectations and increased government spending could help boost the economy, but US tariffs are a significant challenge in the short term. Looking ahead, IfW forecasts a slow recovery, estimating growth of 1.3% in 2026 and 1.2% in 2027. The budget deficit is also likely to widen, increasing from 2% of GDP in 2024 to about 3.5% by 2027. With growth projected at just 0.1% this year, we see limited potential for German stocks. This follows two consecutive years of economic decline, as shown by July 2025’s industrial production figures, which reported a 0.5% drop from the previous month. Therefore, we might consider shorting DAX index futures or buying put options on the index soon. US tariffs pose a direct threat to Germany’s export-driven industries, especially the automotive sector. We remember how trade disputes affected companies like Volkswagen and BMW from 2018 to 2020, and this new risk could similarly impact stock performance. It would be wise to hedge our investments or take bearish positions in these export-focused companies.Economic Pressure and Strategies

The expected rise in the budget deficit, potentially hitting 3.5% of GDP by 2027, puts pressure on the Euro. Combined with the European Central Bank maintaining interest rates at its August 2025 meeting amidst weak growth, there is a bearish outlook for the currency. We recommend shorting the EUR/USD pair as a suitable strategy for the near term. While there are some signs of improved business expectations, these positives seem fragile. If the market rallies due to this sentiment, it may provide better chances to enter our bearish positions. We anticipate continued volatility, as indicated by the elevated VDAX-NEW index, as the market processes this mixed information. With only a slight recovery expected for 2026, our focus should be on short-term derivative contracts. We should target options expiring in the fourth quarter of 2025 to make the most of the current stagnation. Longer-term bearish positions appear riskier given the possibility of a slow, eventual recovery. Create your live VT Markets account and start trading now.The German construction sector faces a moderate decline, with a decrease in residential activity and a slight improvement in civil engineering.

Future Outlook

Many are feeling uncertain about the future as the outlook index drops. This is mainly due to high long-term interest rates and challenges for the new government. While input price inflation has lessened, it still poses issues for construction. There are some signs of improvement, such as faster supplier delivery times—the best they’ve been since February. Subcontractor availability has increased, although the pace is slow, and their prices are rising more than before. The construction environment remains tough, and any recovery is expected to be gradual. The German construction PMI is at 46.0, clearly indicating weakness in this key area of Europe’s largest economy. This trend isn’t new; it mirrors what we saw during the economic downturn in 2023 when rising interest rates first impacted growth. The data strengthens concerns about German domestic demand in the coming weeks. With a significant fall in new orders for residential and commercial buildings, it may be wise to consider buying put options on major German construction and real estate firms. Companies like Vonovia and Heidelberg Materials, which are sensitive to the housing market, are good candidates for bearish bets. Recently, Heidelberg Materials lowered its Q3 revenue forecast due to a decline in residential project orders, aligning with the PMI data. A simple strategy would be to buy out-of-the-money puts on the DAX index, expiring in October or November 2025, to capitalize on a wider market decline. Weakness in construction often signals broader economic issues, and we expect German GDP for Q3 2025 to reflect this slowdown. With current market volatility low, options are an affordable way to prepare for a potential downturn.Interest Rates and Economic Impact

High interest rates are contributing to the situation, with the European Central Bank keeping its main rate at 3.5% in its most recent meeting. This indicates that tackling inflation is still a top priority. The latest German inflation data for August 2025 is 3.1%, which is above the 2% target, meaning borrowing costs for construction projects are unlikely to decrease soon. This ongoing strain makes recovery in the sector seem remote for this year. On the plus side, civil engineering is benefiting from government spending on infrastructure. This creates an opportunity for experienced traders to engage in a pair trade. They can go long on firms heavily involved in public works projects while shorting a residential homebuilder, aiming to profit from the differing performances of these sectors. The ongoing economic weakness in Germany is also putting pressure on the euro. This could be a good time to short the EUR/USD currency pair using futures contracts or to buy put options on Euro-focused ETFs. With the US economy showing more strength, we expect the dollar to continue gaining against the euro through the fourth quarter. Create your live VT Markets account and start trading now.Notification of Server Upgrade – Sep 04 ,2025

Dear Client,

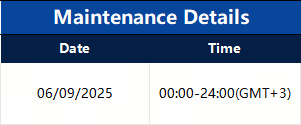

As part of our commitment to provide the most reliable service to our clients, there will be maintenance this weekend.

Maintenance Details:

Please note that the following aspects might be affected during the maintenance:

1. The price quote and trading management will be temporarily disabled during the maintenance. You will not be able to open new positions, close open positions, or make any adjustments to the trades.

2. There might be a gap between the original price and the price after maintenance. The gaps between Pending Orders, Stop Loss, and Take Profit will be filled at the market price once the maintenance is completed. It is suggested that you manage the account properly.

3. During the maintenance period, VT Markets APP will not be available. It is recommended that you avoid using it during the maintenance.

4. During the maintenance hours, the Client portal will be unavailable, including managing trades, Deposit/Withdrawal and all the other functions will be limited.

The above data is for reference only. Please refer to the MT4/MT5 software for the specific maintenance completion and marketing opening time.

Thank you for your patience and understanding about this important initiative.

If you’d like more information, please don’t hesitate to contact [email protected].