Central banks are likely to make different interest rate changes at their meetings, with varying probabilities.

The EU is considering countermeasures to US tariffs while pursuing a negotiated agreement.

Meeting In Berlin

Later this week, German Chancellor Merz and French President Macron will meet in Berlin. They plan to continue their talks about tariffs after discussing them over the weekend. The rising discussions of countermeasures may lead to more market volatility. The EURO STOXX 50 Volatility Index (V2X) has been trading below 15, making options that benefit from increased uncertainty seem appealing. This situation offers a good chance to buy protection or bet on market fluctuations before the deadline. Looking back at the US-China trade tensions from 2018-2019, we observed the VIX index jump over 40% within days after tariff increases. If a deal isn’t reached by the August 1 deadline, European markets could react similarly. We expect that breakdowns in negotiations will hit export-heavy indices like Germany’s DAX particularly hard.Opportunities In Currency Derivatives

Given the potential size of the retaliation, we are focusing on protective put options for European car and luxury goods sectors. These industries often face challenges in trade disputes and saw their stocks drop by 5-10% during previous tariff threats. The upcoming meeting between Merz and Macron will be crucial in determining how coordinated and forceful the response may be. The uncertainty surrounding a deal also opens doors in currency derivatives, especially concerning the EUR/USD pair. If tensions escalate, the Euro could weaken, as a trade dispute may harm the EU’s growth outlook more than the US’s. We see value in buying EUR/USD put options with expiration dates after the August deadline to protect against negative outcomes. Create your live VT Markets account and start trading now.Bitcoin stabilizes above key levels as bullish momentum fades amidst positive economic signals and uncertainties.

Traders monitor GBPUSD as it consolidates above support, expecting a breakout due to economic data releases.

Market Trends And Forecast

Traders are closely watching economic data and the upcoming tariff deadline, which may cause market disruptions if it is not postponed. On the one-hour chart, there is a potential trading range between the 1.3368 support and the 1.3480 resistance. A breakout above this range could lead to buyers aiming for a rise to the 1.36 level, while sellers might target a drop to the 1.32 level. With mixed economic signals, we believe GBPUSD will remain stable in the near term. The recent US inflation rate of 3.3% was lower than expected but did not create lasting weakness for the dollar. This supports our view that derivative markets, which see over a 60% chance of a Federal Reserve rate cut by September, are already prepared for a shift towards a more dovish stance. On the UK side, the situation is just as complicated. Although services inflation remains high at 5.9%, the unemployment rate recently rose to 4.3%, giving the central bank some leeway to ease policies. As a result, the market is pricing in a strong chance of a rate cut by August, which puts a cap on the pound’s strength.Trading Strategies And Market Outlook

In the coming weeks, we plan to sell volatility within the 1.3368 to 1.3480 range. Strategies like selling strangles will allow us to collect premiums while the market processes the contrasting economic data from both countries. This strategy benefits from the expected sideways price movement until clearer directions for policy emerge. A breakout upwards towards the 1.36 level will likely need a significant delay in the Bank of England’s rate-cutting cycle. If upcoming UK wage or inflation data comes in unexpectedly high, we would switch to buying call options to capture that upward movement, signaling that the UK’s rate edge over the US may last longer than currently thought. On the other hand, a break below the key support level is quite possible, especially if the UK cuts rates in August while the US keeps its rates steady. Historically, when one country eases its monetary policy while another holds firm, it tends to weaken the currency of the nation that is easing. In this scenario, we would prefer buying put options targeting a fall to the 1.32 level. Traders should also keep an eye on rising trade tensions between the US and China. Any significant retaliation from China against new tariffs from Washington could lead to a global flight to safety, benefiting the US dollar and potentially pushing the currency pair below its support level, regardless of domestic data. Create your live VT Markets account and start trading now.European equities show hesitation as focus shifts to US-EU trade negotiations.

Growing Trade Tensions

The EU plans to impose retaliatory tariffs on US goods totaling around €72 billion. This includes €11 billion on aircraft, €9.4 billion on machinery, €8 billion on cars, and €1.2 billion on alcohol. Both sides will meet again for talks on August 1. Increased trade tensions could harm local stock performance. While the ECB is expected to make a policy decision later this week, it will likely keep its current stance through the summer. Therefore, the ECB’s meeting will likely be less significant compared to the pressing trade negotiations, which will probably drive market sentiment more. According to analysis from Low, the biggest risk for European markets is a failure in the US-EU trade discussions. Derivative traders should prepare for higher volatility and possible declines, especially as we near the August 1 deadline. The current market uncertainty offers a chance to position for when a clear direction becomes evident. We suggest buying put options on major European indices like the DAX and CAC 40. The Euro STOXX Volatility Index (VSTOXX) is currently low at around 14, meaning options pricing does not fully reflect the potential for fear. This makes it a good time to buy protection ahead of what could be a tense negotiation period.Impact of Trade Disputes on Stocks

Historical data indicates that trade disputes can severely impact regional stocks. For example, during the peak of the 2018 trade war, the export-driven German DAX fell over 18% in six months as tariffs were implemented. A similar negative reaction could occur if current negotiations fail. Traders should also focus on specific sectors mentioned in the proposed tariffs. Since the EU’s list includes autos, machinery, and aircraft, buying puts on leading companies in these industries can be a smart way to hedge. The recent drop in Stellantis stock demonstrates how quickly market sentiment can shift for exposed companies. The ECB’s expected inaction clarifies our outlook. With monetary policy likely on pause this summer, the focus shifts away from interest rate speculation and centers on the trade discussions. This makes the trade negotiations the key factor for market movements in the coming weeks. Create your live VT Markets account and start trading now.Week Ahead: Ethereum Gains Ground From Regulatory Tailwinds

Ethereum doesn’t appear to be waiting for the next bull market to start making moves. While Bitcoin continues to dominate the headlines and capture the spotlight in terms of price action, the real transformation is unfolding quietly in the regulatory corridors of Washington. Three significant pieces of crypto legislation are making their way through the US Congress. They may be technical and hard to digest, but collectively, they could reshape Ethereum’s role in the global financial system.

The GENIUS Act, the CLARITY Act, and the Anti-CBDC Act might not sound thrilling, but together they could place Ethereum at the heart of the next regulated crypto era. And here’s the critical point: Ethereum stands to benefit more than any other blockchain, including Bitcoin.

GENIUS Act: Not Just Clever Branding

Let’s begin with the GENIUS Act, which is all about tidying up the stablecoin ecosystem. It would mandate full reserve backing, comprehensive audits, and improved user protections. While that may seem like regulatory red tape, for Ethereum, it’s a welcome boost.

The vast majority of stablecoins, such as USDC, USDT, and PYUSD, are built on Ethereum’s ERC-20 framework. These tokens depend on Ethereum for issuance, transactions, and network support. With legal clarity, institutions can finally participate without fear of regulatory pitfalls. And when they do, they’ll almost certainly utilise Ethereum’s infrastructure.

Bitcoin, for all its strengths, lacks the smart contract capabilities to host stablecoins at scale.

CLARITY Act: Ethereum Steps Out Of The Shadows

The CLARITY Act is arguably the most significant of the three. This proposed legislation would officially designate ETH as a commodity, placing it under the jurisdiction of the Commodity Futures Trading Commission (CFTC), rather than the Securities and Exchange Commission (SEC).

This change matters. Ethereum’s legal status has remained uncertain, particularly following its transition to proof-of-stake. The SEC has long implied ETH could be classified as a security, causing unease among investors. The new law would erase that ambiguity, giving institutions the all-clear to get involved without fear of enforcement actions.

Bitcoin, for comparison, never faced this uncertainty. It has always been treated as a commodity. So while this act strengthens Bitcoin’s standing, it effectively liberates Ethereum from its regulatory limbo.

The Anti-CBDC Act: An Unexpected Win For Ethereum

The third bill, the Anti-CBDC Act, might seem unrelated at first glance. It essentially blocks the Federal Reserve from launching a central bank digital currency (CBDC), such as a digital dollar. But this is indirectly great news for Ethereum.

Why? Because it keeps the path open for private stablecoins to remain the dominant option for digital USD transactions. And since the bulk of these stablecoins reside on Ethereum, the network stands to gain further dominance.

Sure, networks like Solana, Tron, and Binance Smart Chain also support stablecoins. But Ethereum still offers the deepest liquidity, the most mature infrastructure, and the largest DeFi ecosystem by far.

Even when stablecoins bridge to other chains, their foundational layer and most significant liquidity pools tend to remain on Ethereum. Institutions also generally place greater trust in Ethereum’s decentralisation, longevity, and security. These are traits that become increasingly important in a regulated environment.

Ethereum’s Foundational Advantage

Markets are already beginning to take notice. ETH has outperformed BTC in several recent sessions, a trend that may continue as the regulatory momentum builds. That said, legislation alone doesn’t guarantee price gains. Traders will want to see actual adoption such as rising stablecoin volumes, new institutional products, or fresh innovation in decentralised finance.

And of course, these bills haven’t yet become law. Political delays, amendments, or resistance could disrupt the timeline.

Still, the groundwork is forming. Should the legislation pass, Ethereum would no longer be just a decentralised smart contract platform. It would become the regulatory backbone for US-based digital finance. It would process tokenised dollars, anchor compliant staking products, and support enterprise-grade DeFi.

This marks a sharp divergence from the traditional ETH-versus-BTC narrative. Bitcoin may remain the champion of digital gold, but Ethereum is fast becoming the infrastructure layer for everything else.

Strategically speaking, this positions ETH as an attractive candidate for medium-term accumulation. Traders focused on macro correlations should monitor stablecoin inflows, CFTC commentary, and total value locked in DeFi. If the regulatory doors swing wide open, the capital will flow in, and Ethereum will be waiting.

Market Movements Of The Week

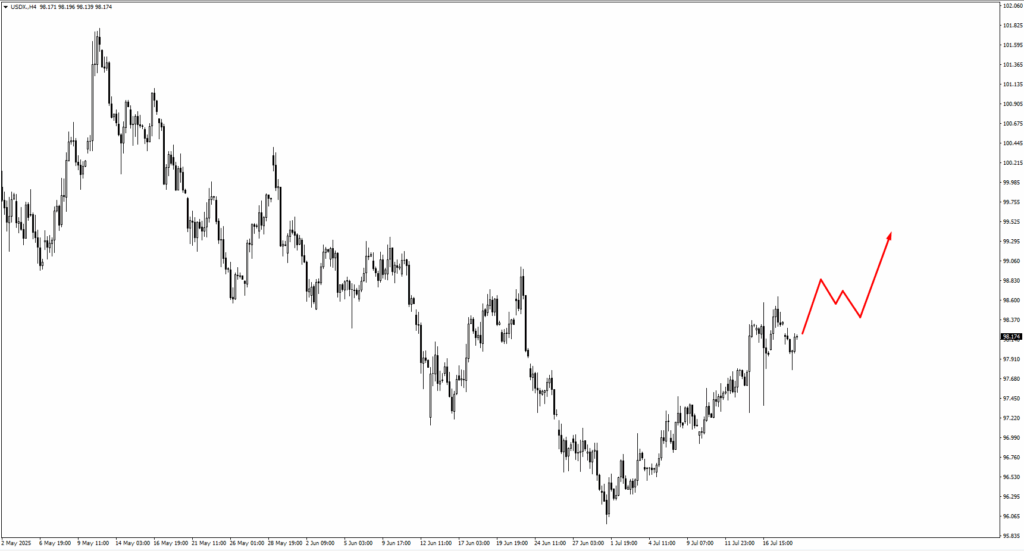

The US Dollar Index (USDX) inched upwards from its 98.50 retracement zone. Resistance at 98.75 remains active, with targets around 99.85 and 100.15 emerging if momentum persists. The dollar’s strength now seems underpinned by structure, buoyed by soft eurozone PMIs and a resilient US economy. That said, a disappointing GDP or Core PCE print next week could halt this climb. Until then, the bias remains modestly bullish.

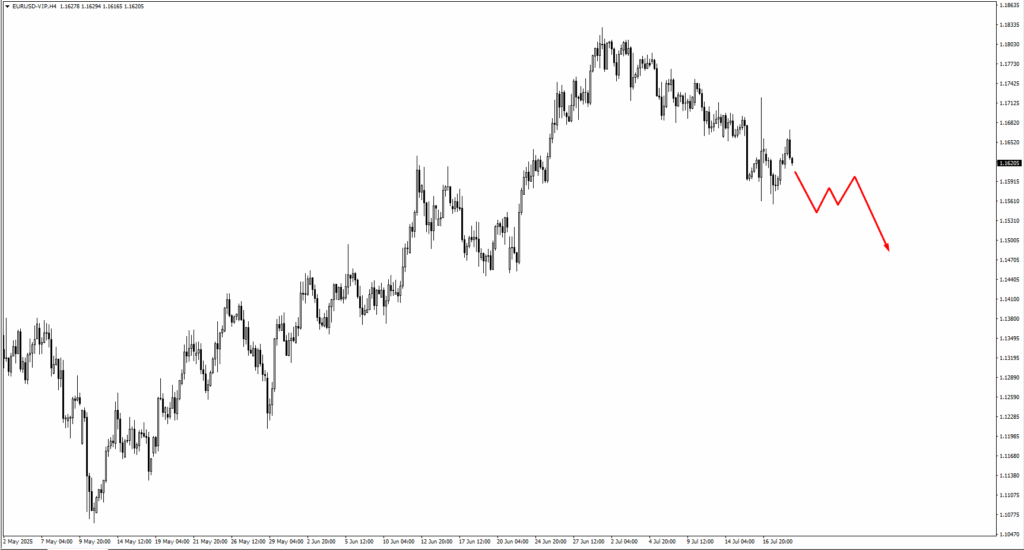

EURUSD reflected this narrative, softening toward the 1.1480 zone, a key area for bullish setups. With limited PMI optimism, euro strength looks shaky. If USD gains momentum into next week’s macro data, a clean break lower could expose the 1.14 region.

GBPUSD dropped below the 1.33645 swing low, now crawling towards the 1.3315 support. If the pair consolidates here, another leg down toward 1.3215 could follow. Traders should watch for bullish reversal patterns, but with Bailey due to speak and no major UK data releases, sterling might simply track broader dollar trends.

USDJPY edged toward 149.20, a crucial resistance point. Should this level break, bulls might aim for 149.95. However, the Bank of Japan’s upcoming policy statement will be decisive. A dovish stance could lift the pair, while any tightening hint may cause a sharp correction.

USDCHF retraced from 0.8050, yet another push toward 0.8115 remains possible. The pair appears to be waiting on a broader dollar breakout. Should USDX breach 99.85, CHF could weaken further.

AUDUSD and NZDUSD both slipped from their monitored zones, 0.6520 and 0.5985, respectively. For AUD, 0.6485 is the next key level to test. Should we see consolidation there, a deeper move lower could unfold. Likewise, NZDUSD is approaching 0.5930. These levels matter. Both currencies remain vulnerable to dollar strength and soft commodities, so risk-off sentiment or poor China data could drag them further.

USDCAD moved higher from 1.3715. If this rally continues, 1.3810 and 1.3840 are the next resistance levels to monitor for bearish setups. With CAD tethered to oil’s volatility, it’s worth watching crude as a cross-reference. A strong oil bounce could cap this pair, but weakness in energy might lift it further.

USOil pulled back, with 63.35 and 61.00 acting as the next key demand zones. If price stabilises there, bulls may step back in. But current sentiment feels tentative. Without a geopolitical spark or inventory draw, oil may drift or consolidate through the zones, rather than spike sharply.

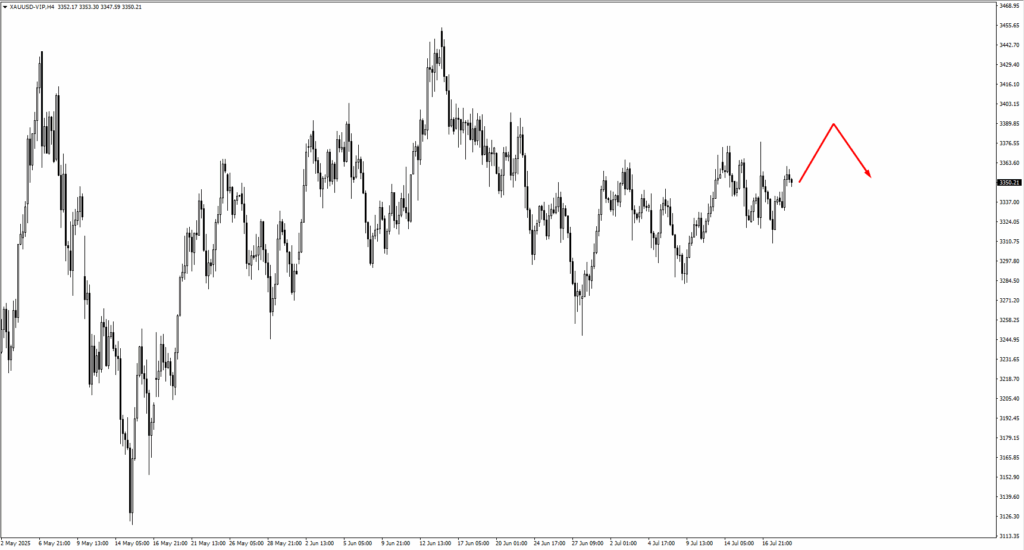

Gold tested the 3340 level and still appears to have upward momentum. If it pushes through to 3380 and 3410, sellers may re-enter. Monitor for signs of exhaustion at these levels, as momentum is still closely tied to real interest rates and the dollar.

The S&P 500 reached a new high, approaching the 6400 mark. If bullish momentum continues, 6630 is the next target. However, with earnings season beginning and the Fed on the horizon, traders may shift to a more defensive posture above 6400 unless supported by breakout volume.

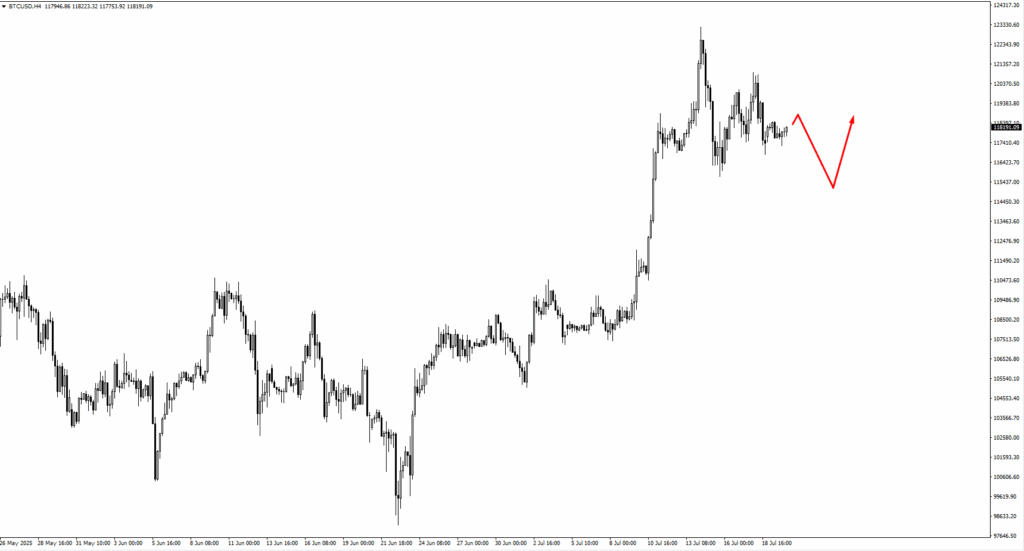

Bitcoin couldn’t hold above the 120,350 mark, failing to close strong. The pullback brings 113,345 and 111,000 into focus for potential bullish setups. If those levels show strength, short-term buyers may look for re-entry. However, ETH’s recent rejection at 6,773 and signs of outperformance are beginning to shift attention across the majors.

Natural gas continues to hold traders’ interest. If it consolidates near 3.26, bulls may eye a run at the 3.615 high. Seasonality and weather volatility remain key catalysts, so traders should stay nimble. A clean breakout above 3.615 would change the structure entirely, but only if volume confirms it.

Key Events Of The Week

On Tuesday, 22 July, all eyes will be on Bank of England Governor Andrew Bailey. With GBPUSD under pressure and drifting near 1.3315, any dovish tilt in tone could increase downside risk. No rate change is expected, but the rhetoric will be closely analysed.

Thursday, 24 July, is packed with data. RBA Governor Michele Bullock will speak while AUDUSD hovers near 0.6520. With no formal rate decision, traders will dissect every word. A cautious tone could drive AUD toward 0.6485, while hawkish comments might give it a brief lift.

Shortly after, Germany’s flash PMIs arrive. Manufacturing is forecast at 49.4, just above last month’s 49.0, with services at 50.0. These are marginal improvements, so surprises may impact the euro sharply. Weakness here could push EURUSD toward 1.1480.

The UK’s own PMI data follows closely. Manufacturing is expected at 48.1, up from 47.7, and services at 52.9, a tick above the previous 52.8. This leaves sterling in a tight spot. A miss, especially on the services side, could push GBPUSD through 1.3315 and test support at 1.3215. Traders should be watching for bullish patterns at those levels if consolidation appears.

The ECB’s main refinancing rate decision lands later in the day. No surprises are expected here—the rate is forecast to hold steady at 2.15%, unchanged from last month. But the press conference that follows could offer the bigger takeaway. Markets are anticipating one final rate cut in September to wrap up the easing cycle. Any comment that supports or challenges that outlook could inject some movement into EUR crosses.

Finally, US flash PMIs round out the session. Manufacturing is projected to dip slightly to 52.7 from 52.9, while services are expected to rise to 53.0 from 52.9. The data won’t change Fed policy on its own, but with the FOMC press conference and Core PCE around the corner next week, it could shift sentiment. If the numbers beat expectations, it may help the dollar extend gains, particularly if USDX breaks out above the 99.85 level.

Looking ahead, next week could bring heavier macro winds: US Advance GDP (30 July), CAD Overnight Rate, FOMC Press Conference, Core PCE Price Index, Japan’s Monetary Policy Statement, and US Non-Farm Employment Change (1 August). For now, though, all eyes are on Thursday, a day dense with data, tone shifts, and short-term trading opportunity.