European stock markets are climbing as many indices approach all-time highs due to improved investor sentiment.

Mixed performance of the USD observed as Japanese election influences JPY outlook amid trade negotiations and positioning

Technical Analysis

From a technical perspective, the daily chart shows USDJPY around the significant 148.30 resistance level. Buyers are aiming for a rise to 151.20, while sellers need a drop below 148.30 to push their bets down to 142.35. The 4-hour chart shows a bullish trend, indicating favorable movement for buyers. Traders on the 1-hour chart seek setups that align with this behavior. Upcoming events include the University of Michigan Consumer Sentiment survey and the Japanese elections. The consolidation near this key resistance has broken, with the pair now trading at multi-decade highs. This surge is mainly due to the growing interest rate gap between a strong US Federal Reserve and a still-dovish Bank of Japan. Derivative traders should see any dips as buying opportunities rather than signs of a trend change, driven by the appealing carry trade. The situation regarding US inflation data is still significant. Recent US CPI figures for April 2024 showed an annual rate of 3.4%, well above the central bank’s target. This increases expectations that US rates will remain high for an extended period, keeping the dollar robust against the low-yielding yen. In Japan, the scenario has shifted from speculation to action as the central bank ended its negative interest rate policy in March 2024. Yet, with their policy rate still near zero, this change was mostly symbolic and did little to narrow the yield gap with the United States. Any further rate hikes will likely be announced in advance and probably won’t be aggressive enough to change the main trend.Market Strategy

The “crowded trade” idea is more relevant than ever. Recent data from the CFTC shows that speculative net long positions in the dollar against the yen are close to historic highs. The main risk now isn’t a shift from central banks, but direct currency intervention, as seen in late April and early May 2024, when authorities likely spent over ¥9 trillion to protect their currency. Thus, traders holding long positions should brace for sudden drops caused by official actions. Given the high risk of intervention, buying out-of-the-money USD/JPY put options is a sensible way to hedge long positions. This strategy offers protection from sharp declines while still allowing for gains if the carry trade remains strong. The elevated implied volatility reflects the market’s awareness of this risk. Looking back at interventions in 2022, we saw that official actions could lead to temporary sharp reversals of 5-7% in the pair. However, the upward trend eventually resumed as the interest rate differential took charge again. This implies that while we must respect the risk of intervention, the general bullish outlook for the pair stays strong as long as the policy gap remains wide. Create your live VT Markets account and start trading now.Today’s agenda includes low-tier Eurozone data and important US housing and consumer sentiment reports.

University Of Michigan Index Expectations

The University of Michigan index is expected to increase from 60.7 to 61.5. This rise in soft data is likely to continue due to recent legislative changes and reduced uncertainty around tariffs. The survey’s inflation expectations are also noteworthy, as they have fallen from their peak in April. This decline is part of a larger economic trend. Current data does not indicate that the Federal Reserve will cut rates in July, despite varied opinions on this. There’s no evidence suggesting an imminent change in interest rates. We view the latest University of Michigan sentiment report as a significant indicator for the coming weeks. It unexpectedly dropped to 65.6, marking a seven-month low and showing that consumers are more concerned about the economy than expected. This weakness hints that buying protective put options on equity indices like the S&P 500 may be a wise choice to safeguard against a potential market decline.Inflation Expectations And Market Implications

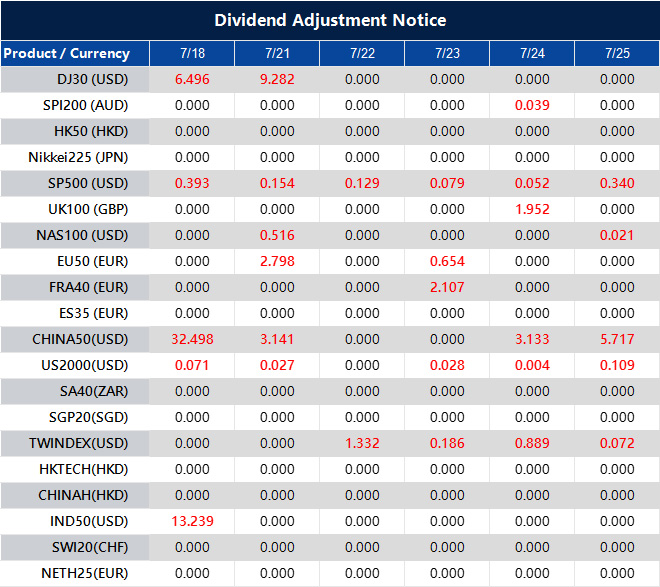

The survey’s inflation expectations are also crucial; they haven’t decreased. The one-year outlook is stuck at a high 3.3%. This gives the central bank reason to keep interest rates high. For traders, this stickiness means that bets on quick rate cuts may not work, making strategies focused on sustained higher rates more attractive. Mr. Waller’s caution is supported by the Fed’s latest “dot plot,” which now projects only one rate cut in 2024, a significant decrease from three cuts expected in March. With no strong data suggesting a change, a July rate cut seems unlikely. This situation makes selling call options on rate-sensitive assets potentially profitable, as there’s no immediate bullish factor. Historical data shows that the current low market volatility, with the VIX index around 13, is significant. This calm often precedes a major market shift when the economic direction becomes clearer. Such an environment makes it relatively affordable to buy longer-term options, preparing for a potential surge in volatility later this year. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – Jul 18 ,2025

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].