SocGen predicts a 50 basis point Fed rate cut, unlike the market’s expected 25 basis points

The US dollar faces challenges as EURUSD trades within its range, waiting for potential movements.

Future Economic Activity

If upcoming rate cuts boost economic activity, the 2026 rate cuts could be reassessed, which would likely support the dollar. However, the current trend is still downward, and strong data is needed for a turnaround. The ECB has kept its rates steady, with only minor easing expected by 2026. On the daily chart, the EURUSD faced resistance near 1.1789 and has stayed within range; a spike might lead to sellers targeting a drop to the 1.16 support. Buyers are looking to break through to 1.1831. Similar patterns are visible on shorter-term charts, with sellers active near 1.1745 and aiming for lower levels while buyers seek upward movement. Next week brings important events, including US Retail Sales data, the FOMC policy announcement, and US Jobless Claims figures. The EURUSD is pushing against a significant resistance zone near 1.1745 as we await the FOMC decision this week. Last week, the dollar’s weakness intensified when initial jobless claims unexpectedly jumped to 415,000, a level not seen since late 2021 during the post-pandemic recovery. This data, combined with a CPI report showing manageable inflation at 2.8%, has strengthened expectations of further easing from the Federal Reserve. This difference in monetary policy is driving current market dynamics. Traders are fully expecting a third 25-basis-point cut at this week’s meeting, which would lower the Fed Funds Rate to a target range of 4.50-4.75%. Meanwhile, the European Central Bank has kept its main rate steady at 3.50% for three meetings, indicating the end of its easing cycle that began earlier this year.Trading Strategies

For derivative traders, the current range offers a clear strategy. Sellers are stepping in near the 1.1745-1.1789 resistance, a tactic that has worked as the pair has risen from the 1.10 levels seen at the beginning of 2025. This strategy aims for a move back toward the 1.1600 support, betting that the dollar’s bearish sentiment may be stretched. Traders should also prepare for a potential breakout if upcoming US data or the FOMC announcement is more dovish than expected. A decisive move above 1.1789 would signal buyers to target the next resistance level around 1.1831. The Fed signaling a faster pace of cuts for the rest of the year would be a key factor. Options can be a good way to handle this event risk. Buying EUR/USD put options with a strike price below 1.1700 allows for defined risk while positioning for a drop back to the 1.1600 support. On the other hand, traders expecting a dovish surprise from the Fed could buy call options with a strike above 1.1800 to benefit from a breakout. All attention will be on tomorrow’s US Retail Sales figures and the FOMC policy announcement on Wednesday. These events will likely decide if the pair remains range-bound or if the upward trend picks up speed. We will also monitor the weekly jobless claims data on Thursday to determine if last week’s spike was an anomaly. Create your live VT Markets account and start trading now.In July, the Eurozone’s trade balance rose to €12.4 billion, up from €7.0 billion.

Trade Balance Dynamics

The rise in trade balance might indicate higher exports or lower imports, both of which can affect the economy. These trade changes can shape economic strategies within the Eurozone. These figures help us understand the Eurozone’s trade dynamics and economic direction. Ongoing growth suggests shifts in global trade patterns. Eurostat’s data allows for month-to-month analysis of Europe’s economic performance. Monitoring these numbers can assist in predicting future conditions. The Eurozone’s trade surplus of €12.4 billion in July is a notable improvement from last month. This suggests that demand for exports is stronger than expected, which may support the Euro in the coming weeks. This is a positive sign for the region’s economic health.Financial Market Implications

This strong trade data adds complexity to the outlook for the European Central Bank, especially after the stubbornly high inflation rate of 2.8% in August. A strong economy may lessen the ECB’s need to cut rates soon. Therefore, we can expect interest rate futures to reflect a lower chance of such cuts. For currency derivatives, this data supports a positive outlook on the Euro, especially against the US dollar. Recent US job data shows slower growth, leading to a clear policy difference in favor of the Euro. We should think about buying near-term call options on the EUR/USD pair to benefit from this potential rise. The underlying strength seems to come from the manufacturing sector, especially in Germany, which had a surprising 1.5% increase in factory orders last month. This suggests that European industrial stocks, particularly major exporters, are in a good position. We can take advantage of this trend through call options on indices like the DAX or the Euro Stoxx 50. We have seen similar trends in the past, particularly after 2014, when strong exports helped the Eurozone despite weaker domestic demand. However, we must stay alert to any global growth slowdowns, which pose the biggest risk. Strategies should account for this risk, possibly by setting clear profit targets on long positions. Create your live VT Markets account and start trading now.Kazimir emphasized that minor inflation deviations shouldn’t lead to policy changes, supporting the ECB’s current rate stance.

Market Pricing And Economic Indicators

Currently, the market expects only a slight easing of 4 basis points by the end of the year and a total of 11 basis points by the end of 2026, consistent with the ECB’s current position. With the European Central Bank indicating a firm pause, we anticipate that interest rates will remain stable for the foreseeable future. There are noticeable risks of inflation rising, and the monetary policy will stay flexible but inactive unless there is a significant economic shift. This means that small fluctuations from the 2% inflation target won’t lead to more rate cuts. This approach is backed by recent data from late August 2025, showing that Eurozone core inflation remains steady at 2.2%. Even though overall economic activity is slow, with German industrial production showing little growth last quarter, the ongoing inflation allows the ECB to hold off on any action. The market has recognized this, with almost no pricing for future cuts expected by the end of the year.Strategies For Derivative Traders

For derivative traders, this situation suggests strategies that take advantage of low volatility in the coming weeks. Opportunities can be found in selling short-dated options on Euribor futures, as the central bank’s strong position is likely to keep short-term rates stable within a narrow range. The volatility index for euro-denominated rates has dropped to its lowest point since early 2024, indicating that this trend is already underway. We’ve seen similar situations before, especially during the US Federal Reserve’s extended pause throughout much of 2024, when the market repeatedly anticipated cuts that did not occur. The main risk here is a sudden spike in energy prices as winter approaches, which could raise inflation concerns. Therefore, if you hold short volatility positions, it’s important to size them cautiously to handle any sudden shifts in market sentiment. Create your live VT Markets account and start trading now.Nvidia’s shares drop 2% amid Chinese antitrust investigation

Sight deposits at the SNB slightly decreased to CHF 468.5 billion, in line with recent trends.

Recent Trends in Sight Deposits

This decrease in sight deposits is consistent with recent trends. New data on Swiss sight deposits indicates a small decline, suggesting that the Swiss National Bank (SNB) is maintaining a hands-off approach in the currency markets. Their lack of intervention indicates they are not actively opposing the franc’s current strength. This suggests that their policies will remain steady and predictable for now. We are looking forward to the SNB’s monetary policy decision next week, making this data especially important. The small drop in liquidity supports our belief that a surprise interest rate cut is very unlikely. Traders should prepare for the SNB to either keep rates steady or confirm a hawkish position. This view is supported by recent inflation reports. The August 2025 Swiss CPI indicated inflation at 2.1%, still above the central bank’s target of 2%. Given this ongoing inflation, the SNB has little reason to consider loosening its policy anytime soon.Market Impact on Franc Volatility

For derivatives, this suggests that implied volatility on Swiss Franc options is likely to remain strong as we approach the SNB’s meeting. While the market is not expecting major changes, the potential for a hawkish surprise keeps volatility elevated. Selling short-dated franc volatility appears risky at this moment. Looking back, this trend is part of a long normalization process that started after the significant balance sheet expansions of the early 2020s. The gradual decline in sight deposits since 2024 indicates a commitment to reducing liquidity over time. This reduces the likelihood of a sudden, large-scale intervention to weaken the franc compared to previous years. Consequently, strategies focused on the EUR/CHF pair should concentrate more on the relative policies of the SNB and the ECB. With the European Central Bank also maintaining its stance but facing its own economic issues, there may be limited movement in the cross-rate until one of the banks signals a different direction. This suggests that range-trading strategies using options may be effective in the coming weeks. Create your live VT Markets account and start trading now.A week of economic data releases and central bank meetings is expected in several countries.

The US Retail Sales Forecast

In the U.S., retail sales are expected to grow by 0.2% month-over-month, with core sales at 0.4%. Retail sales are holding steady due to strong demand in various sectors, though spending on home improvement and dining out is weaker. Analysts predict that growth in August will slow to 0.4%, with spending likely decelerating by the end of the year due to economic challenges. The BoC may keep rates unchanged despite speculation of a rate cut. Canada’s economy shrank by 1.6% in Q2, but signs in Q3 look more stable. Inflation data may show the Consumer Price Index (CPI) rising to 2.1%, which will affect the BoC’s decisions. The Fed is likely to restart rate cuts, targeting a range of 4.00%–4.25%. Even with steady inflation and employment levels, the Fed might reconsider its long-term growth and employment goals, basing decisions on new data. New Zealand’s GDP is forecasted to decline by 0.3% this quarter due to technical factors. Growth momentum has slowed, indicating a complex trend. In Australia, August is expected to see an employment rise of 15,000, with the unemployment rate slightly increasing to 4.3%. The BoE is predicted to hold rates steady and focus on future policy signals, paying close attention to labor and inflation data. Inflation is expected to show food prices climbing over 5%, but service costs may begin to ease.The Bank Of Japan Decision

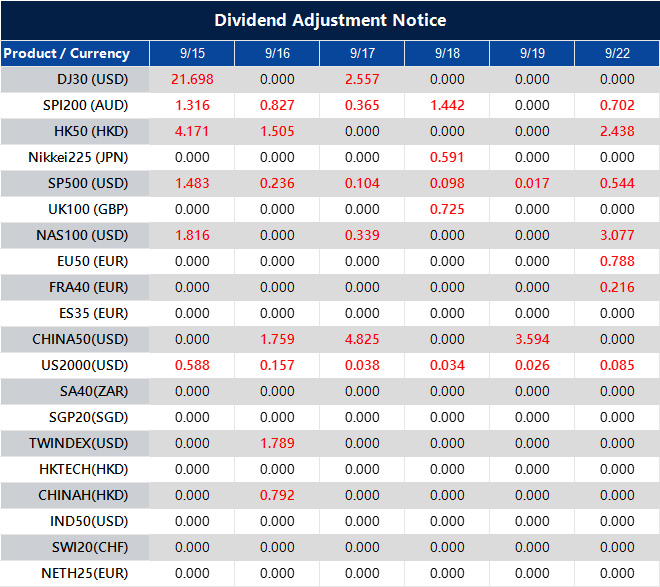

The BoJ is expected to keep rates at 0.50%. Political changes have pushed back expected rate hikes until early 2026, with the economic situation supporting higher rates, despite modest price growth. The key event this week is Wednesday’s Federal Reserve meeting, where a rate cut is already priced into the market. Following the August jobs report, which revealed a slight cooling in hiring to 187,000 and steady core inflation at 3.5%, expectations for this move are high. Traders should watch for surprises in the Fed’s dot plot, as volatility in index futures could rise if the Fed hints at more future cuts than anticipated. The Bank of Canada’s decision adds uncertainty this week, with mixed market views on a potential rate cut. All eyes will focus on Tuesday’s inflation figures, especially after the economy officially contracted by 1.6% in Q2 2025. This uncertain scenario suggests significant movement in the Canadian dollar, making options straddles on USD/CAD an appealing strategy. For the Bank of England, we expect rates to remain unchanged on Thursday, with a shift in focus to guidance for the November meeting. Recent wage growth data is stable around 6.0%, and persistent service inflation could motivate policymakers to wait. Traders may find value in longer-dated options on GBP/USD, anticipating a possible rate cut later this year rather than immediate volatility. Attention will also be on Australian employment data on Thursday, a crucial indicator for the Reserve Bank of Australia’s future stance. We’ll be watching closely for the unemployment rate to rise to the expected 4.3%, as a higher number could increase expectations for a later rate cut. Traders should prepare for short-term volatility in the AUD/USD pair after the release. The Bank of Japan is likely to maintain current rates this Friday due to recent political instability. With inflation easing to about 2.5% last month and the yen remaining weak, there is little urgency for immediate changes. This outlook suggests that yen volatility might stay low, making strategies like selling out-of-the-money options on USD/JPY appealing for income generation. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – Sep 15 ,2025

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].