Akazawa to host US delegation in Osaka amid ongoing discussions and potential tariffs

UK unemployment rate rises to 4.7%, slightly above expectations, affecting BOE rate decisions

Conflicting Labor Market Indicators

When excluding bonuses, earnings also increased by 5.0%, just above the expected 4.9%. However, payrolls in June dropped by 41,000. This is an improvement over May’s revised decrease of 25,000, which was originally 109,000. The Bank of England is facing challenges as rising unemployment and falling real wages put pressure on their economic plans. Total pay fell to 1.0%, while regular pay reached 1.1% in the three months to May, marking the lowest point since mid-2023. According to Mr. Low, the latest labor market report shows a mixed picture. However, the sharp increase in the unemployment rate is a crucial signal. Although job creation exceeded expectations, the rising unemployment rate, now at its highest since 2021, indicates a slowing economy. This suggests that the Bank of England is considering an interest rate cut. As a result, we are preparing for a weaker pound in the upcoming weeks. We find it worthwhile to buy GBP/USD put options or take short positions in sterling futures. Ongoing wage growth, though slowing, is unlikely to stop the central bank from easing policies due to the struggling job market.Monetary Policy Implications

We think the UK interest rate market is underestimating how quickly easing will happen. When central banks begin to cut rates after a long period of high rates, as occurred from 2022 to 2024, the changes can happen rapidly. Thus, we are looking into SONIA futures contracts that predict lower overnight rates later this year. Lower borrowing costs should help boost UK stocks, benefiting the equity markets. We expect this to support the FTSE 100 index. Buying call options on the index could be an efficient way to capitalize on this potential growth. This mixed data may increase uncertainty in the market as we approach the next policy meeting. By mid-2024, the UK unemployment rate was already on the rise at 4.4%, so this new higher figure will spark more debates and could lead to higher implied volatility in sterling options. Strategies like straddles can be useful if we anticipate significant movement in either direction but are unsure when it will occur. Create your live VT Markets account and start trading now.Bitcoin Approaches Breakout As Stablecoin Inflows Intensify

Bitcoin is holding firm within the $116,000 to $120,000 range, keeping traders alert as it consolidates and prepares for a potential breakout.

In overnight trading, BTC briefly reached a high of $120,062 before easing back to the current level near $118,300. This suggests the market is pausing to absorb recent gains while setting the stage for its next directional move.

But it’s not just the price action driving optimism. According to CryptoQuant analyst Amr Taha, nearly $2 billion worth of newly issued stablecoins entered derivatives exchanges earlier today, primarily in the form of Tether (USDT). This sudden wave of liquidity is widely seen as a sign of institutional players gearing up for leveraged long positions in both Bitcoin and major altcoins.

Leverage Builds On Fresh Liquidity

Historically, large stablecoin inflows to derivatives platforms tend to foreshadow bullish trends. These deposits often coincide with an uptick in open interest, something already beginning to unfold.

As prices firm, open interest is rising in tandem, reflecting increased trader conviction and growing market participation.

However, this build-up also introduces risk. Greater open interest suggests higher leverage exposure, which may amplify both gains and losses. Momentum can accelerate quickly, but any sudden shift in sentiment could trigger sharp unwinding.

Technical Analysis

Bitcoin has entered a mild downtrend after failing to maintain its hold above $120,000, with a local peak at $120,062 before retracing to around $118,000.

The MACD confirms weakening momentum with a sharp bearish crossover and widening histogram divergence, signalling continued selling pressure in the near term. The price has now slipped below all three short-term moving averages (5, 10, 30), and the recent bounce appears corrective rather than a reversal.

Macro sentiment hasn’t helped. This week, Fed Chair Powell reaffirmed the Fed’s cautious stance on rate cuts, while on-chain data from CryptoQuant shows slowing inflows to derivatives exchanges, hinting at reduced appetite for aggressive long positions.

With a lower high now in place and 118,000 being retested, bulls will need to reclaim 119,000 swiftly or risk seeing BTC retest the 117,000–116,500 liquidity zone.

Temporary Pause Or Short-Term Peak?

While some short-term indicators hint at exhaustion, Bitcoin has yet to experience a major correction, highlighting the market’s underlying strength. So far, consolidation appears more likely than capitulation.

At the time of writing, BTC is trading at $119,171, marking a 2.4% gain over the past 24 hours. With billions in stablecoin liquidity still waiting on the sidelines and derivatives traders seemingly preparing for further upside, attention now turns to whether Bitcoin can establish a clean breakout above $120,000, or if it first needs to flush out weak-handed traders.

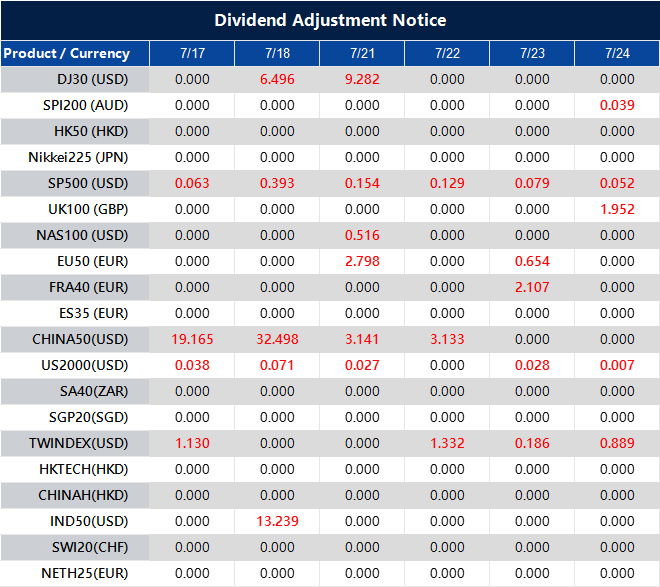

Dividend Adjustment Notice – Jul 17 ,2025

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].