The NZD/USD pair faces selling pressure, falling below 0.6000 in Asia for a second consecutive day.

China’s yuan exports to the US fell by 9.9%, while imports decreased by 7.7% year-on-year.

Gold prices increased today in Saudi Arabia, according to data sources.

Week Ahead: Washington’s Crypto Gamble

Ethereum kicked off the week on the front foot, having soared past the $3,000 mark thanks to a surge in ETF inflows. But ahead lies a delicate balancing act, with inflation data and political developments in Washington poised to shape the near-term outlook.

At the heart of this rally is BlackRock’s iShares Ethereum Trust (ETHA), which recorded an all-time high of $300 million in inflows last Thursday, its most substantial single-day haul to date. This boosted ETHA’s assets under management to $5.6 billion, cementing its status as the leading spot Ethereum ETF in the United States. Across all Ethereum-linked ETFs, roughly $703 million was channelled in last week, their third-largest weekly intake since inception.

Momentum has been gathering for some time. The 30-day average trading volume for ETHA has climbed to 18.83 million shares, up from about 13 million in early June. Trading hit a fever pitch last Wednesday, with 43 million ETHA shares changing hands, the highest daily volume since launch. And this isn’t just short-term capital on the move. Since early June, ETHA has seen net inflows exceeding $1.2 billion, including $159 million on Tuesday alone, its biggest single-day tally since 11 June.

Options Market Echoes The Optimism

The options market is singing the same tune. Bullish positioning dominates, with call options heavily outweighing puts across several expiries. ETHA’s open interest has reached a one-year high, reflecting widespread expectations of continued gains. For options expiring 18 July, traders are clustering around the $22 strike (roughly $3,000 ETH), with noticeable interest building at $23 and $24, a signal that traders aren’t just expecting Ethereum to hold ground, but to push toward $3,200.

This optimism extends into later expiries. For 25 July, call options at $23 and $24 remain dominant, while lighter interest at $25 and $26 implies some traders are eyeing a move as high as $3,300. The same trend can be seen in the 1 and 8 August expiries, where calls outweigh puts right up to $26. With little downside protection evident, traders expect ETH to remain above $3,000, with room to climb further if momentum holds.

‘Crypto Week’ In Washington Poses Pivotal Test

Ethereum’s bullish run doesn’t exist in isolation. It comes during a crucial week in Washington, as US lawmakers embark on what’s been dubbed ‘Crypto Week’. The House is reviewing three landmark bills that could dramatically reshape the nation’s crypto regulatory framework.

Top of the list is the Digital Asset Market Clarity Act, which seeks to distinguish between securities and commodities. The bill would give the CFTC oversight of crypto markets and provide regulatory exemptions for mature decentralised networks, a long-standing request from the industry.

More immediately impactful is the GENIUS Act, designed to create a proper framework for stablecoins. The legislation, which already enjoys bipartisan backing and Senate approval, mandates full 1:1 reserve backing, licensing, and regular disclosures. It also brings stablecoin issuers under the Bank Secrecy Act. President Trump has signalled support, which could speed up passage. Stablecoins underpin crypto liquidity, and regulatory clarity here could pave the way for larger institutional flows into Ethereum and similar assets.

Meanwhile, the Anti-CBDC Surveillance State Act aims to prevent the Federal Reserve from launching a central bank digital currency without explicit Congressional consent. Although politically charged, the bill aligns with pro-crypto sentiment, advocating for open networks over centralised control.

Even if not all three bills pass this week, their progress is already influencing sentiment. The very act of bringing them to the table signals a step closer to regulatory clarity, and markets are responding.

Strong Momentum, But Not Without Risks

That said, caution is warranted. Analysts at Citi have reiterated that digital assets remain far from earning their place as conventional safe-haven investments like gold. Ethereum’s pace of ascent, though underpinned by strong inflows, could trigger a bout of profit-taking or exhaustion, especially among leveraged long holders or deep-in-the-money options traders.

At present, Ethereum’s upward move appears to be backed by real capital and shifting regulation. Retail and institutional players are responding accordingly. Provided ETF flows remain steady and legislative momentum continues, the recovery remains on solid footing. But as always in crypto, volatility is never far behind.

Market Movements Of The Week

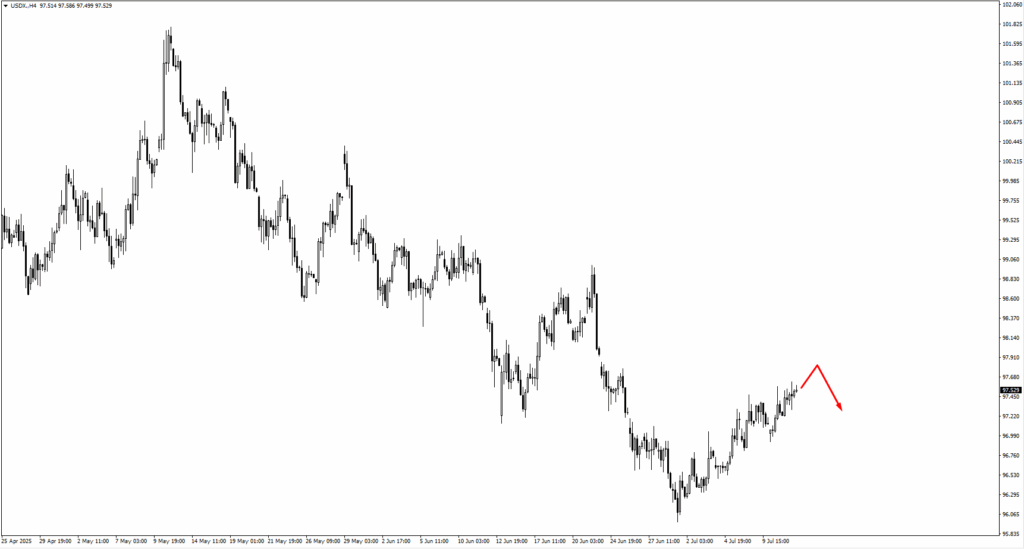

The US dollar index (USDX) is slowly grinding higher, but it’s approaching a key test. Price action near the 97.70 zone may act as a turning point. If USD strength pushes beyond that level, bears are eyeing the next resistance around 98.10. A breakout here could reshape short-term expectations for FX pairs, especially if Tuesday’s US CPI surprises to the upside.

EURUSD is drifting lower, with traders now watching for signs of bullish reversal at 1.1660 or 1.1605. These levels represent key structure zones, and a CPI beat could keep the euro on the defensive. However, any softness in inflation could ignite a retracement rally, particularly if European sentiment stabilises.

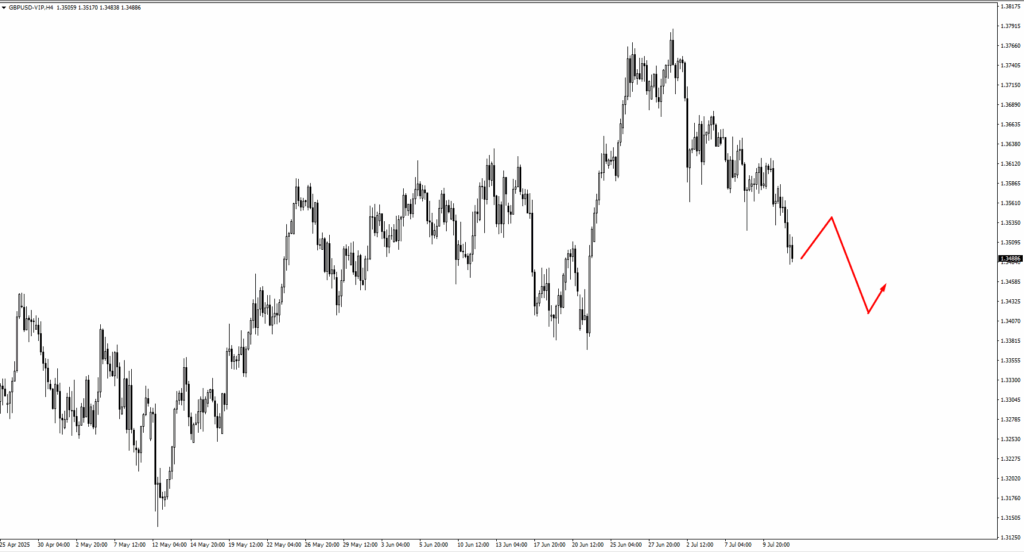

GBPUSD has entered a slower consolidation phase. With UK CPI due Wednesday, bulls are looking for a bounce near 1.3415. That zone could offer a tactical long setup if inflation surprises are mild. But if broader USD strength continues, any upside may remain capped under 1.3535–1.3570 resistance.

USDJPY has already rejected from the 147.75 zone and is now consolidating. If the pair breaks higher on fresh inflation momentum, 148.05 becomes the next upside magnet. However, traders should be cautious, since any rejection near these levels could signal a short-term top.

USDCHF continues to inch upward, heading toward 0.8050. With little data from Switzerland this week, USD direction will likely dictate where this pair goes next. Traders should watch closely how the price behaves once it reaches that resistance.

In the commodity currencies, AUDUSD is holding above its consolidation zone. If price remains stable around 0.6550, bulls may step in ahead of Thursday’s Australian jobs report. A move higher would put 0.6665 back on the radar. Similarly, NZDUSD has traded down from the 0.6050 level and may print a new swing low before finding support. Watch for base-building before considering long positions.

USDCAD is testing the 1.3715 resistance area. If price breaks through with conviction, especially post-CPI, it could quickly move to test the 1.37587 high. The tug-of-war between Canadian inflation and US macro signals will be central here.

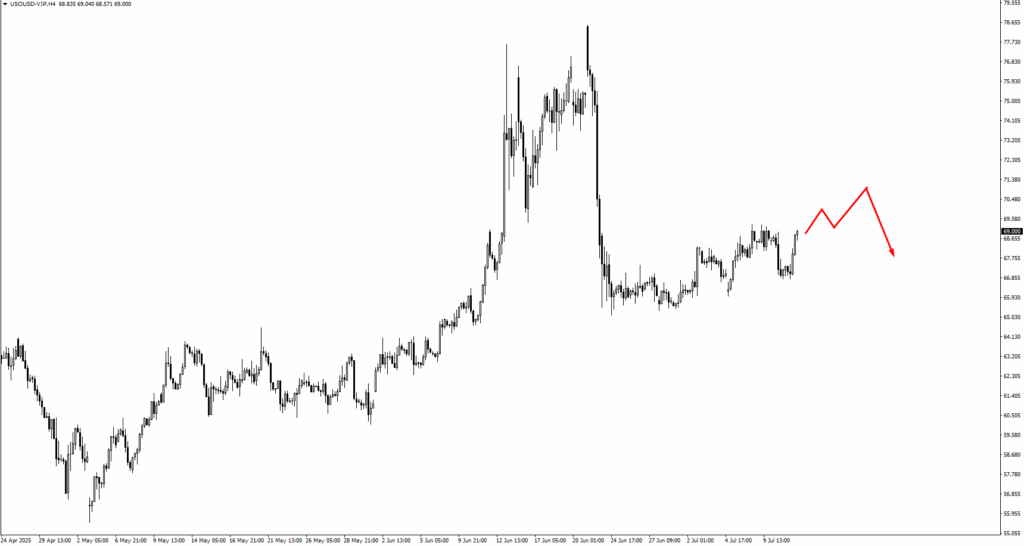

Commodities remain on a knife’s edge. USOIL has rallied slightly but faces resistance at 71.80 and 73.40. These zones are likely to draw selling interest unless supply-side headlines extend the bounce. On the downside, 63.35 and 61.00 remain key supports to watch for reversal setups.

Gold has finally broken above its trendline, suggesting bullish momentum is beginning to return. If prices consolidate cleanly above the breakout zone, bulls will likely aim for 3340 next. However, any renewed dollar strength could limit upside, especially as traders reassess inflation and rate cut timelines in the US.

The SP500 is walking a tightrope. Trump’s renewed tariff threats against Mexico and Europe are clouding what was a strong trend higher. Price has support around 6230, with deeper downside capped at 6170. If bulls recover control, 6400 and 6630 are the next upside levels to monitor.

Bitcoin is back on the rise after a shallow consolidation. Price is approaching the 122,100 to 124,720 zone, a key area where profit-taking could occur. Still, momentum remains constructive, and the broader crypto environment continues to benefit from ETF flows and the regulatory optimism spilling over from Ethereum.

Natural Gas (NG) is still dancing around the 3.35 zone. If it pushes higher, 3.40 is the next resistance level to watch. Volatility remains high here as seasonal shifts and supply dynamics continue to affect trader sentiment.

This week’s price action is less about chasing breakouts and more about timing entries at known technical zones. Many major pairs are sitting near decision points. Patience and precision will be key as traders wait for the next macro catalyst to tip the scales.

Key Events of the Week

After a relatively quiet start to the month, this week swings the spotlight back onto macro data. Traders won’t have to guess where market sentiment might shift next with the calendar loaded with reports that could redefine interest rate expectations across major currencies.

All eyes are first on Tuesday, 15 July, where both Canada and the United States drop their latest inflation readings. For Canada, the CPI y/y is forecast at 3.60%, down from the previous 3.85%. A softer print could reignite dovish bets for the Bank of Canada, particularly if USD strength persists. However, the crosscurrents from ongoing US tariff issues may muddy CAD’s reaction, especially if broader risk appetite begins to falter.

The US print could steal the show. Headline CPI y/y is forecast to rise to 2.60%, up from 2.40%. This is not the direction markets nor the Trump administration want to see. A hotter inflation number here could stall any discussion of near-term rate cuts from the Fed. The result? A stronger dollar and potentially sharp downside in risk-sensitive FX pairs like AUDUSD and NZDUSD. Even equities may pause if markets begin re-pricing the Fed’s glidepath.

On Wednesday, 16 July, the UK delivers its CPI data, forecast flat at 3.40% y/y. With no change expected, the report may take a back seat unless there’s a surprise. But traders should still watch price action around this release, as GBPUSD sits near key resistance and could break either way on deviation.

Thursday, 17 July, kicks off with Australia’s Employment Change report, where the forecast stands at +21.0K, a rebound from last month’s -2.5K. If AUDUSD is truly building a base as recent price action suggests, this report could provide the fuel for a breakout toward 0.6665. Strong numbers here would also help anchor RBA rate expectations and calm recent concerns about domestic demand.

Later that day, the US Retail Sales m/m lands, with a forecast of 0.20%, following last month’s -0.90%. A bounce here would paint a picture of improving consumer strength, giving the Fed even more reason to delay any easing cycle. Traders should watch how the USD behaves into this print. If the number beats expectations, we could see US yields firm up again, putting pressure on gold, AUD, and equities.

In June, China’s yuan exports rose by 7.2% and imports increased by 2.3%.

China’s exports increase by 7.2% and imports fall by 2.7%, setting trade records

Trade Trends and Implications

These numbers indicate stronger foreign demand for Chinese products, while imports are struggling. The 7.2% increase in exports from January to June shows that Chinese manufacturing supply chains are stable and competitive, especially in electronics, consumer goods, and machinery. The 2.7% decrease in imports points to weak domestic demand, likely due to low consumption or delays in manufacturing supplies. The total trade volume exceeded 20 trillion yuan for the first half of the year, reflecting a 2.9% growth compared to last year. Though the trade surplus is increasing, it does so unevenly, benefiting from strong exports rather than balanced trade. This difference reveals where growth is happening and where there are still concerns. These changes affect how we predict price volatility in commodities and specific sectors. Industries focused on exports may enjoy favorable conditions in the short term. However, the drop in imports—especially for raw materials—calls for a reevaluation of hedging strategies, particularly regarding manufacturing output or domestic consumption.Impact on Trade and Finance

Strong external demand and softening domestic intake may further shift the yield curve for contracts related to ocean freight, container shipping, and materials like copper or iron. We should remain vigilant for unexpected changes in trade policies or shipping costs, as these can lag behind shifts in trade volume. As the yuan experiences pressure from the trade surplus and differing global interest rate expectations, short-term strategies involving currency pairs may require tighter controls or frequent adjustments. Liu’s data clearly shows that exports are rising while imports are lagging. Traders linked to East Asian production trends and consumer demand must adjust their strategies accordingly. Historical trends during similar trade environments suggest a widening gap between the prices of industrial inputs and finished goods. This can increase basis risk and lead to discrepancies between hedging payouts and expectations, especially close to settlement. It’s important to look beyond the headline figures and examine the underlying details. For example, electronic components and crude oil will have different impacts on transport and input costs. What seems like simple growth may hide deeper instabilities in certain categories. Moving forward, our strategy should focus on contracts that align clearly with export-oriented sectors, while being more cautious about assets tied to domestic consumption or dependent on high-volume imports. We view Chen’s figures not just as standalone numbers but as indicators of a broader shift between external and domestic factors. Systems that rely on stable trade flows may become less reliable under current conditions. Create your live VT Markets account and start trading now.BHP and CATL establish a memorandum of understanding for battery technology collaboration

The USD weakened, while the EUR and JPY strengthened; the AUD and NZD declined in a mixed performance.

Trade Data Expectations

Aside from these developments, there’s no major news. China’s trade data for June is still awaited and is scheduled for release on July 14. This situation showcases how news-driven trading can lead to quick changes in currency and equity markets. The tariff announcement put immediate upward pressure on the US dollar, which typically happens during international trade tensions. However, the fact that this initial strength didn’t last indicates that traders are uncertain if this move alone justifies a significant shift in US assets. Merz’s prompt collaboration with French and EU leaders aims to maintain internal unity before the August deadline. Timing is crucial here: markets rarely account for long-term risks until they have to. The EU’s choice to delay retaliatory actions isn’t a lack of intention but a strategic decision—a pause that gives market participants some breathing space. However, this breathing room can come with a cost, allowing currency markets to react quickly and potentially shift expectations permanently. This explains why EUR/USD climbed despite broader risk-off signals. It’s not often we see such a clear example of relative policy actions driving gains. The decline in Asia-linked currencies like the AUD and NZD also highlights the situation. It’s no surprise these pairs were affected—both are closely tied to global trade, and speculative positions were already heavily weighted long.Volatility Adjustments And Strategic Anticipations

We have adjusted our short-term volatility expectations for dollar-yen and euro-dollar, leading to wider pricing spreads on all contracts expiring after July 15. The JPY’s decline against the dollar to around 147.00 may lead to revisiting April’s intervention zone. While we don’t see an urgent need for a directional bias yet, we are preparing for possible policy responses from Tokyo, depending on this month’s inflation data. US equity futures drifting lower fits the trend. The absence of a rebound shows that no one is expecting a supportive policy change from Washington soon. Technical indicators are slowly degrading, making any future price adjustments more costly week by week. In such conditions, responsiveness is more valuable than simply having a directional bias. Looking ahead to July 14, the upcoming Chinese trade figures could reveal more lingering supply-chain issues. We have observed a decline in export figures since April. If this trend continues, it might intensify existing short positions in Asia FX and encourage defensive moves into the euro and, to a lesser degree, sterling. We have reduced our exposure to beta-sensitive currency pairs and widened our hedging thresholds on volatility strategies extending beyond July. Pricing isn’t broken, but spreads are tighter than what might be expected given the realized risks. If you’re modeling decay curves, apply a longer lag for political risks, especially since the EU and US are on completely different response timelines. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – Jul 14 ,2025

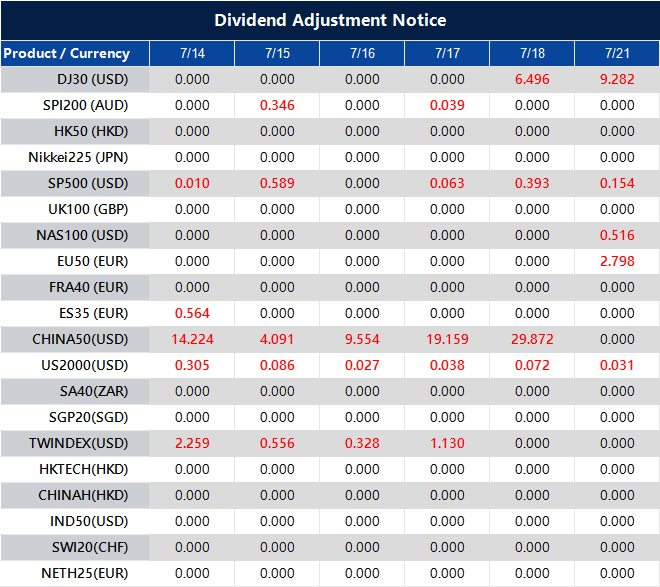

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].