Recent economic data suggests the Fed might implement a 50 basis point rate cut at their upcoming meeting.

China’s M2 money supply increased by 8.8% in August, but new yuan loans were below expectations

Weak Credit Demand

The loan data for August is disappointing, showing that demand for credit remains slow, despite stability in the money supply. This situation is likely to put pressure on Chinese stocks and industrial commodities, such as copper. We remain cautious about the short-term outlook for assets tied to China. This trend is not new; similar weaknesses were evident throughout 2023 and 2024, especially in the struggling property sector. For instance, official data indicated that property investment dropped more than 9% in 2024, a decline that has proven hard to reverse. This ongoing weakness suggests that any recovery could be fragile and face setbacks. However, the main point to note is the expected government stimulus, which could lead to significant market changes in the coming weeks. The uncertainty surrounding weak current data alongside possible future support is likely to increase volatility. We believe that buying options strategies, such as straddles on the Hang Seng Tech Index, could be a smart way to profit from potential price swings.Immediate Term Strategy

In the short term, weak credit numbers suggest that puts on iron ore futures or currencies tied to commodities, like the Australian dollar, could be effective. On the other hand, any solid news about stimulus could lead to a significant rally, making longer-dated call options on major Chinese tech stocks appealing for those expecting a rebound. Timing the government’s announcement is now the most important factor for our trading desks. Create your live VT Markets account and start trading now.Rehn signals inflation stabilization but cautions about risks from energy prices and Euro strength

ECB’s Dovish Shift

Recent comments suggest that inflation is now more stable, leading us to believe the European Central Bank may cut rates next rather than raise them. The focus has shifted from combating high inflation to fearing it may fall too low. This dovish approach signals a change in the interest rate environment we’ve been accustomed to. New data from August 2025 supports this idea, showing Eurozone inflation at 1.9%, slightly below the central bank’s target. This dip is due to lower energy prices, as Brent crude oil has stabilized around $75 a barrel. Additionally, a stronger Euro, now at 1.10 against the dollar, makes imports cheaper and adds to the downward pressure on inflation. For derivative traders, this outlook means it’s wise to prepare for lower interest rates in the coming months. We recommend buying Euribor futures contracts, which would profit if the ECB hints at rate cuts later this year or in early 2026. This directly plays into the market’s adjustment towards a more lenient monetary policy. In the currency market, the ECB’s concerns about a strong Euro are significant. Although the Euro has been strong, a more dovish central bank usually weakens the currency. We see an opportunity to buy put options on the EUR/USD, betting that the interest rate difference with the U.S. will shift against the Euro.Opportunities For Traders

This scenario could be beneficial for European equities since lower rates would reduce borrowing costs for companies. We are looking into buying call options on broad indices like the Euro Stoxx 50. This strategy would gain from a market rally fueled by easier financial conditions. Looking back, this situation is a sharp contrast to the aggressive rate hikes of 2023 aimed at tackling high prices. That period was marked by high interest rate volatility. Now that inflation seems to be under control, we expect volatility to decline, making strategies that benefit from stable or falling volatility more attractive. Create your live VT Markets account and start trading now.Recent BOE survey reveals UK inflation expectations rise to 3.6% for the coming year

Rising Long-Term Inflation Expectations

Long-term expectations for inflation over the next five years are at 3.8%, up from 3.6%. This 3.6% rate reflects the highest public inflation outlook since the same time two years ago. These results may indicate growing risks of stagflation in the UK economy. The rise in public inflation expectations should raise concerns. With the one-year forecast hitting 3.6%, a level we haven’t seen since August 2023, it suggests that people are starting to accept higher inflation as a norm. This makes the Bank of England’s job even more challenging, especially since the latest official CPI data for August 2025 still shows inflation at a stubborn 3.1%. The Bank of England now faces a tough situation. Expectations like these can become a self-fulfilling prophecy. This new information disrupts market pricing, as seen in SONIA futures, which had initially tilted towards a possible rate cut by the second quarter of 2026. As a result, we might need to prepare for a more aggressive Bank of England that could keep rates higher for longer or even raise them again.Strategic Implications for Traders

For interest rate traders, this means selling near-term sterling interest rate futures to challenge the market’s relaxed views. A more aggressive central bank is likely to push short-term yields up, making this a direct response to the changing outlook. This strategy addresses the risk that reaching 2% inflation will take longer than expected. In the currency market, this could boost the pound. If the Bank of England needs to be tougher on rates than the Federal Reserve or the ECB, sterling could strengthen. We should consider buying GBP/USD or GBP/EUR call options to benefit from a stronger pound while managing risk. For equity derivative traders, increased talk of stagflation is a significant warning. Persistent inflation combined with higher rates could hurt corporate profits and economic growth. As a precaution against a potential downturn, we should look at buying put options on the FTSE 250 index, which is more tied to the UK economy. Create your live VT Markets account and start trading now.Former FX official warns BOJ about inflation risks from a weakening yen

Role In Plaza Accord

Gyoten was a key figure in the 1985 Plaza Accord and was the director-general of the International Finance Bureau at Japan’s Ministry of Finance. He opposed Japan’s decision to sell the yen in 2010, a rare move since 2004. He stated, “Japan’s interest rates are simply too low,” which clearly adds to the yen’s weakness. With USD/JPY trading close to 168.50 this week, the pressure is increasing. If this trend continues, it may lead to faster inflation, and the Bank of Japan needs to take this into account. This ongoing weakness could significantly increase import costs and overall inflation, which has been stubbornly high. The latest national core CPI data for August 2025 showed a 2.8% year-on-year rise, marking the sixth straight month above the Bank of Japan’s 2% target. This steady inflation puts the central bank in a tough spot.Possibility Of Intervention

For derivative traders, this indicates a rising chance of a policy shift or even direct intervention. It’s worth considering buying USD/JPY put options to benefit from a sudden yen strengthening, with a target around the 160 level in the next month or two. In the current climate, holding long yen positions through options has become an appealing hedge against an unexpected move by the Bank of Japan. Looking back, the yen is still notably weak, and there’s no strong reason it shouldn’t increase in value. Historical intervention in 2010, when USD/JPY was around 83, and levels near 115 before the global hiking cycle began in 2022 highlight the potential for a major correction. The risk of being short the yen at these levels continues to grow. Create your live VT Markets account and start trading now.Patsalides notes that future interest rate changes will depend on inflation, potentially leading to increases if needed.

ECB Policymaker Position

ECB policymaker Patsalides agrees with Schnabel about being open to more rate hikes if needed. Although talking about raising rates seems early, it might become relevant in 2026 based on economic conditions and inflation trends. There’s a sign of significant uncertainty from the ECB, indicating that their predictable policy period is over for now. Recent data from Eurostat shows that core inflation in August 2025 remained steady at 2.7%. This makes it tricky to determine the future direction of monetary policy. For derivative traders, this means they should expect higher implied volatility in interest rate options, like those for Euribor or Bund futures. The ECB’s balanced approach suggests that a wider range of outcomes is now likely, compared to what the markets were expecting. Strategies such as long straddles or strangles might become more appealing to take advantage of significant market movements, regardless of whether they go up or down.Impact on Forex Market

The possibility of a rate hike, even if it’s not immediate, challenges the belief that rate cuts were a sure bet for early 2026. Traders may pull back their expectations for quick easing, which could lift short-term bond yields. This is an important change, reminding us of the unexpected policy shifts seen during the 2022-2023 rate hikes. In the foreign exchange market, this creates both risks and opportunities for the Euro. The chance of a rate hike boosts the currency, but the weak GDP growth of just 0.2% in Q2 2025 could hold it back. We anticipate increased demand for EUR/USD volatility options as traders prepare for a possible breakout from the recent tight trading range. Create your live VT Markets account and start trading now.Dollar remains steady as European trading opens amid mixed US economic data and market sentiments

Key Points for Traders

Traders foresee approximately 71 bps of rate cuts by the end of the year. There’s only a 7% chance of a 50 bps cut next week. As the Fed meeting nears, US data like the University of Michigan consumer sentiment and retail sales will be crucial. These reports will shape the Fed’s strategy for October. On the charts, AUD/USD stands out after surpassing the July high of 0.6625, reaching levels we haven’t seen since last November. From a technical perspective, this pair could continue to rise. Currently, the US dollar is struggling as markets count on nearly three rate cuts by year-end. The latest Consumer Price Index (CPI) report from August 2025, showing inflation easing to 2.4%, indicates that the Fed may start easing policy. This drives the options market to predict about 71 bps of cuts before 2026.Trading Opportunities

For those trading derivatives, opportunities arise in options as the dollar may weaken further, though not drastically. Buying short-dated call options on EUR/USD or AUD/USD ahead of next week’s Fed meeting could be a good strategy. However, with much easing already reflected in prices, selling out-of-the-money puts on the dollar index could also be effective, as a major fall seems unlikely for now. The ECB’s recent decision to keep rates steady has intensified the dollar’s decline, highlighting a clear policy gap that supports EUR/USD above 1.1700. This situation resembles the ‘insurance cuts’ the Fed made in 2019, where they began to ease to support the economy even without a full recession. This historical context adds confidence in the Fed’s dovish shift. We should closely monitor AUD/USD, which has clearly risen above its July 2025 high of 0.6625, a significant technical level. A weak University of Michigan sentiment report today or poor retail sales on Tuesday could strengthen the narrative for Fed rate cuts and push the pair even higher. This technical breakout indicates that the upward trend is likely to continue for now. Create your live VT Markets account and start trading now.Escriva expresses satisfaction with inflation targets despite slow GDP growth and competitiveness concerns

End Of Rate Hikes

With inflation appearing under control, it is clear that the European Central Bank’s rate hikes are over. Eurostat’s early estimate for August 2025 shows annual inflation at 1.9%, just below the ECB’s goal. This suggests that the next move in policy is more likely to be a cut rather than an increase. We can expect lower short-term interest rates and bond yields throughout the Eurozone. This signals an opportunity to invest in derivatives that benefit from lower rates, such as taking fixed positions in interest rate swaps or purchasing futures on German Bunds. This marks a significant change from the hawkish stance the ECB maintained in 2023 and 2024. The expected shift to a more relaxed monetary policy should help European stocks, especially as it lowers borrowing costs for businesses. One way to capitalize on this is by using call options on indices like the Euro Stoxx 50. This is a relief after the second-quarter 2025 GDP figures showed minimal growth at just 0.1%.Pressure On Euro

The difference in policy between the European Central Bank and the US Federal Reserve, which has taken a more measured approach, is likely to put downward pressure on the EUR/USD exchange rate. Therefore, we should explore strategies that benefit from a weaker Euro, like purchasing put options on the currency. Interest rate markets are currently estimating over a 70% chance of a 25 basis point cut at the December 2025 meeting. Create your live VT Markets account and start trading now.Japan’s corporate earnings could drop by 3% because of US tariffs, making wage negotiations and rate hikes more difficult.

The Risk of Tariffs

Reduced corporate earnings might complicate the Bank of Japan’s plans to raise interest rates in 2026. Ryosei Akazawa, Japan’s top trade negotiator, has voiced concerns about the tariffs and their potential effects on the economy. With the potential of a 15% US tariff, Japanese corporate earnings now face significant risks. The Nikkei 225 has surged over 20% this year and reached record highs earlier in 2025, making it vulnerable to a decline due to this news. We may want to buy Nikkei put options expiring in October or November to protect ourselves or profit from a potential drop. This situation directly poses challenges for the Bank of Japan regarding its goal to increase interest rates in 2026. A delay in policy changes would keep the interest rate gap between the US and Japan large, putting pressure on the yen. We could see USD/JPY break above the 160 level, which it hasn’t maintained consistently, making long positions in USD/JPY futures or call options a smart move.Opportunities and Strategies

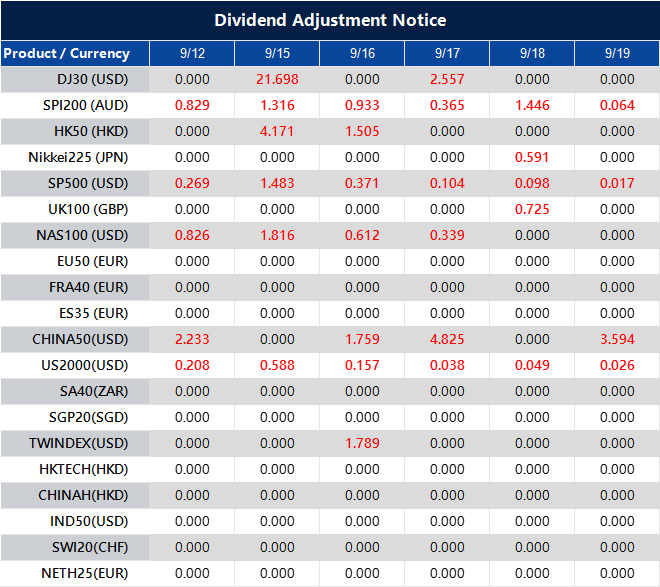

Uncertainties in trade policy often lead to increased market volatility, as seen during the 2018 trade disputes. The Nikkei Volatility Index, currently at a low 14, might experience a significant rise soon. Purchasing call options on the volatility index itself is a direct way to capitalize on the expected surge in market activity. These tariffs specifically target cars and auto parts, a vital sector. The United States is the largest market for Japanese automakers, making up over 35% of all vehicle exports last year. Therefore, we see a clear opportunity in buying put options on major companies like Toyota and Honda, as their earnings forecasts could be directly impacted. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – Sep 12 ,2025

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].