Japan’s PMI shows signs of recovery, but businesses stay cautious due to fragile demand and uncertainty

Silver price exceeds $36.00 due to risk aversion and increased tensions in the Middle East

Fed’s Potential Influence

Officials from the U.S. Federal Reserve, including Governor Waller, have suggested possible interest rate cuts as early as July. This outlook has supported silver prices because lower rates can make the metal cheaper for foreign buyers. However, the renewed strength of the U.S. Dollar might limit how much silver prices can grow. Investors are looking forward to the preliminary U.S. S&P Global PMI for June. Strong data from the U.S. could strengthen the Dollar in the near future. Silver is used in many industries due to its excellent electrical conductivity. Changes in industrial demand can affect its price, as silver is widely used in electronics, solar energy, and is also tied to gold. Silver prices often follow gold’s movements, influenced by similar factors like economic stability and geopolitical issues. The recent surge in silver prices to around $36.10 reflects two key issues: geopolitical unrest and changes in monetary policy. With attacks on critical sites in Iran and warnings from Tehran, safe-haven assets are absorbing the market’s shock. Silver benefits from increased political risk, as it serves both as a store of value and an industrial metal. As seen early Monday, these trends continue, and market anxiety is growing. From Washington, the language has become more cautious. President Trump’s strong warnings about retaliation suggest that any further actions could quickly escalate the situation. As a result, market volatility has increased, with silver becoming a popular option for those seeking protection against potential losses. Traders should watch for possible price increases if tensions worsen, especially if reports become more direct or actions in the region resume.Monetary Positioning and Market Dynamics

At the same time, monetary positioning is providing additional support. Governor Waller and others at the Federal Reserve have left the possibility of rate cuts open for July. Lower interest rates increase the appeal of holding metals like silver, which do not earn interest. This environment is slightly favorable for metals due to easing inflation, encouraging more buying. Yet, it’s not all one-way movement. The Dollar has shown some strength, which can limit gains in USD-denominated commodities. If the upcoming S&P Global PMI data is better than expected, the Dollar could rally, putting further upward pressure on silver prices in the short term. This creates a mixed situation where the demand for safe-haven assets is rising, but a stronger Dollar could counteract that. From a strategic viewpoint, silver is sensitive not only to market sentiment but also to changes in manufacturing demand. It is heavily used in electronics, solar panels, and clean energy processes. Any decline in demand in these areas will have an impact on prices. We will also be monitoring gold, as their price movements are often linked and respond similarly to broader economic signals. We will keep an eye on guidance from the Fed at upcoming speaking events and monitor physical silver delivery trends. Stronger flows into ETFs or tighter spreads in dealer markets could suggest capital is shifting toward metals for the medium term. Currently, near-term options skews are low, indicating traders may not be fully prepared for sudden moves. Adjusting risk exposure while markets are sensitive to news could be wise. As events unfold in the Middle East and among central bankers, staying alert to cross-market signals is crucial. While the silver market typically reacts quickly, broader trends often take longer to adjust. Create your live VT Markets account and start trading now.Democratic Republic of Congo extends cobalt export ban, leading to sharp price increases

Market Supply Shift

The current scenario highlights a significant shift in market supply, driven mainly by policy changes in the Democratic Republic of Congo. With the cobalt export ban extended through the third quarter of next year, we are seeing changes in pricing. Initially, this was a reaction to long-term low prices, but it has evolved into a response that directly affects trading volumes and price volatility. Cobalt futures quickly reacted; the 35% price increase is not just recovery but also a re-evaluation of supply and future risks. Usually, slow physical market restrictions take time to reflect in derivatives, but that’s not happening here. Prolonged disruptions tend to alter assumptions about future pricing, and we are already seeing this recalibration, especially for the second half of 2025. These changes impact not just the current rates—there’s a growing sense of scarcity affecting shorter-term contracts. Market participants will have adjusted how they view the correlations between cobalt and related metals like nickel and lithium. Movements in those metals have been less drastic, suggesting that this reassessment is localized. However, there is potential for wider effects as substitution factors start to influence pricing models. The impact of reduced cobalt supply will also affect contract structures, particularly for instruments used for synthetic exposure by industrial hedgers.Glencore And Indonesia

Looking at Glencore, the pause in Congolese exports has significantly reduced market flow. This creates an opportunity for smaller producers to fill the gap, although they may do so slowly. Since processing is concentrated in just a few areas, especially China, any drop in raw materials leads to delays that impact settled prices. We can no longer just depend on stated production capacity—timing is now more critical than volume. In Indonesia, we’ve noticed mining companies gearing up to increase output, likely in anticipation of future supply needs. If this trend continues, and if exports are made under competitive contracts, the differences in pricing between regions could tighten paper market spreads. Currently, these movements show less correlation, but they suggest a buffer capacity that we didn’t focus on earlier in the year. The tight supply situation should raise awareness about margin requirements, especially for short positions. Strategies that relied on earlier low prices now face risks from both price changes and access costs—financing availability and delivery obligations are now more sensitive to changes in contract pricing. We are increasing our near-term volatility estimates, especially around important inventory data releases and policy updates. Seasonal factors are less impactful now; policy and logistics play a much larger role. Create your live VT Markets account and start trading now.USD/CHF trades near 0.8170 as safe-haven demand increases after earlier gains

Rising mortgage arrears in Australia linked to high costs and interest rates affecting households

NZD/USD pair falls from yearly highs as it reacts to news about Iran

US Fed Influence

The USD is also gaining strength from the Federal Reserve’s hawkish signals. They forecast fewer rate cuts in 2026 and 2027, while still expecting two cuts in 2025. Meanwhile, the Reserve Bank of New Zealand is likely to lower interest rates due to falling inflation and economic issues caused by US tariffs. From a technical perspective, if NZD/USD drops below the short-term trading range and the 0.6000 psychological level, it suggests a downward trend. This view is supported as the market waits for upcoming US PMIs to provide new direction. The recent downward pressure on NZD/USD indicates not only a change in overall sentiment but also a significant shift in risk due to the latest geopolitical events. With tensions in the Middle East rising after US actions targeting Iran, traders are moving their money into safer assets. The US Dollar, typically the go-to asset in uncertain times, has benefited from this trend. When risk appetite decreases, currencies linked to commodities or global growth expectations, like the New Zealand Dollar, generally decline. Additionally, expectations around US monetary policy are helping the Dollar. The Federal Reserve’s guidance suggests a waning chance of prolonged easing, leading to continued strength for the Dollar. Although there may still be a couple of rate cuts next year, longer-term signs indicate the Fed is not in a rush to ease their tightening stance. This perspective keeps rates relatively high, providing ongoing support for the Dollar.RBNZ Perspective

On the other hand, the Reserve Bank of New Zealand (RBNZ) is on a different path. With inflation rates falling and new challenges from US trade policies, New Zealand may soon have to lower borrowing costs. The softening inflation could push policymakers to relax conditions, although this won’t happen immediately. This difference in direction is not favorable for the Kiwi. When we look at the charts, the importance of the 0.6000 level is clear. The recent breach below this threshold suggests a more sustained move downward. Hitting fresh monthly lows shows how shifted market sentiment has become. Support is not expected until closer to the 0.5900 area, where there’s historical buying interest. As for upcoming economic releases, Wednesday’s US PMI figures may create some volatility and lead to corrections if expectations aren’t met. Conversely, if the data remains strong and reaffirms a robust US economy, the Dollar could strengthen even more. Traders should keep an eye on supply chains and business orders, both of which indicate persistent inflation that the Fed will pay attention to. We anticipate continued high volatility. A tactical approach may be more effective in the near term, given the reliance on data for US monetary policy. It’s wise to set tighter stop-loss orders, especially below recent support levels, while monitoring short-term resistance near 0.5980 during any corrective rallies. In summary, without a significant easing of geopolitical risks or a major decline in upcoming US economic data, any rebound in the NZD/USD pair may be limited. Current positioning favors Dollar strength over Kiwi resilience in the immediate future. Create your live VT Markets account and start trading now.GBP/USD falls to around 1.3405 as safe-haven flows rise amid geopolitical tensions

Rising Tensions and Market Dynamics

The US has launched airstrikes on Iranian nuclear sites, escalating geopolitical tensions. President Trump announced that Iran’s facilities were “obliterated” and warned of more action unless Iran seeks peace. In response, Iran has pledged to retaliate, driving up demand for safe-haven assets. In the UK, retail sales fell by 2.7% in May, reversing a previous increase and putting pressure on the Pound. The Bank of England kept interest rates unchanged at 4.25%, with possible cuts in future meetings due to uncertain economic forecasts. The Pound Sterling is affected by the Bank of England’s policies and economic data. The Trade Balance is another factor that impacts the Sterling by influencing currency strength based on export and import differences. As GBP/USD trades lower around 1.3405 in early Monday sessions, new patterns are emerging that warrant attention. Increased demand for the Dollar, driven by geopolitical risks from US military actions against Iran, has led to higher volatility. This situation often pressures GBP-based pairs during uncertain times.Impact of Geopolitical and Economic Factors

The recent airstrikes have prompted Washington to intensify its warnings of further military options, while Tehran has vowed to respond. Consequently, markets are pricing in greater instability, which historically benefits the Dollar in times of tension. Although the current pricing of Cable reflects this, there are deeper issues at play. In the UK, the economy experienced a significant drop in consumer spending last month. Retail sales plunged by 2.7% in May, marking a major reversal from previous resilience. This decline puts additional pressure on growth forecasts and complicates future monetary decisions. The Bank of England decided to keep interest rates steady at 4.25% in its latest meeting. However, with slowing growth data and flattening inflation, speculation about a rate cut before summer’s end is growing. Markets have taken notice, with short-term interest rate futures adjusting prices, impacting institutional demand for the Pound in yield-seeking contexts. Later today, the purchasing managers’ index (PMI) reports will be closely monitored by institutional investors. PMI data for both manufacturing and services, covering the UK and the US, can significantly shift market sentiment if they differ from expectations, especially with current tight trading ranges. The market’s reaction will likely set the tone for the week. Moreover, Britain’s trade data remains crucial. A widening trade deficit, whether due to increased imports or declining exports, puts added pressure on the domestic currency. In light of disappointing retail figures, weak trade performance further paints a fragile economic picture that many did not anticipate weeks ago. All this underscores the focus on interest rate direction. If US indicators show continued strength and the Federal Reserve maintains a relatively hawkish stance, the differences in monetary policies between the US and UK will be hard to overlook. In this environment of short-term volatility and data releases, it’s vital to reassess risks and fine-tune exposure. Movements in GBP/USD are now more closely linked to macroeconomic updates than to technical factors. Timing market entries based on high-probability outcomes may yield better results than relying solely on static price levels. This week is expected to remain volatile. Keeping an eye on data releases and geopolitical events is crucial, especially during US afternoon sessions when Dollar trading volumes increase. Currently, the directional trend favors the Dollar, but its persistence will depend more on the length of this wave of risk aversion than on previous price levels. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – Jun 23 ,2025

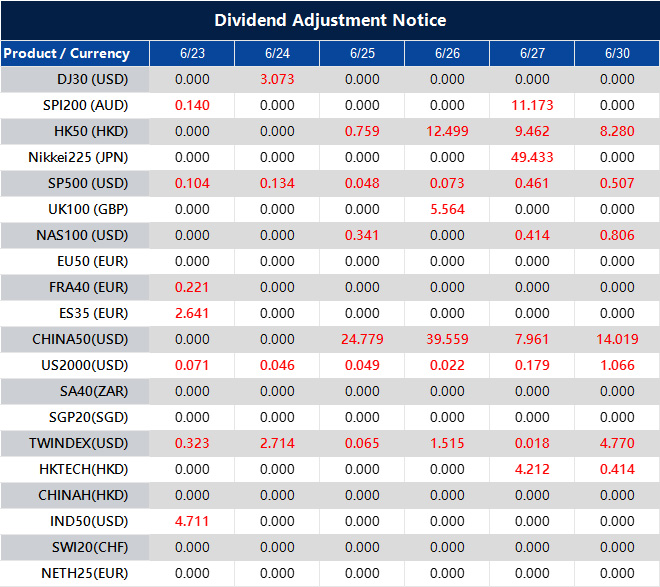

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].