NASDAQ traders watch for bearish outlook below 23,650 and bullish potential above 23,711

Rehn highlights Euro area resilience, noting inflation’s decline and close monitoring of economic conditions for possible action.

Dollar Dominance

Despite external pressures, a quick decline in the dollar’s dominance seems unlikely. As summer wraps up, more statements from ECB leaders are expected, continuing their focus on stable policies. The ECB’s steady approach signals that European interest rates may not change much in the near future. The latest flash estimate for Eurozone inflation in August 2025 is 1.9%, just under the target, meaning there is little incentive for surprise actions. This environment suggests that selling options on short-term interest rate futures, like the December Euribor contract, can be a smart strategy to earn premiums while the central bank remains inactive. In contrast, the situation across the Atlantic appears different. Potential political pressures on the Federal Reserve create uncertainty. The recent US inflation for July 2025 is higher at 3.2%, leading to a policy gap between the US and Europe, which might affect currency markets. For traders, it could be wise to buy volatility on the EUR/USD pair, as significant movements are likely to stem from news in the US.European Growth and Market Strategy

European growth remains strong, as shown by a slight increase in the German Ifo Business Climate index for August. This gives a positive outlook for equities. With steady borrowing costs, indices like the Euro Stoxx 50 may continue to rise slowly. Therefore, selling out-of-the-money puts on the index could provide a good way to gain bullish exposure while having some protection. We need to remember the intense market reactions to central bank changes in late 2023 and early 2024. Although the current market seems stable, this period won’t last. Hedging strategies, like buying longer-dated options for early 2026, can help protect against unexpected shifts in central bank policies as we enter the new year. Create your live VT Markets account and start trading now.In July, eurozone M3 money supply increased by 3.4%, just below the expected 3.5%

The European Central Bank’s Decision

With July’s M3 money supply being slightly lower, this supports the ECB’s choice to pause any changes. The data shows that while money growth is stable, it’s not speeding up, reducing any need for the ECB to consider raising rates soon. For traders in derivatives, this lowers expectations for any unexpected aggressive moves shortly. This steady money supply data fits into the larger economic picture we’ve been observing. The Eurozone’s GDP growth for Q2 2025 was only 0.1%, and although July’s inflation decreased to 2.7%, it still remains above the central bank’s target. This mix of a slowing economy and ongoing inflation puts the ECB in a tough spot, making it likely that interest rates will stay the same for a while. In this context, implied volatility for European assets might decrease in the upcoming weeks. Selling short-term call options on the Euro Stoxx 50 could be wise as the market adjusts to this steady information and the VSTOXX index could fall from its current level around 14. Without a clear trigger, big increases in stock prices seem unlikely for now.Interest Rate Traders Strategy

Interest rate traders should focus on the longer term. While short-term contracts are likely to stay stable, we can explore options that speculate on a possible policy shift in 2026. Reflecting on the market fluctuations in late 2024 after the last rate hike, it became clear that waiting was essential, and markets did not reward bets on immediate rate cuts. This situation is reminiscent of the “wait-and-see” phase we went through last year. Range-trading strategies on the EUR/USD, like selling strangles, could be effective since the currency may not have a strong directional trend. We should expect the euro to stay within its recent range until we get clearer signals about inflation or growth. Create your live VT Markets account and start trading now.Business confidence in Italy exceeded expectations, but consumer confidence fell short of predictions.

Market Impact

These small differences in confidence levels are not expected to affect the market significantly. They show only slight changes from what was anticipated, and larger shifts are needed to influence market conditions. Today’s confidence numbers from Italy do not change our short-term outlook. The small rise in business confidence is balanced by a decline in consumer confidence. Both indicators have decreased since July 2025, indicating a slow cooling trend. Traders will likely overlook these minor figures and wait for more substantial data releases. Our main concern is the upcoming Eurozone HICP inflation data. The preliminary figure for August 2025 remains steady at 2.5%. This persistence puts pressure on the European Central Bank, which has signaled it is ready to take action if necessary. Any surprises in the broader inflation data across Europe will have a more significant effect than today’s sentiment figures from one country.Italian Debt and European Policy

In the near term, this mild announcement from Italy may lead to selling front-week volatility in indices like the FTSE MIB. Options traders might consider selling short-dated strangles, betting that the index remains stable until more important European data emerges. The limited effect of this report supports the idea that there’s no immediate trigger for a breakout. We must keep the larger context in mind, especially the market turbulence during the 2023 rate hiking cycle. With Italy’s public debt close to 138% of GDP, the market’s attention is still on sovereign bond spreads and the ECB’s policy direction. Minor sentiment data does little to change this underlying sensitivity. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – Aug 28 ,2025

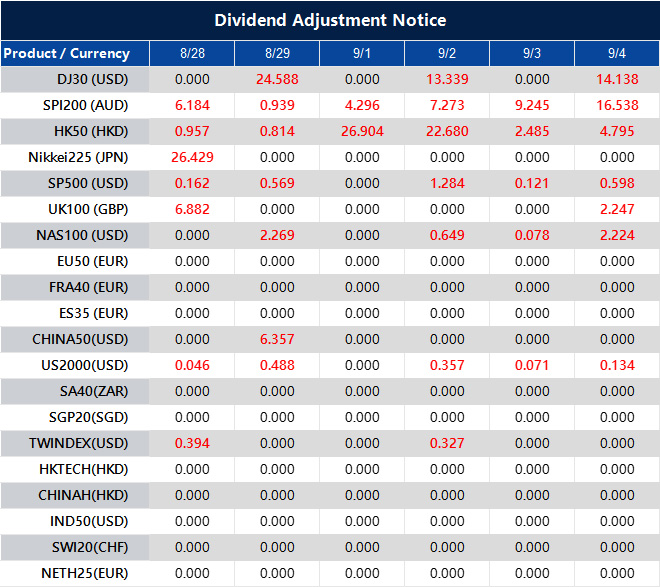

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].

European stocks rise slightly as analysts believe France’s issues are already reflected in prices.

Europe’s Market Stability

Current market trends suggest that France’s political crisis might already be priced in. Some analysts believe that the stability of the European market largely depends on Germany, while French assets reflect some political risk. While concerns about France’s situation persist, there are no major worries in the wider European market. The small rebound in European markets indicates that the initial shock from France’s political situation may be easing. Although the CAC 40 is positive today, it is still down for the week, suggesting that confidence remains shaky. This situation might be an opportunity for traders who think the worst has been accounted for, as suggested by some major banks. A key indicator to observe is market volatility, which spiked after the unexpected election announcement in France in early August. The Euro VSTOXX index, which measures volatility in Eurostoxx 50 options, rose to nearly 25 but has now settled around 20. This decrease indicates that panic is subsiding. The drop in implied volatility, even amidst market nerves, makes selling options premiums a potentially attractive strategy for the upcoming weeks. For those who believe the crisis is under control, selling out-of-the-money puts on the CAC 40 or the Eurostoxx 50 due in September could be a smart move. This approach benefits from the gradual market recovery and the slow decline in option prices as volatility continues to normalize. We witnessed a similar trend following political uncertainty in Italy in 2022, when selling volatility became profitable once initial fears eased.Risk Management Tactics

However, caution is essential, and hedging is a wise choice. The French-German 10-year bond spread, an important risk indicator, widened to over 80 basis points earlier this month and is currently around 65 points, which is still above its historical average. Traders might consider buying puts on specific French banks that are vulnerable to government risk, as a cost-effective way to protect against a potential second wave of selling. The growing gap between Germany and France is also shaping up as a clear trading theme. Recent flash PMI data from this week showed German manufacturing sentiment rising to 48.5, while French services dipped to 47.0 amid domestic concerns. This supports a strategy of going long on German DAX futures while shorting CAC 40 futures, betting that Germany will outperform in the short term. Create your live VT Markets account and start trading now.A Chinese trade negotiator is visiting the US this week to meet with officials.

Nature Of The Visit

Li Chenggang’s trip won’t include a meeting with US trade representative Greer. It’s also important to mention that the visit was not initiated by the US, adding to the complexity of the situation. We believe the announcement of this Chinese trade delegation is unlikely to significantly impact the market. Since the talks will involve only deputy-level officials, a major breakthrough is unlikely, which should help keep market volatility in check. The CBOE Volatility Index (VIX) is around 16.5, and this news doesn’t provide strong reasons for a sharp increase in volatility in the near future. For traders involved in sectors sensitive to US-China relations, like semiconductors and industrials, this situation could offer a chance to earn some income. Strategies such as selling out-of-the-money call options might make sense, as the chances of a major positive announcement have decreased. For example, the semiconductor sector has faced recent declines, like the 4% drop in the SMH ETF over the past month, suggesting that any upside could be limited. The ongoing uncertainty is also significant for currency markets, especially the USD/CNH exchange rate. Right now, this pair is trading close to 7.28, and the stalled talks suggest that Chinese authorities are not inclined to allow the Yuan to appreciate significantly. This environment favors strategies that expect continued stable trading or a slow decline of the CNH against the dollar.Historical Context Of Trade Headlines

We recall the time between 2018 and 2020 when similar trade news could move the S&P 500 by over 1% in just one day. However, the limited nature of current diplomatic talks indicates that we shouldn’t expect such sharp reactions in the coming weeks. The greater risk now is slow progress driven by fundamental factors, rather than sudden turmoil from a cancelled high-level summit. Create your live VT Markets account and start trading now.Switzerland’s GDP grew by 0.1% in Q2, accounting for sports events, reflecting economic stability

Economic Growth Amid Challenges

After adjusting for sporting events, GDP also saw a 0.1% increase in Q2, following a 0.7% rise in the first quarter. Despite facing challenges, the Swiss economy continues to show modest growth. The introduction of 39% tariffs poses a challenge for future economic performance. We will closely monitor how these tariffs affect the economy moving forward. Current data shows the Swiss economy is mostly stagnant. While the 0.1% quarterly growth prevents a contraction, the downward revisions and the shortfall on the yearly figure indicate weak momentum. This fragile state makes the economy susceptible to external shocks.Impact of 39 Percent Tariffs

The key focus is not just on past data but the future impact of the 39% tariffs. The United States is a vital export market for Switzerland, making up over 16% of total Swiss goods exports in 2024, with pharmaceuticals and watches being major sectors. This significant hit will likely put pressure on corporate earnings and investment plans for major companies in the Swiss Market Index (SMI). Given the uncertainty, there is an opportunity to invest in volatility. Implied volatility on the SMI and currency pairs like EUR/CHF may be mispriced before the tariffs take effect. We should think about buying straddles or strangles to prepare for a large price move, regardless of its direction. Looking back at the trade disputes from the late 2010s, we saw markets respond sharply to tariff news, resulting in significant but unpredictable price swings. Having options was a better strategy than simply betting on the direction of equities or currencies. The Swiss Franc is in a complex situation, offering trading opportunities in the FX options market. A blow to the export economy is generally negative for the franc, but its safe-haven status might attract capital if tariffs lead to broader global risk aversion. This tug-of-war could lead to sharp and unpredictable movements in currency pairs like USD/CHF, making long volatility strategies appealing here as well. Create your live VT Markets account and start trading now.Holiday Trading Adjustment Notice – Aug 28 ,2025

Dear Client,

Affected by international holidays, the trading hours of some VT Markets products will be adjusted. Please check the following link for the affected products:

Holiday Trading Adjustment Notice

Note: The dash sign (-) indicates normal trading hours.

Friendly Reminder:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].

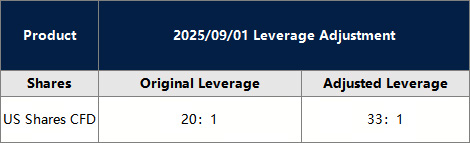

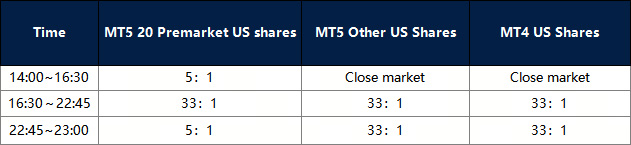

Modifications on US Shares – Aug 28 ,2025

Dear Client,

To provide a favorable trading environment to our clients, VT Markets will modify the trading setting of US Shares:

1. The leverage for all US stock products is 33:1, except for the 20 US stock products on MT5 that can be traded during the pre-market session.

2. Pre-market trading on MT5 for eligible 20 US shares:

During pre-market trading and 15 minutes before market close, leverage would be adjusted to 5:1 when opening positions. Leverage remains 33:1 during all other trading hours.

3. MT5 20 pre-market US stocks: TSLA, NVIDIA, NFLX, META, GOOG, AMAZON, AAPL, ALIBABA, MSFT, SHOP, BOEING, IBM, BAIDU, JPM, EXXON, INTEL, TSM, MCD, ORCL, DISNEY.

The above data is for reference only, please refer to the MT4 and MT5 software for specific data.

Friendly reminders:

1. All specifications for Shares CFD stay the same except leverage during the mentioned period.

2. The margin requirement of the trade may be affected by this adjustment. Please make sure the funds in your account are sufficient to hold the position before this adjustment.

If you’d like more information, please don’t hesitate to contact [email protected].