Geopolitical tensions affected markets as Australian inflation expectations rose sharply and business sentiment fell.

TD opens a tactical long position in gold, targeting $3,650 per ounce.

Attention AUD traders: RBA’s David Jacobs to discuss Australia’s bond market today in Tokyo

Australia Bond Market Volatility

Jacobs’ speech will cover “Australia’s Bond Market in a Volatile World.” This talk is part of the Australian Government Fixed Income Forum happening in Tokyo. It is also set to begin at 07:20 GMT and 03:20 US Eastern Time. Jacobs discussing global bond market volatility at an overseas forum is significant. It shows that monetary policymakers are alert to risk factors that can impact domestic funding and, in turn, affect currency values. Bond market behavior, especially during times of stress, can influence derivative pricing, hedging behavior, and overall market sentiment. Jacobs probably won’t provide direct advice on interest rate changes. His role suggests he will take a more operational and descriptive approach, possibly looking at funding patterns, liquidity issues, and market structure. While we may not get direct policy hints, we can gain operational insights into how the Reserve Bank views recent disruptions and the tools it might consider using in response.Impact On Trading Strategies

In the short term, this speech may impact funding spreads and the yield curve. Traders will likely pay attention to any comments regarding stress indicators, such as bid-ask spreads in short-term government debt or shifts in repo markets. These elements are important because changes can influence rates futures, options expiry, and strategies relying on mean-reversion. Those monitoring implied volatility in AUD pairs already see that recent global rate concerns have widened daily ranges. If Jacobs discusses market function—possibly addressing internal RBA liquidity tools or operations—this could further shape our views on swap spreads and carry costs. While Jacobs is unlikely to change expectations for policy direction, his remarks on the stability of domestic bond markets could lead us to reassess premium estimations in OIS markets. It’s also wise to keep an eye on commentary from Japanese institutional investors since the speech is taking place in Tokyo, putting Australian fixed income on their radar. Traders should consider how updates on issuance profiles or changes to sovereign debt management might alter short-term expectations for AUD demand. Those holding long gamma or short basis risk should think about adjusting their positions around the timing of his remarks. A sharp market move isn’t guaranteed, but market makers often adjust quotes before unpredictable RBA events, especially those discussing liquidity. Monitoring correlations between 10-year ACGBs and currency pairs has been helpful in recent weeks. If this correlation tightens after the speech, it could justify reallocating delta exposure in cross-currency swaps or adjusting duration hedges in regional portfolios. Create your live VT Markets account and start trading now.Notification of Server Upgrade – Jun 12 ,2025

Dear Client,

As part of our commitment to provide the most reliable service to our clients, there will be maintenance this weekend.

Please note that the following aspects might be affected during the maintenance:

1. During the maintenance hours, the Client Portal and VT Markets App will be unavailable, including managing trades, Deposit/Withdrawal and all the other functions will be limited.

2. The price quote and trading management will be temporarily disabled during the maintenance. You will not be able to open new positions, close open positions, or make any adjustments to the trades.

3. There might be a gap between the original price and the price after maintenance. The gaps between Pending Orders, Stop Loss, and Take Profit will be filled at the market price once the maintenance is completed. It is suggested that you manage the account properly.

The above data is for reference only. Please refer to the MT4 / MT5 / VT App for the specific maintenance completion and marketing opening time.

Thank you for your patience and understanding about this important initiative.

If you’d like more information, please don’t hesitate to contact [email protected]

Consumer inflation expectations in Australia rise to 5%, impacting AUD performance against other currencies.

S&P 500 Pulls Back As Inflation Data Tempers Market Confidence

The S&P 500 lost ground on Thursday, ending the session at 6,012.55 after briefly touching an intraday peak of 6,074. While initial optimism was sparked by softer-than-expected US inflation figures, that enthusiasm proved short-lived as global risk factors and doubts surrounding the US – China trade truce returned to the fore. The index dipped 0.21% on the day, suggesting some exhaustion after edging close to record highs earlier in the week.

Investor attention was firmly on the latest Consumer Price Index (CPI) release, which indicated that US inflation rose at a slower pace than anticipated in May. Although this eased immediate pressure on the Federal Reserve to adjust interest rates, caution prevailed among traders. Eyes now turn to forthcoming producer price data, which could reignite inflationary concerns, particularly given ongoing cost pressures linked to tariffs. This report will also provide insights into the Fed’s preferred inflation gauge, the Personal Consumption Expenditure Index.

Markets are currently factoring in a 70% likelihood of a quarter-point interest rate cut by September, despite expectations that the Fed will hold steady at its upcoming meeting. Shane Oliver, Chief Economist at AMP Capital, noted that tariffs could either stoke inflation or squeeze corporate margins, reinforcing the rationale for the Fed’s careful approach.

Trade policy developments added another layer of uncertainty. President Trump confirmed that within the next fortnight, the US will begin issuing letters to major trade partners, setting out unilateral tariff terms ahead of new negotiations. Although he hailed the recent US – China deal, which includes relaxed restrictions on rare earth exports and student visas, investors remained sceptical. Many are awaiting more concrete details before committing further.

Technical Analysis

The S&P 500 retreated from its high of 6,074 following a volatile trading session, briefly finding support at 5,997.55 before regaining stability. Despite a promising start, momentum weakened during European hours, with MACD indicators turning negative and red histogram bars signalling a decline in bullish strength.

Moving averages have begun to level out, pointing to a period of consolidation. Although the index is attempting a modest recovery above the 6,000 threshold, upward momentum appears fragile unless prices can regain the 6,030 to 6,050 zone. A drop below 5,995 would increase the risk of a deeper pullback in the near term.

With key inflation data, central bank guidance, and further commentary from Washington on the horizon, volatility is likely to rise. Traders should remain alert for sudden shifts in sentiment as geopolitical uncertainties and market expectations begin to align more closely.

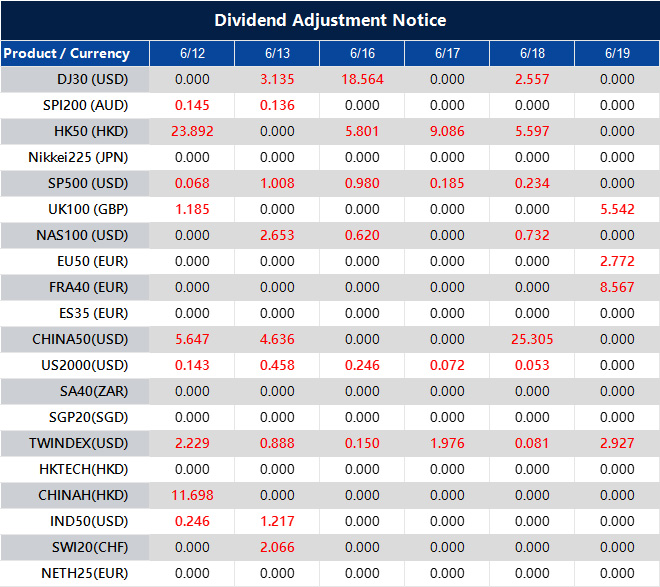

Dividend Adjustment Notice – Jun 12 ,2025

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].