Democratic Republic of Congo extends cobalt export ban, leading to sharp price increases

USD/CHF trades near 0.8170 as safe-haven demand increases after earlier gains

Rising mortgage arrears in Australia linked to high costs and interest rates affecting households

NZD/USD pair falls from yearly highs as it reacts to news about Iran

US Fed Influence

The USD is also gaining strength from the Federal Reserve’s hawkish signals. They forecast fewer rate cuts in 2026 and 2027, while still expecting two cuts in 2025. Meanwhile, the Reserve Bank of New Zealand is likely to lower interest rates due to falling inflation and economic issues caused by US tariffs. From a technical perspective, if NZD/USD drops below the short-term trading range and the 0.6000 psychological level, it suggests a downward trend. This view is supported as the market waits for upcoming US PMIs to provide new direction. The recent downward pressure on NZD/USD indicates not only a change in overall sentiment but also a significant shift in risk due to the latest geopolitical events. With tensions in the Middle East rising after US actions targeting Iran, traders are moving their money into safer assets. The US Dollar, typically the go-to asset in uncertain times, has benefited from this trend. When risk appetite decreases, currencies linked to commodities or global growth expectations, like the New Zealand Dollar, generally decline. Additionally, expectations around US monetary policy are helping the Dollar. The Federal Reserve’s guidance suggests a waning chance of prolonged easing, leading to continued strength for the Dollar. Although there may still be a couple of rate cuts next year, longer-term signs indicate the Fed is not in a rush to ease their tightening stance. This perspective keeps rates relatively high, providing ongoing support for the Dollar.RBNZ Perspective

On the other hand, the Reserve Bank of New Zealand (RBNZ) is on a different path. With inflation rates falling and new challenges from US trade policies, New Zealand may soon have to lower borrowing costs. The softening inflation could push policymakers to relax conditions, although this won’t happen immediately. This difference in direction is not favorable for the Kiwi. When we look at the charts, the importance of the 0.6000 level is clear. The recent breach below this threshold suggests a more sustained move downward. Hitting fresh monthly lows shows how shifted market sentiment has become. Support is not expected until closer to the 0.5900 area, where there’s historical buying interest. As for upcoming economic releases, Wednesday’s US PMI figures may create some volatility and lead to corrections if expectations aren’t met. Conversely, if the data remains strong and reaffirms a robust US economy, the Dollar could strengthen even more. Traders should keep an eye on supply chains and business orders, both of which indicate persistent inflation that the Fed will pay attention to. We anticipate continued high volatility. A tactical approach may be more effective in the near term, given the reliance on data for US monetary policy. It’s wise to set tighter stop-loss orders, especially below recent support levels, while monitoring short-term resistance near 0.5980 during any corrective rallies. In summary, without a significant easing of geopolitical risks or a major decline in upcoming US economic data, any rebound in the NZD/USD pair may be limited. Current positioning favors Dollar strength over Kiwi resilience in the immediate future. Create your live VT Markets account and start trading now.GBP/USD falls to around 1.3405 as safe-haven flows rise amid geopolitical tensions

Rising Tensions and Market Dynamics

The US has launched airstrikes on Iranian nuclear sites, escalating geopolitical tensions. President Trump announced that Iran’s facilities were “obliterated” and warned of more action unless Iran seeks peace. In response, Iran has pledged to retaliate, driving up demand for safe-haven assets. In the UK, retail sales fell by 2.7% in May, reversing a previous increase and putting pressure on the Pound. The Bank of England kept interest rates unchanged at 4.25%, with possible cuts in future meetings due to uncertain economic forecasts. The Pound Sterling is affected by the Bank of England’s policies and economic data. The Trade Balance is another factor that impacts the Sterling by influencing currency strength based on export and import differences. As GBP/USD trades lower around 1.3405 in early Monday sessions, new patterns are emerging that warrant attention. Increased demand for the Dollar, driven by geopolitical risks from US military actions against Iran, has led to higher volatility. This situation often pressures GBP-based pairs during uncertain times.Impact of Geopolitical and Economic Factors

The recent airstrikes have prompted Washington to intensify its warnings of further military options, while Tehran has vowed to respond. Consequently, markets are pricing in greater instability, which historically benefits the Dollar in times of tension. Although the current pricing of Cable reflects this, there are deeper issues at play. In the UK, the economy experienced a significant drop in consumer spending last month. Retail sales plunged by 2.7% in May, marking a major reversal from previous resilience. This decline puts additional pressure on growth forecasts and complicates future monetary decisions. The Bank of England decided to keep interest rates steady at 4.25% in its latest meeting. However, with slowing growth data and flattening inflation, speculation about a rate cut before summer’s end is growing. Markets have taken notice, with short-term interest rate futures adjusting prices, impacting institutional demand for the Pound in yield-seeking contexts. Later today, the purchasing managers’ index (PMI) reports will be closely monitored by institutional investors. PMI data for both manufacturing and services, covering the UK and the US, can significantly shift market sentiment if they differ from expectations, especially with current tight trading ranges. The market’s reaction will likely set the tone for the week. Moreover, Britain’s trade data remains crucial. A widening trade deficit, whether due to increased imports or declining exports, puts added pressure on the domestic currency. In light of disappointing retail figures, weak trade performance further paints a fragile economic picture that many did not anticipate weeks ago. All this underscores the focus on interest rate direction. If US indicators show continued strength and the Federal Reserve maintains a relatively hawkish stance, the differences in monetary policies between the US and UK will be hard to overlook. In this environment of short-term volatility and data releases, it’s vital to reassess risks and fine-tune exposure. Movements in GBP/USD are now more closely linked to macroeconomic updates than to technical factors. Timing market entries based on high-probability outcomes may yield better results than relying solely on static price levels. This week is expected to remain volatile. Keeping an eye on data releases and geopolitical events is crucial, especially during US afternoon sessions when Dollar trading volumes increase. Currently, the directional trend favors the Dollar, but its persistence will depend more on the length of this wave of risk aversion than on previous price levels. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – Jun 23 ,2025

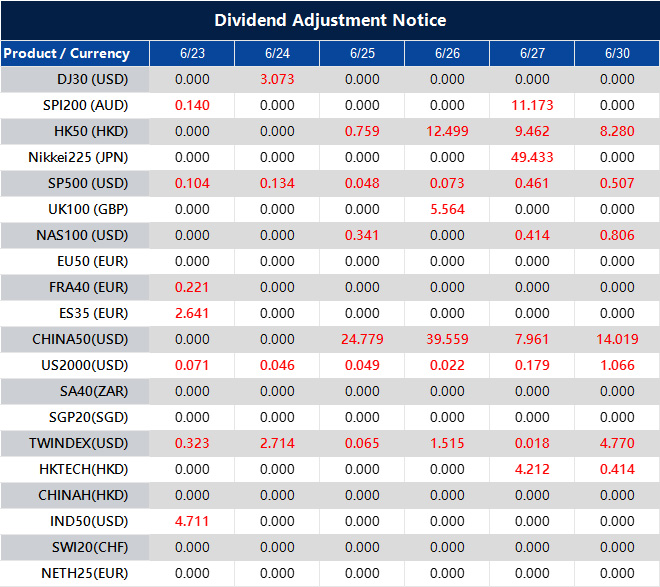

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].

The People’s Bank of China sets the USD/CNY reference rate at 7.1710, an increase from 7.1695.

Influence of the Chinese Communist Party

The PBOC is owned by the People’s Republic of China and is affected by the Chinese Communist Party. The current governor, Mr. Pan Gongsheng, also serves as the Secretary of the CCP Committee. The PBOC uses various monetary policy tools, including the Reverse Repo Rate, Medium-term Lending Facility, and Reserve Requirement Ratio. The Loan Prime Rate is crucial in shaping loan and mortgage rates, as well as the Chinese Renminbi’s exchange rates. China’s financial sector has 19 private banks, with WeBank and MYbank as notable digital lenders. In 2014, China allowed privately funded banks to operate, diversifying its state-dominated financial sector. The PBOC’s setting of the USD/CNY central rate at 7.1710 suggests a careful intervention. Although slightly higher than the previous rate, it’s well below the market expectation of 7.1914. This indicates a subtle effort to counteract depreciation pressures on the Renminbi while managing volatility. A rate below expectations usually signals that policymakers are wary of the yuan weakening too much, especially given the fragile consumer confidence and low export activity. The central bank’s decision shows a desire for stability. Instead of allowing the currency to drop further, they chose a more stable reference point. This can indicate a reluctance to let capital outflow concerns grow or to cause speculative issues. The central rate serves as a guiding tool. When markets receive a lower value than expected, it suggests a careful strategic approach. Gongsheng plays a key role in both policy implementation and party alignment, linking political goals with economic tools. Monetary decisions are generally influenced by domestic targets like GDP and employment, as well as managing systemic risks. The use of policy instruments like the Medium-term Lending Facility and Reverse Repo supports this approach.Adjustments and Financial Sector Dynamics

Recent cautious liquidity adjustments indicate that while easing may happen, it’s done with consideration of currency pressures. Although there’s ongoing talk of broad stimulus, the actions taken appear targeted, aiming to boost areas like infrastructure lending or support for small and medium-sized enterprises (SMEs) without causing broad inflation. This is evident in the stable Loan Prime Rate, which helps guide borrowing costs for households and businesses downwards. China’s financing model has evolved over time. The emergence of banks like WeBank and MYbank, along with the introduction of privately funded institutions since 2014, shows a willingness for reform. However, these new players still play a peripheral role, with state-linked lenders and policy intermediaries remaining dominant. In this context, any shifts in liquidity or capital flows need careful monitoring. While tools like the Reserve Requirement Ratio could change if growth declines sharply, current strategies focus on measured adjustments. This includes managing expectations regarding exchange rate flexibility, which is vital for exports and offshore derivatives. Practically, this means we should expect currency guidance to be used more openly, especially if foreign exchange reserves decline or trade data falls short of expectations. The Renminbi will likely be kept within specific limits rather than allowing quick, sentiment-driven changes. In the short term, anything related to USD/CNY fluctuations or offshore Renminbi instruments should be approached with caution, as Beijing isn’t ready for sharp disruptions. They appear focused on managing volatility rather than letting the market dictate outcomes. Thus, forward pricing or hedging strategies should account for tighter currency controls rather than unexpected shifts. We should also be alert to where foreign exchange pressures might arise if global sentiment on emerging markets changes. Monitoring signals from official sources and market indicators — especially swap rates and repo spreads — will help us understand how tightly liquidity is being controlled underneath the surface. Create your live VT Markets account and start trading now.WTI oil price nears $75.50 per barrel after US strikes on Iranian nuclear sites

Impact Of Potential Closure Of Strait Of Hormuz

Traders expect oil prices to rise even more because of fears that Iran might close the Strait of Hormuz, a crucial route for about 20% of the world’s crude oil supply. Even though there are alternative pipeline routes, a significant amount of oil may remain unexported if access to the strait is blocked. WTI Oil is produced in the U.S. and transported through the Cushing hub. It serves as an important benchmark in the oil market. Prices for WTI Oil can change based on supply and demand, political situations, and global economic factors. Weekly oil inventory reports from the API and EIA also influence prices by showing supply and demand changes. OPEC’s decisions, which involve major oil-producing countries, play a critical role in determining WTI Oil prices. The recent increase in WTI crude oil, which rose over 2% and settled around $75.50 per barrel, is linked to heightened tensions in the Middle East. This tension stems from U.S. and Israeli military actions targeting Iranian nuclear sites in Isfahan, Natanz, and Fordow. President Trump confirmed the strikes, describing them as a strategic response, which raised urgent concerns about oil supply. Iran’s strong condemnation of the attacks and its threat of retaliation poses a real danger to maritime logistics in the region, especially concerning the Strait of Hormuz. This narrow route is essential for transporting nearly one-fifth of the world’s crude oil. Although there are alternative pipeline options, they cannot fully compensate for a potential closure of this key maritime route. Consequently, the oil market is adjusting to this supply chain risk.Geopolitical Influence On Oil Pricing

We’ve seen this happen before—the markets react quickly when geopolitical events occur in key energy areas. As we move forward, contract holders should watch for changes in oil pricing, specifically looking for signs of increased short supply. If this trend continues over the next week, those positioned for tight supply could benefit. One aspect often overlooked during geopolitical events is how supply chains respond. Even without extended disruptions, market sentiment tends to stay high until political stability returns. This sentiment impacts refining margins and transportation costs, influencing how traders develop strategies around fuel derivatives and energy-related indices. Weekly inventory data from the API and EIA can provide temporary insights into domestic supply, but they likely won’t overshadow the broader geopolitical factors at play. For instance, last week’s unexpected drop in commercial stocks was largely ignored as traders focused more on long-term risks rather than short-term supply adjustments. Regarding policy, OPEC’s decisions will be under close observation. Their production quotas, especially from Gulf countries, may be revised if regional shipping faces new challenges or insurance costs rise. They might be willing to help address global supply imbalances, though any changes could lag behind spot market shifts. Since WTI is settled at the Cushing delivery point, it’s also important to consider how much crude from the Gulf Coast is redirected inland. This could widen the Brent-WTI spread again, creating opportunities for arbitrage or different hedging strategies. Pay attention to any significant build-up in Gulf inventories, which may ultimately affect price differentials. As traders adjust their positions using options and swaps, we see that volatility pricing is already indicating higher uncertainty in the future. Traders are reevaluating costs for near-date crude options, which are seeing price increases. There’s also a rise in AI-generated alerts for refining operations as companies respond to this price spike. In addition to traditional supply-demand analytics, keep an eye on freight rates, insurance costs, and geopolitical risk indices—data increasingly integrated into quantitative models. These factors can influence trading positions on ICE and CME-linked energy contracts and impact overall market liquidity. Create your live VT Markets account and start trading now.Week Ahead: Healthcare Bets Back On The Table

Healthcare shares are typically viewed as a defensive stronghold in turbulent times. Yet, the past year defied this expectation. The sector tumbled 29%, making it the worst performer across all S&P 500 categories. This surprising downturn has prompted traders to ask: What exactly went wrong, and could this pullback present an opportunity?

In general, healthcare firms fare well even during economic slowdowns. People continue to require medications, medical equipment, and hospital care regardless of economic conditions. With an ageing global population and rising incidences of chronic illnesses, demand for healthcare remains structurally strong.

However, despite these favourable long-term trends, the healthcare sector came under pressure over the past 12 months.

A primary driver of the decline was surging costs, particularly for large firms like UnitedHealth Group (UNH). Post-pandemic, more patients, especially older individuals, sought medical services than expected. This led to a rise in medical expenditure, compressing profit margins. Concerns deepened when UnitedHealth’s CEO stepped down, followed by the company cutting its earnings outlook for the year.

Even so, UnitedHealth continues to post solid top-line growth. Revenues climbed beyond $400 billion in 2023, although elevated costs have weighed on profits. Looking ahead, the firm aims to recalibrate premium pricing and rein in expenses to restore earnings momentum.

Its financial fundamentals remain robust. UnitedHealth benefits from strong cash flow to support dividends and operations. That said, traders should monitor its increasing debt load, which reached $76.9 billion, well above levels seen ten years ago. While debt-funded expansion may be strategically sound, prudent debt management remains essential.

For traders, UnitedHealth shares currently appear undervalued. With an intrinsic value estimated around $570 per share, its forward price-to-earnings ratio of 13.2 looks appealing. If cost controls succeed, its stock could rebound once temporary pressures abate.

Meanwhile, Novo Nordisk presents a contrasting picture. The Danish pharmaceutical powerhouse recorded strong revenue gains, primarily driven by its high-demand diabetes and weight-loss treatments. Profit margins stood at a remarkable 48%, outpacing many healthcare peers.

Nonetheless, Novo Nordisk faces risks stemming from lofty market expectations and reliance on regulatory approval of new drugs. Rising competition, particularly from Eli Lilly, could also challenge its future dominance.

In 2023, Novo increased its debt to over $14 billion after acquiring three Catalent manufacturing sites. While the move enhances production capabilities, it also introduces financial risks. However, Novo’s cash flow remains sufficiently strong to fund dividends and strategic investments.

Importantly, the company’s Return on Invested Capital (ROIC) consistently exceeds its cost of capital, an indicator of sound management. Analysts place its intrinsic share value at approximately $150, well above its current trading price of $80. Despite a higher forward P/E of 19.5, the valuation is justified given Novo’s superior growth outlook.

Given today’s macro backdrop, healthcare stocks could start drawing fresh attention. Ongoing trade tensions, persistent inflation, and waning global growth may remind investors of healthcare’s defensive appeal.

While the sector has recently faltered, underlying demand remains intact. For some traders, the current weakness could represent a prudent re-entry point.

Nonetheless, investors should remain vigilant to firm-specific risks, such as UnitedHealth’s mounting debt and Novo Nordisk’s regulatory exposure. Still, with attractive valuations and strong fundamentals, healthcare may gradually regain favour over the coming months.

Market Movements This Week

The US Dollar Index (USDX) recently rebounded from the 98.20 region but struggled to attract committed buyers. If this hesitation continues, the index could soften before attempting another move higher. Watch closely for potential support near 97.70. Should strength return, the next resistance lies around the 99.00 level.

EURUSD has broken above 1.15297, signalling possible upside momentum. However, resistance near 1.1550 may cap further gains. If prices retreat, keep a close eye on support around 1.1420.

GBPUSD encountered firm resistance near the 1.3510 zone. Traders should closely monitor for bearish signals around 1.3485, particularly if the market consolidates at current levels. In the event of further upward pressure, 1.3560 would become another critical resistance area. Conversely, downside movements will test supports around 1.3360 and possibly 1.3315.

USDJPY continues to move higher after pausing near resistance around 145.75. Potential bearish pressure may re-emerge around the 146.55 area, an important zone to monitor in upcoming sessions.

USDCHF currently sees limited selling activity around 0.8220. Prices could edge higher, targeting the 0.8200 level, but any new upward swing would likely invite fresh bearish activity at the 0.8220 level once again.

AUDUSD faces stiff resistance at the closely monitored 0.6500 zone. A critical test will be the upcoming encounter with its underlying trendline. Traders should be ready for decisive price action once this occurs.

NZDUSD has recently declined from the 0.6025 resistance area. Further downside pressure could test levels around 0.5940 or even down to 0.5900, presenting critical zones to watch for potential reactions.

For USDCAD, the 1.3715 area provided only minor resistance, suggesting upward momentum remains possible. Traders should carefully observe price actions approaching the next critical zone at 1.3795.

Turning to commodities, US crude oil remains volatile amid escalating geopolitical tension between the US and Iran. The next resistance to watch lies around the 83.90 mark.

Gold has stabilised at support near 3330, and upward momentum could see a test of resistance at 3410.

As for indices, the S&P 500 remains under pressure in light of geopolitical unrest. Key support to watch is the 5810 area.

In cryptocurrency markets, Bitcoin (BTC) declined sharply from the 106825 area, subsequently breaking below the 103358 support. The ongoing geopolitical tensions involving the US and Iran could intensify pressure on Bitcoin. If the critical low at 100396 breaks, traders should anticipate deeper consolidation or further downward moves.

Finally, Natural Gas prices sharply retreated after nearing the resistance at 4.06. Further consolidation at current levels could push prices toward a lower critical support zone at 3.57. Traders should watch for clear signals at this level for directional guidance.

Key Events This Week

On Monday, 23 June, attention turns to the Eurozone. Germany’s Flash Manufacturing PMI is forecast to edge up to 48.9 from 48.3, while Services PMI is projected to rise to 47.8 from 47.1. This slight improvement could offer the euro some support to start the week.

In the UK, expectations are for a small increase in Flash Manufacturing PMI to 46.9 (from 46.4), and Services PMI to tick up to 51.2 from 50.9. Better-than-expected readings may offer sterling a modest lift early in the week.

In the US, PMI data suggests a slightly softer outlook. Flash Manufacturing PMI is expected to fall to 51.1 (from 52.0), and Services PMI to 52.9 (from 53.7), potentially exerting downward pressure on the US dollar index.

On Tuesday, 24 June, Canada’s CPI (m/m) is forecast to rise by 0.5%, reversing last month’s -0.1%. This could initially push USDCAD higher, though a retracement may follow soon after.

Come Wednesday, 25 June, Australia will release its annual CPI figure, expected to remain steady at 2.4%. Traders should pay attention to the prevailing price structure around this event.

By Thursday, June 26, the US Final GDP quarterly data will be reported, holding steady expectations at -0.2%. This unchanged forecast prompts traders to focus closely on market structure and price patterns rather than expecting major volatility from this data alone.

Lastly, Friday, June 27, brings the US Core PCE Price Index monthly figures, expected unchanged at 0.1%. Like previous events, market participants should reference existing technical structures and cautiously gauge market reactions accordingly.

Overall, these economic updates provide crucial insights, helping traders navigate currency and equity markets with informed caution this week.

Create your live VT Markets account and start trading now.