JPY bulls show weak commitment despite strong domestic CPI and rising Middle East tensions

Calm news from the Middle East boosts risk assets and positively impacts the US dollar and equities

Gold prices decline in Pakistan, according to market data

Global Risk Sentiment

Global risk sentiment remains fragile due to trade uncertainties and geopolitical tensions, especially in the Middle East. Ongoing tensions between Iran and Israel, along with possible US involvement, raise fears of a broader conflict. The US Dollar retreated after recent market activities, which may help support commodity prices like gold. This situation suggests stability for gold prices, and some buying activity is expected as prices drop. Gold is often seen as a safe-haven asset during difficult times, and central banks are significant buyers. The price of gold is influenced by factors such as geopolitical stability, interest rates, and the strength of the US Dollar. Although the drop in gold prices seems small, it signals a shift in sentiment after the Fed’s recent announcement. By maintaining interest rates and indicating a slower timeline for cuts, the Fed showed concern about persistent inflation. Chairman Powell’s comments did not offer much hope for those anticipating quick monetary easing, as the projection for just one rate cut in 2026 and 2027 suggests.Geopolitical Risks and Market Sentiment

For traders of derivatives linked to commodities like gold, the Fed’s caution should prompt a reassessment of medium-term strategies. Although nominal yields haven’t dramatically increased, they remain elevated, limiting gold’s upside momentum in the short term, despite a weaker Dollar. Geopolitical risks are still high, particularly in the Middle East. Tensions between Tehran and Tel Aviv continue to dominate headlines, and potential American involvement keeps markets in a wait-and-see approach. This caution tends to increase demand for safe-haven assets, though recent reactions have been muted. Currently, we observe selective hedging rather than significant trading volume. Notably, the Dollar pulled back after the Fed’s announcement—possibly a minor correction or a reflection of revised rate expectations. This reduction has eased some pressure on Dollar-denominated assets, creating a supportive base for commodities. Gold tends to benefit when the Dollar weakens, as its price becomes more appealing internationally. A lower Dollar generally increases buying interest from non-US markets. Support levels are currently being tested, providing opportunities. While investments in physically-backed ETFs have slowed, market interest remains. Long-term buyers may not pursue recent highs but are often ready to re-enter at attractive price levels, especially if inflation persists and geopolitical tensions remain. If regional conflicts escalate, we can expect increased interest in defensive assets. Traders should prepare for wider bid-ask spreads in such scenarios, especially in times of low liquidity. Conversely, unexpected news from the next Fed meeting or signs of economic softening in the US could renew a dovish outlook, reviving bullish bets on gold. Sharp price changes are unlikely unless a clear trigger appears. For now, focus on where buying resumes. If prices test previous support zones and buying increases, it’s a reasonable opportunity for short-term trading. Caution is advised with leverage, particularly as macro risks rise and holiday trading volumes dwindle. Any short positions should be closely monitored and not left unattended if significant news breaks. Although gold remains within a broad trading range, we see early signs of accumulation at lower levels. Pay attention to shifts in open interest and how implied volatility reacts during significant intraday movements, as these often provide clearer insights than price alone. Also, keep an eye on the commitment of traders data—renewed long positions by large speculators often signal upcoming directional moves. Create your live VT Markets account and start trading now.The yuan’s reference rate is set at 7.1695, which is lower than the expected 7.1801.

PBOC’s Recent Actions

On that same day, 202.5 billion yuan worth of funds expired. This led to a total withdrawal of 41.3 billion yuan from the financial system. In simple terms, the PBOC actively manages the yuan’s value each day by setting a central rate and allowing slight fluctuations around it. This daily rate serves as a guide, letting the currency vary within a controlled range. The central bank’s recent liquidity strategy tells an important story. By pushing in 161.2 billion yuan with short-term reverse repos, which help alleviate short-term cash shortages, the PBOC also let 202.5 billion yuan mature. This resulted in a 41.3 billion yuan drop in available funds. These actions indicate that the bank is focusing on tighter conditions, aiming to manage speculation and control inflation rather than loosening monetary policies. For those tracking short-term interest rates and risks, these daily changes are significant. They may slightly raise short-term interest rates, impacting strategies like carry trades and overnight swaps. With the PBOC signaling tighter funding, it’s crucial to adapt strategies around yuan exposure in the coming days.Implications for the Economy

There’s also a hidden message about the yuan’s future. A lower net injection, along with controlled fluctuations, can signal a push for stability—often leaning toward strength, especially when combined with higher fixing rates. Observing how the midpoint rate behaves in the trading week could reveal the central bank’s near-term intentions. It’s less about reacting to the overall liquidity numbers and more about understanding the balance between money entering and leaving the system. Whether the daily net figure is positive or negative should guide strategies for leverage and holding periods. Caution is advised when holding onshore yuan through local contracts, as the authorities might not want to encourage too much yuan weakness, even as the dollar strengthens. As we monitor these liquidity operations, it’s wise to reconsider the costs of maintaining open positions in yuan-linked contracts. Changes in repo dynamics, particularly with 7-day rates, may alter forward pricing, affecting short-dated options and other time-sensitive contracts. A broader approach to loosening measures from Beijing is unlikely unless visible financial stress emerges. In conclusion, it’s essential to pay close attention to the PBOC’s daily operations rather than waiting for larger macro updates or meetings. Create your live VT Markets account and start trading now.Australian dollar strengthens after China’s interest rate decision, despite rising tensions in the Middle East

China’s Economic Indicators and Australia’s Employment

In May, China’s Retail Sales grew by 6.4% year-on-year, surpassing expectations, while Industrial Production increased by 5.8% year-on-year, falling short of forecasts. Australia experienced a slight job loss of 2,500 positions in May, keeping the unemployment rate steady at 4.1%. The US Dollar Index is around 98.60, showing a slight decrease. The Federal Reserve has chosen to maintain interest rates at 4.5%, although future cuts may rely on upcoming economic data. Tensions between the US and Iran persist, with reports hinting at potential US military action. Ongoing uncertainties about Iran’s nuclear program could impact future market movements, and traders are closely monitoring discussions from the US administration. Let’s focus on how different factors are interconnected. The Reserve Bank in Beijing’s decision to hold the Loan Prime Rates steady provided some predictability. What happened next? The Australian Dollar rose slightly, but this shouldn’t be mistaken for confirmed upward momentum. It simply bounced back within a previous range. When retail sales in China temporarily exceed expectations—like the 6.4% year-on-year increase in May—it usually indicates stronger consumer sentiment. However, the lower-than-expected industrial production growth at 5.8% offers a more sobering outlook. This balance between consumer spending and manufacturing output creates pressure on resource-linked currencies, particularly concerning export demand and overall investor interest in commodities, especially iron ore, which is crucial for Australia.US Dollar and Geopolitical Tensions

Looking at Australia’s own situation, employment numbers showed a slight decline with 2,500 jobs lost, yet the unemployment rate held steady at 4.1%. This indicates a level of stability or resilience within the domestic job market. Nonetheless, the small reduction in employment doesn’t provide the impetus for aggressive policy changes from the Reserve Bank of Australia. Meanwhile, the Fed decided to keep rates steady at 4.5%, a largely anticipated move. The key question now is whether we’ve reached peak rates and when a shift towards easing may begin. The Fed is framing future decisions based on economic data, keeping options open but not yet acting. The US Dollar Index around 98.60 suggests a minor pullback rather than a downward trend. It’s a calm period, but awareness is high. With the possibility of new military actions in the Middle East surfacing again, the broader implications cannot be ignored. Any escalation in this region, especially affecting energy supplies, could give the Dollar a solid boost. Historically, such situations lead to increased demand for safe-haven assets, often benefiting the greenback. Concerns about Iran’s nuclear ambitions do not exist in isolation; they directly impact commodity prices and overall market sentiment. As discussions among policymakers intensify, reactions in treasury and derivative markets are likely to become sharper. There’s no neutral ground here—traders will remain cautious until there’s more clarity. In summary, market pricing will heavily depend on interest rate expectations and geopolitical developments. We are watching both ends of the spectrum: short-term bets related to oil prices and long-term options reflecting central bank strategies. In options markets, we see minor adjustments in premiums, indicating a wait-and-see approach rather than strong directional trends. Overall, while the AUD/USD has gained some ground, the broader picture—soft job numbers, uncertainty around China’s manufacturing, and risks of US military involvement—suggests it’s wise to adjust risk profiles for potential challenges rather than pursue short-term gains. Volatility isn’t absent; it’s just compressed and may emerge quickly. Create your live VT Markets account and start trading now.The People’s Bank of China keeps the Loan Prime Rate steady, meeting market expectations and promoting stability

Gold prices in India have declined, according to recent data analysis from various sources.

Gold’s Relationship with Other Assets

Gold typically moves in the opposite direction of the US Dollar and US Treasuries. When these assets lose value, gold often increases. Its price is affected by global events, interest rates, and shifts in currency values, notably the US Dollar. Pricing is based on adjusting international rates to the Indian Rupee and local standards. Although prices change daily, there may be slight differences from local rates. Factors like market conditions and currency exchanges influence gold prices, so thorough research is essential before investing. The recent decline in gold prices, seen in both per-gram and per-tola rates, may be a response to broader economic changes, particularly the strengthening of the US Dollar and stable Treasury yields. As gold usually moves against these trends, this dip follows typical patterns. Those monitoring price movements for short-term trading should assess whether this drop is just a pause or signals a trend change in the coming weeks. Historically, central banks in non-Western countries have accumulated gold, and the addition of 1,136 tonnes in 2022 was intentional. Policymakers recognize gold’s defensive advantages. This institutional demand tends to be focused on the long term and does not directly affect daily prices but can provide support during deeper declines. However, unless there’s an outside shock, this demand won’t significantly impact short-term price movements.Impact of Exchange Rate Changes

Exchange rate volatility is also important to consider. When the Rupee weakens, even steady or slightly falling international prices can lead to higher local prices. Currently, domestic rates are decreasing, suggesting either a stable or stronger Rupee or a sharper decline in global prices compared to exchange rates. We need to closely follow central bank statements and US macroeconomic updates to see if this trend continues or reverses. Price movements related to the Dollar are a key factor. If data continues to indicate a tight monetary policy in the US, then a hawkish stance from Washington could further suppress non-yielding commodities. A cautious approach might involve gradually entering the market rather than expecting immediate support. There’s no gain in overcommitting when key support levels haven’t been tested adequately. Additionally, geopolitical factors can create volatility in precious metals. Upcoming elections and possible international tensions should be monitored. While they may not immediately affect gold prices, they can trigger sharp reactions if risk sentiment changes. During such times, liquidity and leveraged positions can lead to unpredictable price behavior, impacting spreads and pricing during off-hours. It’s better to refine entry points rather than react impulsively. Indian gold prices reflect more than just global rates; local premiums, taxes, and spikes in consumer demand — especially during festivals or seasonal changes — should be taken into account. While these factors can offset broader trends, current seasonal demand isn’t strong enough to counter external pressures. Patience is key; wait for signs of stabilization or capitulation before adjusting your strategy. Recent data suggests we are in a phase where sentiment is shifting and expectations are adjusting, particularly among funds sensitive to interest rate changes. Therefore, it’s important to monitor sentiment indicators and shifts in open interest alongside price movements. This combination often provides earlier signals of change than price alone. Create your live VT Markets account and start trading now.The GBP/USD pair is rising, meeting initial resistance at the nine-day EMA of 1.3501.

Pound Stabilizes After Four-Week Low

The GBP/USD rose for the second consecutive day, trading close to 1.3500 during Asian hours on Friday. The pair showed a bullish trend, with the 14-day RSI above 50. However, it remained below the nine-day EMA, indicating weaker short-term momentum. On Thursday, GBP/USD bounced back above 1.3450 after a dip near 1.3400. This movement occurred as US markets paused for a holiday, easing some pressure on the US dollar. The Pound stabilized after hitting a four-week low of 1.3383, gaining strength following the Bank of England’s rate decision. Geopolitical uncertainties added pressure on the pair, while the US Dollar continued to rise. The BoE’s choice to keep rates unchanged, influenced by rising oil prices and tensions in the Middle East, reflects a weakening UK labor market. This raises concerns about potential rate cuts, keeping the financial landscape in focus. Sterling’s slight recovery, spurred by the Thanksgiving lull and reduced USD buying, doesn’t necessarily signal renewed optimism about the UK economy. It seems more like a temporary release of pressure due to thin liquidity and lower market participation rather than a solid bullish outlook. The Bank of England’s decision to maintain rates was not surprising, but the cautious tone caught attention. The divide among policymakers highlights worries about wage growth and slowing hiring trends, which are starting to affect monetary policy. Interestingly, the increase in GBP/USD happened despite no policy changes, showing how quickly sentiment can shift when market activity is low.Brent Highlights Inflation Expectations

The RSI remaining above 50 suggests continuing demand, but the failure to break above short-term averages dampens enthusiasm. This scenario indicates that traders have a slightly positive outlook but lack strong commitment—momentum appears weak. In short, the appetite for trading is careful, not aggressive. Brent prices remaining high have drawn attention to inflation expectations again, particularly in the energy market. While this typically supports rate-sensitive pricing, the BoE’s caution suggests that inflation alone may not warrant rate hikes, especially with the labor market softening. This brings discussions about potential rate cuts into sharper focus as we approach year-end. With GBP/USD hovering around 1.3500, a solid trading range is forming between 1.3400 and 1.3550. Breaks outside this range could encourage bolder trading, but as things stand, rallies are struggling to gain traction. For those monitoring the derivatives market, implied volatilities can be quite useful here. The demand for downside protection hasn’t surged, indicating that market participants are not anticipating drastic changes—at least, not yet. Still, there’s a notable lean toward GBP puts, particularly for shorter-term contracts. Recently, the yield gap between UK gilts and US Treasuries has narrowed, but this lack of correlation shows that broad dollar sentiment is still a major driver. GBP/USD seems to react more to external flows than domestic data. Caution is advised not to overemphasize BoE narratives unless they diverge significantly from expectations. The geopolitical backdrop adds another layer of complexity. While oil’s influence on headline inflation is significant, it seems that risk appetite is becoming more reactive rather than anticipatory. Movements in GBP/USD that align with oil price shifts tend to be temporary, fading quickly as larger macro themes come back into play. In terms of positioning, there is no strong evidence yet of a fundamental shift in sentiment. Commitment of Traders data shows that large speculative accounts are holding balanced positions, reducing both long and short bets slightly. This suggests that major players are taking a wait-and-see approach. As we enter December, quieter trading periods can lead to exaggerated price movements. This uncertainty promotes a focus on gamma flows and event-driven swings, with expectations for ranges to hold unless a significant catalyst shifts sentiment. That catalyst could come from NFP reports, inflation data, or unexpected central bank comments. The strategy here may be to trade around clear levels, observe shifts in implied volatility, and avoid getting caught up in broader macro narratives that aren’t currently influencing price action. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – Jun 20 ,2025

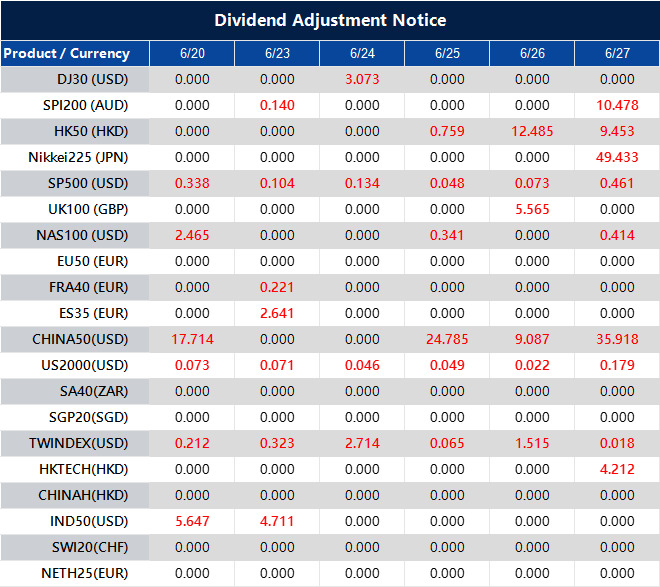

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].