Halifax reports a monthly decline in house prices, showing stability despite affordability challenges and interest rate uncertainties.

FX options set to expire include various currency pairs with amounts tied to price levels.

Japan’s April leading economic index misses expectations due to trade uncertainty and inflation concerns

Economic Indicators Overview

The leading economic index helps us predict Japan’s economic trend over the next few months. A drop to 103.4, below the anticipated 104.1, suggests potential economic weakness ahead. The previously reported figure of 108.1 was revised down to 107.6, reinforcing the idea that optimism may have been too high. The coincident index shows the current state of the economy. It decreased slightly to 115.5 from a revised 115.8. Although this is just a small decline, it indicates that recent economic performance may be slowing. When both leading and coincident indicators drop at the same time, it often signals a cooling momentum. We should remember that the Bank of Japan’s policy decisions are influenced by how inflation behaves and the progress of trade discussions. The latest figures suggest there will not be quick changes in interest rates. Policymakers are taking their time, and that’s the right approach.Market Implications and Outlook

This weaker data from Japan suggests a cautious approach for investors. The lower-than-expected leading index reading may prompt revisions in interest rate exposure. Historically, when indicators dip early in a tightening cycle, yield curves tend to shift lower. Therefore, we should approach changes in interest-rate differentials with caution. In the coming weeks, markets will determine whether this soft data is a temporary blip or the start of a deeper slowdown. For now, we prefer to pay close attention to sentiment from Tokyo instead of chasing uncertain trends. The messaging from the central bank will likely be more influential than any new data. It’s important to note that recent adjustments are not just numbers—they also indicate delays. Revisions—like from 108.1 to 107.6—affect our baseline. While these changes may not grab headlines, they influence expectations, particularly in yen-related carry trades. We don’t anticipate chaos, but we are closely monitoring forward rates and risk premiums. The drop in these indices will likely keep a check on any aggressive re-pricing. Current spreads are telling their own story, indicating no expectation of sharp shifts. Overall, local rates and FX valuations are unlikely to change drastically unless a surprising new indicator emerges. Practically, this means we should adopt defensive hedges and avoid excessive exposure ahead of the Bank of Japan’s next meeting. Right now, we are more focused on how volatility markets are adjusting rather than on price movements. The price action might lag behind signals but not by much. Create your live VT Markets account and start trading now.European session has low-tier data, while the US may show important employment figures and trends.

China’s central bank unexpectedly injects 1 trillion yuan to ease rising liquidity concerns among banks

Anticipated Liquidity Support

Additional liquidity support is expected in June to help banks lend more and ensure smooth government debt issuance. This action is not just a routine cash operation; it’s a proactive approach to stabilize borrowing markets during tougher economic conditions. The People’s Bank of China speeded up both the timing and amount of their support, injecting almost $140 billion through an unusual window. They are using three-month reverse repurchase agreements, where banks sell securities to the central bank and agree to buy them back later. The aim is clear: make short-term cash more accessible as pressures begin to rise. The increase in financial stress didn’t happen overnight. With over four trillion yuan in short-term bank debts due in June through certificates of deposit, the central bank’s intervention was timely and strategic. Rising interbank borrowing costs indicate that banks are starting to protect their liquidity. This early cash injection is designed to prevent potential issues before they escalate. Interestingly, last month’s sale of 50-year bonds—rare due to their long duration—saw yields increase for the first time in a year and a half. This reflects a decreased appetite for long-term government bonds given current interest rates, as investors sought higher returns for such long maturities. This context shows why action is being taken now.Setting For Financial Control

This situation suggests a broader strategy for maintaining control. With more government bonds set for auction and signs of tighter credit conditions, this cash injection serves multiple purposes. It’s about preventing disruptions in the repo markets and stabilizing lending rates, while also ensuring smooth fiscal issuance in the coming weeks. By injecting liquidity early, authorities reduce the risk of pricing volatility when significant public borrowing occurs. This can be viewed as a signal to the financial system that the trends from April and May are being monitored. It also invites consideration of where short-term policy operations might head next, and whether long-term inflation expectations are truly stable, as some believe. With central planners willing to adapt their usual strategies, previous assumptions about timing and amounts may need to be reevaluated. Create your live VT Markets account and start trading now.Japan’s Ministry of Finance may change its bond strategy to focus on shorter maturities due to weakening demand.

JP Morgan revises prediction for ECB’s next rate cut to September

Changing Economic Signals

The shift from July to September indicates a shift in how economic indicators have been viewed recently. Early predictions suggested a quicker rate reduction, but new data hasn’t given central bankers the confidence to act fast. For example, inflation rates are still higher than desired, and wage pressures in some eurozone countries are keeping prices steady. Additionally, unemployment remains low, reducing the urgency for immediate policy changes. Differing opinions on whether current inflation levels will last have led strategists to adjust their forecasts. Policymakers seem to prefer taking their time, wanting more data before deciding on easing financial conditions that could spark unwanted inflation. They seem to favor confirming trends over relying on temporary relief signs. For those involved in derivatives, this delay alters how we plan in the near and mid-term. Expectations for rate cuts this summer need to be toned down, and preparing for the September meeting is now more important. Volatility in interest rate futures and options may rise as market participants update their strategies. The period from now until late September will be crucial, with increased market sensitivity to small changes in CPI and policy discussions.Market Reactions

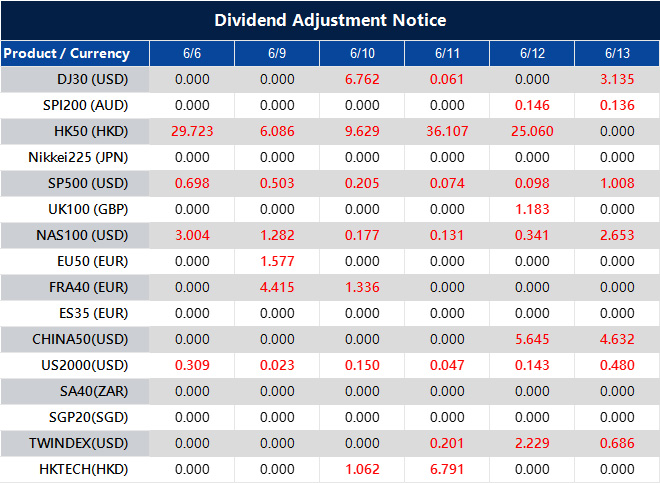

Lagarde and her team likely won’t diverge much from the consensus, but any slight changes in their tone—like a more cautious stance or hints at future guidance—could lead to big reactions in interest rates and foreign exchange markets. Currently, monetary conditions are already tight compared to historical standards, and without a clear direction, it’s challenging to manage duration confidently. We must be more precise with timing and exposure. While the expected easing cycle is still in place, its pace is now in doubt. Strategies involving flatteners or steeper curve plays may need adjustments; those looking to buy short-term volatility should rethink their strike selections. Strategies based on a July cut in short-dated contracts should adapt as trading volume shifts toward later dates. Ultimately, movements in the markets this summer will depend more on concrete data releases than statements from policymakers. Pricing models should move from prediction-based to response-based. With fewer assumptions and more control over scenarios, we shouldn’t expect the markets to remain quiet until the ECB meets in September. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – Jun 06 ,2025

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].