The dollar’s recovery follows last week’s decline, driven by dovish Fed expectations and market complexities.

The EU plans to quickly remove tariffs on US goods in response to Trump’s requests and conditions.

Market Sentiment Shift

The news about the EU possibly acting fast to cut tariffs on US industrial goods suggests a big change in market sentiment. This could help ease trade tensions that affected German auto exports to the US, which dropped by over 8% year-over-year in the first half of 2025, according to VDA data. If the new 15% auto tariff is backdated to August 1, it could significantly boost third-quarter earnings for major car manufacturers. For traders, this indicates a positive outlook for the European auto sector and the German DAX index, which has underperformed the S&P 500 by nearly 4% this year. We should consider buying near-term call options on companies like Volkswagen and Mercedes-Benz, as their stocks react strongly to US tariff news. Additionally, trading DAX index futures could be a direct strategy to benefit from a broader European recovery linked to this news. If the deal goes through, the Euro may strengthen against the US dollar, reversing some earlier summer losses. Implied volatility on EUR/USD options has risen to 8.2%, above its three-month average, creating an opportunity. Selling EUR/USD put options could be a good way to express a positive outlook on the Euro while taking advantage of higher premiums.Volatility and Risk Management

If a deal is officially announced by the end of the week, we can expect a sharp drop in market volatility. The VDAX-NEW, which measures DAX volatility, is currently high due to uncertainty around this trade issue. Selling straddles on the index may be profitable, as it bets on volatility decreasing and the market settling at a higher trading range after the positive news is factored in. However, there is a risk that this proposal could fail, similar to the breakdown in talks we saw in late 2024. Any political pushback within the EU could derail the deal and trigger a rapid reversal. Thus, holding some inexpensive, out-of-the-money DAX put options as a hedge in the coming weeks would be a wise precaution against negative surprises. Create your live VT Markets account and start trading now.Bitcoin’s price is affected by Fed expectations and upcoming US employment data, influencing market trends.

US Non-Farm Payroll Report Anticipation

Attention now turns to the upcoming US Non-Farm Payroll report, which could really impact interest rate expectations. Strong data could reduce the chances of a rate cut in September, putting short-term pressure on Bitcoin. On the flip side, weak data might increase bets on a more dovish monetary policy, potentially helping the cryptocurrency. Currently, Bitcoin is trading below the important support level of $111,900. Sellers aim to push the price down to $100,000, while buyers hope for a rise above $111,900 to trigger a rally towards $123,000. On shorter timeframes, downward and upward trendlines are visible, with sellers focusing on bearish trends and buyers pursuing upward momentum. Upcoming reports like Jobless Claims and the PCE price index will be crucial for market direction. These will help decide if the market will support an upward or downward trend. Bitcoin’s recent drop is surprising, especially after the dovish signals from the Federal Reserve on August 22nd. Even with an 84% probability for a rate cut seen on CME’s FedWatch Tool, the price couldn’t hold its gains and broke key support. This suggests that the market is currently prioritizing factors beyond just monetary policy.Bitcoin Futures and Market Trends

The price is now below the key $111,900 level, which is acting as resistance. We have observed a rise in put option volume on exchanges like Deribit, with significant interest in contracts expiring in September at the $100,000 strike price. This indicates that traders are hedging or positioning themselves for a potential drop to that psychological support level. For those who expect a further decline, the downward trendline on the 4-hour chart is an important area to watch for signs of weakness. A possible strategy involves taking short positions with a defined risk set just above the $111,900 resistance. This selling pressure is supported by data showing a 12% decrease in Bitcoin futures open interest over the past week, indicating that some long positions have been closed. On the other hand, bullish traders need to see a strong break and consistent trading above $111,900 to regain market control. A move like this could lead to a short squeeze and open the way to the $123,000 target. Buyers might consider the minor upward trendline on the 1-hour chart as a potential entry point for a short-term bounce. All eyes are now on the Non-Farm Payrolls report set for next week, on September 5th. Given mixed economic signals earlier this summer, this jobs report will play a key role in influencing the Fed’s next decision. A strong report could lower the likelihood of a September cut and put pressure on Bitcoin, while weak data would likely support dovish bets. Before that key report, we’ll receive the PCE price index this Friday, the Fed’s preferred inflation measure. We’ll also see the latest jobless claims figures tomorrow. These updates will help refine expectations and could lead to short-term volatility ahead of the important jobs data next week. Create your live VT Markets account and start trading now.Nasdaq rises on Powell’s comments, boosting hopes for rate cuts and impacting market dynamics

Key Developments In The Market

Important events include Nvidia’s earnings release and the US Jobless Claims data, with the US PCE price index coming out later this week. These factors are likely to influence market trends soon. The recent statements from the Federal Reserve have changed the market outlook and created a favorable atmosphere for the Nasdaq. Currently, the market anticipates an 84% chance of a rate cut next month, based on the latest data from the CME FedWatch tool. This easing sentiment will likely shape our short-term trading strategies. All attention is now on the upcoming Non-Farm Payrolls report, which could be a key turning point. After July’s unexpected report, which revealed 215,000 jobs added, economists predict a lower figure of 160,000 for August. Any significant deviation from this forecast could lead to a sharp market movement, making long volatility strategies such as straddles on the QQQ ETF worth considering.Technical Analysis Considerations

From a technical perspective, we are closely monitoring the 23,375 level as a crucial support point for the Nasdaq 100 index. Selling out-of-the-money put options with strike prices near or below this level may be a good way to earn premium while the easing sentiment lasts. If the market continues to rise toward the 23,650 resistance, we should brace ourselves for some profit-taking. The Nasdaq’s volatility index, the VXN, has dropped to 14.5, which is low compared to earlier in 2025. This makes buying protective puts or even speculative call options relatively inexpensive. Given how quickly sentiment shifted in spring 2024, it’s wise to maintain downside protection even in the current bullish environment. The Nvidia earnings report later today poses a significant risk for the tech sector. Implied volatility for Nvidia options expiring this week has risen above 90%, indicating a strong expectation of price movement. Traders should note that a major surprise—positive or negative—could not only impact Nvidia but also cause the Nasdaq 100 index to open with a significant gap tomorrow. Create your live VT Markets account and start trading now.UBS reports a decline in Swiss investor sentiment due to US tariffs on exports affecting forecasts.

Bearish Signals for Swiss Assets

With sentiment in Switzerland falling drastically, we see clear bearish signs for Swiss assets. This suggests strategies that could benefit from a decline, especially for the Swiss franc (CHF) and the Swiss Market Index (SMI), the country’s main stock index. The negative outlook is expected to worsen as the market absorbs the full effects of the US tariffs. A direct approach is to focus on the currency. We might consider purchasing put options on the CHF against the US dollar, expecting further weakness as demand for Swiss exports shrinks. Past trade tensions, especially in the late 2010s, showed how tariff announcements could lead to sharp currency moves, and it’s unlikely the Swiss National Bank will support a weakening franc. The SMI includes major multinational exporters like Nestlé, Roche, and Richemont, all of which will feel the impact of the new US tariffs. Thus, buying put options on SMI-tracking ETFs or shorting SMI futures offers a direct way to trade on this negative sentiment. Swiss exports to the US exceeded 60 billion francs annually in the early 2020s, especially in pharmaceuticals and watches, emphasizing the vulnerability of these major companies.Market Volatility and Opportunities

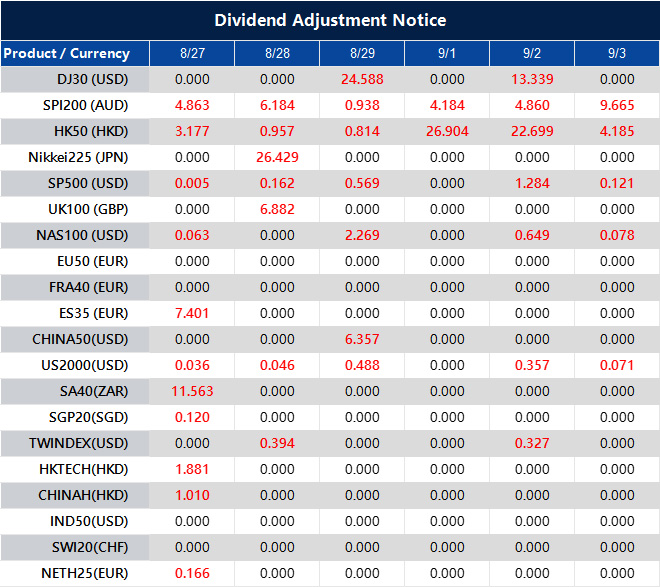

This significant decline in sentiment indicates that uncertainty and market volatility are on the rise. We should pay attention to the Swiss Volatility Index (VSMI), which usually spikes during economic shocks. Buying call options on the VSMI or employing option straddles on the most affected export-oriented stocks could yield profits from the expected price swings. Additionally, this situation presents relative value opportunities, comparing Swiss assets to those in Europe. As capital likely moves out of Switzerland in search of stability, we may see the EUR/CHF exchange rate increase. A pair trade—going long on a broad European index while shorting the SMI—could protect against broader market risks while targeting the specific damage to the Swiss economy. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – Aug 27 ,2025

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].