GBP/USD shows resilience near 1.3570, but analysis suggests the bullish trend may weaken

China NBS spokesperson emphasizes need for stronger economic recovery foundation amid uncertainties

Challenges in the Labour Market

Even though prices are low overall, this is affecting businesses, jobs, and incomes. Some sectors are struggling to find workers, and certain groups are facing job pressures. The tricky external environment is impacting China’s labour market. Uncertain trade policies have made it tough for China to keep steady economic growth since the second quarter. In May 2025, China’s industrial output grew by 5.8% compared to last year, which is slightly below the expected 5.9% and down from 6.1% previously. However, retail sales in May saw the fastest growth since December 2023. This summary shows a mixed but revealing view of China’s current economy. On one side, new data indicates stronger retail sales, likely boosted by online discount campaigns, showing there’s still consumer interest. But, the increase in retail sales isn’t seen equally in other key areas. Industrial production rose by 5.8% year-on-year, falling short of predictions and signaling a slight slowdown. Although this difference seems small, it suggests the economy is not moving forward uniformly across sectors. Divergence between manufacturing and services can lead to volatility in capital flows.External and Internal Pressures

Consumer demand seems stable, but low prices and weak inflation hint at underlying issues: producers are struggling. If companies are lowering prices just to sell their goods or meet weak demand, this can hurt wages, hiring, and long-term profits. Recruitment challenges in key sectors reflect a broader slowdown in job growth. We cannot overlook the external uncertainties—much of this stems from unclear global trade guidelines and geopolitical tensions. Changes in demand from other countries and shifts in global sourcing have complicated growth planning. This mix of persistent and temporary challenges has required ongoing action from policymakers. Officials have already shown they are ready to adjust fiscal support and monetary policies. This proactive approach is common in times of uneven growth. However, just because these tools are available doesn’t mean they will work effectively—especially when confidence is fragile and financial markets react more to news than fundamentals. Looking ahead, we should prepare for more fluctuations in manufacturing output, shipping, and domestic demand metrics. Any plans depending heavily on industrial growth to boost the short-term economy need to consider new disruptions—especially in sectors sensitive to commodity prices or slim profit margins. By keeping an eye on monetary policies and public spending shifts, we can identify where the next round of support might emerge. Typically, there’s a delay between policy changes and their effects on the economy—this lag creates vulnerable moments when volatility can increase. Limited liquidity—often seen in Asian markets during summer—can make things worse. When momentum seems broad but data tells a different story, it may be safer to limit short-term risks. Focusing on steady but selective demand—especially where consumer reliance is on imports rather than local sources—may offer more reliable guidance. While opportunities will not vanish, they might be less noticeable due to differences in data timing and policy responses. In the end, retail figures may capture attention, but issues in employment and capital formation will have a greater impact on medium-term stability. Investors should pay closer attention to labour market indicators than to broad headline indices. As Li’s team continues to enhance stimulus efforts, it’s not just the scale of policy that matters, but also how quickly it’s implemented that will shape reactions. Short-term optimism should not overshadow the areas of deceleration that have already emerged. Economic indicators can be like streams under ice: calm on the surface, but deeper movements can reveal the true direction. Create your live VT Markets account and start trading now.Despite a small increase in the USD, the USD/TWD pair remains below 29.50 due to a lack of buyers.

Fed Meeting Outlook

Investors are cautious ahead of the Federal Open Market Committee’s two-day meeting. Any rate cuts by the Fed in September could lead to further losses for the USD/TWD pair. The Federal Reserve directs US monetary policy, adjusting interest rates to respond to the economy. It holds eight meetings a year to make these decisions. The Fed uses quantitative easing to boost credit during downturns and quantitative tightening to restrict it, which generally strengthens the USD. This information carries risks and uncertainties and is for informational use only. Investors should do thorough research before making decisions. The authors are not responsible for any investment results stemming from this information. Despite trading below the 29.50 mark, traders are observing downward movements, even with a slight increase in Dollar demand. Although this seems contradictory, the broader market sentiment around trade relations and tech momentum provides clarity.Trade Sentiment and Tech Sector Influence

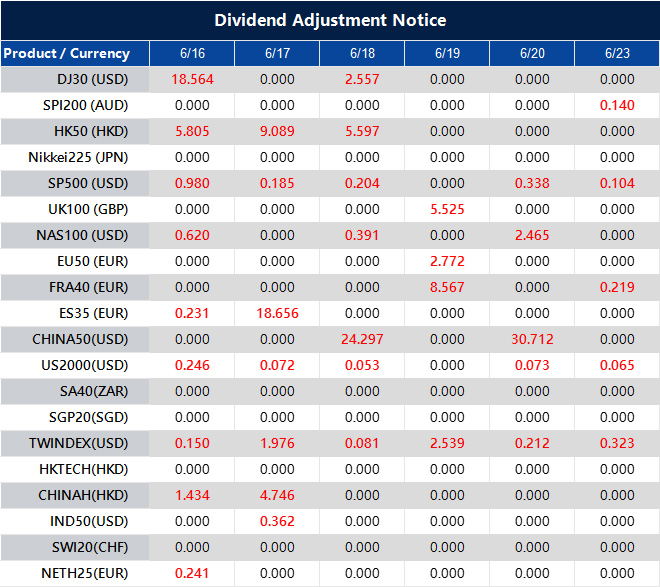

Optimism about easing trade tensions between major economies supports regional currencies, particularly the Taiwan Dollar. Recent gains in prominent US tech stocks also affect currency flow, leading to shifts that don’t reflect short-term Dollar strength. Many expected a stronger Dollar, but underlying market forces are changing quickly. Looking ahead, traders are adjusting to the upcoming Fed discussions. These meeting often cause quick changes in expectations, especially when new policies differ from previous views. Current positioning suggests that traders expect possible rate changes as early as September, depending on upcoming labor data and inflation. While current rates may hold, soft signals from the Fed could lean the bias against the Dollar, especially for this pair. The Federal Reserve employs several key policy tools, the most obvious being the benchmark interest rate. However, its balance sheet actions are also important. When the Fed expands its balance sheet to support liquidity, it often loosens financial conditions, which usually eases upward pressure on the Dollar. Reducing the balance sheet generally tightens capital in the system, strengthening the Dollar. Right now, it looks like markets are anticipating a more dovish stance from the Fed, driven by external positivity rather than internal weakness. If the upcoming statements reflect a softer tone, this bias could deepen, especially if inflation numbers stay stable. This would indicate a gradual return to normal policy. It’s crucial to monitor not just formal policy decisions but also the tone of recent Fed speeches. Any indications of patience or a focus on data could weigh more heavily than forecasts imply. Therefore, adjustments should consider changes in timing for future rate decisions. Additionally, volatility in the derivatives market may start to reveal a more asymmetric risk profile if these trends continue influencing rate expectations. These evolving factors are already being priced in, meaning current levels may not fully capture anticipated outcomes. Staying flexible with positions, especially in shorter-term instruments, could be more beneficial than relying solely on Dollar sentiment. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – Jun 16 ,2025

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].