Market analysis shows bearish pressure on the S&P 500, highlighting key trading levels

Eurozone’s Q2 GDP grew by 0.1% quarter-on-quarter and 1.5% year-on-year, unexpectedly.

Economic Indicators

Gross fixed capital formation dropped by 1.8% in the euro area and 1.7% in the EU, moving away from earlier gains. Exports fell by 0.5% in the euro area and 0.2% in the EU, reversing prior growth. Imports stayed the same in the euro area but grew by 0.3% in the EU after previous increases. Markets are now looking ahead at economic forecasts rather than focusing on past quarterly data. The Eurozone’s 0.1% growth in Q2 confirms the slowdown we expected after the +0.6% growth recorded in Q1. This stagnation is largely due to a big drop in business investment and falling exports. The data indicates the economy is struggling, relying mainly on government spending. Looking forward, weak performance is supported by recent indicators. The flash manufacturing PMI for August 2025 fell to 48.5, marking its third month in downturn territory. This suggests the weakness from Q2 has likely worsened in Q3.Central Bank Challenges

This situation poses challenges for the European Central Bank (ECB). After raising its key deposit rate to 3.0% in July 2025, the market may now expect no further rate hikes and even consider possible future cuts. We believe the ECB’s tough stance is no longer credible given the current economic climate. For equity index traders, a cautious approach with instruments like the EURO STOXX 50 is advised. Buying put options could be a good hedge against a downturn as corporate earnings forecasts are officially lowered. The significant 1.8% decline in capital formation is a strong warning sign of future weakness. This data suggests higher volatility in the coming weeks. A similar situation was seen in the 2011-2012 period when slowing growth data led to a spike in the V2X index. Traders should brace for wider trading ranges and more unpredictable markets. Overall, this environment is negative for the Euro, making short positions in EUR/USD futures or buying put options appealing. On the other hand, we expect German bund futures to perform well as investors seek safety and anticipate a softer ECB. The trend for yields seems to be downward from here. Create your live VT Markets account and start trading now.Retail sales in Italy held steady in July, defying expectations, with varying performance across categories.

Year-On-Year Sales Growth

Compared to last year, retail sales climbed 1.8%, up from a previous estimate of 1.1%. In comparison to July 2024, large-scale distribution saw a 2.8% increase, small-scale retail rose by 0.6%, and non-store sales went up by 0.9%. Online sales grew by 2.9% year-on-year. Among non-food items, cosmetics and toiletries increased by 3.7%, while electric household appliances and audio-video equipment dropped by 3.1%. The lack of growth in Italian retail sales is concerning. It indicates that European consumers are losing steam. This flat performance, below expectations, suggests our earlier hopes for a strong third quarter might not be realistic. This serves as a warning sign for European stocks focused on the domestic market. Consumer weakness stems from the European Central Bank’s policies, which have kept interest rates above 3.5% for over a year. This data could push the ECB to consider rate cuts sooner than expected, possibly before the end of 2025. This is different from the US Federal Reserve, which is taking a more cautious approach.Bearing In Mind Market Volatility

The Italian report isn’t alone; it follows last week’s news of a decline in Germany’s manufacturing PMI, which dropped to 48.5. Together, the slowing Italian consumer and weak German industry create a gloomy outlook for the Eurozone. We are entering a period of slowdown that seems to be quickening as autumn approaches. In light of this, buying put options on the FTSE MIB index may be wise, as it is highly influenced by domestic demand and the banking sector. The weak growth in retail suggests that the actual economic activity is weaker than reported. Historically, these kinds of discrepancies, similar to those seen in the slowdown of 2023, often foreshadow market corrections. This uncertainty can also lead to increased market volatility. The VSTOXX index, which measures volatility in Europe, has already risen to 15.6 this morning due to this news. Buying call options on the VSTOXX for October 2025 could be a smart way to benefit from the expected increase in market fluctuations. Moreover, the data is likely negative for the Euro. With a dovish ECB expected, we should consider short positions against the US dollar. Purchasing EUR/USD put options offers a way to limit risk while betting on the currency’s decline from its current level of around 1.09. The report also points to a cautious consumer who prefers cosmetics over pricey household appliances. This indicates a potential strategy: buying puts on consumer discretionary companies reliant on bigger sales while buying calls on consumer staples. This approach allows us to take advantage of the evident shift in spending habits. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – Sep 05 ,2025

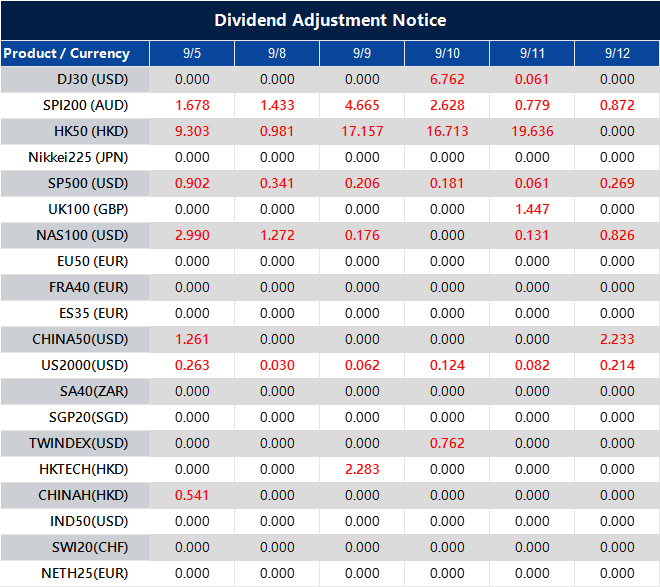

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].