Optimism among silver buyers keeps prices above $33.00, with daily highs around $33.25 to $33.30.

US Dollar weakens, leading USD/CHF to drop towards 0.8250 after earlier gains

Fed Governor’s Economic Stability Statement

Fed Governor Christopher Waller believes there could be economic stability if tariffs stay around 10%. He also mentioned possible rate cuts later. The CME FedWatch indicates a 71% chance of interest rates remaining stable. The Swiss Franc is strengthening as a safe-haven currency amid ongoing economic and geopolitical uncertainties. The Swiss National Bank’s decisions could influence the CHF, with market expectations for a rate cut in June. The value of the CHF is closely tied to Swiss economic data and Eurozone policies. Known for its stability, the Swiss Franc often attracts investors during market stress. The USD/CHF trend is downward, near 0.8260, as the Greenback faces pressure from new concerns regarding U.S. fiscal health. The Congressional Budget Office’s projections show a $3.8 billion increase in the federal deficit due to proposed tax breaks, which are linked to fiscal expansion. Although aimed at stimulating growth, these tax breaks raise concerns about long-term sustainability and inflation. At the same time, the Dollar Index has slipped to 99.60, indicating a downturn. Risk appetite has decreased due to domestic fiscal issues and ongoing geopolitical challenges. In such situations, currencies known for stability, like the Swiss Franc, usually see more inflows. The Franc has responded quickly, benefiting from classic risk-averse behavior. It’s important to note that the CHF often mirrors perceived economic weakness in other countries. Traders should consider this consistent behavior since confidence in the Franc grows when broader markets decline. This is bolstered by the reliability of Swiss monetary policy and its focus on inflation. Interestingly, mixed signals from U.S. economic indicators complicate the bearish outlook for the dollar. While budget concerns persist, unexpectedly strong PMI data hints at solid performance in manufacturing and services, reducing the need for immediate Federal Reserve action. This may soften recent declines in the dollar. Waller’s recent comments align with a cautious perspective. He is open to rate cuts but only in controlled scenarios. Specifically mentioning tariff levels indicates a willingness to handle near-term inflation as long as trade relationships remain stable. Here, monetary policy seems more reactive than proactive.Market Expectations And Economic Print Monitoring

The CME’s FedWatch tool reflects this sentiment, showing that about 70% of market participants expect rates to stay unchanged at the next meeting. Expectations have shifted slightly, providing the dollar with some room to stabilize, though not necessarily recover significantly. Focus now shifts to Switzerland. There’s ongoing speculation about a potential policy change by the Swiss central bank, with a modest rate cut expected in June. If this happens, it might slow the recent rise of the Franc. However, any adjustments are likely to be small, keeping the CHF steady rather than volatile. We continue to monitor economic data from both Switzerland and the Euro Area, as these factors will heavily influence short-term valuations. The Swiss Franc often reacts more to international instability than domestic events, highlighting why geopolitical factors are critical indicators for assessing the cross’s short-term direction. Overall, many are adjusting their positions. While volatility remains high, the focus is leaning towards the downside for USD, where concerns about U.S. spending and debt seem to exceed growth trends. Although positioning against the dollar has increased, it has not yet reached extreme levels, indicating that markets could continue current trends before reversing. Those trading derivatives should adapt their strategies accordingly, favoring tactics that align with sustained CHF strength unless the SNB suggests otherwise—especially in markets rewarding patience and precision. Create your live VT Markets account and start trading now.The Indian rupee strengthens as the US dollar weakens, drawing in sellers

Positive Economic Indicators

India’s Manufacturing Purchasing Managers Index (PMI) rose to 58.3 in May, exceeding expectations. The Services PMI also improved, contributing to a higher Composite PMI and signaling robust economic activity. India and the US are likely to finalize the first phase of their trade deal by July. In the US, both Composite PMI and Manufacturing PMI improved, and jobless claims fell below expectations. The USD/INR exchange rate remains above the 100-day Exponential Moving Average. If momentum continues, the rate could rise to 86.61. On the downside, targets are set at 85.35 and potentially 84.15. External factors such as the US Dollar and oil prices impact the Rupee’s performance. The Reserve Bank of India aims to keep the exchange rate stable and control inflation by adjusting interest rates.Future Challenges and Opportunities

Higher interest rates can strengthen the Rupee by attracting foreign investment. Other factors, like GDP growth and trade balance, also affect its value. Inflation trends can influence currency, impacting international trade and investment. The Indian Rupee has appreciated recently, mainly due to a weaker US Dollar and positive sentiment around a trade agreement expected by July. However, challenges such as high oil prices and potential capital outflows from Indian stocks may put pressure on the currency in the short term. The fluctuating US Dollar adds complexity to the situation. Consumer inflation in India has dropped significantly, to levels unseen in years. This slowdown raises speculation that the central bank might keep interest rates low for a longer time. While lower inflation could hinder the Rupee’s strength, it may encourage more spending and economic growth, which can attract foreign investors. Manufacturing numbers have proven resilient too. PMI readings reflect business sentiment and production strength. A strong Services PMI, along with rising Composite figures, suggests the economy is progressing. If this trend continues, it could increase demand for Indian financial assets, helping to offset concerns about foreign equity outflows. Recent economic data from the US shows a strong domestic economy. Both Manufacturing and Composite PMIs increased, indicating expansion and suggesting that Federal Reserve officials might be cautious about reducing rates. Jobless claims have not risen significantly, indicating labor market stability. Consequently, upcoming comments from US policymakers will be crucial in assessing their stance on interest rates. Extended higher rates in the US could strengthen the Dollar in the medium term, limiting short-term gains for the Rupee. From a technical standpoint, the USD/INR pair’s position above the 100-day EMA means downward momentum hasn’t fully reasserted itself. If the Dollar remains strong, the upside risk is toward the 86.61 area. Conversely, if the Rupee strengthens, it might drop to around 85.35. However, a significant rate shift could push it down to 84.15. It’s important to remember that the Reserve Bank of India’s primary goals are to control inflation and stabilize the currency. Their interest rate decisions influence not only inflation management but also currency confidence. If the Federal Reserve holds steady while Indian inflation decreases, it may attract investors looking for better returns. However, geopolitical tensions or oil market fluctuations could change the risk landscape. As we look ahead, domestic factors such as economic growth, trade balance, and core inflation will become increasingly important. If India continues to show strong export numbers while keeping imports in check, it can improve external stability and support the Rupee. Nevertheless, global derisking or unexpected bond yield shifts—especially in emerging Asian markets—could increase volatility. We need to pay close attention to short-term rate indications, oil futures trends, and India’s ability to secure foreign investments through FDI and portfolio flows. These factors are crucial indicators of risk appetite. Being prepared for changes in global yields, especially from North America and Europe, is essential. Create your live VT Markets account and start trading now.US Dollar Index falls to around 99.50 after initial approval of Trump’s act

Impact Of PMI Data

Some support for the Dollar came from stronger US S&P Global PMI data. The Composite PMI rose from 50.6 in April to 52.1 in May, with improvements in both the Manufacturing and Services sectors. Fed Governor Christopher Waller suggested there might be rate cuts in the future. According to the CME FedWatch tool, there’s a 71% chance that interest rates will stay the same in upcoming meetings. The US Dollar is currently weakest against the Japanese Yen, declining by 0.42%. A heat map showing exchange rates demonstrates changes across major currencies in percentage terms. The US Dollar (USD) is facing challenges and drifting lower near the 99.60 mark, reflecting recent lows. This decline is largely influenced by the decrease in long-term Treasury yields, with the 30-year bond yield dropping to 5.05% from 5.15%. When yields fall, returns on US assets decrease, putting additional pressure on the USD. Furthermore, ongoing federal budget discussions are impacting sentiment. The House has passed a proposal that would increase the deficit by $3.8 billion, which worries global markets. This change suggests that investors are recalibrating their expectations about fiscal policy. Increased spending without additional revenue typically raises inflation risks over time, but it currently weighs on the Dollar. Despite the positive news from the S&P Global PMI, which indicates growth (up to 52.1 in May from 50.6 in April), its effect on the Dollar was short-lived. Instead, markets are more focused on potential interest rate movements than current economic activity. Waller’s comments indicate that changes in fiscal policy might lead to rate cuts, although this won’t happen immediately. Traders are estimating about a 71% chance that interest rates will remain unchanged in upcoming meetings, according to the CME’s FedWatch tool. It’s important to understand that stagnant rates amid rising inflation expectations, along with the possibility of increased spending, diminish the Dollar’s attractiveness. As a result, the US Dollar has fallen 0.42% against the Japanese Yen. The Yen’s strength comes from traders selling off Dollar positions rather than strong performance in Japan.Future Implications For The US Dollar

Looking forward, we should be aware of a few changes. Yields aren’t increasing, inflation concerns aren’t boosting the Dollar, and political developments are causing uncertainty. A heat map of exchange rates shows the Dollar’s overall weakness, particularly against the Yen. This situation indicates that expectations for interest rate movements will take precedence over short-term growth data. Any signals from policymakers suggesting comfort with current rates or potential easing could reinforce these trends. We should watch how the market prices the October and December Fed meetings. Changes in nominal yields, especially in the 10-to-30-year range, will provide clear direction. We should also pay attention to forward rate agreements, particularly how three-month interest rate expectations change six months from now, as these often lead to adjustments in futures contracts, which in turn influence option volatilities and skew. The swings we are seeing also highlight the correlation between the Dollar and equities. If business data improves, like the recent PMI rebound, yet the Dollar continues to drop, it indicates a shift in trader priorities. This disconnection is something to watch closely. It tends to resolve quickly, and until then, expectations of a weaker USD could intensify. Create your live VT Markets account and start trading now.UK retail sales rose 1.2% month-over-month, surpassing the expected 0.2% increase.

GBP/USD Responds to UK Data

The GBP/USD rose by 0.29% to 1.3457 following the positive UK data, showing the British Pound’s strength against the US Dollar. A heat map shows percentage changes among major currencies, highlighting the British Pound’s status. The base currency is on the left, while the quote currency is at the top, reflecting their percentage shifts. Keep in mind that there are risks and uncertainties in these forward-looking statements. The information is for informational purposes and does not serve as investment advice. Market participants should conduct their own analysis before investing, as all risks, including potential losses, are their own responsibility. April’s retail figures from the UK exceeded expectations. Monthly sales jumped 1.2%, significantly above the forecast of just 0.2%, and March’s early estimates were also revised slightly higher. Excluding fuel, core retail sales showed stronger momentum with a 1.3% rise for April. The annual growth figures were impressive as well, showing a 5.0% increase in retail and a 5.3% gain in core sales, more than doubling previous readings. This surprising increase in consumer spending affected the currency markets. The GBP/USD strengthened by nearly 30 basis points to 1.3457 right after the release, indicating renewed interest in Sterling. The change wasn’t due to market volatility related to commodities or interest rates; it stemmed from strong raw data. Such significant data can lead to adjustments in near-term financial instruments, particularly when it catches market traders off guard.Sterling Trends and Market Reactions

The heat map shows that Sterling’s gains weren’t limited to the dollar; it also rose against several other currencies, subtly changing positions across G10 currencies. In sessions like this, where the market response confirms stronger fundamentals, longer-term implied volatility often stabilizes while short-term strategies become more responsive to new information. This trend can benefit specific trading strategies that rely on strong fundamentals. Surprises in consumer data can shift short-term expectations. Even a single data point can prompt a fresh look at rate-sensitive instruments. In this instance, there may be a growing sensitivity in shorter-term derivative markets tied to the GBP, especially since policymakers have not ruled out further tightening. Observing how Sterling trades after a shock is vital. The spot price touched levels last seen before the last inflation data release, indicating a potential end to certain bearish positions. If we continue to see positive surprises, we could see increased liquidity around crucial resistance levels, with some traders possibly adjusting their positions to recapture premium. For short-term strategies, we must keep a close eye on gamma values due to these sharper price movements. Data-driven rallies don’t always last beyond a few sessions, so while there’s potential upside, it requires careful adjustments. Monitoring any gaps between realized and implied volatility can indicate whether the current movement has further momentum or if market positions have merely lightened temporarily. The market’s current response suggests that the idea of a slowing UK consumer may not be as certain as it seemed a month ago. Although long-term trends remain sensitive to interest rates, wages, and overall confidence, the data currently points towards stability in consumers’ spending habits, if not growing optimism. Whether this optimism is due to seasonal trends, wage negotiations, or job stability, it appears households aren’t pulling back as quickly as previously expected entering Q2. Create your live VT Markets account and start trading now.Germany’s year-on-year GDP adjusted for working days has remained stable at -0.4% for the first quarter.

Gold Recovery and Market Trends

Gold prices bounced back, reaching $3,330, thanks to a weaker US Dollar and a cautious market mood. Avalanche (AVAX) was traded at $25.74, benefiting from support from FIFA and VanEck in blockchain initiatives. Retail traders are becoming more active and are showing buying interest. In contrast, institutional investors remain cautious due to ongoing global economic uncertainties. Overall, fears about US government debt, trade tensions, and fiscal unpredictability create a complex backdrop for financial markets. Germany’s GDP growth of -0.4% suggests there is no solid recovery ahead. This reinforces earlier signals of stagnation and indicates that domestic demand has not rebounded enough to counter external challenges. Manufacturing is still struggling with high energy prices and a cautious global trade outlook. This situation signals moderate risk for Euro-denominated assets, especially concerning interest rate trends that may remain defensive. Currency markets reacted swiftly to these broader issues. As the euro approached 1.1350 against the dollar, it became evident how quickly concerns about US budget deficits and political gridlock were influencing trade. The dollar’s response was unsurprising, reflecting increasing pressure from growing fiscal responsibilities. With Treasury yields dropping and weak auction demand appearing, shifts into other currencies, particularly the euro and pound, seem more like necessary adjustments than speculative moves. This highlights real concerns about US fiscal health.Sterling and Market Volatility

The pound’s rise into the mid-1.35s followed surprisingly strong UK consumption figures. This unexpected boost in retail sales could disturb interest rate expectations, especially if it leads to price pressures. This puts the Bank of England in a challenging position. If the data trend continues, rate cuts might be postponed or lessened. Those monitoring volatility in short-term GBP options should focus on real data shifts rather than just forward guidance. With gold rising to $3,330, it reinforces its role as a hedge against both inflation and unstable monetary conditions. The current flows reflect investor skepticism towards fiat currency reliability. There is notably strong demand for gold futures, especially those with shorter maturities, indicating that traders are preparing for currency disruptions or central bank missteps. Movements in gold prices reflect decreasing confidence in yield-bearing assets. In the digital asset space, AVAX trading above $25.70 shows that altcoins can still respond positively to real-world endorsements, despite a lack of substantial institutional investment. Corporate support from organizations like FIFA and backing from fund managers provide traction that’s hard to find elsewhere in crypto assets. Increased speculative interest in near-dated AVAX options indicates that traders expect ongoing momentum from overall crypto optimism rather than specific coin fundamentals. Retail traders are taking on more risk across trading platforms, willing to make bold moves despite larger funds being hesitant. This distinction is important. As leveraged positions grow in times of low liquidity, price breaks become more likely, and market moves can be significantly influenced by stop-loss actions. Currently, there’s heightened sensitivity to news and sudden data changes, making risk metrics like gamma exposure and skew very useful indicators in the short term. Amid significant macro concerns—especially regarding US debt and fragile international trade—market behavior has shifted towards being more reactive rather than forward-looking. Instruments like forward rate agreements, breakevens in bond markets, and volatility indices reflect this uncertainty. There isn’t a consistent directional bias among traders, which makes focusing on short-margin trading more practical. In these conditions, cash flow, timing, and the stability of counterparties are critical. For now, we will remain close to the data and take shorter positioning horizons. Create your live VT Markets account and start trading now.The GBP/USD pair approached 1.3468, rising about 0.25% during Asian trading.

Mixed Economic Signals

On Thursday, GBP/USD stayed above 1.3400 despite mixed economic signals. US PMI figures provided some support, while fiscal concerns lingered. The US Dollar Index saw a slight recovery, stopping its previous decline and trading near the 100.00 level. The information provided here is for informational purposes only and does not serve as financial advice. Always do thorough research before making financial decisions, as there is no responsibility for any inaccuracies or investment results. The Sterling has strengthened, trading around 1.3450 after UK consumer sentiment showed slight improvement. The GfK Consumer Confidence Index, while still negative, increased from -23 to -20 in May. Although this number isn’t fully optimistic, it is better than expected and shows a shift in sentiment. Households are still cautious, but the outlook is gradually improving. However, this cautious optimism must be considered alongside expectations of weaker retail spending. The market predicts a small monthly decline of 0.2% in retail sales for April, which would halve the 0.4% gain from March. Nevertheless, year-on-year sales are expected to rise to about 4.5%. If this happens, it would highlight healthy consumer activity annually, even as month-to-month growth appears uneven. The ability of GBP/USD to remain around 1.3400 amidst mixed factors suggests strong underlying demand, partly due to a weakened USD. However, the situation isn’t entirely one-sided. US manufacturing and services PMIs have stabilized, providing some support for the dollar, even as worries about Treasury yields and budget issues cause fluctuations.Interest Rate Path Expectations

Short-term traders should pay attention to the current environment where binary outcomes are possible from macro data and market positioning. Reactions to UK spending data could significantly affect sentiment, especially if this week’s results do not match the upbeat tone suggested by consumer confidence and the year-on-year retail predictions. Meanwhile, the Dollar Index stopping its decline near 100.00 might indicate a potential bottoming out. However, we need to be cautious, as US debt and yield issues are still not resolved. This could limit the dollar’s upside without new drivers, leaving GBP/USD somewhat top-heavy, particularly if UK data begins to disappoint. In terms of volatility, this suggests tighter implied ranges might be disrupted by occasional bursts. This pattern is common in markets where confidence is shaky but not collapsing, and fundamentals are being reassessed daily. Traders with gamma exposure should be alert to intraday swings, especially around frequent data releases, while vega desks might see lower premiums unless significant macro changes occur. We recommend adjusting short-dated straddle exposure based on whether Friday’s UK retail sales align with expectations or differ sharply. If the figures significantly miss or exceed projections, expect quick price adjustments, particularly as FX markets have recently reduced sterling risk premiums. From a positioning perspective, directional views should consider that expectations for interest rate paths – from both the Bank of England and the Federal Reserve – will likely remain uncertain for some time. This uncertainty allows for the opportunistic fading of overshoots, especially as longer-term yield trajectories are not yet reflected in spot pricing. In short, those managing exposure in related futures and options should avoid relying too heavily on a single theme or data point. The current outlook is selective, and sentiment is likely to change rapidly in response to subtle macro surprises. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – May 23 ,2025

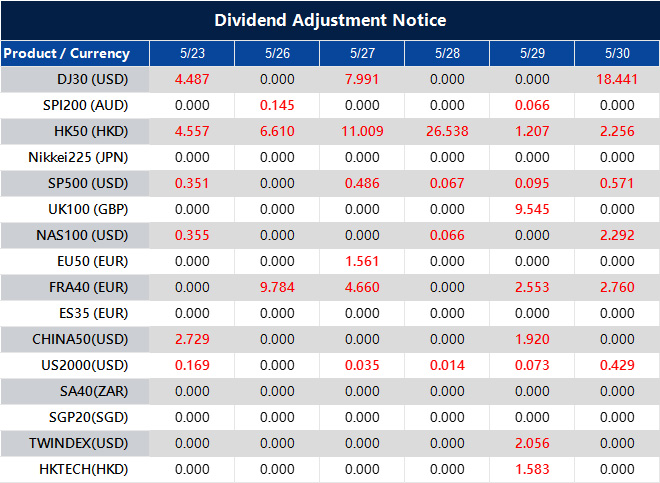

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].