Japan’s manufacturing sector shows signs of stabilisation despite ongoing challenges and weak global demand

Goldman Sachs predicts OPEC+ will increase production in August and revises 2026 Brent price projection to $56

Goldman Sachs on Oil Production

Goldman Sachs is projecting a moderate increase in OPEC+ oil production in August, followed by stable supply for the rest of the year. They emphasize that there is plenty of oil available from regions outside U.S. shale, which is holding back any hopes for rising prices. Therefore, they don’t expect prices to increase significantly in the next two years. Their price forecasts support this idea. Brent crude, often considered the global standard, is expected to average $60 per barrel in 2025, which is close to current levels. This suggests Goldman Sachs doesn’t see any sharp price recoveries. In comparison, WTI, which reflects U.S. conditions, is estimated to be slightly lower at $56 for the same year. For 2026, both benchmarks see lower averages, with Brent at $56 and WTI at $52. What does this mean for market positioning? It indicates that expectations for tighter supply, which previously boosted futures contracts, are now tempered by real-world production stability. Notably, their forecast does not indicate a shortage in the market for the next two years.Market Implications and Strategy

Current prices appear to be capped. This isn’t due to a decrease in demand, but rather because other producers outside of shale are increasing production without needing to raise prices. This keeps futures traders realistic, as there aren’t sudden shortages or barrel scrambles. With expected low volatility and steady production from major suppliers, short-term spreads might not widen significantly. Calendar spreads are likely to stay flat. For now, we wouldn’t anticipate sudden changes in the forward curve without significant disruptions. Long bets on backwardation might require patience rather than offering quick returns. The focus seems to shift towards carry performance and roll yield stability, rather than major price movements. Price drops driven by headlines are unlikely to last unless supported by major structural changes – which are not indicated in the current data. In summary, these forecasts suggest a balanced market with ample supply. Positions should reflect limited upside potential, moderate carry, and low likelihood of sudden price shocks. Create your live VT Markets account and start trading now.Waller hints at possible interest rate cuts in 2025, depending on trade and inflation trends.

Focus on Inflation Expectations

Waller highlighted his focus on market and expert opinions about inflation. He considers the long-term effects of tariffs on inflation to be moderate, viewing their price pressures as temporary. Although some surveys show that consumers expect higher inflation, Waller believes the current job market doesn’t allow workers to demand raises effectively. He remains open to rate cuts later this year, choosing to ignore any inflation pressures caused by tariffs, even if the job market stays stable. Waller’s insights clarify how the central bank is looking at price changes. Basically, he thinks the inflation caused by new tariffs may spike but is unlikely to persist. What’s more important is whether that inflation lasts, not just appears and then fades. This perspective helps policymakers be patient instead of reacting too quickly with higher interest rates. The Fed can take a step back now because recent economic data through April shows strong growth. This allows for a wait-and-see approach until there is more clarity. During such times, when market expectations are shifting and bond market signals remain stable, the focus shifts to finer details—like whether wage growth lags behind rising prices or if it starts to catch up. Waller suggests that the balance here shows inflation risks are under control, justifying a wait-and-see approach. Though some surveys indicate that households expect rising prices, other areas of the market Waller monitors show different trends. There’s a reason for this gap. Survey-based expectations often change in response to news, especially about tariffs. However, future-looking measures seen in asset prices are currently stable. This makes those measures more reliable in today’s environment.Impact on Short-Term Rates Markets

Now, let’s consider how these factors influence short-term rates markets. Earlier this month, expectations for easing returned, but they became unpredictable due to ongoing tariff news. Understanding how the central bank is weighing these risks and selectively ignoring temporary ones helps clarify the picture. It indicates that data sensitivity will be more crucial than reacting to headlines moving forward. If tariffs start leading to widespread price increases, impacting areas like services or wages, policy officials will likely change their tone. But we haven’t reached that point yet. Current inflation readings have been cooling since March. Additionally, weaker-than-expected unit labor costs support Waller’s perspective. Going forward, we need to track how quickly inflation changes, not just the overall level. Meanwhile, employment indicators mainly reflect consumer strength rather than wage pressures. Policymakers are looking for signs that slowing job growth could reduce excess spending without harming overall consumption. In fixed income and derivatives markets, this means volatility will likely respond more to surprising increases in prices than to decreases. A gradual decline in inflation won’t prompt immediate action, as that trajectory has already been communicated. However, if inflation numbers fall sharply, it could reignite expectations for earlier rate cuts. The risk, as Waller has subtly pointed out, is overreacting to short-term changes or expecting persistent inflation where it may not exist. The upcoming period will likely favor quick reactions over firm beliefs. There’s little benefit in sticking rigidly to one view, especially if it overlooks softer data. At the same time, markets shouldn’t react too strongly to noisy inflation reports. We’ll interpret the data like policymakers do: focusing on persistence rather than drama. Create your live VT Markets account and start trading now.Japan’s capital spending increases by 6.4% year-over-year, exceeding expectations, but company profits fall short.

Company Sales Growth and Profit Analysis

Company sales grew by 4.3% compared to a year ago. This was better than the forecast of 3.0% and an increase from the earlier 2.5%. However, profits only increased by 3.8%, falling short of the expected 6.0% and down from a prior rise of 13.5%. The USD/JPY exchange rate remained stable despite these economic changes. Overall, there’s a significant rise in corporate capital spending—much higher than what markets expected. When companies increase their investments like this, it often shows confidence in the economy and suggests that they anticipate steady or growing demand in the coming months. The fact that spending on tangible assets, such as plants and machinery, increased even more indicates that companies are focusing on long-term plans. Although the 1.6% quarterly rise may seem small, it’s more significant due to seasonal patterns and the ongoing economic uncertainty. This growth indicates that companies are no longer just holding back—they’re putting resources to work again. Sales figures show that demand is not only stable but improving. An annual gain of 4.3%, which is over a percentage point above expectations, suggests that consumers and businesses are engaging more actively. However, the slower profit growth should be noted. The 3.8% rise is considerably lower than the anticipated figure, indicating potential challenges with profit margins. Factors like rising input costs, labor expenses, or changes in product mix could be contributing to this.Market Impact And Future Outlook

For market players, the difference between strong sales growth and weaker profits is important to watch. If companies are absorbing higher costs without increasing prices, this could limit profit growth later on. Trends like these can influence interest rate expectations as analysts question the sustainability of this business momentum. Currently, the limited movement in the currency market—where the dollar-yen exchange rate has remained steady—suggests traders are not using these numbers to change their broader economic expectations. They might believe that the pace of investment will not significantly impact the overall policy outlook. Yen volatility has been low, indicating that market participants think central bank actions and inflation expectations will remain stable, or that other events have overshadowed these data points. Looking ahead, the risks in derivatives pricing are shifting. If corporate investment continues to grow into the next quarter, it might lead to different expectations in market volatility. Market makers will consider the higher baseline of business activity, and if actual profits don’t match those expectations, it could lead to larger shifts in premium pricing around future earnings reports or central bank announcements. For now, staying close to specific calendar events and monitoring future trends remains crucial. Create your live VT Markets account and start trading now.The Bank of Japan has raised provisions for bond losses due to expected interest rate increases.

The Australian manufacturing sector grew, despite a slight drop in output and moderate growth rates

Production And New Orders

In May, production fell for the first time in three months, and new orders increased at a slower pace. Stocks of purchases also went down as buying slowed down. On the bright side, some indicators suggest that output may grow in the coming months, thanks to rising export orders and better business confidence. Employment continued to rise, with firms actively hiring for open positions. Inflation pressures eased, marking the lowest costs in over a year, which may soon help boost demand. The report hinted that the recent slowdown might be linked to the election, making it potentially temporary. The May PMI reading of 51.0 keeps the manufacturing sector just above the line that divides growth from decline. Although it’s lower than the preliminary estimate and last month’s figure, it still indicates a slight softening in activity. However, the index remains above 50, which shows the sector still has some resilience, even if it’s a bit less than before. The drop in output, the first since February, shows a slowdown in production momentum. While it’s not drastic, this shift after previous gains suggests hesitation among manufacturers. This could be due to easing order backlogs or clients being cautious. Purchasing managers cut back on buying inputs, leading to a decline in stocks for the first time in several months. Demand seems less urgent, even though firms are optimistic about the future.Export Orders And Business Confidence

The rise in export orders is a positive sign. Focusing on foreign demand may help maintain activity levels if local conditions remain weak for a while. Business confidence has increased, according to survey results, but history suggests this doesn’t always lead to immediate volume gains; it often takes time to show in actual output. Labour conditions are tightening. Continued hiring indicates that firms expect strong enough demand to justify keeping or expanding their capacity. This hiring trend, alongside reduced cost inflation—the lowest in over a year—may create an environment where profit margins start to stabilize or improve. Lower input costs can also lead to better inventory management and price competition without hurting profits right away. There’s also a political aspect to this data. National elections can influence economic activity, partly due to uncertainty and partly due to expectations for new policies. It’s likely that some clients, especially in sectors that require heavy investment, postponed orders temporarily. Once policy clarity returns, we usually see those delayed decisions come back into play. Given these changes, we should expect mixed data in the near future. Past instances of stalled output growth without a broader decline have led to tighter implied volatility in manufacturing-driven markets. This suggests potential opportunities for strategies focused on stable conditions or lower-risk derivatives. Furthermore, employment growth combined with easing input costs may create a solid foundation for future price expectations linked to industrial production. We shouldn’t overlook export strength. While it may not immediately affect overall economic measurements, it is beneficial for products related to producer sentiment or shipping volumes. Changes in purchasing habits and stock reductions may result in a slower increase in forward indicators, indicating that mid-term derivative structures could benefit from later entry points. Lastly, decreasing inflation pressures, especially if they continue over time, might change yield curve expectations. If we continue to see this alongside stable hiring, fixed income derivatives related to products may need adjustments. Scenarios should be revisited to put greater emphasis on sustained growth in a disinflationary setting. Create your live VT Markets account and start trading now.Bessent believes that Trump will soon discuss trade issues with Xi.

Period Of Low Transparency

Bessent’s remarks point to a time of low transparency in global trade, especially concerning the industrial parts that support broader manufacturing. The possibility of a discussion between the leaders shows that there are serious concerns and could lead to changes in how countries manage their economic ties. Uncertainty like this can increase market volatility, especially in areas related to industrial production and trade logistics. If key materials or parts are delayed or restricted, prices can change quickly. Markets linked to commodities or manufacturing could start to adjust their expectations before any official agreement is made. It’s important to pay attention to guidance from both direct policy statements and other signs, like changes in tariffs, supply chain disruptions, or changes in inventory. Price trends in short-term interest rate futures may start to show expectations of slower economic activity, particularly if the market thinks negotiations might take longer than expected.Impact On Economic Friction

Traders involved in foreign exchange (FX) contracts should think about how economic friction could affect the strength of the dollar, especially if investors seek safe-haven assets. Movements in bond futures can also indicate expectations about trade resolutions; for instance, how curves steepen or flatten can show where agreement might be forming. While no date has been set, the chance of an official discussion opens up a speculative window. This could lead to changes not only in traditional equity and commodity markets but also in trades that depend on a stable supply chain. We should be ready for sudden price changes that often happen before official announcements. Markets tend to anticipate changes rather than simply react. Watching for volume spikes in sector-specific ETFs or calendar spreads can provide early insights into shifts in sentiment. Stay flexible in your positioning. Low liquidity in certain derivative products may lead to exaggerated price movements during these times. It’s wise not to depend on just one financial instrument or news headline when facing this kind of cross-border economic strain. Create your live VT Markets account and start trading now.China’s manufacturing PMI shows slight improvement, but contraction continues; non-manufacturing sector remains in expansion despite cautious sentiment

Underwhelming Momentum in Manufacturing

Looking at the May numbers from the National Bureau of Statistics, we see a mix of small improvements but an overall lackluster performance. The manufacturing PMI stands at 49.5, an improvement from April’s 49.0, but it still indicates the sector is contracting, just at a slower pace. A PMI below 50 shows a decline in general activity. Notably, large companies reported growth with readings above 50, while medium and smaller firms struggled. This gap creates complicated signals across production levels and demand. The production sub-index increased to 50.7, giving a hint of optimism, yet new industrial orders rose only slightly to 49.8. While this represents some improvement, it does not signal a full return of demand. Employment remains a challenge. With a figure of 48.1, job losses are still occurring, though the decline is less severe than in the previous month. Stronger hiring would signal a more consistent recovery. In the non-manufacturing sector, there are signs of growth, but it’s not particularly impressive. The PMI at 50.3 shows slight expansion but falls short of expectations. When forecasts were for 50.6, a number just above the break-even point suggests weaker service momentum than policymakers envisioned. The decline in construction activity to 51.0 does not provide much reassurance, especially given the sector’s importance in past recovery efforts.Divergence in the Service Sector

Examining the service sector further reveals a split between declining and thriving categories. Transport and tech-related areas, such as air, rail, IT, and postal services, are performing well with scores in the mid-50s, indicating strong activity. Meanwhile, real estate and financial services, especially capital markets, are still contracting and struggling even before any new credit or fiscal policy is announced. New orders in the service and construction sectors increased slightly, but at 46.1, they indicate customers are still hesitant. Demand is not robust, and any improvements seem inconsistent. Input and selling prices are also decreasing, but the decline is slowing down. This ongoing price deflation may indicate softer consumption or reluctance to restock materials, a trend to keep an eye on. Workforce numbers remain concerning in the service sector as well. A reading of 45.5 is weak and shows that businesses are not hiring. Even if intentions are steady, actions have not followed through. Despite this, future expectations remain high, suggesting that companies are hopeful but not yet ready to act. A score of 55.9 reflects confidence, but unless new policies lead to real changes, this optimism may not hold much weight. Overall, the key takeaway is the gap between sentiment and actual performance. There is clear anticipation for government support, with further measures expected in mid-June. This might involve coordination with monetary or lending policies. Until those measures are in place, traders should focus on actual data rather than just forecasts. Market responses in equities and rates may remain subdued until we see significant improvements in investment and consumption numbers. Recent months hint at a fragile recovery, but not one that is reliable yet. For now, fluctuations in certain futures contracts suggest that traders are being cautious until stimulus plans are clearly defined and implemented. It’s important to watch for updates on infrastructure spending, measures supporting private businesses, and incentives aimed at boosting consumer demand. Keeping an eye on sector-specific performance—especially in real estate, services, and logistics—will provide the best short-term insights. Changes are happening at a gradual pace, but they remain uneven; trading strategies should reflect this reality. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – May 30 ,2025

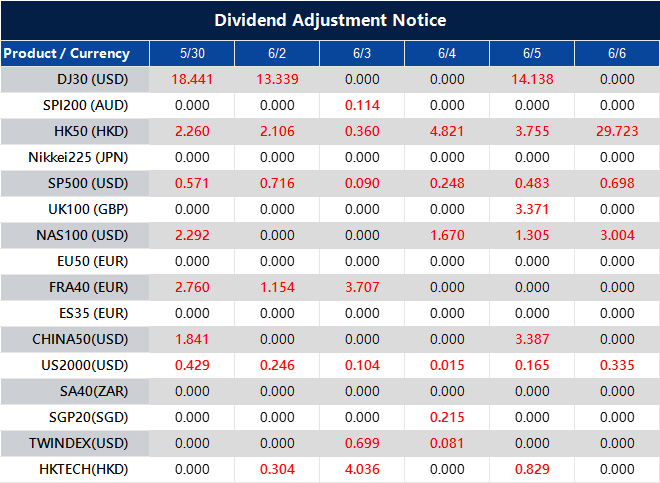

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].

Notification of Trading Adjustment in Holiday – May 29 ,2025

Dear Client,

Affected by international holidays, the trading hours of some VT Markets products will be adjusted. Please check the following link for the affected products:

Notification of Trading Adjustment in Holiday

Note: The dash sign (-) indicates normal trading hours.

Friendly Reminder:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].