If trade negotiations fail, US Treasury Secretary Scott Bessent suggests tariffs may rise again.

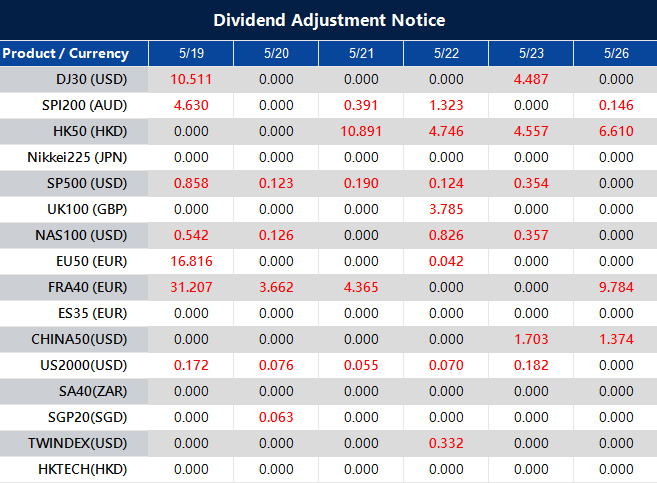

Dividend Adjustment Notice – May 19 ,2025

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].

Week Ahead: Moody’s Downgrade Rattles Market Confidence

The trading week commenced under a cloud of fiscal unease after Moody’s became the final major credit rating agency to lower the United States’ sovereign rating, shifting it from AAA to Aa1.

Although the revised rating still signals strong creditworthiness, the symbolic impact is substantial. For decades, US Treasuries have served as the gold standard of global safety. It is an almost risk-free benchmark underpinning worldwide credit markets. That status is now being called into question.

Investor sentiment turned cautious in response. After-hours trading saw yields on the 10-year U.S. Treasury note climb to 4.48%, as risk premiums adjusted. The SPDR S&P 500 ETF dipped by 0.4%, a relatively modest decline, yet underscoring simmering concern beneath the surface. Markets are not yet in turmoil, but the erosion of trust has begun.

The rationale behind the downgrade is clear. The US national debt is forecast to grow from 98% of GDP in 2024 to 134% by 2035, while the annual budget deficit could swell from $1.8 trillion to $2.9 trillion over the same period. Compared with similarly rated economies, these figures are significantly elevated, prompting scrutiny over the country’s premium status.

The Treasury market, already under strain from increased issuance and declining foreign appetite, now faces further headwinds. Countries that once absorbed U.S. debt uncritically are reassessing. Broader shifts in global trade dynamics, tariff conflicts, and the gradual emergence of alternative reserve currencies continue to erode America’s central role in the global financial order.

For the everyday borrower, the implications are tangible. Treasury yields influence everything from mortgage rates to student loan terms. If institutional traders demand greater returns for the risk of lending to the US, banks and lenders will inevitably pass those costs down to households and businesses. Even a small uptick in yield curves can translate to hundreds of billions in added debt servicing costs over time. The result is tighter consumer credit, pricier capital, and diminished room for government stimulus during future downturns.

Politically, the downgrade highlights Washington’s persistent dysfunction. Moody’s had issued warnings as early as November, citing lawmakers’ repeated failure to resolve debt ceiling impasses or enact lasting fiscal reforms. The removal of Speaker Kevin McCarthy in 2023 and extended Congressional paralysis laid bare the governance challenges. Uncertainty surrounding the Federal Reserve’s independence has added fuel to the fire. Remarks by former President Trump regarding potential changes to central bank leadership have unsettled global markets.

Meanwhile, fiscal policy remains contradictory. Trump’s proposal to extend the 2017 tax cuts would slash government revenue by $4 trillion over the next decade. Even with drastic reductions in Medicaid and food assistance spending, the plan is projected to add $3.3 trillion to the national debt. The so-called Department of Government Efficiency, a flagship initiative, has reportedly missed its initial objectives.

In this environment, the US risks drifting into a debt spiral. As interest payments rise, the share of the federal budget allocated to debt servicing grows, leaving less room for essential spending on infrastructure, education, and healthcare. Traders are already reacting. Bond yields are climbing. Equity markets are wobbly. Even the dollar, though still dominant, faces pressure as other economies begin to decouple from traditional US-centric models.

The coming days could prove pivotal. Should the 10-year yield surpass 4.5%, increased equity market volatility is likely. Defensive sectors such as healthcare and utilities may see inflows, while tech shares, often sensitive to interest rate changes, could suffer.

Market Movements This Week

The USD Index (USDX) remains delicately poised. Having fallen towards the 100.60 mark, the dollar now faces an important juncture. A rebound could take it to 101.40 or 102.40, but sentiment needs to stabilise first. A break lower could see the 99.80 region tested, which may trigger wider ripples across risk assets. With US credit quality now under examination, the dollar’s safe-haven credentials are on trial.

EURUSD is approaching the 1.1195 resistance level. A failure to breach this zone may lead to another test of 1.1105. A sustained rise beyond 1.1300 could signal broader shifts, possibly tied to softer US data or revised rate expectations.

GBPUSD is staging its attempt at higher ground. The 1.3320 level marks the next technical ceiling. If sellers defend this range, bulls may regroup at 1.3215. With UK CPI data due midweek—forecasted at 3.30% y/y compared to the previous 2.60%—volatility in the pair is likely, especially if inflation surprises to the upside. The market is already bracing for a possible rate recalibration.

USDJPY continues its ascent but remains cautious near the 145.00 level. A slide toward 144.65 or 143.80 is plausible if market sentiment sours or yields ease. The yen’s haven appeal remains muted but could return swiftly amid geopolitical shocks.

USDCHF, meanwhile, is trapped in a range. The pair is hovering close to key levels, with a possible bullish bounce eyed at 0.8300. Broader sentiment toward Europe’s monetary trajectory and risk flows into the franc will shape its next steps.

AUDUSD found its footing at 0.6370 and now eyes resistance at 0.6425. This week’s Australian cash rate decision looms large, with markets anticipating a cut to 3.85% from 4.10%. Should that scenario unfold, a retracement back toward 0.6295 could materialise. But if support holds amid a dovish surprise, the Aussie might find breathing room to stabilise.

NZDUSD has bounced from 0.5860, currently testing 0.5905. Failure here could send the kiwi back toward 0.58459. Commodity sentiment and global growth forecasts remain key drivers.

USDCAD continues its slow rotation. If the pair drifts lower, price action near 1.3940 or 1.3910 could offer renewed support. On the upside, resistance is being eyed at 1.4055 and potentially 1.4140. The Canadian dollar remains tethered to oil’s performance, which brings us to energy markets.

US crude oil (USOil) is stuck in a narrow range. A move toward 63.05 may invite selling pressure. Despite geopolitical tensions, lacklustre demand is keeping prices in check for now.

Gold rebounded sharply from $3,154 and is now hovering near $3,210. A clean move through this level may open the door for another test of $3,270, while failure could send it back toward $3,120.72. Its appeal as a hedge remains intact but is complicated by the dollar’s uncertain direction.

The SP500 is treading carefully after its recent rally. Bullish setups may emerge near 5740 or 5690, but if equities push higher too quickly, a reaction at 6100 could limit upside. With yields rising and the fiscal backdrop turning uncertain, the broader equity market may lack the momentum for a breakout, unless earnings or economic data offer fresh support.

Bitcoin remains tightly coiled just under $100,000. Support at 99,400 and 96,600 will be crucial if prices dip. A breakout would shift attention to new record highs. Traders remain hopeful, but wary.

Natural Gas continues to retreat after peaking at 3.45, now nearing 3.02. While this level might offer support, subdued demand and healthy inventories suggest any rally may be short-lived.

Key Events This Week

On Tuesday, May 20, the market turned its attention toward the Pacific and North America, with two releases drawing early focus. Australia’s cash rate decision came in with a forecast of 3.85%, down from 4.10% previously. This anticipated rate cut reflects increasing pressure on the RBA to ease financial conditions amid a slower domestic economy. Meanwhile, Canada’s Median CPI y/y was forecast to hold steady at 2.90%, matching the prior figure. Any deviation from this inflation forecast would challenge the Bank of Canada’s stance, but with no surprises expected, the pair held ground, consolidating as markets awaited structural direction. Tuesday’s movements were light but preparatory—zones were marked, and momentum traders kept their entries tight.

On Wednesday, May 21, the spotlight shifted to the United Kingdom, where the CPI y/y was forecast to jump to 3.30%, up from 2.60% previously. This sharp expected rise underscores the lingering stickiness of inflation in the UK economy, particularly in core services. However, with broader economic growth faltering and labour conditions beginning to cool, a spike in inflation might not translate directly into rate hikes. Should the actual figure match or exceed the forecast, short-term momentum may favour GBP strength—but upside would likely be capped without a broader shift in the BoE’s tone.

On Thursday, May 22, a wave of PMI data swept through Europe and the United States, offering a barometer for economic sentiment across sectors. Germany’s flash manufacturing PMI was forecast at 48.8, slightly improved from 48.4 previously, while services PMI was expected to rise to 49.6 from 49.0. Though both remain in contraction territory, the marginal increase hinted at a stabilising tone. In the UK, flash manufacturing PMI was forecast at 46.2 (up from 45.4) and services PMI at 50.0, up from 49.0. This would signal a tentative return to growth in services, though manufacturing continues to lag.

Lastly, the U.S. released its own PMI flash readings: manufacturing expected at 49.9, down from 50.2, and services slightly lower at 50.7 from 50.8. These softer forecasts suggested the Fed may remain in a holding pattern. Thursday shaped up as the most technically active day of the week—tight ranges began to widen, and macro narratives re-entered the charts.

Create your live VT Markets account and start trading now.