Germany’s IFO expectations exceeded forecasts in May, reaching a score of 88.9

In May, the Eurozone’s Manufacturing PMI rose slightly, but the sector remained in contraction.

HCOB Manufacturing PMI for the Eurozone drops to 48.4, missing expectations of 49.3

Gold Prices Update

Gold prices are pulling back from their recent peaks, showing a slow decline. This movement doesn’t seem driven by any new data and is likely to continue moderately due to various supportive factors. Chainlink’s price rose nearly 2%, boosted by increased whale activity and capital flow. Since February, large holders have bought up 25 million LINK tokens. Retail buyers are becoming more active amid economic risks and earnings concerns, while institutional investors are being cautious. Ongoing worries about trade tensions, U.S. debt, and the careful approach of the Federal Reserve are affecting markets.Forex Trading Strategies

For those looking to trade EUR/USD, several brokers offer competitive spreads, fast execution, and strong platforms, suitable for both beginners and experienced traders in the Forex market. The Eurozone’s Manufacturing PMI for May recorded at 48.4, falling short of expectations. Since this figure is below 50, it shows that factory activity in the region is contracting. Traders with euro-denominated contracts should check forward-looking indicators to see if this decline will continue into the summer. Adjustments to speculative positions on EUR/USD are recommended since such underperformance can shake confidence among businesses and investors. Even though the FX market keeps the EUR/USD pair above 1.1300, the recent PMI data suggests limited potential for further gains. Any upward movement seems restricted unless there are changes in fiscal policy or an increase in regional production. The euro’s strength may be tested if upcoming figures, like retail sales or industrial production, turn out disappointing. In contrast, the UK offers slightly better news with a PMI of 49.4 in May. While it’s still below 50, indicating mild contraction, it’s an improvement from the previous month. This type of less-negative data often gives a slight boost to sterling-based contracts, especially when compared to weaker Eurozone data. Gold is also adjusting after its recent rise. This pullback is not prompted by any new information; it resembles a typical correction after a considerable rally. We are observing technical support levels for signs of fresh long positions. Given the ongoing uncertainty around monetary policy and mixed real yields, this gradual decline in gold prices may continue. Attention is turning to Chainlink, where large token holders, perceived as more knowledgeable investors, have been quietly increasing their positions since early this year. This accumulation has stabilized the price, and the recent 2% increase reflects ongoing interest. While modest, this steady action could pave the way for greater volatility in the future as liquidity increases or utility activity rises. In the broader market, there’s a noticeable rise in retail activity. Traders seem more willing to engage despite evident earnings risks and unresolved macro threats like trade tensions and the U.S. fiscal outlook. In contrast, institutional flows have been more cautious. This difference is revealing; when larger players pull back, it often indicates that short-term returns may struggle until risks improve or Fed communication changes. Execution is also important. With competitive spreads and faster execution on platforms, now is a good time to assess execution efficiency. Whether pursuing directional strategies or hedging, modern tools offer tighter control over positions. Those already exposed to FX or digital assets should evaluate the strength of their entry and exit points as market volatility fluctuates. Create your live VT Markets account and start trading now.In May, Germany’s HCOB Manufacturing PMI reported a figure of 48.8, which was below expectations.

Challenges in Manufacturing

The PMI result hints at challenges or a slowdown in the manufacturing industry. It suggests that production levels or business conditions might be worse than expected. Such metrics are closely watched to understand economic trends and to inform future business or policy decisions. Even though the difference is small, it still reflects the current state of the sector. Even though May’s reading was just 0.1 below the forecast, it’s significant when considered in context. The 48.8 score keeps Germany’s manufacturing PMI below the 50 mark for another month, reinforcing the idea that the sector is still in decline. While not a drastic change, consistently low numbers indicate that activity remains sluggish, despite hopes for a rebound.Investor Sentiment and Market Impacts

For traders in interest-sensitive assets or short-term index products, this suggests that investor sentiment toward the eurozone’s manufacturing base is weak. Although the contraction isn’t worsening quickly, it also isn’t improving, which becomes increasingly important over time. We should also consider how central banks interpret these numbers. A small miss usually doesn’t change monetary policy views on its own, but repeated underperformance—even if slight—can strengthen dovish expectations or delay any changes in tone from officials. Combined with low inflation readings and upcoming consumer sentiment reports, this could lead to cautious positioning ahead of central bank meetings. Traders with bets on a recovery in European manufacturing may need to reduce their positions or tighten risk controls, as indicators aren’t giving a strong basis for confidence. For options strategies, implied volatility could provide more opportunities than directional bets in this current climate. Looking at the situation more closely, the manufacturing sector’s ongoing difficulty crossing the 50 threshold decreases confidence in short-term domestic demand growth from industrial producers. While export-focused companies have some flexibility, the domestic downturn affects purchasing and hiring, impacting GDP more broadly. We should also watch for supply chain remarks in the July PMI reports. Any rise in delivery times or price pressures amid declining output could indicate deeper issues rather than just temporary weakness. This adds another layer of complexity for traders, especially when analyzing long-term interest rate futures. Timing market entries is crucial. With German output soft but not collapsing, traders looking for direction might find more clarity from incoming orders or Q2 corporate earnings than from the overall PMI numbers. Although the PMI slipped slightly below expectations, its continued position below 50 suggests stagnation rather than volatility. This slower pace can lead to dullness in some derivatives markets unless triggered by unexpected events or policy changes. Overall, the slight miss is less a one-time occurrence and more of a sign of ongoing macro conditions, such as low growth, shaky momentum, and cautious investor sentiment. Create your live VT Markets account and start trading now.Notification of Server Upgrade – May 22 ,2025

Dear Client,

As part of our commitment to provide the most reliable service to our clients, there will be maintenance this weekend.

Maintenance Details:

Please note that the following aspects might be affected during the maintenance:

1. The price quote and trading management will be temporarily disabled during the maintenance. You will not be able to open new positions, close open positions, or make any adjustments to the trades.

2. There might be a gap between the original price and the price after maintenance. The gaps between Pending Orders, Stop Loss, and Take Profit will be filled at the market price once the maintenance is completed. It is suggested that you manage the account properly.

The above data is for reference only. Please refer to the MT4/MT5 software for the specific maintenance completion and marketing opening time.

Thank you for your patience and understanding about this important initiative.

If you’d like more information, please don’t hesitate to contact [email protected].

US Dollar recovery leads to a drop in the Australian Dollar’s recent gains

US Dollar Index Performance

The US Dollar Index has declined for the fourth consecutive session and is trading around 99.50. Investors are looking ahead to the S&P Global US PMI data, expecting stable growth in business activity for May. There are ongoing developments in US politics and the economy. A tax-cut bill from President Trump is waiting for a House vote, amid economic concerns raised by the Cleveland and San Francisco Fed Presidents. The Atlanta Fed President warned about issues with trade logistics. Moody’s recently downgraded the US credit rating, predicting federal debt to rise by 2035. US economic indicators show inflation easing, with both CPI and PPI revealing reduced price pressures. This has led to hopes for interest rate cuts in 2025. Weak Retail Sales numbers have heightened worries about a prolonged economic slowdown. China criticized the US’s chip export measures, labeling them protectionist. The People’s Bank of China lowered Loan Prime Rates to support the market. Meanwhile, in Australia, the Labor Party regained power after the coalition collapsed.Australian Dollar Against Other Currencies

The AUD/USD pair is currently around 0.6440, with support from technical indicators positioned above important moving averages. Resistance levels are seen at 0.6515 and 0.6687, while support is located at 0.6427 and 0.6367. A drop below these levels could challenge the March 2020 low of 0.5914. Against other currencies, the AUD performed best against the New Zealand Dollar, while its performance was mixed against the USD, EUR, and CAD. The S&P Global Composite PMI data, based on surveys of executives, serves as an indicator of US private business activity. Traders are keenly awaiting upcoming data to understand market trends. Today’s market shows the Australian Dollar holding on to a small portion of earlier gains against the US Dollar after the PMI figures. The Manufacturing sector has remained steady, but Services and Composite numbers have slightly decreased. These modest changes suggest a slight loss of momentum in Australia’s economy, which might be concerning for those investing in growth-sensitive assets. The Reserve Bank’s decision to cut the Official Cash Rate by 25 basis points reflects their concerns about ongoing price pressures. Their message indicates that further reductions could happen if inflation remains a problem. For investors, this introduces the chance of further support for risk assets, while also raising the risk of a deeper economic slowdown if demand falls too quickly. On the other hand, the US Dollar is under pressure, having dropped for a fourth session. The Dollar Index dipping towards 99.50 shows a decreasing appetite for safe-haven assets due to softer inflation data. Lower Consumer and Producer Price Index figures suggest easing cost pressures, which supports speculation that the Federal Reserve might cut rates in 2025. The focus now shifts to upcoming US PMI numbers. If these figures show steady output from private companies, it could alleviate fears of contraction but also challenge expectations for rate cuts. Adjustments may be needed based on any positive surprises that could strengthen the Dollar and alter positioning, especially for those with a short USD bias. In Washington, discussions around former President Trump’s tax policies continue, adding uncertainty to the near-term outlook. Concerns have been raised by multiple Federal Reserve branch executives about ongoing economic challenges, particularly from the Cleveland and San Francisco Fed Presidents. The Atlanta Fed President has pointed out disruptions in transport channels. These issues contribute to uncertainty and may increase market volatility. Additionally, structural debt concerns remain, with Moody’s downgrade of US sovereign credit highlighting long-term fiscal risks. In Asia, tensions have escalated again. Beijing has accused Washington of limiting technological competition through chip export controls, keeping traders on edge in tech-related sectors. The People’s Bank of China has reduced its Loan Prime Rates to support domestic credit markets, providing relief to struggling areas of the economy. This introduces another loose policy element into the macro mix, affecting cross-border flows. Back in Australia, political shifts have brought the Labor Party back to power after a coalition collapse, adding another layer of uncertainty around fiscal priorities and regulations. While this is not currently moving markets, it could influence sentiment depending on future policy signals. Currently, the AUD/USD trades near 0.6440, supported by momentum indicators and remaining above short-term moving averages. Resistance is fairly close at 0.6515 and extends to 0.6687. A sustained dip below minor support levels at 0.6427 or 0.6367 could lead to prices not seen since early 2020. Heightened global risk aversion could increase this pressure quickly. Of note with other currencies, the Aussie has strengthened most notably against the New Zealand Dollar, while its performance has been mixed against the USD, EUR, and CAD. Differences in policy directions, especially between central banks, may influence price action in the upcoming weeks. Observing forthcoming releases, particularly those related to services and labor markets, is crucial, as these may provide a clearer outlook than manufacturing data. Moving forward, timing and execution will be key. Liquidity could thin out before significant macroeconomic updates, raising the likelihood of sharp intraday movements. While sentiment currently favors softer US data supporting the carry trade, this support relies on mild inflation and labor figures. Our focus is clear—monitor rates, follow policy discussions, and stay adaptable as technical levels come into play. Create your live VT Markets account and start trading now.Here are the FX option expiries for the NY cut at 10:00 AM Eastern Time.

Investment Risks in Open Markets

The markets and instruments mentioned here are for information only; no recommendations are being made. It’s crucial to do your research before making any investment decisions. Be aware that investing in open markets comes with risks, including the possibility of losing your entire investment. As we approach the expiration date on May 22, we may see increased volatility around key price levels, especially in major currency pairs where large options are about to expire. These levels can act like magnets, drawing spot prices closer as positions are adjusted. In the case of EUR/USD, there is a significant interest of 2.1 billion euros at the 1.1175 level, which is much larger than the usual daily expirations. Such high volume can create a gravitational pull on prices if they trade near this level, especially when traders are adjusting their risks. If the price moves toward 1.12, we could see additional resistance or support depending on market flows. The higher level at 1.1400 has a 751 million euro interest as well, but it has less impact unless strong price movements occur leading into the expiration.Recognizing Positioning Pressure

Sterling traders should keep an eye on the 778 million GBP set to expire at 1.3260. This level is slightly above current market prices, suggesting that a slight upward movement may happen, especially in a bullish market. The same logic applies to the yen market. Although the 601 million USD at 143.50 isn’t overly significant, it can still provide resistance or support if prices move up. The situation with USD/CHF looks different. The 598 million around 0.8525 could offer minor technical resistance, but it doesn’t have the volume needed to be a strong attractor. It’s worth considering, especially on days with low liquidity. For AUD/USD, while the volumes of 204 million and 286 million AUD are lower compared to other pairs, the range between 0.6100 and 0.6700 is important. The lower end may serve as a support level during risk-off periods, while reaching the higher level of 0.6700 will likely require major economic changes. That upper level is currently out of reach without a significant market impulse. Create your live VT Markets account and start trading now.Gold prices rise in Pakistan today, according to the latest data.

New Zealand announces NZ$4 billion increase in bond program over four years, says Willis

Currency Reaction

The New Zealand Dollar has barely reacted to the budget news, trading 0.25% lower at around 0.5925. The government does not expect to see an operating balance surplus in the next five fiscal years, and trade tariffs remain influential on how quickly the economy can recover. Although the deficit figures may seem alarming—especially with a deeper deficit forecast for 2025/26—the government is prioritizing fiscal support over spending cuts. The projected 0.8% GDP contraction next year reflects this broader borrowing strategy which favors economic stimulus. Despite these challenges, core inflation remains steady. The forecast keeps inflation within the 1% to 3% band, indicating that price stability is not currently at risk. This allows monetary policy to stay stable without needing an immediate response. As the government increases bond issuance, funding costs may rise, but the Reserve Bank doesn’t need to react aggressively right away. The currency’s slight dip suggests that the market was prepared for these projections. The Kiwi dropped only 0.25%, indicating that investors are becoming more accustomed to deficit announcements when inflation and growth seem stable. This indicates a calm response regarding interest rates and currency fluctuations.Trade and Interest Rates

The balance of risks largely depends on timing. While the multi-year recovery looks promising from 2025 onward, the current economic downturn will impact interest rates. Expect the yield curve to remain relatively flat over the next two quarters, especially if international factors remain subdued. It’s essential to analyze future expectations. Export tariffs continue to impede predicted trade growth, which adds uncertainty to the recovery but is less affected by domestic policies. Positions that consider a slow or uneven improvement in trade balances may perform better than fixed growth expectations. Short-term interest rate trades may stay stable unless the Reserve Bank changes its approach sooner than anticipated. However, for longer-term rates, any increase in bond issuance could widen spreads, especially during periods of weaker GDP. We are focusing on how interest rates in New Zealand compare to global benchmarks, noting how the budget plan aligns with monetary policy. For those trading volatility, a stable inflation outlook suggests limited upward movement in break-evens and inflation swaps in the short to medium term. However, with growing deficits and borrowing needs, concerns about sovereign credit can arise intermittently. Option pricing might remain low, but could rise if debt issuance outpaces market absorption. Robertson’s budget figures did not significantly impact the Kiwi, but the ongoing debt dynamics and changing long-term growth rates create opportunities—especially as policy differences emerge. Be cautious with long Kiwi positions during global rate changes or demand shocks. The real challenge will be watching whether the anticipated bounce in 2025/26 overcomes initial hurdles or if downward revisions threaten the projected 3% growth targets. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – May 22 ,2025

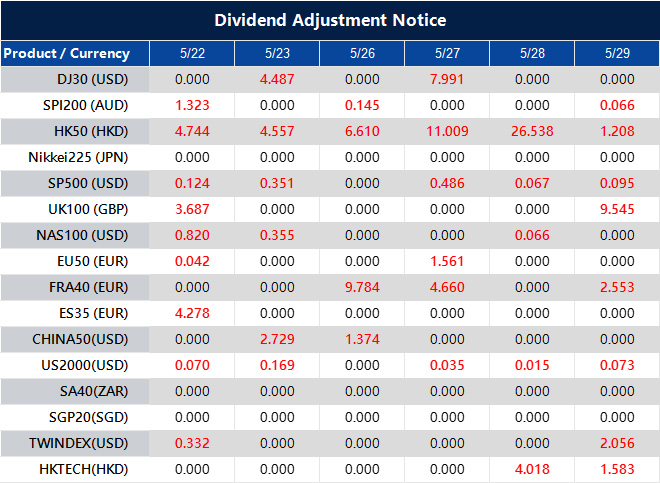

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].