Gold rises 0.8% in European morning trade, keeping its bullish trend amid low market activity

BofA forecasts minor downside risks for the euro after the upcoming ECB policy decision.

Foreign Exchange Reactions

In terms of foreign exchange reactions, Bank of America sees a small downside risk for the euro after the meeting. They predict the euro may weaken against the pound and the Australian dollar. However, they believe the overall effect on foreign exchange from this week’s meeting will be limited. After yesterday’s ECB meeting, the decision to keep rates unchanged was expected. Now, President Lagarde’s cautious tone is the main focus. Her comments about rising economic risks and the need for flexibility indicate the careful approach we predicted. The market has responded by slightly increasing bets on a rate cut before the year ends. This dovish sentiment appears to be a reaction to slowing growth. Recent data shows Germany’s industrial production fell by 0.5% in July 2025. Although Eurostat’s early estimate for August revealed headline inflation dropping to 2.1%, core inflation remains steady at 2.4%. This creates a challenging situation for the central bank. We need to keep an eye on this tug-of-war between slowing growth and ongoing inflation. Given Lagarde’s repeated emphasis on “flexibility” and not making firm commitments, we believe implied volatility for EUR assets will stay high. Traders should think about strategies to take advantage of this uncertainty, as the central bank is allowing room to adjust based on new data. This is quite different from the clear guidance we had in 2023 and 2024.Divergence in Central Bank Policy

The differing policies between central banks make short EUR positions against the pound and the Australian dollar particularly attractive. The Bank of England is signaling a “higher for longer” approach to fight its own inflation, creating a noticeable policy gap. Options traders might consider buying puts on EUR/GBP or setting up bearish risk reversals to prepare for further declines. While the market has already raised its expectations for a rate cut, now anticipating about 15 basis points of cuts by December 2025, we see potential in betting on an even more dovish path. The risks to growth seem more serious than what current rates suggest. This makes interest rate swaps that pay a fixed rate in exchange for a floating rate look appealing. History shows that during the 2011-2012 period, markets often underestimated the ECB’s willingness to cut rates in a slowing economy. Create your live VT Markets account and start trading now.AUDUSD climbs toward the upper trendline as dovish sentiment impacts the USD ahead of FOMC

The 1 Hour Chart

The 1-hour chart shows a temporary pause in the rally as the market waits for US inflation data. Important levels to monitor are 0.6580 for possible pullbacks and 0.6620 for additional upward movement. Key upcoming releases include the US PPI, CPI, Jobless Claims, and University of Michigan Consumer Sentiment reports. The US dollar continues to weaken as the market processes this morning’s soft August 2025 inflation data. The core Consumer Price Index (CPI) is now at 2.8% year-over-year. This supports our belief that the Federal Reserve will lower interest rates at its next meeting, with fed funds futures indicating an 85% chance of a 25 basis point cut. The dollar’s trend appears to be downward as we approach this decision. For derivative traders, this environment is good for strategies that profit from a continued rise in the AUDUSD pair. Buying call options with a strike price near 0.6650 could help us benefit from the expected upward momentum towards the upper trendline discussed earlier. This strategy limits our maximum risk while offering a significant potential reward if the dollar continues to weaken.The Australian Dollar’s Stability

However, we should be careful, as the dovish sentiment towards the Fed may be overstated. We saw a similar situation in late 2023 when aggressive rate cut expectations led to a dollar rally. A wise hedge would be to purchase put options with a strike price just below the key upward trendline, around 0.6550. This protects against any unexpected strength in upcoming US economic reports, such as Friday’s consumer sentiment data. The Australian dollar’s stability supports the pair’s upward trend, with its inflation rate around 3.2%, higher than in the US. Thus, the Reserve Bank of Australia is likely to keep rates unchanged, creating a policy divergence that favors a stronger Aussie against the greenback. This fundamental difference is the primary driver we anticipate for this trade in the coming weeks. Create your live VT Markets account and start trading now.Von der Leyen praises US-EU trade agreement, despite German automakers’ concerns about tariffs

Current Date and Market Implications

Today’s date is 2025-09-10. This trade deal creates a clear divide in European markets that we need to address. Although it seems like a win, the ongoing US tariffs will negatively affect some industries, particularly German automakers. They’ve already seen exports to the US drop by over 12% in the first half of 2025. This bad news signals caution. We should consider buying put options on major German car makers like Volkswagen, BMW, and Mercedes-Benz. Their stocks are likely to perform poorly as the market realizes that tariff relief isn’t coming. The advantages for others translate directly into disadvantages for these manufacturers. On the other hand, we should look into call options for companies benefiting from this “relative advantage,” particularly in sectors with less US competition. French luxury goods companies, like LVMH, are a great example. They face fewer barriers and have already seen a 5% stock increase this week due to these developments.Profitable Trading Strategy

This difference in performance suggests a pairs trade could be lucrative at the index level. We can short DAX index futures while buying into France’s CAC 40 index. Recent data shows the CAC 40 outperforming the DAX by 4% over the past month, and this deal is likely to widen that gap in the upcoming weeks. Market anxiety about the long-term effects of the deal is rising. The Euro Stoxx 50 Volatility Index (VSTOXX) has climbed to 22, its highest level since early 2024’s market scare. Buying VSTOXX futures or call options is a direct bet on increased market volatility as these new trade dynamics unfold. We recall the instability from the trade wars of the late 2010s and early 2020s. While this deal aims to bring stability, it creates clear winners and losers in Europe. Our strategy must focus on navigating both sides of this division. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – Sep 10 ,2025

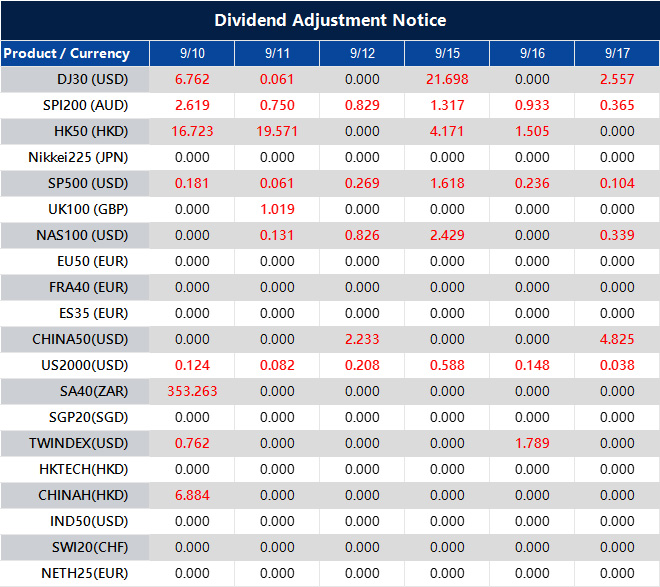

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].