UK house prices rose by 0.5%, exceeding expectations due to favorable conditions for buyers.

Japanese Prime Minister reaffirms strong stance on US tariffs after Akazawa’s visit to Washington

EUR/USD has an expiry at 1.1350 today, potentially supporting price movements due to dollar weakness.

Eur Usd Chart Levels

The key level that many traders are watching is 1.1350 for the EUR/USD pair, where several options will expire today. What makes this level important is its closeness to the 100 and 200-hour moving averages, which sit around 1.1330 to 1.1335. The combination of technical factors and option volumes often makes price movements more responsive in these areas, attracting scalpers and traders positioning around key expiries. The dollar has weakened, primarily due to how markets are responding to recent global trade events. The return of some tariff measures has caused investors to feel uneasy about the future of trade talks between Washington and Beijing. Traders see this change as a potential drag on US economic activity, leading to decreased demand for the dollar, particularly in pairs sensitive to broader market risks.Tactical Market Approach

We are approaching the market from a tactical perspective, considering both the impact of options and short-term sentiment. With a number of expiry levels focused around the current price, and more expected later in the week, even small changes in market tone could increase volatility. Historically, when prices interact with dense option clusters near moving averages, this often leads to price consolidation or quick rejections on either side, which usually fade as the expiry passes. Powell’s recent comments didn’t significantly alter the overall market tone, and the economic data calendar is light in the near term. This makes it easier for headlines or technical patterns to influence market activity. When liquidity is low, these expiries often have a bigger impact than usual. Therefore, traders should be cautious about price movements around the discussed levels. Taking on a position that doesn’t align with expiring adjustments could be ineffective this week. Many traders we spoke with are adjusting their order placements slightly earlier than normal, due to strike levels exerting pressure during the London and New York trading sessions. Finally, market flows are primarily driven by events and are short-term focused. Our view is that any retests of significant levels will attract some hedging interest before trading resumes its normal course after expiry. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – Jun 02 ,2025

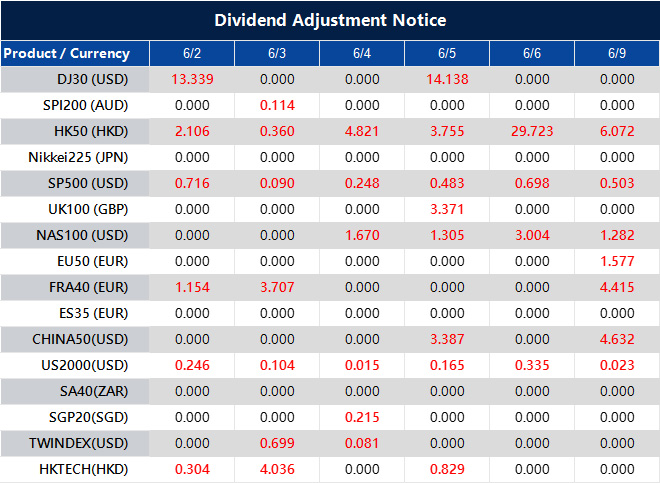

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].