NZD/USD Nears 0.5900 as Weak New Zealand Fundamentals Weigh on Cautious Investor Sentiment

Jamie Dimon Warns Recession Risks Remain Due to Inflation, Deficits, and Possible Interest Rate Hikes

Recession concerns persist

Michael Feroli, the chief U.S. economist, warns that risks remain “elevated.” This has led many businesses to hesitate on making new investments. Goldman Sachs predicts that the Federal Reserve may start tapering in the first quarter of 2022, with possible interest rate hikes in 2024. Dimon is cautioning about the future, not just because of what we know now, but due to the multiple pressures affecting the economy. He highlights ongoing budget problems and stubbornly high inflation that traditional methods cannot easily address. This indicates a challenging economic environment where financial support may not be as effective and where policy options are limited. When Feroli discusses businesses holding back on investments, he suggests this isn’t just indecision. It’s a sign of deeper concerns influencing decisions across many industries. Companies usually don’t pause like this without significant reasons; such reluctance often comes before changes in overall demand. It isn’t necessarily fear but rather a careful calculation considering current factors like narrower profit margins, unpredictable costs, and uncertainty about labor and interest rates.Tracking policy signals

Looking at monetary policy, Goldman’s forecasts for rate changes indicate a measured approach rather than an aggressive one, expecting a gradual return to normal as long as things stay stable. However, this forecast can change. If spending slows down faster than anticipated or if financial issues arise unexpectedly, we may see guidance adjusted again. Right now, it’s important to closely monitor treasury yields, especially those in the seven-to-ten-year range, where rate changes typically occur before official statements. Given the current indicators and policymakers’ strategies, we are evaluating the flattening curve against inflation-linked assets as the next test of market sentiment. The focus is no longer just on predicting policy moves but also on understanding how hesitation in capital spending relates to central bank timelines. For our positioning, we are reviewing short-term contracts most sensitive to volatility linked to policy announcements and data releases such as consumer price indices, core spending trends, and unemployment claims. When expectations narrow, market reactions become sharper. Although the likelihood of a recession has decreased to below fifty percent, we don’t see this reduction in risk as a sign that everything is okay. Statements from Feroli and movements from Goldman show some cautious optimism but also recognize a crucial point: the margin for error is currently smaller than it has been in the last two tightening cycles. Create your live VT Markets account and start trading now.Walmart’s Stock Rebounds After Impressive Quarterly Results Following 5% Drop

ECommerce Growth and International Performance

In the last quarter, Walmart saw a 22% annual increase in Global eCommerce and a remarkable 50% jump in international advertising revenue. Comparable sales in the US rose by 4.5% year-on-year, exceeding the 3.9% forecast. US transactions and average purchase amounts also grew, although international sales were down by 0.3%. Walmart’s leadership expects price increases due to tariffs, causing them to withhold EPS and operating income guidance for Q2, though they expect $167.8 billion in revenue. Full-year net sales are estimated to grow by 3% to 4%, with operating income projected to rise by 3.5% to 5.5%. For Walmart’s stock to gain bullish momentum, it needs to convincingly break the $100 mark. The closeness of the 200-day Simple Moving Average to the 50-day average could affect the stock price. Overall, the company’s first-quarter performance exceeded expectations in many areas. They reported earnings per share and revenue figures that were more than $2 billion above estimates. However, the stock initially dropped sharply, indicating a gap between good numbers and investor concerns. That negative reaction was short-lived as the session progressed, fueled by more favorable macroeconomic indicators, especially the lower-than-expected wholesale prices. While revenue increased, international sales showed less optimism with a 0.3% decline, hinting at weaker performance abroad despite strong growth in global eCommerce and a notable rise in international advertising revenue. In the US, consumer activity remained strong, with rising transactions and average spending reflecting broad demand resilience.Future Outlook and Market Reactions

Looking ahead, management has noted potential risks from rising import costs linked to tariffs, causing them to withhold specific EPS and operating income guidance for the upcoming quarter. This caution suggests concerns about higher input costs or consumer sensitivity to rising prices. However, their revenue target of nearly $168 billion shows confidence in stability, even if profit margins face pressure. Their full-year outlook suggests moderate sales growth of 3% to 4%, with operating income expected to rise slightly faster, indicating some strength in margins—likely driven by advertising revenue or efficiencies from technology. Nevertheless, they need to overcome the $100 barrier firmly. Until they can do so, momentum could fade. The proximity of the 200- and 50-day SMAs introduces a risk of volatility, especially with automated trading strategies based on those averages. With wholesale prices declining and April retail sales barely positive, market participants should closely monitor forward guidance charts. Inflation data’s disinflationary signal may influence how investors respond to these trends, particularly if other data supports this narrative. This could lessen reactions to weak international sales figures, especially if margin expansion continues. For us, being included in the index adds more variables. The Dow’s slight midday rebound indicates how major components can affect market readings. Investors with leveraged equity exposures and those buying options on these stocks may need tighter hedging strategies in the coming days, especially ahead of tariff-related announcements. The revenue growth, especially in digital segments, likely boosts confidence in more speculative call positions. Still, we’re cautious that short-duration assets could react sharply if international weaknesses become more pronounced. Watch for changes in implied volatility around earnings announcements or trade-related comments from executives. Keep an eye on the put-call ratios at current levels; if we don’t see a strong move above $100, we might face further risks. We will monitor trading volume, correlation with broader market trends, and fluctuations in ATM option premiums. If these narrow without confirming moves in the stock, there is a risk of being too heavily positioned for a breakout that hasn’t yet occurred. Create your live VT Markets account and start trading now.Indices Show Mixed Results: NASDAQ Drops After Meta Delays AI Model

Japanese Yen Strength Weakens GBP/JPY as Risk Aversion Increases on Thursday

Bank of Japan Policy Shift

The Bank of Japan has hinted at a potential change in policy, encouraged by rising inflation and a strong Producer Price Index. If Japan’s Q1 GDP report shows better results than the expected 0.1% contraction, it will support this shift. Market sentiment is defensive, favoring the Yen in these uncertain times. In the short term, we are unlikely to see GBP/JPY change significantly unless there’s a shift in monetary policy or overall risk appetite. GBP/JPY continues to move downward as investors become more cautious. This trend isn’t just about a preference for the Yen; rather, it’s about a general move away from risk in the markets. Safe-haven buying increases during global instability, especially with ongoing geopolitical tensions and fragile discussions between major economies. Despite the UK’s strong quarterly growth, reaching 0.7% which surpassed many expectations, it hasn’t lifted the Pound. The Bank of England’s cautious tone remains. Even with positive domestic data, officials are hesitant to signal a shift away from high interest rates. This uncertainty makes it hard for traders to justify long positions in the Pound, particularly against the Yen which benefits from the broader risk-averse trend. Going forward, it’s less about whether UK data stays strong and more about whether policymakers change their messaging. Without clear signals or significant policy shifts, the demand for the Pound isn’t likely to return strongly. The Governor and the Monetary Policy Committee are focused on inflation and wage growth, with concerns about persistent price pressures outweighing positive economic surprises.Japan’s Economic Outlook

On Japan’s side, there are early signs of a potential policy change. The rising Producer Price Index indicates underlying inflation may continue. If Japan’s GDP report shows less weakness than the expected -0.1% contraction, it would strengthen expectations for future interest rate hikes, benefiting the Yen. Overall, the market remains cautious, and this sentiment influences trading strategies. Investors are favoring stability over growth as geopolitical risks escalate. In this environment, the Yen becomes more appealing. For derivative traders, the strategy should focus on stability rather than speculation. Defensive positions typically perform better during volatile times with uncertain policy direction. In terms of strategy, tracking breakouts from unexpected data will be key. If Japan’s economy performs better than expected, it will increase the chances of gradual tightening and strengthen the Yen, which may push GBP/JPY lower, especially if there’s no optimistic shift from the Bank of England. Additionally, managing short-term risk around major events, like central bank announcements or PMI readings, can provide practical entry points rather than blindly chasing trends. The most impactful movements are likely to arise from macroeconomic surprises rather than slow, steady trends. The momentum is clearly leaning toward caution. Until interest rates change or global risks lessen, we will maintain a defensive position. The current price action tells an important story. Create your live VT Markets account and start trading now.Michael Barr: US Economy is Stable, but Trade Policies Create Uncertainty for the Future

US Economy and Trade Policies

Right now, the US economy is holding steady with inflation close to 2%. However, trade policies bring some uncertainties. A sudden trade shock could hurt small businesses and lead to price increases if supply chains struggle or businesses go under. Barr’s remarks highlight concerns about the pressure certain policy changes could put on smaller companies. Higher costs from tariffs add to this pressure. It’s important because small businesses play a key role in keeping supply chains running and creating jobs. If many of them start facing these challenges, we could see wider disruptions. In terms of derivatives, pricing models might need changes if inflation expectations rise again. While consumer prices are closer to 2%, this progress could reverse if rising import prices create cost-push inflation. We’re not only looking at the price of goods but also logistics and storage costs, which are already tight, and this is reflected in derivatives contracts. Those involved in rate-sensitive strategies should take note: even without a rise in the Consumer Price Index, the Federal Reserve might keep rates high for longer if they anticipate price pressures from trade issues. Barr’s cautious comments suggest the Fed is paying attention to how policies affect the market. Thus, strategies based on expected cuts might need adjustment if consensus on timing changes.Market Adjustments and Risk Parameters

Additionally, spreads across different durations may shift if there’s a growing gap between short-term inflation stability and mid-term risks. This isn’t about panicking but making sensible adjustments. Recent stability in core inflation doesn’t mean that TIPS breakevens won’t widen if input costs rise. This is another factor our models indicate we should track closely. Moreover, high tariffs could reduce business investment. This may impact growth expectations reflected in equity index derivatives, especially in small-cap sectors. These companies often have less power in global markets and tighter profit margins affected by commodity price changes. If futures and options are too closely tied to forecasts that overlook these economic pressures, traders might be caught off guard. Given this situation, we’re making small adjustments to our risk parameters for positions related to global trade exposure. While this isn’t a dramatic shift yet, the cost of ignoring this risk has started to push up some implied volatilities on longer-dated contracts linked to industrials and transport. That shift may not be gradual, and once liquidity aligns with these assumptions, pricing changes can happen more suddenly than expected. Barr’s message is not a prediction, but a warning that the market has certainly noticed. Create your live VT Markets account and start trading now.Notification of Server Upgrade – May 15 ,2025

Dear Client,

As part of our commitment to provide the most reliable service to our clients, there will be server maintenance and product adjustment this weekend.

Maintenance Details: MT4 / MT5 – 17th of May 2025 (Saturday) 00:00 – 03:00 (GMT+3)

Please note that the following aspects might be affected during the maintenance:

1. During the maintenance hours, Client portal and VT Markets App will be unavailable, including managing trades, Deposit/Withdrawal and all the other functions will be limited.

2. During the maintenance hours, the price quote and trading management will be temporarily disabled during the maintenance. You will not be able to open new positions, close open positions, or make any adjustments to the trades.

3. There might be a gap between the original price and the price after maintenance. The gaps between Pending Orders, Stop Loss and Take Profit will be filled at the market price once the maintenance is completed. If you don’t want to hold any open positions during the maintenance, it is suggested to close the position in advance.

4. Following the maintenance, it is important to note that the latest version will be 4475. If your MT5 version is below 4410, it is suggested that you download the latest version on official website by navigating to “Trading” → “Platforms”→ “MetaTrader 5”.

Check your MT5 software version with the following steps:

※ PC: Open the MT5 software > Help > About;

※ Android: Open the MT5 app > About;

※ iOS: Open the MT5 app > Settings > Settings.

Please refer to MT4/MT5 for the latest update on the completion and market opening time.

Thank you for your patience and understanding about this important initiative.

If you’d like more information, please don’t hesitate to contact [email protected].

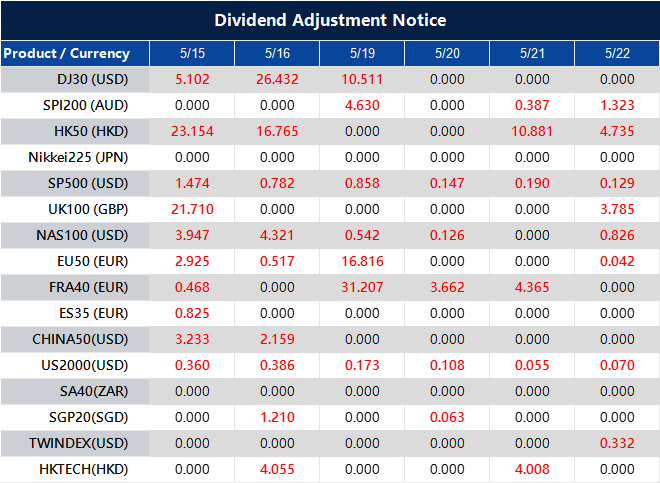

Dividend Adjustment Notice – May 15 ,2025

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].

VT Markets Delivers Its Strongest Trading Month Yet

Raising the Bar in 2025: VT Markets Delivers Its Strongest Trading Month Yet

Record-breaking performance at highlights VT Markets’ momentum in its 10th anniversary year

15 May 2025, Sydney, Australia – VT Markets, a leading global multi-asset broker, has recorded its strongest-ever monthly trading volume, reaching 720BN in April 2025. This milestone reflects the VT Market’s accelerated growth trajectory and influence across global financial markets. It also sets the tone for what promises to be a transformative year as VT Markets enters its 10th anniversary with renewed ambition and elevated client focus.

This trading record coincides with the unveiling of VT Markets’ 10th anniversary plans, officially announced on April 22, 2025. Marking a decade of rapid growth and global impact, the year-long celebration will feature exclusive promotions, offers, and engagement activities with our global community.

As volatility ripples across major asset classes, traders are actively seeking a platform that offers both speed and reliability. VT Markets has emerged as the broker of choice — trusted for its ultra-fast execution, real-time analytics, and client-centric tools that empower users to act decisively in fast-moving markets. In a world where opportunity is measured in milliseconds, VT Markets continues to deliver the performance edge traders need.

VT Markets continues to see exponential growth across regions such as Southeast Asia, the Middle East, and Latin America, with 20% growth in daily active users. The platform’s multilingual support and culturally localized outreach strategies have deepened its relevance in emerging markets, while institutional volumes also surged thanks to deeper liquidity pools and ultra-low-latency trade execution.

“Sharing this milestone with our clients and partners is especially meaningful as it represents more than just numbers — it’s a reflection of the strength behind our platform, the innovation driving our growth, and the confidence the trading community continues to place in VT Markets,” said Ross Maxwell, Global Strategy Operations Lead. “We see it as both a celebration and a responsibility — to keep raising the bar in everything we do.”

As VT Markets advances its technological capabilities, infrastructure, and global client engagement, the company looks ahead to breaking new ground, and setting new standards in the world of online trading.

About VT Markets

VT Markets is a regulated multi-asset broker with a presence in over 160 countries as of today. It has earned numerous international accolades including Best Online Trading and Fastest Growing Broker. In line with its mission to make trading accessible to all, VT Markets offers comprehensive access to over 1,000 financial instruments and clients benefit from a seamless trading experience via its award-winning mobile application.

For more information, please visit the official VT Markets website or email us at [email protected]. Alternatively, follow VT Markets on Facebook, Instagram, or LinkedIn.

For media enquiries and sponsorship opportunities, please email [email protected], or contact:

Dandelyn Koh

Global Brand & PR Lead

Brenda Wong

Assistant Manager, Global PR & Communications

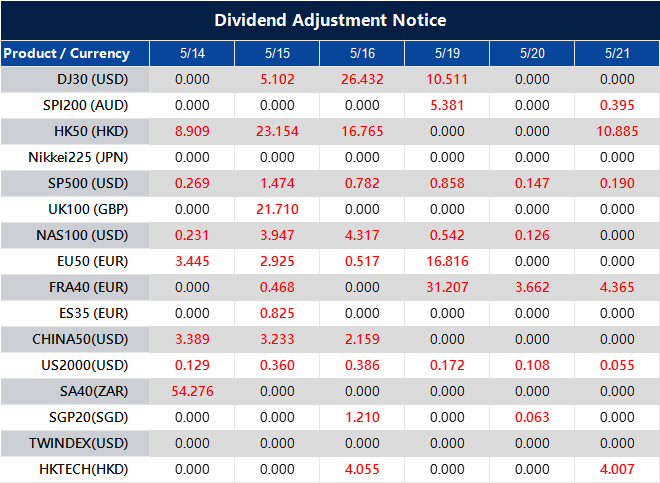

Dividend Adjustment Notice – May 14 ,2025

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].